Interest in the BNB Ecosystem and Its Impact on the Ecosystem

Interest in the BNB ecosystem has gained significant momentum recently, largely due to YZi Labs’ announcement of its $1 billion “Builder Fund.” This fund was established by YZi Labs, considered CZ’s family office, to support projects in areas such as DeFi, RWA (real-world assets), AI, payments, and wallet solutions built on the BNB Chain.

The announcement of the fund is not merely a financial move; it can also be interpreted as an initiative that could attract the attention of the developer community and institutional investors to the BNB Chain’s infrastructure. This strong interest could indirectly reflect on the BNB token. The capital and projects directed towards the ecosystem demonstrate that the chain is on a usage-based growth trajectory, not just a price-driven expectation.

The staking of new projects, increased user participation, and the expansion of the token’s role in both usage and governance could create an increase in demand for BNB. Furthermore, institutional investors turning to BNB could reinforce the perception of the token as a strategic asset beyond a speculative one.

BNB Token Price Trends and Technical Outlook

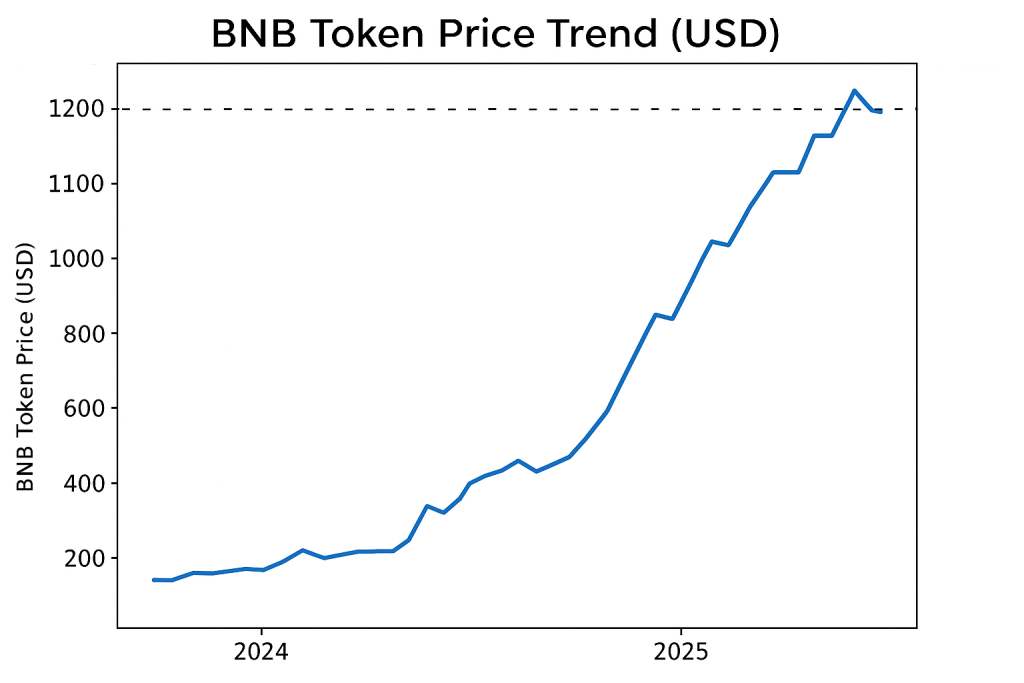

The BNB token’s price trend has shown a steady increase since 2024. The graphical view reveals that metrics within the ecosystem also support this increase. This table can be considered a reflection of the structural transformation process initiated by the YZi Labs fund on the BNB Chain.

Technical Overview

From a technical perspective, BNB appears to be maintaining the rising channel structure it has been in for a long time. With the recent correction, the price has approached the middle band of the channel, and the Relative Strength Index (RSI) indicator is giving buy signals at 47.28. This indicates that BNB’s overall outlook remains positive.

Future Scenarios

Positive Scenario

With increased developer activity and new project launches, BNB’s application layer could strengthen. During this process, BNB demand could increase, while supply pressure could decrease through staking and token burning mechanisms. In this case, levels of $1,500 and above could be targeted.

Neutral Scenario:

Even if the ecosystem continues to grow, macroeconomic uncertainties or slowdowns in market volume may temporarily limit price momentum. In such a case, the BNB price is likely to move within a horizontal band.

Negative Scenario:

A decline in risk appetite in global markets (such as an increase in US bond yields or renewed regulatory pressures) could lead to a decrease in investment interest in the BNB ecosystem. Under these conditions, if BNB breaks below its rising channel support, the technical outlook is also likely to turn negative.

Conclusion and Evaluation

These developments are expected to have a meaningful impact on the token price in the medium to long term. Increased project diversity and developer activity will boost the volume of transactions within the ecosystem, while supply-restricting mechanisms such as staking and token burning may also support price stability. Thus, BNB has the potential to evolve from being merely a market volatility-sensitive asset into a digital economic tool grounded in its utility value. Therefore, the current landscape presents a structural opportunity for the BNB ecosystem while also signaling a period requiring a medium- to long-term perspective for investors.

In short, BNB’s current trajectory is shifting from speculation to strategy; from price expectations to a growth model based on infrastructure and ecosystem development.

Disclaimer

The information provided does not constitute investment advice. Cryptocurrency investments involve risk, and past performance is not indicative of future results.