Rally in Digital Assets

Global markets were mostly driven by the US trade war agenda last week. While President Trump’s decisions on tariffs caused the challenging climate to continue, digital assets told a different story.

Donald Trump’s decisions and his behavior since becoming President have been one of the main dynamics determining the value of all investment instruments without exception. And it looks like it will continue to be so for many assets. However, as we approached the end of last week, we observed a different pricing pattern on the digital assets front. While global investors were forced to remain cautious in the shadow of Trump’s unpredictable stance and developments in trade negotiations, long-awaited pricing in crypto assets began to materialize.

Bitcoin hit a new record high and altcoins also saw significant value increases. In fact, we cannot say that there was a brand-new news or development for this rally to occur. However, as we have been saying in our analyses for a long time, both the continued interest of institutional investors (as we have seen with the inflows to ETFs) and the acceleration of regulations on crypto assets in the world’s largest economy, such as the US, laid the groundwork for the inevitable gains to finally be recorded. In addition, the global investment environment has also become less sensitive to other dynamics. For example, trade negotiations somehow continued and did not lead to a global trade crisis, geopolitical risks did not create a major war despite the hot developments in the Middle East, and the monetary policy course of the US Federal Reserve (FED) was almost certain. All these components created the ground for the ceiling on cryptocurrencies to remain and a rise that would trigger each other’s purchases.

Next week will be a period referred to as “Crypto Week”. We think that expectations regarding this are also effective in the recent rises. However, it is worth noting that no market is independent of the global liquidity environment, and in this parallel, we think that developments regarding the FED’s interest rate cut course will remain important for all assets. Therefore, in order to preserve the recent gains of digital assets, we will be closely monitoring the FED’s decisions that will be decisive in this regard. Next week, a number of macro indicators will be released that may have an impact on the FED’s decisions on the interest rate path. We think that the most important of these will be the inflation figures.

US Consumer Price Index: CPI

One of the important macro indicators that may provide information on the timing of the US Federal Reserve’s (FED) interest rate cut will be the June inflation, the Consumer Price Index (CPI) change. In the current difficult conjuncture, CPI data will be closely monitored as it may provide a signal for the course, as it may have an impact on pricing behavior.

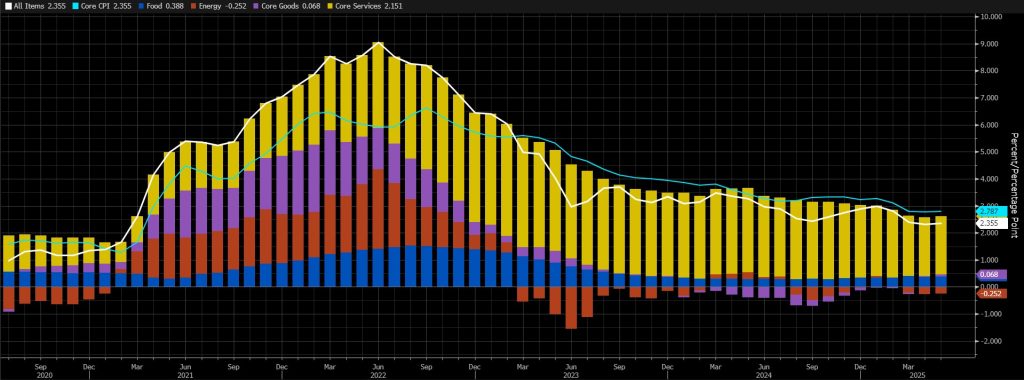

The annual inflation rate in the US rose to 2.4% in May 2025 from 2.3% in April, the first increase in four months. On a monthly basis, CPI rose by 0.1%, below the previous month and the forecasts of 0.2%. Annual core inflation remained at 2.8%, the lowest level of 2021, while expectations pointed to an increase to 2.9% . Monthly core CPI also rose by 0.1%, below April’s 0.2% and expectations of 0.3%.

Source: Bloomberg

As can be seen in the chart above, core services continue to have the largest share in the overall price level. Our expectation is for a monthly increase of 0.05% and an annualized CPI of around 2.15%. Nevertheless, let us remind that the market will react according to the consensus expectation.

A CPI data that will be below the market expectations may mean that the FED’s hand will be relaxed in terms of interest rate cuts and this may have a positive impact on digital assets. A figure that would exceed the forecasts would reinforce the expectations that the FED would not rush to cut interest rates again, potentially adding pressure.

Other Key Macro Indicators to be announced

US Retail Sales Data: It is an important measure of consumer spending, which accounts for a large part of overall economic activity. It shows the change in the total value of retail-level sales and is published monthly, about 16 days after the end of the month. A separate measure of the change in the total value of retail-level sales excluding automobiles is called core retail sales. The retail sales data set is generally expected to have a positive impact on digital assets if it is below expectations.

US Prelim UoM Consumer Sentiment; It is a survey conducted by the University of Michigan (UoM) with approximately 420 consumers, asking respondents to assess the relative level of current and future economic conditions. Financial confidence is a leading indicator of consumer spending, which accounts for a large share of overall economic activity. It has two cycles, 14 days apart, called Preliminary and Revised. The “Preliminary” is usually relatively more influential on prices and is published monthly in the middle of the current month. If the actual data comes in below expectations, it can have a positive impact on cryptocurrencies.

Important Economic Calendar Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.