Market Compass

Tariffs, Courts…

The issue of US tariffs continues to be at the top of the global markets’ agenda. Following the temporary compromise with China, we are leaving behind a week in which we received messages that relations with the European Union have softened. However, this time “court decisions” were also included in the tariff agenda and were influential in the changes in the risk appetite in the markets.

The US Court of International Trade’s ruling that President Trump’s tariff changes were illegal created a brief buzz in the markets. The fact that the President’s main foreign policy instrument, high tariffs, had become a weapon that could be taken away from him could perhaps have ended trade uncertainties. But the appeals court allowed the tariffs to remain in place for the time being, and the mood did not last long. Still, it is worth noting that the issue is still far from reaching a final conclusion.

For major digital assets, both global developments and sector-specific news flow continued to have an impact on prices. We see the adoption of the law on Stablecoins in the US as a dynamic that could increase the legitimacy and adoption of the sector. On the other hand, the messages from the Trump family were also encouraging. However, Bitcoin seems to want a new climate to refresh its new record update around $ 112,000. We think that this should be achieved through both the crypto asset ecosystem and global developments. In a period when geopolitical risks were somewhat in the background, a perception that the FED would not want to delay too much for an interest rate cut could be supportive of this equation. In this context, the US statements and macro indicators should be carefully monitored in the first week of June.

At the beginning of the week, we will watch Powell’s speech. A number of macro indicators will be monitored throughout the week, but the US labor market statistics for May are the most important development of the week due to the light it may shed on the FED’s interest rate cut course.

June 2 – FED Chair Powell’s Speech

On the first trading day of the week for traditional markets, the markets will focus on the statements of US Federal Reserve Chairman Jerome Powell. The Chairman will deliver a keynote speech at the Federal Reserve Board of Governors International Finance Department’s 75th Anniversary Conference in Washington DC.

We do not expect Powell to give a clear clue about the timing of the Fed’s next interest rate change. Nevertheless, Powell’s messages will be important and may determine the direction of asset prices ahead of the May labor market statistics to be released on June 6. For now, the Fed is not expected to cut interest rates before September. Any assessment that may change this expectation should be closely monitored. We do not anticipate a change in Powell’s stance after his meeting with Donald Trump and expect him to maintain his data-driven, patient stance.

Nevertheless, it should be underlined that if Powell gives a message that will be perceived that the timing of the interest rate cut may be closer than September, this may have a positive reflection on the value of digital assets, and in the opposite case, it may have a negative reflection. We can say that we see the FED Chairman’s speech before the critical data as a more neutral development this time.

June 6 – US Employment Data

There is one month left to leave the first half of the year behind and on June 6, we will be receiving the Non-Farm Payrolls (NFP) data for May, which will provide clues about the tightness of the financial ecosystem in the coming period, which will provide information about the interest rate cut course of the US Federal Reserve (FED). In addition to this, March figures such as average hourly earnings and the unemployment rate will also be monitored.

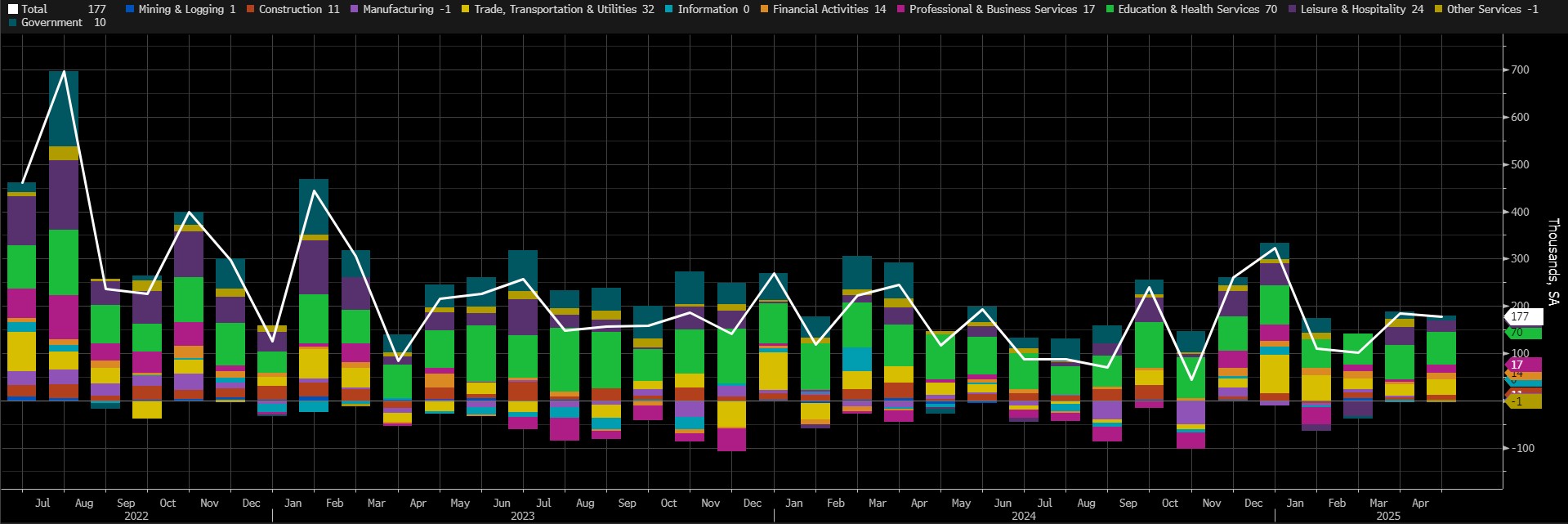

In April, the US economy added 177K jobs (Market Expectation: 138K).

Source: Bloomberg

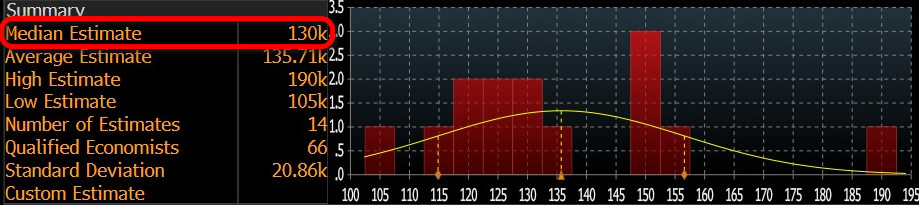

Our forecast for the NFP data, which is highly sensitive to the market, is that we will see that the US economy added 189 thousand new jobs in the non-farm sectors in May, which is higher than the general forecasts. At the time of writing, although the number of forecasts entered is small, we see that the consensus on the Bloomberg terminal is more pessimistic, around 130K.

Source: Bloomberg

Once again, we are of the opinion that if the May NFP data, which will be published in the shadow of the deterioration that Trump’s tariff-centered foreign policy may create domestically, is slightly below expectations, this will be priced as a metric that may create an expectation that the FED may act more boldly to lower the interest rate, thus increasing risk appetite and having a positive impact on financial instruments, including digital assets. We think that a slightly higher-than-expected data may have a similar but opposite effect. However, an NFP data that is well below the forecasts may re-trigger concerns of recession (stagflation) with a commentary on the health of the US economy, which may put selling pressure on assets considered to be risky. It should be noted here that we also expect a much better-than-anticipated reading to have a positive impact. It is worth noting that we anticipate these effects by taking into account the current state of market sentiment.

Other Macro Indicators and Developments

June 2 – ISM Manufacturing PMI; The Purchasing Managers’ Index (PMI) is a diffusion index based on surveyed purchasing managers in the manufacturing industry. Conducted by The Institute for Supply Management (ISM), this survey of approximately 300 purchasing managers asks respondents to assess the relative level of business conditions, including employment, production, new orders, prices, supplier deliveries and inventories. It is usually published monthly on the first business day after the end of the month, with a score above 50.0 indicating that the sector is expanding and below 50.0 indicating contraction. In general, a lower-than-expected ISM Manufacturing PMI is expected to have a positive impact on digital assets by pricing in expectations regarding the monetary policy course of the US Federal Reserve (FED). However, in some cases, it may also lead to pricing based on the strength of the economy. In this case, figures above expectations have a positive effect on digital assets.

June 3 – Job Openings and Labor Turnover Survey (JOLTS); Shows the number of job openings during the reported month, excluding the agricultural sector. This JOLTS data is closely monitored as job creation is an important leading indicator of consumer spending, which accounts for a large share of overall economic activity. It is released monthly and approximately 35 days after the end of the month. A lower-than-expected release is expected to have a positive impact on cryptocurrencies.

June 4 – ADP Non-Farm Employment Change; shows the estimated change in the number of people employed in the previous month, excluding the agricultural sector and government, by analyzing payroll data from more than 25 million workers to obtain estimates of employment growth by Automatic Data Processing, Inc (ADP). It usually gives a hint of employment growth 2 days before the employment data released by the government. Usually, lower-than-expected ADP data has a positive impact on digital assets.

June 4 – ISM Services PMI; The Purchasing Managers’ Index (PMI) is a diffusion index based on surveyed purchasing managers excluding themanufacturing industry. Conducted by The Institute for Supply Management (ISM), this survey of approximately 300 purchasing managers asks respondents to assess the relative level of business conditions, including employment, production, new orders, prices, supplier deliveries and inventories. It is usually published monthly on the third business day after the end of the month, with a score above 50.0 indicating that the sector is expanding and below 50.0 indicating contraction. In general, a lower-than-expected ISM Services PMI is expected to have a positive impact on digital assets by pricing in expectations regarding the monetary policy course of the US Federal Reserve (FED). However, in some cases, it may also lead to pricing based on the strength of the economy. In this case, figures above expectations have a positive effect on digital assets.

*General Information About Forecasts

In addition to the general market expectations, the forecasts shared in this report are based on econometric modeling tools developed by our research department. Different structures were considered for each indicator, and appropriate regression models were constructed in line with data frequency (monthly/quarterly), leading economic indicators and data history.

The basic approach in all models is to interpret historical relationships based on data and to produce forecasts that have predictive power with current data. The performance of the models used is measured by standard metrics such as mean absolute error (MAE) and is regularly re-evaluated and improved. While the outputs of the models guide our economic analysis, they also aim to contribute to strategic decision-making processes for our investors and business partners. Data is sourced directly from the FRED (Federal Reserve Economic Data) platform in an up-to-date and automated manner, so that each forecast is based on the latest economic data. As the research department, we are also working on artificial intelligence-based modeling methods (e.g. Random Forest, Lasso/Ridge regressions, ensemble models) to improve forecast accuracy and react more sensitively to market dynamics. The macroeconomic context should be taken into account in the interpretation of model outputs, and it should be kept in mind that there may be deviations in forecast performance due to economic shocks, policy changes and unforeseen external factors. With this set of studies, updated every month, we aim to provide a more transparent, consistent and data-driven basis for monitoring the macroeconomic outlook and strengthening decision support processes.

Darkex Research Department Current Studies

SHIB Highlights and Market Outlook for the First Half of 2025

Solana 2025 Forecast: Adoption, Price, Risks & Outlook

Litecoin (LTC) Price Prediction for 2025

EURC’s Course in a Macroeconomic Power Wave

Click here for all our other Market Pulse reports.

Important Economic Calendar Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.