Introduction

Donald Trump, who was re-elected as president with the slogan “Make America great again”, has so far been generally interventionist, nationalist and aggressive growth-oriented in his economic outlook. In contrast, the Federal Reserve System (Fed) has been more cautious and data-driven in line with both global and domestic economic dynamics. This divergence of views has come to the fore with Trump’s frequent criticism Fed chair Jerome Powell.

Trump’s Economic Outlook and Policies

Trump’s economic policies constitute the basis for the disagreements with the Fed. In this context, Trump’s economic policies can be summarized as follows:

Protectionist Economic Policy

Trump’s economic policies are based on the vision of “making America great again”. According to Trump, the way to protect American producers is to limit foreign trade. Accordingly, he imposed high tariffs on imports from countries such as China, Mexico and Vietnam in order to reduce foreign trade deficits. Moreover, from this perspective, Trump is critical of the free trade agreement.

Stimulating Growth with Tax Cuts

The corporate tax rate in the US is 21%. This rate was reduced from 35% by the Tax Cuts and Jobs Act (TCJA) enacted by the Trump administration in 2017. Trump’s main objective in his tax cut policy is to attract capital to the US by encouraging investment and employment.

Anti-High Interest Rate and Strong Dollar Stance

Throughout his presidency, Trump has argued that the strong dollar hurts exporters and has pressed the Fed for lower interest rates

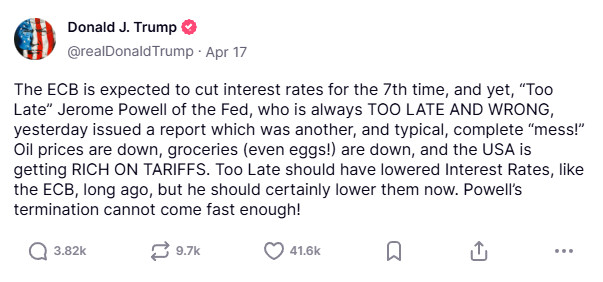

In one of his remarkable posts on the subject, Trump wrote, “It looks like the ECB (European Central Bank) is going to cut interest rates for the seventh time, but Fed Chairman ‘Mr. Too Late’ Jerome Powell, who is always TOO LATE AND WRONG, released a report yesterday that is again a typical ‘mess’! Oil prices are down, grocery prices (even eggs!) are down, and the US is getting RICHER BY DUTY TAXES. ‘Mr. Too Late’ should have cut interest rates much earlier, just like the ECB, but he definitely needs to cut them now. Powell’s dismissal cannot happen fast enough!”

Fed Chair Powell’s Stance

In response to all Trump’s criticisms, Powell emphasized that the Fed is independent from political decisions and said, “Today’s inflation data shows that we are close to the target, but not there yet.” With these statements, Powell pointed out that it is still at an early stage for a rate cut. In addition, Powell emphasized the principle of political independence and said, “In the near term, the election will have no impact on our policy decisions.”

Trump, on the other hand, later softened this rhetoric and said that he had “no intention of dismissing Powell”. Thus, this discourse fell off the agenda for a while.

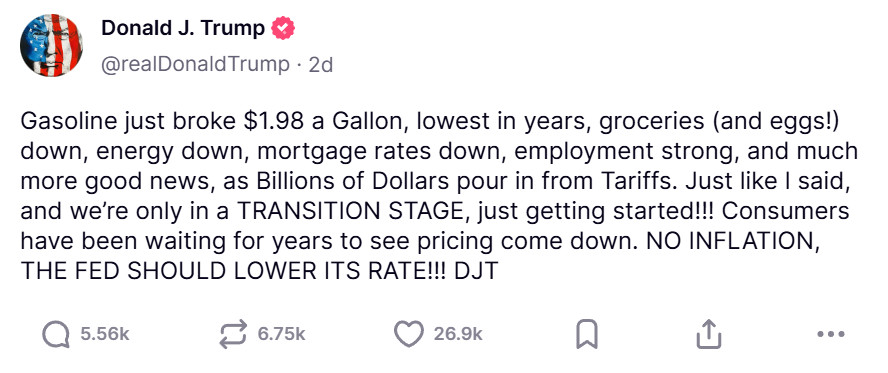

However, Trump’s pressure on the Fed to lower interest rates continues to have an impact. In this context, Trump reaffirmed his unchanged stance in a recent post on his social media account with the following statement: “Gasoline just broke $1.98 a Gallon, lowest in years, groceries (and eggs!) down, energy down, mortgage rates down, employment strong, and much more good news, as Billions of Dollars pour in from Tariffs. Just like I said, and we’re only in a TRANSITION STAGE, just getting started!!! Consumers have been waiting for years to see pricing come down. NO INFLATION, THE FED SHOULD LOWER ITS RATE!!!’’

Market Reactions and Potential Impacts

Trump’s criticism of Powell and his demands for a rate cut created uncertainty in the markets in the early stages. In particular, concerns over the Fed’s independence had a negative impact on investor confidence. However, Trump’s later backtracking and announcement that he would not dismiss Powell was welcomed by the markets.

However, Trump’s similar rhetoric may create a new environment of uncertainty in the markets and this may accelerate capital outflows, which tend to avoid uncertainty.