Introduction

US banking giant JP Morgan has launched its long-tested deposit token, JPM Coin (JPMD), on the Base Layer 2 network for its corporate clients. The entry of a financial giant like JPMorgan into the public stablecoin market with JPM is a critical turning point for the broader cryptocurrency industry. The primary purpose of JPMD is to accelerate high-volume corporate money transfers and make the existing financial infrastructure more efficient. In contrast, public stablecoins have a much broader range of uses. They are actively used in many areas, such as DeFi liquidity, retail payments, decentralized applications (dApps), and cross-border remittances. This distinction reveals that JPMD aims to address a specific segment of “wholesale finance” by using the infrastructure of public blockchains, rather than competing with the retail user base. In this article, we will examine the coin JP Morgan is testing and its advantages.

JP Morgan’s JPM Coin Initiative

On November 12, JP Morgan Chase announced the launch of JPM Coin (JPMD), a USD deposit token for corporate clients, on the Base blockchain. JP Morgan plans to expand this approach by launching a euro-denominated version of JPM Coin in the future. For the price of this token to be published, it must be listed on exchanges, people must be able to buy and sell it, and a supply-demand balance must be established. JPMD, however, will not be listed on any exchange, will not be released to the free market, and will only be used for the corporate payment infrastructure , which sets it apart. This token aims to increase payment efficiency by offering 24/7 transaction capability.

Source: https://www.jpmorgan.com/kinexys/documents/deposit-tokens.pdf

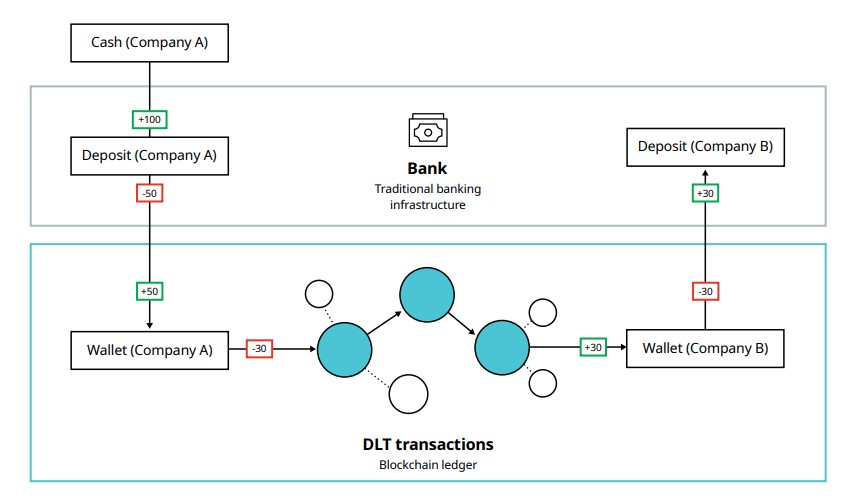

When a company transfers its cash holdings to a bank deposit account within the traditional banking system, this transaction is recorded in the bank’s accounts as cash or deposits. The process begins entirely within the traditional financial layer. The company converts part of its bank deposit into a digital asset represented on DLT (Distributed Ledger Technology). At this stage, the bank deposit account decreases. The same amount is loaded into the company’s wallet on DLT as a digital representation. This digital representation is a direct reflection of the deposit and its value and can be transferred in a fixed manner with the bank counterpart. An asset recorded in the DLT ledger is converted into a digital asset (tokenized deposit) on the DLT, similar to a deposit. When a company transfers part of its digital asset on the DLT to another company, this transfer takes place on the distributed ledger, and instant settlement is achieved.

In this method, which is independent of the traditional system (the bank only holds reserves, does not make transfers) and does not require an intermediary, the role of DLT is to record the transfer and change the ownership of the asset. It is to approve the transaction with decentralized/distributed validators. This stage is the critical point where traditional finance and DLT diverge. If the distributed ledger in the transfer to another company chooses to convert the received digital asset back into a bank deposit, the digital representation is deleted from the DLT wallet. An increase of the same amount is recorded in the bank deposit account.

Digital representation is a reflection of the money held in the bank. The source of value is the reserve held by the bank. Banks now use blockchain as a payment rail. Money can now flow freely between two systems for the first time (Traditional Banking – Blockchain). Deposit tokens, unlike stablecoins, are bank money and are backed by bank balance sheets. It provides speed and cost advantages in corporate B2B payments. JP Morgan’s transition to Base L2 brings this model to public networks and represents a significant departure from the bank’s historical stance in terms of its shift towards blockchain.

Is the Boundary Between TradFi and Crypto Disappearing?

J.P. Morgan’s Kinexys company has pioneered other banks by launching a proof of concept (PoC) for the JP Morgan Deposit Token (JPMD) in USD on a public blockchain as an alternative to stablecoins for local cash payments and payment use cases for J.P. Morgan’s corporate clients. This distinguishes JPMD from widely used public stablecoins like USDT or USDC, which are generally accessible to both retail and corporate users.

| Category | Layer 1 Examples | Layer 2 Examples (Rollup / OP Stack / ZK) | Notes |

|---|---|---|---|

| Stablecoin | ETH, USDC, USDT, DAI | USDC, JPM Coin (JPMD), cbETH on Base | Base is enterprise integration-friendly thanks to Coinbase + OP Stack |

| Deposit Token | None (Bank deposit tokens are generally not available on L1s) | JPM Coin (JPMD), potentially other major banks | After 2025, banks may transition to deposit tokens on L2 |

| RWA-Based Token | Onyx (JPM), Polygon RWA projects | Base begins corporate RWA testing | JPM’s Onyx network was a closed system; moving to Base means opening to public domain |

| Corporate Payment Tokens | XLM, XRP | JPMD + Base payment rails | Base is creating an Ethereum L2 standard for corporate payments |

| Native Token / Gas | ETH, SOL, AVAX | OP, ARB, MNT, BASE (currently no governance token) | Base gas fees are paid in ETH |

The concept of a deposit token implies that JPMD represents a claim on US dollar deposits held at JPMorgan and effectively tokenizes fiat currency for use on-chain, combining the reliability of traditional banking with the efficiency of blockchain technology.

Conclusion and Evaluation

The deposit token model, tested for years on private closed chains, has now been moved to L2. Base is becoming the standard L2 for corporate stablecoins, RWA, and payment infrastructure. The transformation is moving in two directions (deposit → token → deposit). Companies such as Coinbase, JP Morgan, and Circle are officially beginning to move the American financial system’s blockchain base to Ethereum L2. This move triggers a convergence of “central bank, private bank, fintech, L2” in the stablecoin ecosystem. Especially considering CEO Jamie Dimon’s long-standing skeptical approach to Bitcoin and decentralized crypto assets, this transformation signals a strategic shift.

In recent years, JP Morgan has embraced a more open stance in this area, acknowledging the transformative impact of distributed ledger technology (DLT) in financial services. The launch of JPMD on a public L2 network like Base could signify a shift in the bank’s blockchain strategy from a closed system to an open one. This transition can be seen as an important sign that the boundary between traditional finance (TradFi) and crypto finance is becoming increasingly blurred. Digital assets are no longer merely speculative instruments for retail investors but have become a mature component of global finance. Institutional capital inflows have the potential to increase the liquidity of stablecoin markets, making them more efficient and resilient.

Disclaimer

This content is for informational purposes only and does not constitute financial advice. Corporate blockchain services like JPMD are subject to regulatory approvals and usage restrictions. Always ensure compliance with local laws before adopting digital payment technologies.