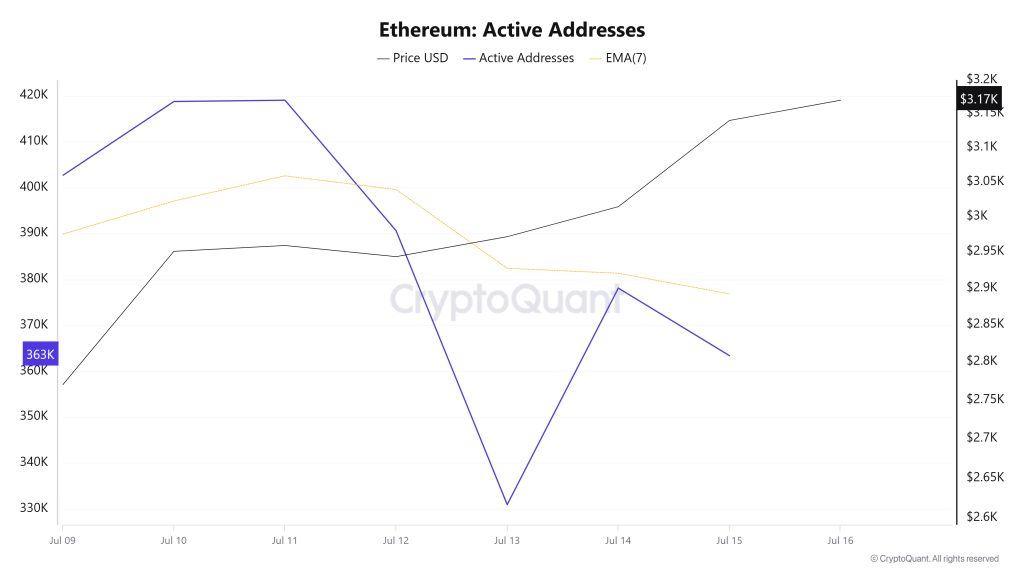

Active Addresses

Between July 9-16, a total of 419,024 active addresses entered the Ethereum network. During this period, the Ethereum price rose from $2,769 to $3,170. Especially on July 13, at the intersection of the price and the number of active addresses, there was a significant drop in the number of active addresses while the price continued to rise. This suggests that despite the price increase, short-term participation has decreased and is likely to be dominated by trades among existing investors. When the 7-day simple moving average (SMA) is analyzed, it is seen that a general upward trend is dominant in the Ethereum price.

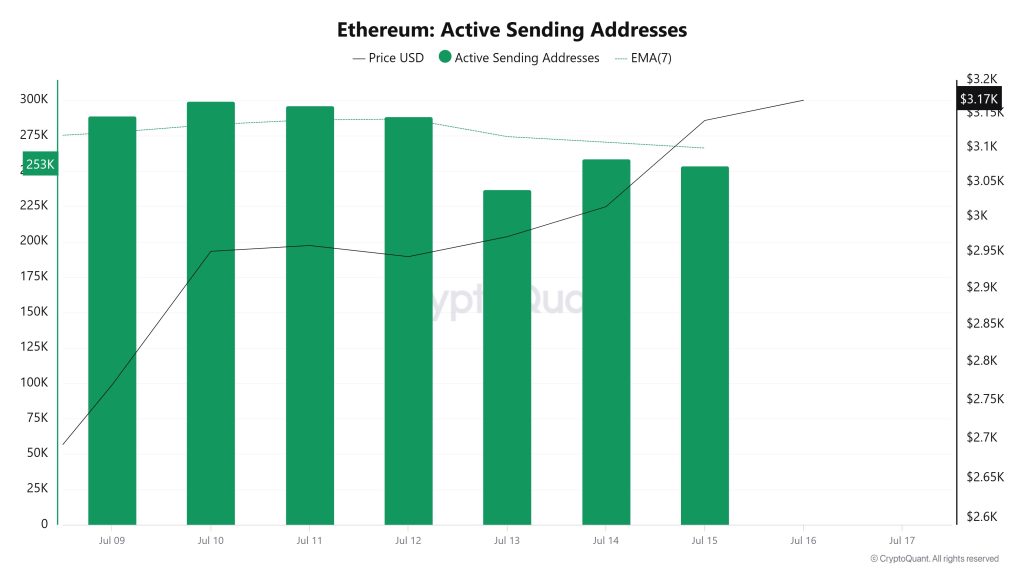

Active Sending Addresses

Between July 9 and July 16, a bullish movement was observed in active shipping addresses with the Black Line (price line). On the day when the price reached a weekly high, active sending addresses were at 299,316; Between July 9-12, Ethereum wallets were seen to rise at a similar point on a weekly basis.

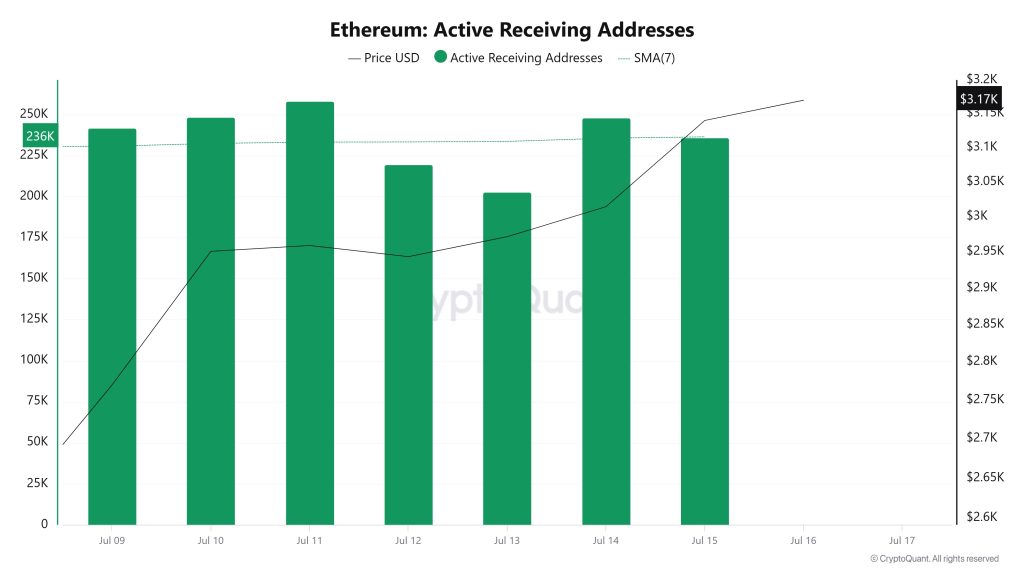

Active Receiving Addresses

Between July 9th and July 16th, there was an increase in active buying addresses and the price consolidated in parallel. On the day the price peaked, active receiving addresses rose as high as 299,316, indicating that buying is accelerating.

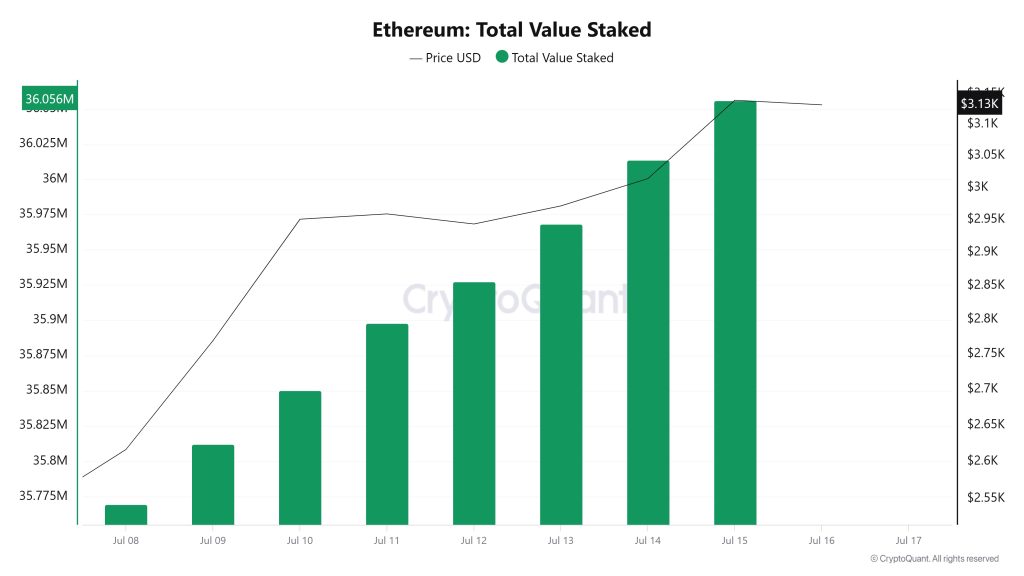

Total Value Staked

On July 9, ETH price was 2,769 while Total Value Staked was 35,812,413. As of July 15, ETH price has increased by 13.35% to 3,139, while Total Value Staked has increased by 0.68% to 36,056,391.

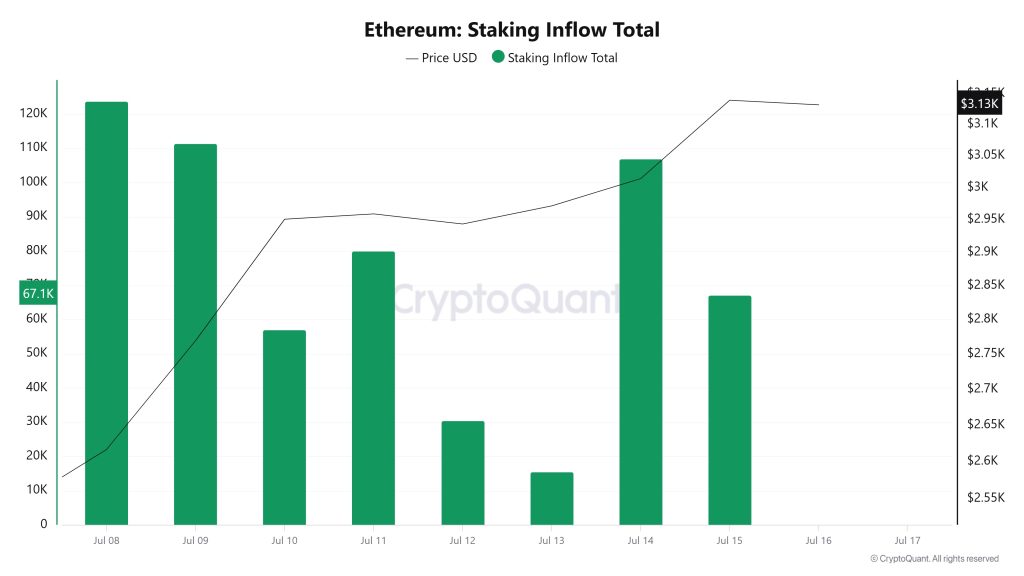

Staking Inflows

On July 9th, ETH price was at 2,769 while Staking Inflow was at 111,335. As of July 15, ETH price rose to 3,139, an increase of 13.35%, while Staking Inflow fell to 67,183, a decrease of 39.67%.

Derivatives

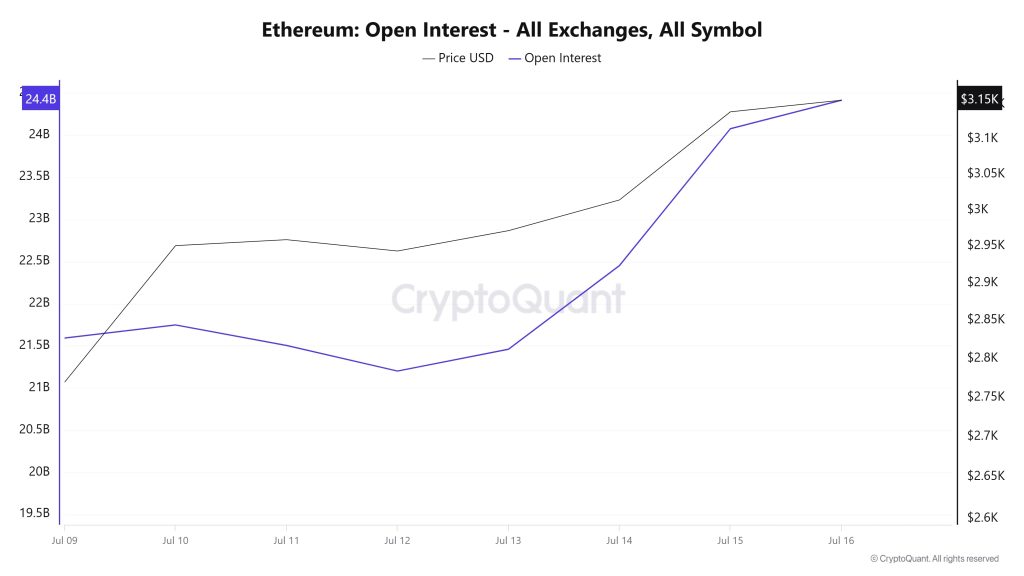

Open Interest

Ethereum’s open interest movement since July 9th seems to have progressed quite synchronously with the price. Open interest, which was around $ 21 billion in the first place, rose to $ 22.5 billion with the price rise. During this period, Ethereum price also accelerated from $ 2,700 to $ 2,950. However, there was a slight pullback on Open Intrest between July 11-12, suggesting that the market entered a short period of breathing or profit realization. However, this decline was short-lived and by July 13, Open Interest rebounded and showed a strong uptrend.

In the last two days, both price and open interest have headed steeply upwards. Open interest reached $24.4 billion, while the Ethereum price hit $3,150. This parallel rise indicates an increase in leveraged positions in the market and investors’ appetite for bullish expectations. Usually, this increase in Open interest along with the price reflects the market’s bullish confidence. However, it is also a reminder that leverage levels are increasing and therefore the risk of volatility is also rising. It is worth being careful in the short term as such vertical breakouts have the potential to bring corrections at the same speed.

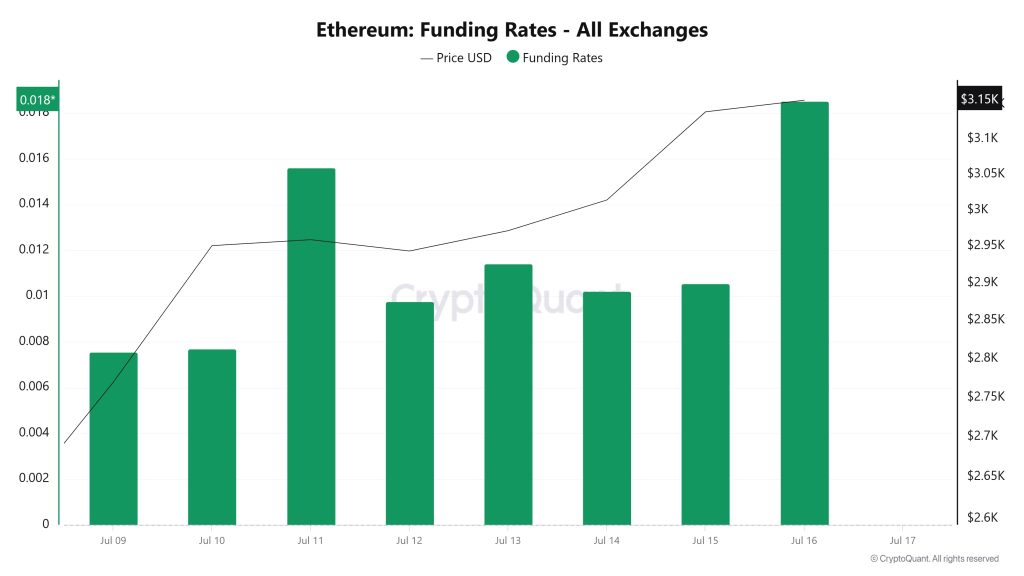

Funding Rate

Looking at Ethereum’s funding rate data, it is seen that the recent upward trend is clearly felt not only in the price but also in the market structure. The significant increase in funding rates, especially in the last few days, shows that the demand for long positions has increased rapidly. This reveals that investors are aggressively positioning for leveraged buying in anticipation of a rise.

What is noteworthy is that this increase is in parallel with the price. In other words, not only the price is rising, but also the structural data supporting this rise is gaining strength. However, the fact that the funding rate remains in such positive territory also indicates that the market is overheating and the risk of a correction in the short term is on the table. Because if funding rates remain consistently high in favor of buyers, this could pave the way for a sell squeeze. Therefore, in order for this rise to continue in a healthy way, a phase has entered a phase where short intervals of stabilization are important.

Long & Short Liquidations

With the ETH price breaking the $3,000 mark, $446 million in long and $509 million in short transactions were liquidated this week.

| Date | Long Amount (Million $) | Short Amount (Million $) |

|---|---|---|

| July 09 | 15.80 | 131.87 |

| July 10 | 38.47 | 123.08 |

| July 11 | 84.39 | 55.33 |

| July 12 | 36.34 | 12.47 |

| July 13 | 26.59 | 27.24 |

| July 14 | 69.71 | 47.43 |

| July 15 | 174.77 | 111.63 |

| Total | 446.07 | 509.05 |

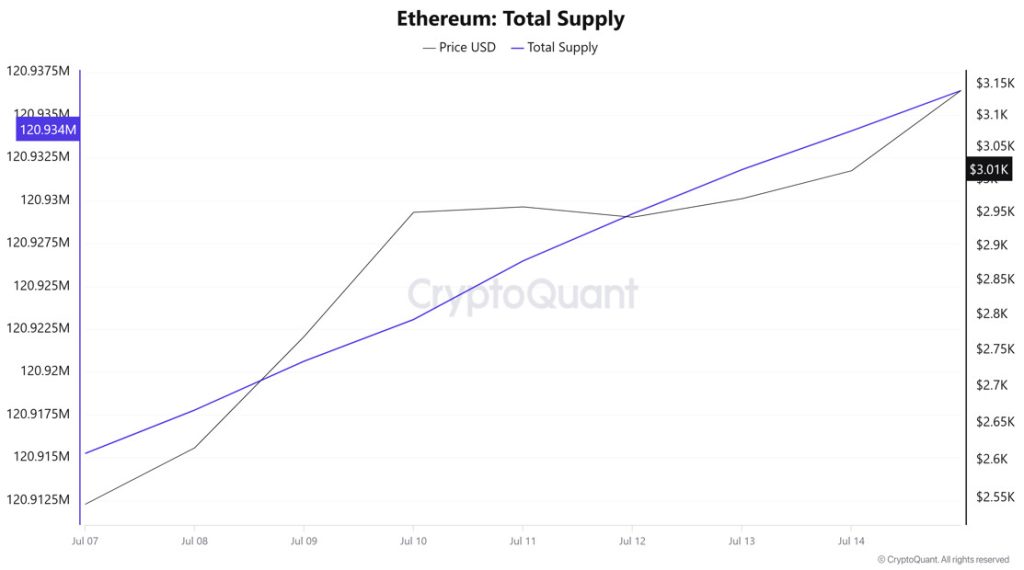

Supply Distribution

Total Supply: 120,934,075 units, up about 0.032% from last week.

New Supply: The amount of ETH produced this week was 38,900.

Velocity: Velocity was 8.58 as of July 14, up from 8.46 last week.

| Wallet Category | 07.07.2025 | 14.07.2025 | Change (%) |

|---|---|---|---|

| 100 – 1k ETH | 9.1249 M | 9.0086 M | -1.2745% |

| 1k – 10k ETH | 13.5084 M | 13.4681 M | -0.2983% |

| 10k – 100k ETH | 16.8689 M | 16.4581 M | -2.4353% |

| 100k+ ETH | 4.0773 M | 4.0726 M | -0.1153% |

According to the latest weekly data, a general downward trend in Ethereum wallet distribution stands out. While there was a limited decrease of 1.27% in the number of wallets in the 100 – 1k ETH range, a 0.30% decline was recorded in the 1k – 10k ETH segment. The 10k – 100k ETH range saw a more pronounced decline of 2.44%, while the 100k+ ETH category saw a slight decrease of 0.12%.

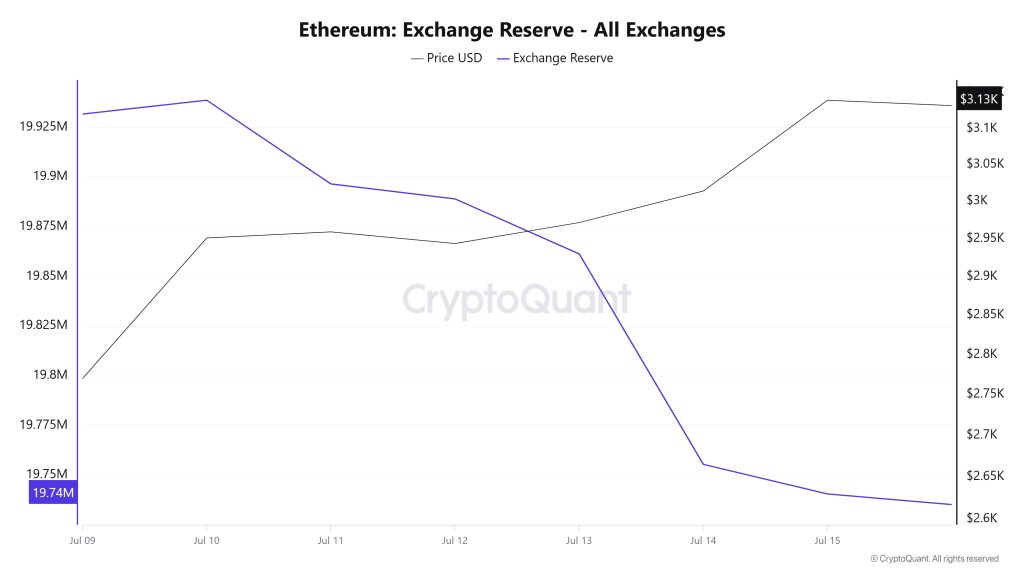

Exchange Reserve

Between July 9-15, 2025, Ethereum reserves on exchanges decreased from 19,931,668 ETH to 19,740,541 ETH. During this period, there was a total net outflow of 191,127 ETH and reserves on exchanges decreased by about 0.96%. During the same period, the Ethereum price rose from $2,770 to $3,140, gaining 13.35%. The increase in outflows from the exchanges indicates that investors tend to store their assets for the long term and the selling pressure in the market has decreased. This indicates that market sentiment is strongly positive.

| Date | 9-Jul | 10-Jul | 11-Jul | 12-Jul | 13-Jul | 14-Jul | 15-Jul |

| Exchange Inflow | 1,107,451 | 1,372,705 | 1,882,961 | 451,486 | 477,293 | 1,320,885 | 1,429,351 |

| Exchange Outflow | 1,077,873 | 1,365,746 | 1,925,086 | 459,021 | 504,953 | 1,426,749 | 1,444,253 |

| Exchange Netflow | 29,578 | 6,959 | -42,126 | -7,535 | -27,660 | -105,863 | -14,902 |

| Exchange Reserve | 19,931,668 | 19,938,627 | 19,896,501 | 19,888,966 | 19,861,307 | 19,755,443 | 19,740,541 |

| ETH Price | 2,770 | 2,951 | 2,959 | 2,943 | 2,971 | 3,014 | 3,140 |

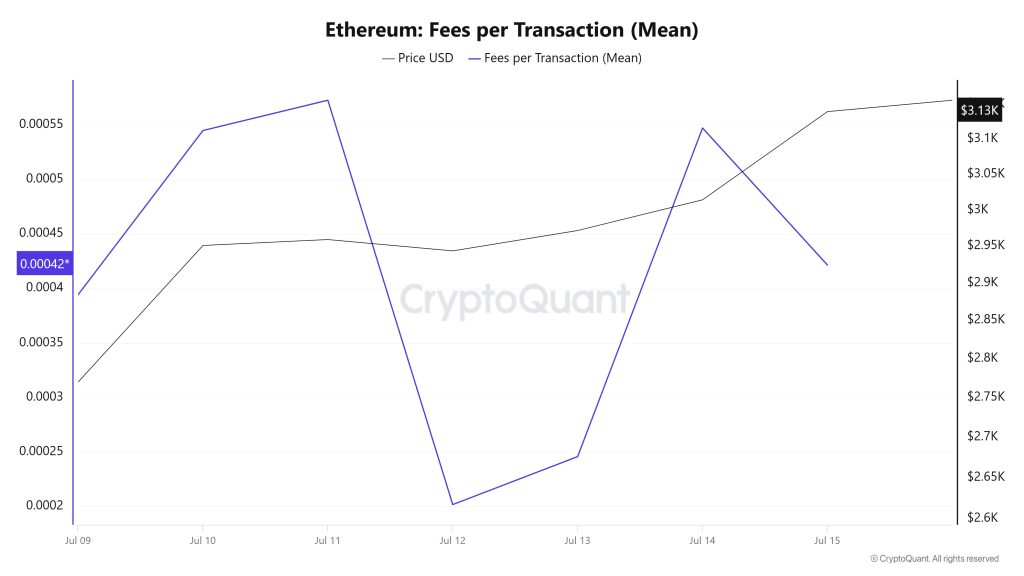

Fees and Revenues

When the Ethereum Fees per Transaction (Mean) data between July 9 and July 15 are analyzed, it is seen that this indicator was realized at 0.000394282864868369 on July 9, the first day of the week.

As of this date, a fluctuating course was observed with the effect of the volatile movements in the Ethereum price; As of July 11, it reached 0.000572846364156753, reaching the highest level of the week.

In the following days, Ethereum Fees per Transaction (Mean) declined again and closed at 0.000421554206869395 on July 15, the last day of the week.

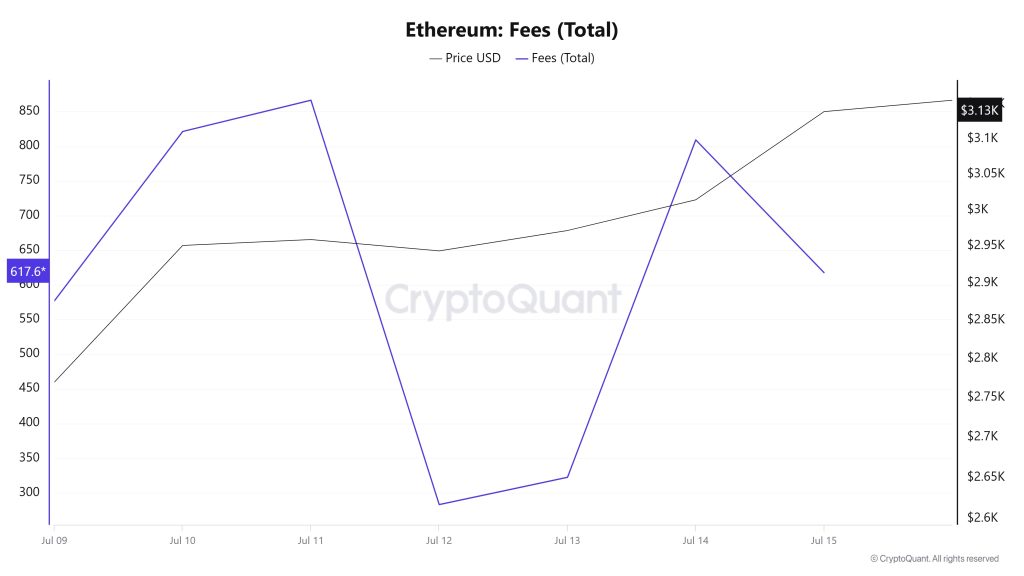

Bitcoin: Fees (Total)

Similarly, when the Ethereum Fees (Total) data between July 9 and 15 is analyzed, it is seen that this indicator was realized at 576,9651560821001 on July 9, the first day of the week.

As of this date, a fluctuating course was observed with the effect of volatile movements in the Ethereum price; As of July 11, it reached 866.4335628652732, reaching the highest level of the week.

In the following days, Ethereum Fees (Total) declined again and closed at 617,6839878322086 on July 15, the last day of the week.

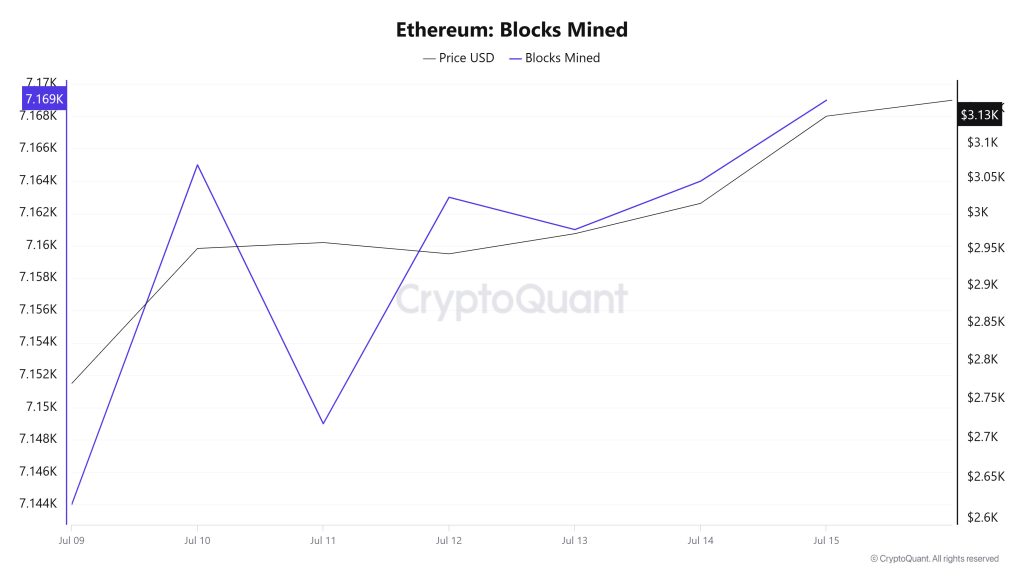

Blocks Mined

Between July 9 and July 15, Ethereum block production data showed a slight increase throughout the week. While 7,144 blocks were produced on July 9, this number increased to 7,169 as of July 15. There was a positive correlation between the Ethereum price and the number of block production throughout the week.

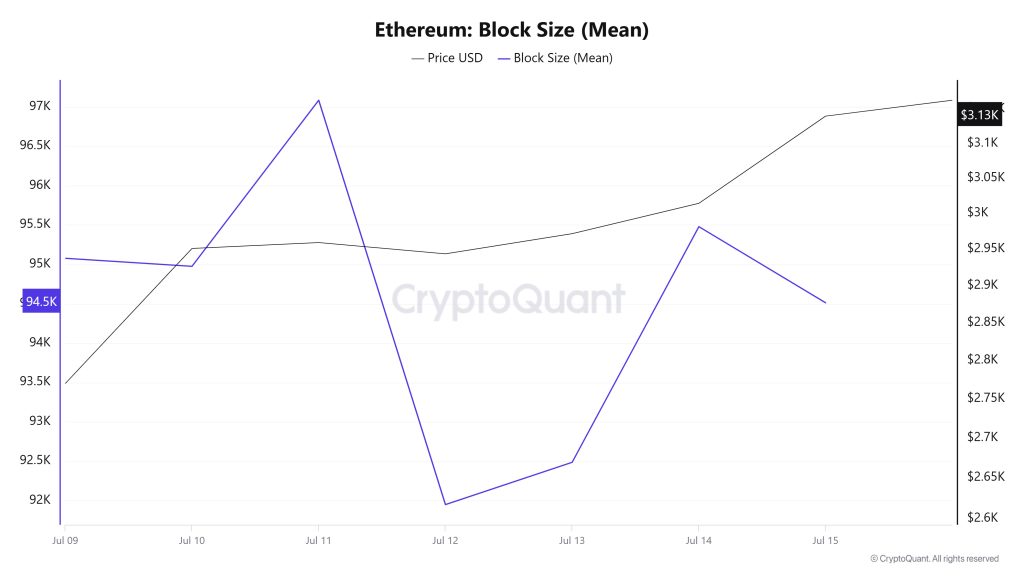

Block Size

When the Ethereum block size data between July 9 and July 15 is analyzed, it is observed that there was a decrease throughout the week. On July 9, the average block size was measured at 95,076 bytes, while this value decreased to 94,511 bytes as of July 15. This decrease indicates that the transaction density or block occupancy rates on the network decreased on a weekly basis.

There was a positive correlation between block size and Ethereum price during the week.

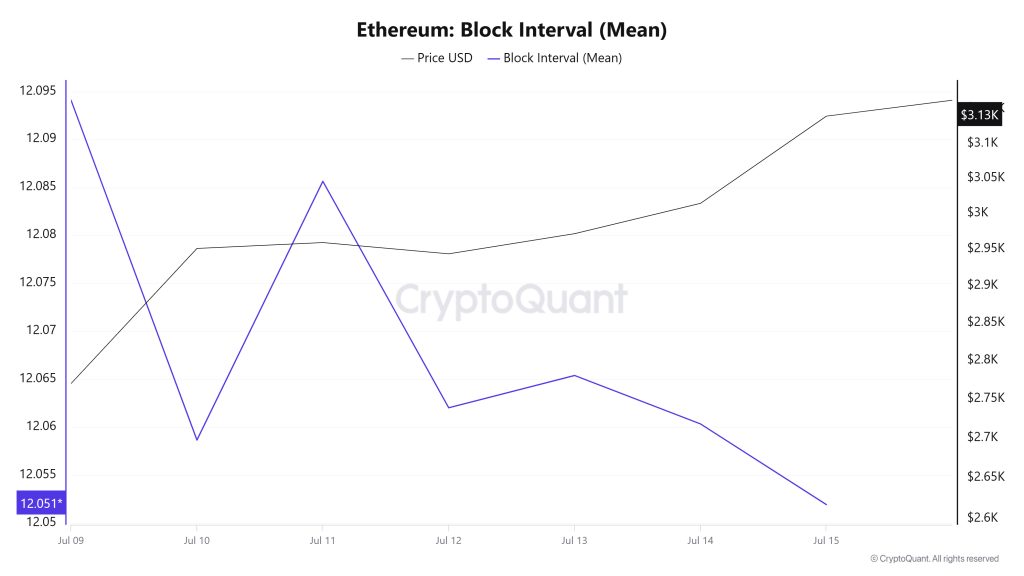

Block Interval

Between July 9 and July 15, Ethereum block data showed a slight decrease throughout the week. On July 9, the average block duration was recorded as 12.09 seconds, while it decreased to 12.05 seconds as of July 15. During the period in question, Ethereum block duration and price movement were negatively correlated throughout the week.

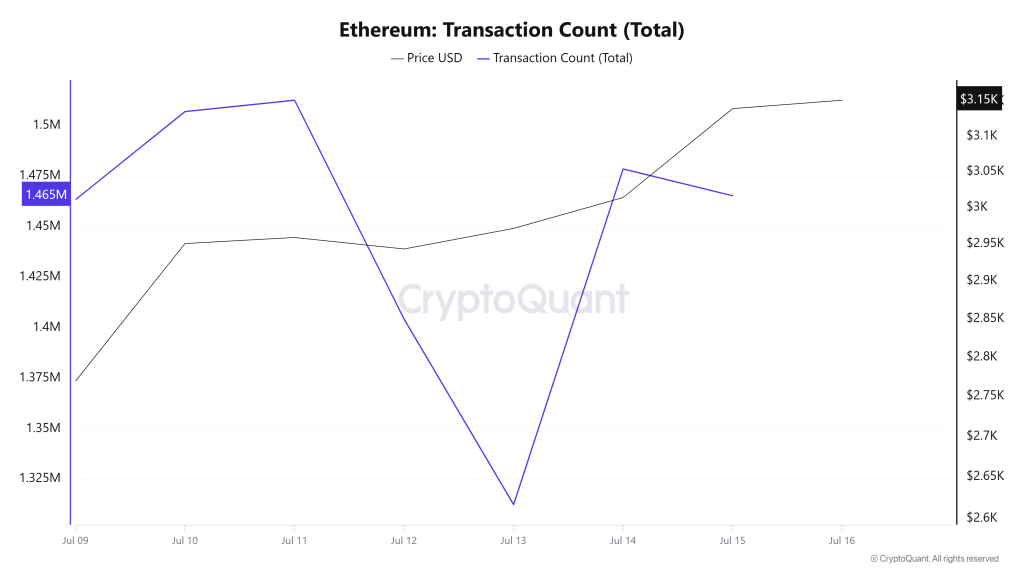

Transaction

Last week, a total of 9,767,021 transactions were executed on the Ethereum network, while this week it increased by about 3.85% to 10,143,208. The highest number of transactions on a weekly basis was 1512,506 on July 11, while the lowest number of transactions was 1,312,482 on July 13.

The change in the number of transactions indicates that the usage on the network is increasing and, accordingly, Ethereum burns have increased compared to last week. The correlation between price and number of transactions was generally stable throughout the week.

Tokens Transferred

Last week, the total amount of ETH transferred on the Ethereum network was 9,335,529, while this week it increased by 84.11% to 17,183,427. The 3,819,852 ETH transfer on July 11 was the highest daily token transfer amount of the week, while the lowest value of the week was recorded on July 13 with only 943,424 ETH transferred. Throughout the week, the price-to-token relationship showed a positive weighted correlation.

The increase in the number of transfers in use of the network, as well as the rise in the amount of tokens transferred, clearly shows that user activity and transaction volume on the Ethereum network is increasing overall. This is a strong sign that Ethereum is expanding its user base on DeFi, NFT and other Web3 applications. The acceleration of liquidity movements on the network reveals that users are conducting more transactions and the Ethereum ecosystem remains vibrant.

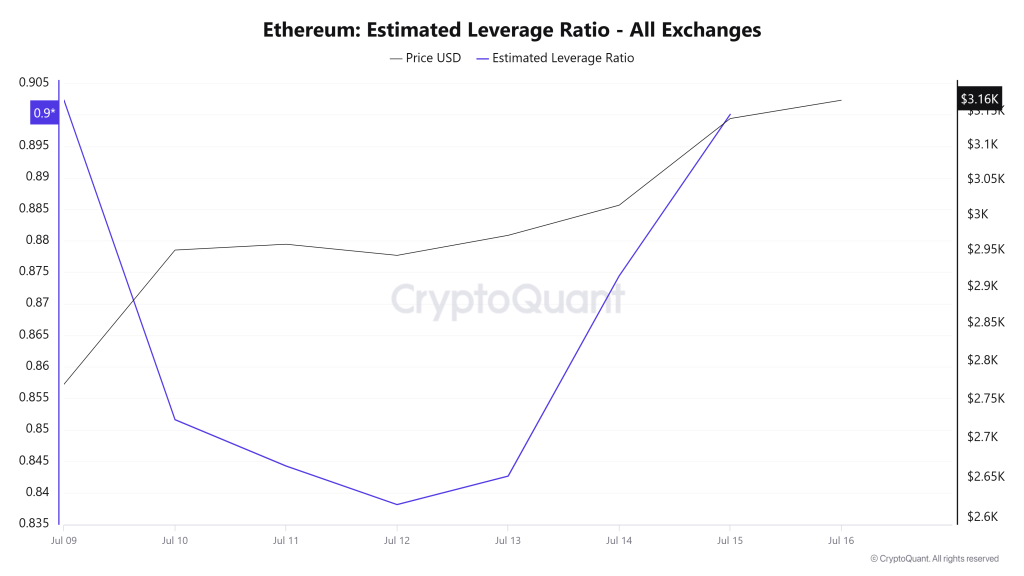

Estimated Leverage Ratio

During the 7-day period, the metric generally fell at the first time of the process. ELR (Estimated Leverage Ratio), which had a value of 0.902 at the beginning of the process, fell to 0.838 on July 12, forming the lowest point of the process. This was also the lowest point of the process. The metric trended upwards after the rest of the process, reaching 0.900 at the time of writing, which is the peak of the process. A higher ELR means that participants are willing to take on more risk and generally indicates bullish conditions or expectations. It should be noted that these rises can also be caused by a decrease in reserves. When we look at Ethereum reserves, there were 19.93 million reserves at the beginning of the process, while this figure decreased during the rest of the process and is currently 19.74 million. At the same time, Ethereum’s Open Interest is seen as 35.57 billion dollars at the beginning of the process. As of now, the volume has increased in the process and the open interest value stands out as 46.00 billion dollars. With all this data, the ELR metric has followed an upward trend since the middle of the process. The price of the asset, with all this data, formed the highest point of the process at the time of writing and was valued at $ 3,164, while the lowest point was realized at the beginning of the process and was valued at $ 2,589. As of now, the increase in the risk appetite of investors and traders continues. The fluctuations in the ELR ratio throughout the process show us that although the open interest has increased, the increase in volume is not only due to buying but also to selling transactions. On the other hand, the downward movement in reserves explains the increase in the ELR ratio since the middle of the period. As a result, as a result of the decrease in reserves and the increase in open interest, it shows that the market is currently in an appetitive approach.

ETH Onchain Overall

| Metric | Positive 📈 | Negative 📉 | Neutral ➖ |

|---|---|---|---|

| Active Addresses | ✓ | ||

| Total Value Staked | ✓ | ||

| Derivatives | ✓ | ||

| Supply Distribution | ✓ | ||

| Exchange Reserve | ✓ | ||

| Fees and Revenues | ✓ | ||

| Blocks Mined | ✓ | ||

| Transaction | ✓ | ||

| Estimated Leverage Ratio | ✓ |

*The metrics and guidance in the table do not, by themselves, describe or imply an expectation of future price changes for any asset. The prices of digital assets may vary depending on many different variables. The onchain analysis and related guidance are intended to assist investors in their decision-making process, and making financial investments based solely on the results of this analysis may result in harmful transactions. Even if all metrics produce a bullish, bearish or neutral result at the same time, the expected results may not be seen depending on market conditions. Investors reviewing the report would be well advised to heed these warnings.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.

NOTE: All data used in Ethereum onchain analysis is based on Cryptoqaunt.