Tariffs, FED, Economic Growth and Geopolitical Agenda

With the first quarter of the year behind us, global markets continue to struggle with a challenging and highly uncertain period. The most prominent headlines can be summarized as the risks brought by Trump’s stance on tariffs, concerns over global economic growth, expectations regarding the US Federal Reserve’s interest rate cut course and the geopolitical agenda in the Middle East and Ukraine.

At the beginning of April, the US will impose additional tariffs on many of its trading partners, barring any new developments. Other countries, particularly the European Union, are preparing to respond, which keeps the risk of a global “trade war” alive. One of the possible outcomes of this is an economic slowdown… A recession, which could affect the value of all financial instruments without exception, is one of the main concerns of investors. After the second Federal Open Market Committee (FOMC) of the year, which concluded last week, the FED’s revisions to economic projections also pointed to the risk of stagflation. The FOMC revised growth expectations downwards and inflation forecasts upwards. Apart from all these, in Europe, the new spending budget approved in Germany, the continent’s largest economy, seems to be creating a stir.

Geopolitical dynamics have been slightly less influential on price changes recently compared to other factors. The Israeli attacks on Gaza and the US operations against the Houthis in Yemen continue. However, markets are less resilient to these developments compared to previous months. More than these developments in the south, the agenda in Eastern Europe has become more prominent, especially with the start of Trump’s presidency. In Riyadh on Monday, Russian and US experts will discuss ways to ensure the safety of shipping in the Black Sea during talks on a possible peace deal in Ukraine. A ceasefire between Ukraine and Russia is not yet in place, but an agreement to limit the strikes on energy facilities could open the door to a peace deal in the future. Developments will continue to be monitored.

Next week, the issue of tariffs, which are expected to come into effect in early April, may be on the agenda a bit more. In addition, we will continue to gather information and try to make predictions about the strength of economic activity and the Fed’s interest rate cut path. In this context, we will focus on the US PCE Price Index, which will be released on Friday.

Digital Compass

We consider it a very important development that a strategic crypto reserve is on the agenda in the US, the locomotive of the world economy. However, the fact that the markets had already priced in the “best case scenario” combined with the “less than perfect” news on this issue put pressure on digital assets. We continue to keep the strategic reserve issue in our equation as a positive variable for cryptocurrencies in the long run. On the other hand, we think that we may continue to see pressure in the medium term if there is no new news flow that will create enthusiasm in the market and if concerns about slowing economic activity in global markets with the tariff agenda increase further. We emphasize that there is no problem with the gradual spot asset accumulation strategy, but caution should be exercised in leveraged “long” transactions. In the short term, markets will continue to be sensitive to macro indicators and Trump’s actions on tariffs, which may continue to keep volatility high.

March 28 – FED’s Favourite Inflation Indicator: PCE

Personal Consumption Expenditures (PCE) shows the change in the price of goods and services purchased by consumers and is an inflation indicator. It is a macro indicator that the US Federal Reserve (FED) monitors more closely than the Consumer Price Index (CPI) to measure changes in consumer prices. It differs from the core CPI in that it measures only goods and services for and consumed by individuals. It is published monthly, about 30 days after the month ends and about 10 days after the CPI.

FED Chairman Powell’s speech at the Jackson Hole Symposium last year led to a significant shift in the equation. Powell’s remarks shifted the focus from inflation to the strength of the labor market and conveyed the message that the FED would now give more importance to the strength of the labor market in its decisions. Or at least that is how the markets interpreted the statements. Recent months have shown that this may not be the right approach.

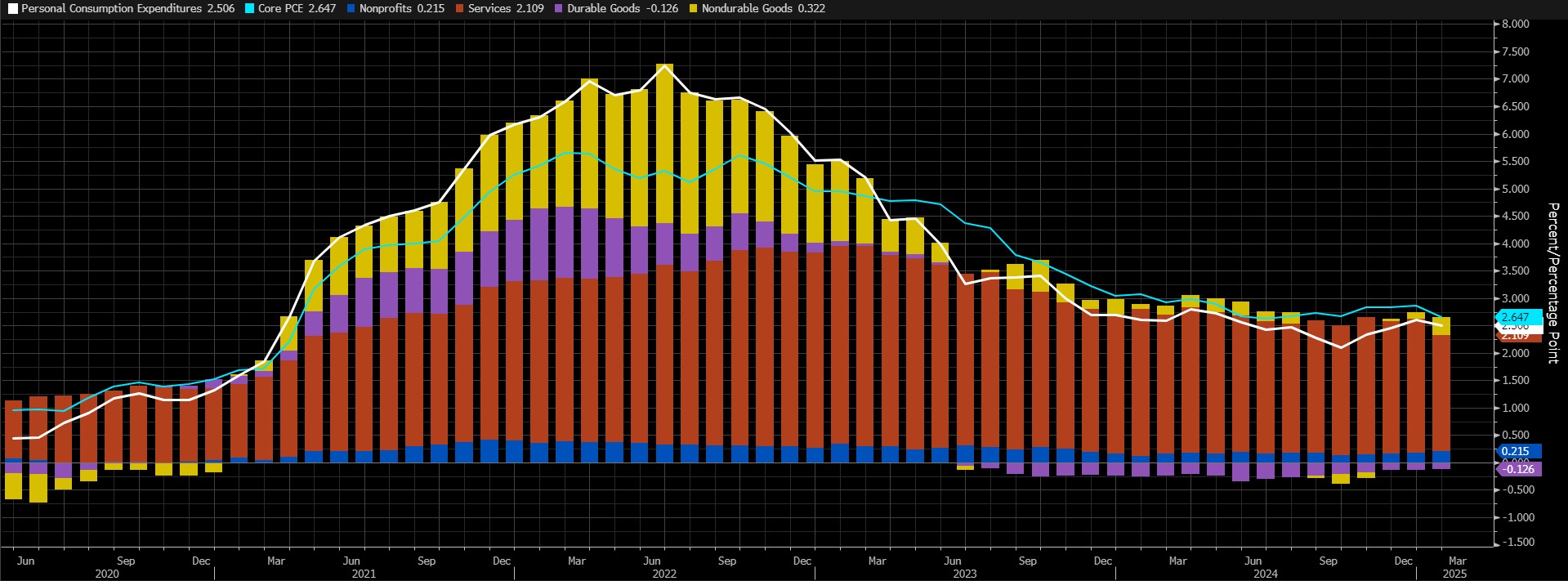

Source: Bloomberg

We will evaluate the annual core Personal Consumption Expenditures (PCE) data for February. However, core data and monthly data will also be important. PCE, which signaled an increase of 2.6% in December, rose by 2.5% in January, according to the latest data. This was the first slower increase in four months. On Wednesday, the FOMC raised its forecast for PCE to 2.7% for 2025, up from 2.5% previously. We can say that this reflects the uncertainty that comes with the fast-changing decisions of the new US President Trump and the burden of tariffs. Analysing the forecasts, we see that in general, the PCE data set is not expected to be very different from the previous figures.

A data above the median forecast may support expectations that the FED will maintain its cautious stance on interest rate cuts, reducing risk appetite and putting pressure on digital assets. A lower-than-expected data, on the other hand, may have the opposite effect and pave the way for value gains.

Darkex Research Department Current Studies

Darkex Monthly Strategy Report – March

Dynamics and Expectations in Investor Positions

Tariffs to be Imposed by the US: Potential Impact on Technology-Focused Companies

Circle and Tether’s Competition in the US and Europe

Stablecoin Issuers Approved Under MiCA Regulation and Market Impacts

Click here for all our other Market Pulse reports.

Important Economic Calendar Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.