Introduction

Cryptocurrency company Ripple announced in July 2025 that it has applied to the US Office of the Comptroller of the Currency (OCC) for a national bank license and Federal Reserve Master Account. Ripple CEO Brad Garlinghouse described this step as part of their commitment to their long-standing “compliance roots”. This development is an indication that Ripple is seeking to integrate more tightly with the US regulatory framework and aims to strengthen corporate trust by establishing new regulatory standards. This report will discuss in detail what Ripple intends to achieve from this license application and its potential impact on the firm’s USD stablecoin, Ripple USD (RLUSD).

National Bank License Application and Objectives

Ripple’s application for a national bank license with the OCC is an effort to gain a banking status that will allow the company to be supervised at the federal level in the US. Garlinghouse described the move as “part of our long-standing compliance strategy.” In a nutshell, here are the key gains Ripple expects from this application:

- Regulatory Security: With the national bank license, the RLUSD stablecoin will now be overseen by both state regulators like New York and federal agencies, increasing the level of trust for institutional investors and customers.

- Access to Financial Infrastructure: An application for a Federal Reserve Master Account (Fed Master Account) has been submitted but has not yet been approved. If approved, Ripple will be able to directly use the Fed’s payment infrastructure and hold stablecoin reserves at the Central Bank. However, it is not yet clear whether this approval will be granted.

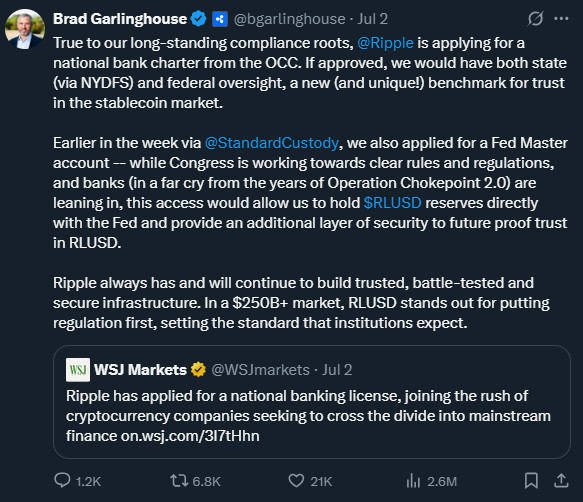

Ripple CEO Brad Garlinghouse announced on July 2, 2025, that these filings cover both state and federal oversight and how moving RLUSD reserves to the Fed will increase confidence:

- Service Diversity: The banking license will allow Ripple to offer deposit acceptance, payment processing and other traditional banking services, and will enable it to develop innovative solutions such as tokenized assets for cross-border transfers.

- Competitive Advantage: In the industry, companies such as Circle (USDC) and Fidelity are applying for similar licenses. By joining this trend, Ripple aims to reduce the risk of regulatory uncertainty, gain credibility and become an industry leader.

These steps seem to be in line with Ripple’s strategy to strengthen the XRP ecosystem and fintech partnerships. After a long legal process with the SEC, the company is seeking to position itself as an institution that issues stable assets based on digital dollars. The bank license will not only provide Ripple with a cost advantage; it will also bring institutional legitimacy to the cryptocurrency industry, paving the way for innovative services.

Features of RLUSD Stablecoin

Ripple USD (RLUSD) is a US dollar stablecoin that was launched on December 17, 2024. The key features of RLUSD are the following:

- Full Reserve Stability: Each RLUSD is 100 percent backed by cash, cash equivalents, or short-term US Treasury bonds that are actually worth US$1. Reserve assets are held in segregated accounts and are subject to transparent supervision.

- Multi-Chain Issuance: RLUSD runs on both XRP Ledger and Ethereum networks, ensuring liquidity and accessibility across both major ecosystems.

- Regulatory: The newly issued RLUSD has been approved by the New York Department of Financial Services (NYDFS). It is planned to be regulated at the federal level with a bank license. There are currently no crypto firms other than Anchorage Digital with a similar license from the OCC.

- Market Size: In a short period of about 6-7 months, RLUSD’s market capitalization has reached $520 million, which ranks RLUSD among the top 20 largest US dollar stablecoins in the world. Trading volume has also reached tens of millions of dollars per day.

The chart below shows RLUSD’s total circulating supply growth from September 2024 to July 2025. Especially the acceleration after April 2025 is remarkable:

RLUSD is designed to serve Ripple’s corporate payment solutions. Ripple aims to promote the use of RLUSD in areas such as corporate payments, payment service providers and cross-border money transfers. Garlinghouse described RLUSD as “a stablecoin developed on the basis of trust and compliance, meeting institutional expectations”

Regulation and Industry Dynamics

Ripple’s bank license move is part of a larger trend of regulation and compliance in the cryptocurrency sector. Among the highlights in recent months are the following:

- GENIUS Act: The US Senate passed the GENIUS bill, which imposes a 100 percent reserve and regulatory clearance requirement on stablecoin issuers in July 2025. This step reinforced the view that stablecoins should operate under bank supervision and was an additional incentive for firms like Ripple.

- Other Applications: Circle (USDC) recently applied to the OCC to establish a national-level trust bank. Large institutions like Fidelity Digital Assets and Coinbase are also showing interest in crypto-related federal banking licenses. This trend is indicative of the industry’s desire to operate under one roof.

- Central Bank Integration: The OCC recently issued new regulations for banks to offer crypto services. Steps to establish Fed connectivity for bank accounts, payments and reserve transactions have accelerated. Ripple’s Fed Master Account application is considered as part of this new opening.

- Seeking Trust and Legitimacy: Crypto companies are increasing their cooperation with regulators to overcome the “de-funding” concerns of the early 2010s. In particular, Garlinghouse emphasizes that “congress is now working on clear rules and banks have started to open up to crypto.” Thus, assets such as XRP and RLUSD are getting the chance to be accepted in the traditional financial world.

In this context, Ripple’s move reinforced the trend of “crypto firms are being banked” in the sector. This is interpreted as a positive development for both investors seeking stability and regulatory authorities.

The Impact of the National License Application on RLUSD

A number of significant impacts are expected for the RLUSD stablecoin if Ripple obtains a bank license:

- Increased Security and Stability: With Fed Master Account approval, RLUSD reserves will be held directly at the Federal Reserve. This will make the reserves more liquid, secure, and auditable, resulting in an exponential increase in trust in RLUSD. According to Garlinghouse, this will be “an extra layer of future proofing for RLUSD.”

- Liquidity and Acceptance Expansion: Federal licensing and Fed access could increase institutional investors’ willingness to use RLUSD. Once reserve management through the bank channel is possible, RLUSD adoption will accelerate in both commercial transactions and payment systems. Market depth and trading volumes could therefore grow.

- Cost and Speed Advantage: The license will enable Ripple to provide direct payments without intermediate banks, which means seamless transfers and lower costs. Especially for cross-border payments, the use of RLUSD could become attractive, as transactions will be settled faster and the risk of exchange rate differences will be reduced.

- Competitive Advantage: The federal license and NYDFS approval for RLUSD puts it in a unique position in the stablecoin market. Being covered by both state and federal regulation sets a new standard of trust. This could give RLUSD a competitive advantage over other stablecoins.

- Contribution to the Ripple Ecosystem: Ripple’s integrated products (e.g. the solution in XRP Ledger and other blockchain applications) work in a structure that includes RLUSD. The bank license will increase the overall credibility of the Ripple platform, positively impacting the entire ecosystem and opening the door to new partnerships.

In summary, the national bank license and Fed Master Account approval is expected to be a positive catalyst for RLUSD. RLUSD will become more secure for investors and users, while Ripple will strengthen its position as a digital dollar issuer. These developments could also set a precedent for cryptocurrency regulation in the US, supporting general acceptance of the sector and the widespread use of stablecoins.

Conclusion

Ripple’s application for a bank license in July 2025 is an important part of the company’s long-term regulatory compliance and corporate integration strategy. If OCC approval and Fed Master Account access are granted, Ripple will both deepen its integration with the financial system and put RLUSD on a firmer footing.

However, this process is not yet complete. For investors, RLUSD stands out as an option with a high regulatory standard, but critical stages such as license approval and market acceptance are still uncertain. Therefore, these uncertainties should be taken into account in investment decisions.

Ripple’s strategic move may not only secure its own future but also contribute to a new regulatory standard in the stablecoin market.

Disclaimer

This article is for informational purposes only and does not constitute investment advice, financial guidance, or a recommendation to buy or sell any asset.