MARKET COMPASS

Trade War Tensions Ease

The issue of “trade wars”, the main driver of global markets, continues to be the first item on investors’ agenda. However, there are signs that the climate has started to soften somewhat. US President Trump has started to sit at the table for negotiations, and it is of great importance where the issue with China will evolve.

Digital assets felt the impact of statements from the Trump front and expectations that US-China tensions would ease. In addition, news flows on crypto reserves and institutional purchases that started to attract attention again also contributed to the value gains. Next week, macro indicators for the US economy will continue to be closely monitored along with the current agenda. While Trump’s softening of his statements questioning the independence of the US Federal Reserve (FED) by stating that he does not plan to dismiss Powell is an important component, expectations for when the FED will cut interest rates may continue to be decisive in prices. Finally, it was noteworthy that Cleveland Fed President Beth Hammack stated that a potential rate cut could come as early as June if reflected in economic data. Whether this will be supported by the data or not, we can see more clearly next week. In this context, we will analyze the economic data of the week in detail.

Job Openings and Labor Turnover Survey (JOLTS); Shows the number of job openings during the reported month, excluding the agricultural sector. This JOLTS data is closely monitored as job creation is an important leading indicator of consumer spending, which accounts for a large share of overall economic activity. It is released monthly and approximately 35 days after the end of the month. A lower-than-expected release is expected to have a positive impact on cryptocurrencies.

April 30 – FED’s Favourite Inflation Indicator PCE

US Federal Reserve Chairman Powell’s speech at the Jackson Hole Symposium last year led to a significant shift in the equation. Powell shifted the focus from inflation to the strength of the labor market and signaled that the FED would now give more importance to the strength of the labor market in its decisions. Or, at least, that is how the markets interpreted his statements at the time. Recent months have shown that this may not be the right approach.

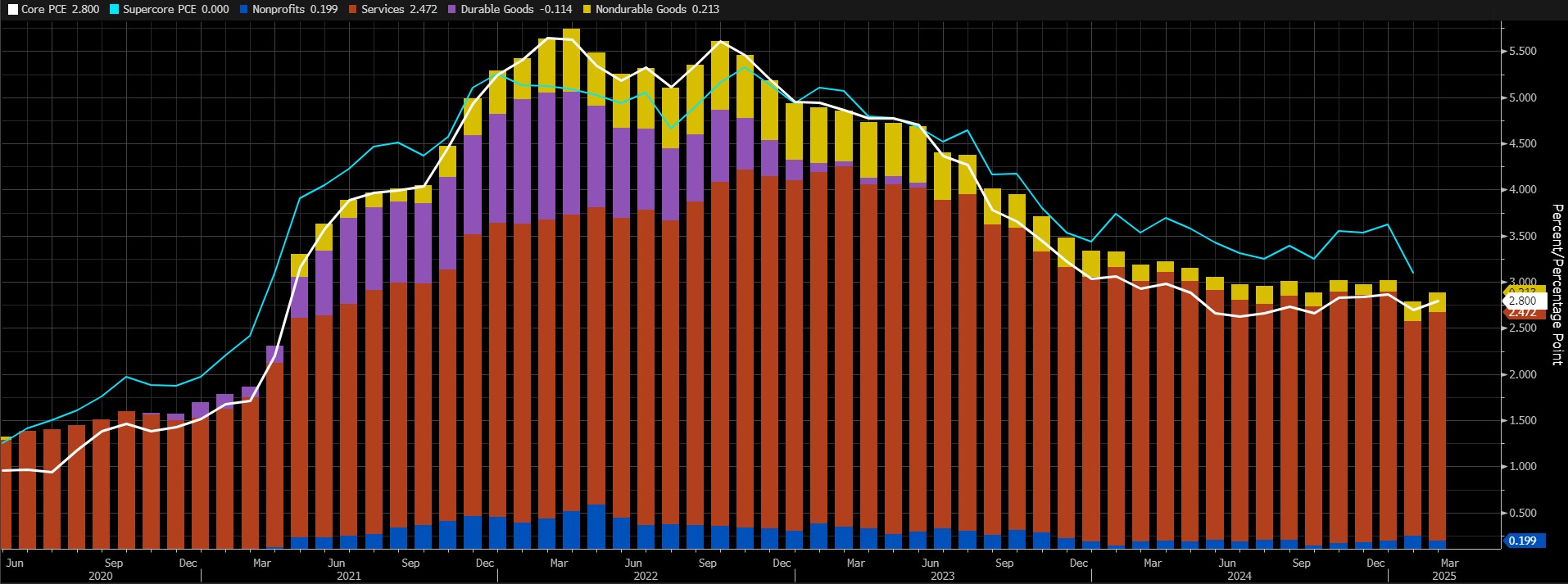

Source: Bloomberg

For March, we will evaluate the annualized core Personal Consumption Expenditures (PCE) data. In January, the index came in at 2.6% (revised to 2.7% in the latest report), down from 2.9% in December (up from 2.9% in December) due to the impact of the services sector, returning to the June 2024 level of increase. Finally, in February, it pointed to a change of 2.8%, exceeding market expectations. The increase in prices in the service sector compared to the previous period seems to have caused inflation to rise again in February.

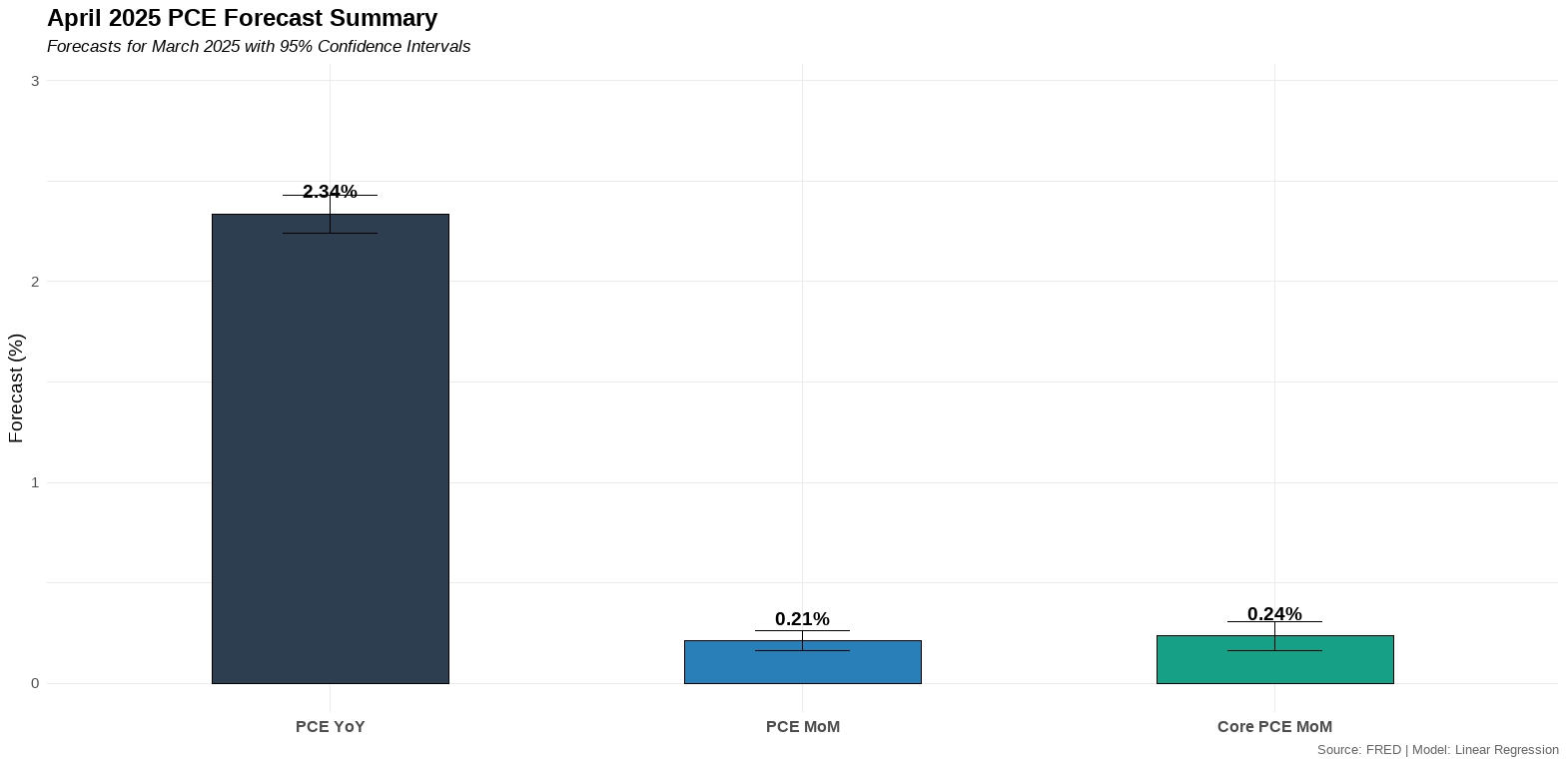

Source: FRED and Darkex Research Department

When we look at the headline PCE Price Index, we see that the 2.6% in December came down to 2.5% in January and February. Our forecast for March is 2.34%. In other words, the rate of increase in prices will remain limited and we will feel the impact of Trump uncertainty. You can see our monthly forecasts in the table above.

A higher-than-expected data may support expectations that the FED will maintain its cautious stance on interest rate cuts, reducing risk appetite and putting pressure on digital assets. A lower-than-expected data may have the opposite effect and pave the way for value gains.

April 30 – US GDP Change

Donald Trump’s unpredictable policy choices are a challenging factor for the entire world. Economic actors are also facing the challenges of this highly uncertain environment as they formulate their expectations and plans for the future. There are some outcomes of this situation. The most important one is the possibility of a slowdown in economic activity. In this respect, it will be very important to see how much the US economy grows in the first quarter of the year, including the period after January 20, when Trunp takes over in the Oval Office.

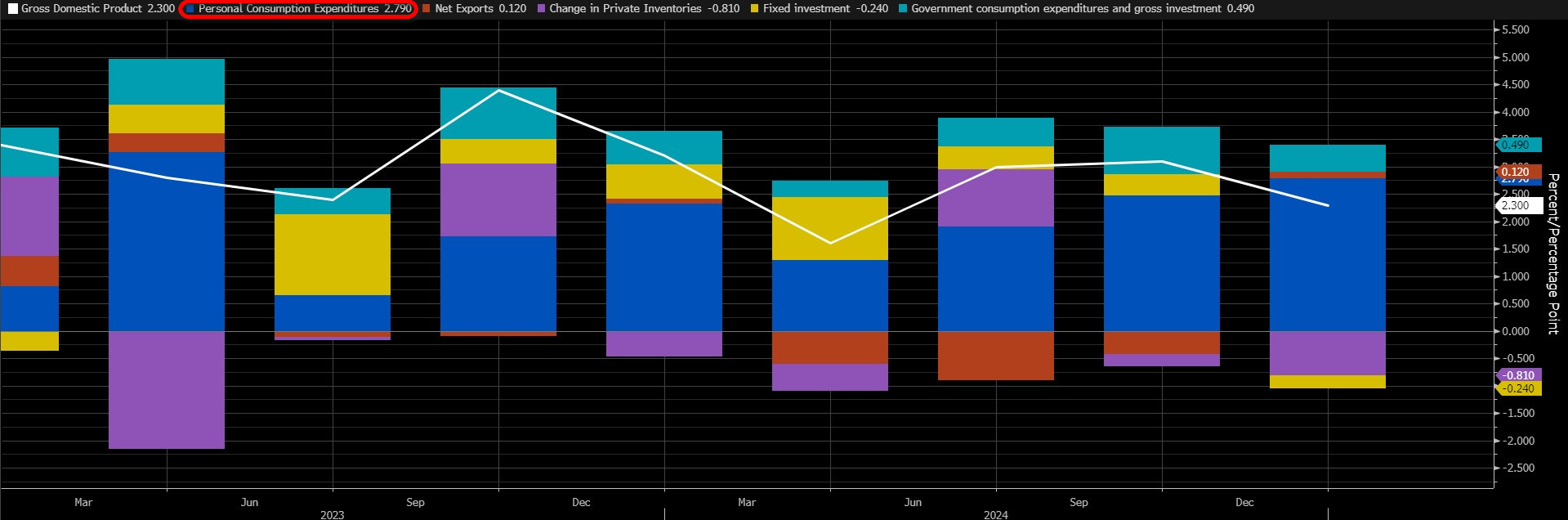

Source: Bloomberg

According to data released on March 27, the US economy grew by 2.4% in the last quarter of 2024. The previous estimate was 2.3% and a small upward revision was made. Our expectation for the new data, which will be important as it will be the first data to be announced for the first quarter of the current year, is that we will not see a growth rate as low as the consensus (25.04.2025 – Bloomberg: 0.4%). This indicates that the Trump effect will not yet be clearly felt. However, it is worth noting that the risks in this forecast are on the downside. This is because the monthly frequency data on consumer spending, which accounts for about 70% of the US economy, published in the relevant quarter pointed to a deterioration in consumer confidence. It seems difficult to quantify and measure this behavior at the moment. The data to be released will allow for healthier and longer-term projections regarding the direction of economic growth.

In terms of immediate market reaction, we think that a data above the consensus expectation may have a positive impact on digital assets by increasing risk appetite. A lower-than-expected GDP data, on the other hand, may have a negative impact from this perspective.

April 2 – US Labor Market Statistics

At the beginning of May, we will be receiving the April Non-Farm Payrolls (NFP) data, which will provide clues about the US Federal Reserve’s rate cut path and the tightness of the financial ecosystem in the coming period. In addition, March figures such as average hourly earnings and the unemployment rate will also be monitored.

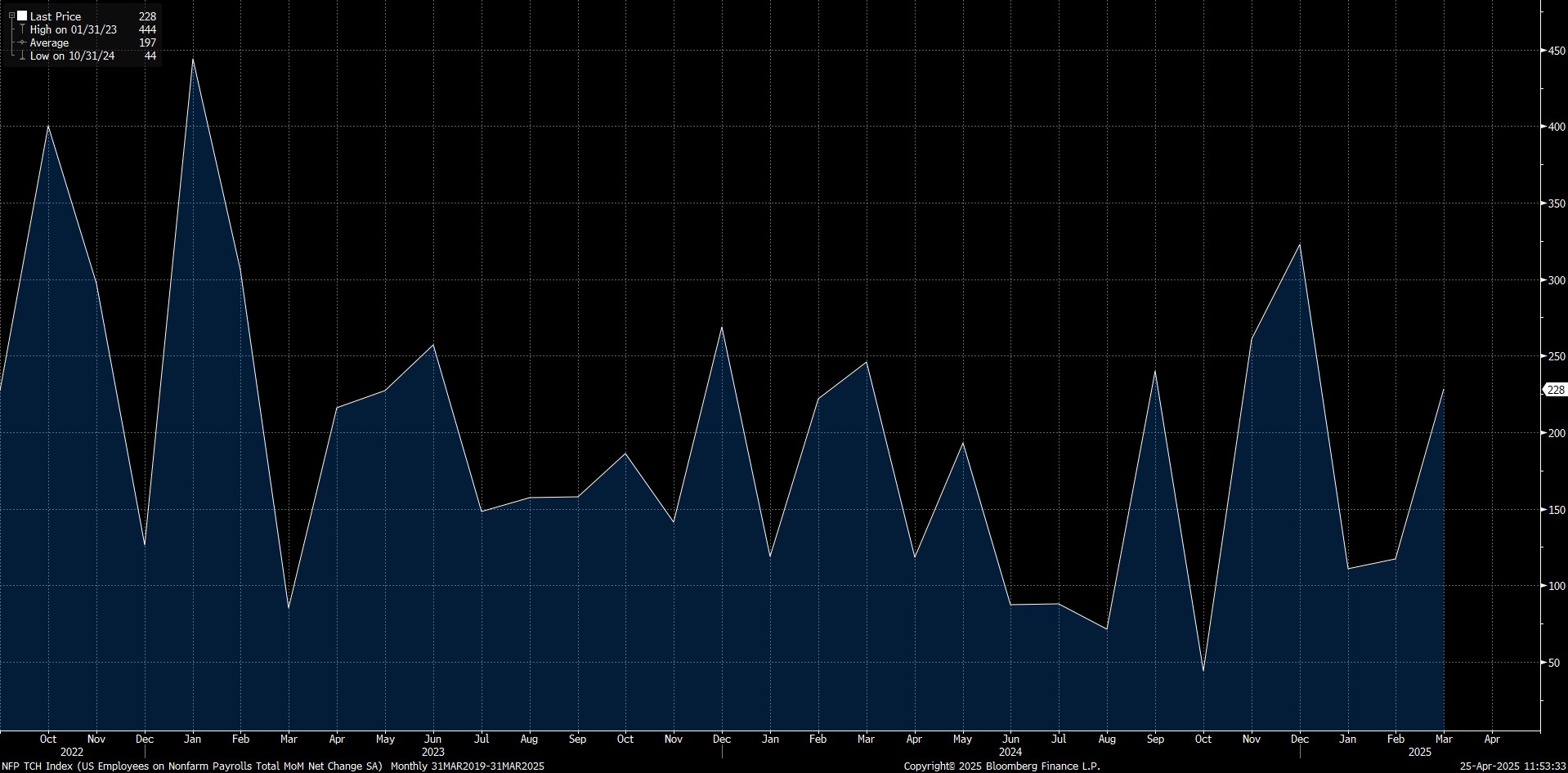

In March, the US economy added 228K jobs (Market Expectation: 137K).

Source: Bloomberg

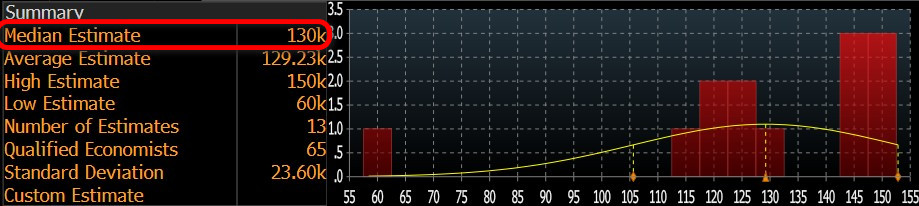

Our forecast for the highly sensitive NFP data is that the US economy added approximately 152K new jobs in the non-farm sectors in April. At the time of writing, although the number of forecasts entered is small, we see that the consensus on the Bloomberg terminal is more pessimistic, around 130K.

Source: Bloomberg

We believe that if the April NFP data, which will be published in the shadow of the deterioration that Trump’s tariff-centered foreign policy may create domestically, is slightly below expectations, this will be priced as a metric that may create an expectation that the FED may act more boldly to lower the interest rate, thus increasing risk appetite and having a positive impact on financial instruments, including digital assets. We think that a slightly higher-than-expected data may have a similar but opposite effect. However, an NFP data that is well below the forecasts may re-trigger recession (stagflation) concerns with a commentary on the health of the US economy, which may put selling pressure on assets considered to be risky. It should be noted here that we also expect a much better-than-anticipated reading to have a positive impact. It is worth noting that we anticipate these effects taking into account the current state of market sentiment.

*General Information About Forecasts

The non-farm payrolls (NFP), personal consumption expenditures (PCE) and GDP growth forecasts presented in this report are based on econometric modeling tools developed by our research department. Different structures were considered for each indicator, and appropriate regression models were constructed in line with data frequency (monthly/quarterly), leading economic indicators and data history.

The basic approach in all models is to interpret historical relationships based on data and to produce forecasts that have predictive power with current data. The performance of the models used is measured by standard metrics such as mean absolute error (MAE) and is regularly re-evaluated and improved. While the outputs of the models guide our economic analysis, they also aim to contribute to strategic decision-making processes for our investors and business partners. Data is sourced directly from the FRED (Federal Reserve Economic Data) platform in an up-to-date and automated manner, so that every forecast is based on the latest economic data. As the research department, we are also working on artificial intelligence-based modelling methods (e.g. Random Forest, Lasso/Ridge regressions, ensemble models) in order to improve forecast accuracy and react more sensitively to market dynamics. The macroeconomic context should be taken into account in the interpretation of model outputs, and it should be kept in mind that there may be deviations in forecast performance due to economic shocks, policy changes and unforeseen external factors. With this monthly updated working set, we aim to provide a more transparent, consistent and data-based basis for monitoring the macroeconomic outlook and strengthening decision support processes.

Digital Compass

In the US, the locomotive of the world economy, we consider it a very important development that a strategic crypto reserve is on the agenda, which started with Trump’s nomination process. However, the fact that the markets had already priced in the “best case scenario” before and after the US elections, combined with the “less than perfect” news on this issue, put pressure on digital assets. We continue to keep the strategic reserve issue in our equation as a positive variable for cryptocurrencies in the long term. On the other hand, we think that there is no new news flow that will create pressure in the medium term, create enthusiasm in the crypto market, and that concerns that global economic activity may slow down in global markets, especially with Trump’s tariffs, will gradually begin to dissipate, and in this parallel, we soften our view that “pressure may continue in the medium term” and align it with our long-term bullish expectation. In the short term, markets will continue to be sensitive to macro indicators and tariff developments.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Darkex Monthly Strategy Report – April

Ripple’s Hidden Road Acquisition: The Beginning of a New Era for

GameStop’s Bitcoin Acquisition Plans and its Strategic Transformation

Digital Collecting, Regulation and Opensea’s Request

The Digital Asset Fund Revolution: Trump Media’s “Made in America” ETF Move

Tether’s Journey to Success: From Crypto World to Global Financial

Click here for all our other Market Pulse reports.

Important Economic Calendar Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.