Strengthening American Leadership in Digital Financial Technology

The US’s digital finance journey gained a new dimension with the White House document titled “STRENGTHENING AMERICAN LEADERSHIP IN DIGITAL FINANCIAL TECHNOLOGY” published in 2025. The key points of this important document and the roadmap the US has outlined for itself in the global digital asset market are discussed in our report.

The report includes the following sections

- Digital asset regulation: The legal framework and approach of U.S. institutions toward digital assets,

- Digital assets in banking: The evolving role of banks and financial institutions,

- Combating illicit finance: Risks and the U.S. approach,

- Taxation: The tax implications of digital assets and current regulatory developments.

In summary, this report evaluates both current developments and key issues for the coming period in light of the main sections of the White House’s report.

Digital Asset Regulation

Satoshi Nakamoto, the creator of Bitcoin, designed Bitcoin not only as a digital currency but also as a platform where users could transact directly with each other. While transactions initially took place through decentralized P2P networks and forums, the rise of centralized exchanges such as Mt. Gox in 2013 marked the beginning of a new era in the sector. Although the collapse of Mt. Gox in 2014 caused significant shock, the crypto sector continued to grow with more robust and professional infrastructure. Today, digital assets are not merely investment tools; they are seen as the building blocks of new-generation financial systems, governance models, and economic value transfer mechanisms.

With this transformation, the question of how regulatory bodies such as the SEC and CFTC in the US will classify and regulate digital assets has become critical. Assets are now categorized into subclasses such as tokenized securities, commodity tokens, hybrid structures, or network tokens, and are subject to function-based regulatory models. In this context, the SEC focuses more on tokens with securities characteristics, while the CFTC has regulatory authority over digital assets and derivative products classified as commodities. However, this distinction is not yet fully clear, leaving market participants to face regulatory uncertainty from time to time.

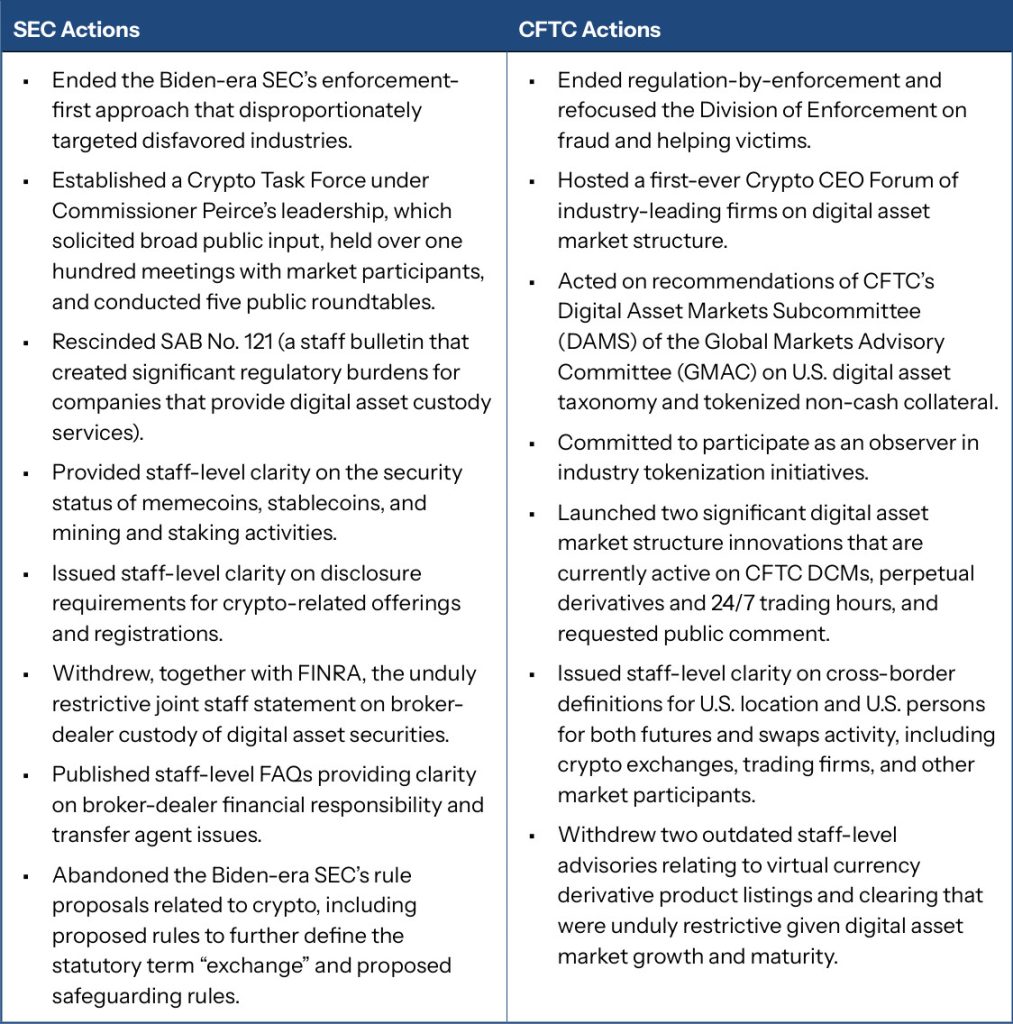

Recent regulatory reforms, particularly those gaining momentum following the Trump administration, highlight the steps taken by the SEC and CFTC regarding digital asset markets, as illustrated in the following visual:

Source: Strengthening American Leadership In Digital Financial Technology / Digital Asset Market Structure

In summary, digital asset regulation in the US is still evolving and taking shape. Clarifying the roles of institutions such as the SEC and CFTC, ensuring consistency in token classifications, and standardizing accounting practices will not only enhance legal compliance but also strengthen investor confidence. While efforts such as the CLARITY Act represent an important step forward, these steps must be supported by a comprehensive strategy that is ” .” The 24/7 nature of digital assets, their cross-border effects, and their rapidly evolving technological structure necessitate thinking beyond traditional financial regulations. This approach will form the foundation not only of regulations but also of the architecture of the digital economy of the future.

The Era of Digital Assets in Banking

The US approach to the digital asset ecosystem has undergone a fundamental shift in recent years. While crypto ventures were largely excluded from banking services during the Trump administration, the new policy approach has removed barriers to banks’ access to the crypto sector. Banks are now supported in their work with digital assets in a manner consistent with the sector’s legal framework and risk management. This paves the way for both financial innovation and American entrepreneurship.

The current regulatory framework aims to establish a clear and technology-neutral foundation for banks’ interaction with digital assets. Clarity and transparency have been prioritized to enable banks to operate in this area. In addition, capital requirements and compliance standards for banks related to crypto assets are being redefined, taking into account the risks of the sector. This protects the integrity of the financial system while also opening up space for innovation.

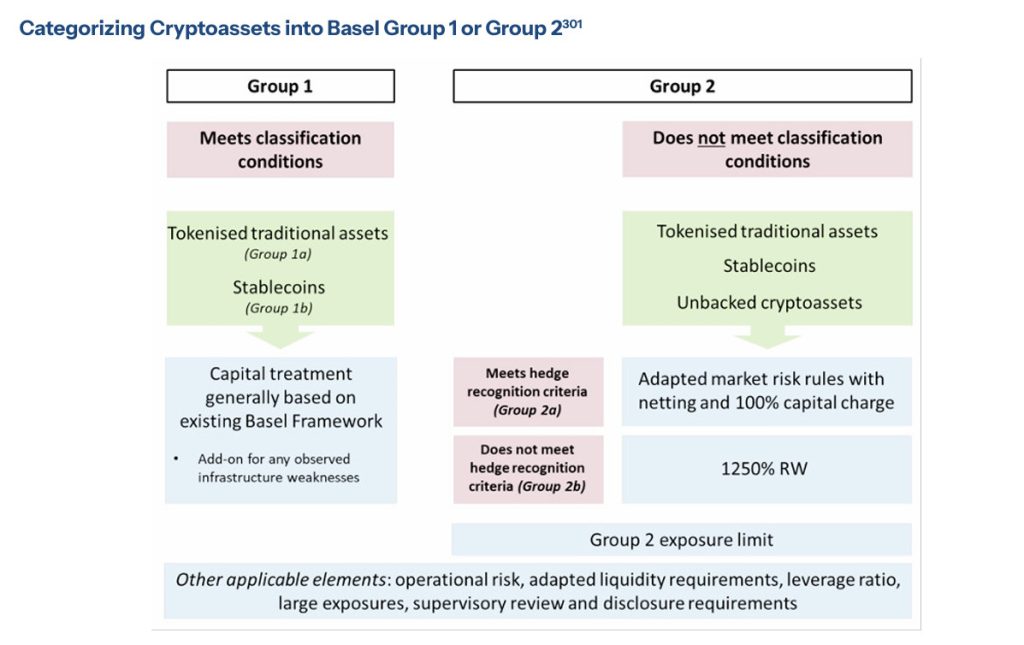

The regulation of digital assets in the banking sector has gained a new dimension with the crypto asset framework developed by the Basel Committee. Under the Basel framework, digital assets are divided into two main groups based on their risk and structural characteristics: Group 1 and Group 2. Group 1 includes tokenized traditional assets and stablecoins that meet the existing classification criteria, and the existing Basel capital standards are applied to these. Group 2, on the other hand, covers assets that do not meet these criteria or are unsecured crypto assets, and these assets are subject to higher capital requirements. In particular, Group 2 assets are subject to strict rules such as a 100% capital charge and even a 1,250% risk weight.

Source: Strengthening American Leadership In Digital Financial Technology / Banking and Digital Assets

U.S. banking regulators emphasize the need to review capital and liquidity requirements for digital assets to ensure they reflect the actual risk of the asset type. In particular, the classification of tokenized traditional assets into a separate group solely based on their technological infrastructure is seen as inconsistent with the principle of technological neutrality. Additionally, the group notes that current distinctions do not provide clarity for crypto assets, particularly between digital assets widely used for payment and investment purposes and speculative “memecoins,” and that a clearer boundary should be drawn between these categories.

The rapidly evolving nature of digital assets requires regulatory authorities to develop flexible and up-to-date approaches. In particular, continuous data collection and review of standards in collaboration with the industry are highlighted as essential in addressing the risks posed by new technologies such as permissionless blockchains. In recent years, it has been emphasized that institutions operating in the banking sector need to use more accurate and dynamic assessment methods for the capital and liquidity requirements of digital asset transactions. In this context, the United States’ launch of a transparent analysis process covering both the public and private sectors will contribute to a healthier determination of the place of digital assets in the financial system.

However, promoting fair and open access to banking services, ensuring that companies wishing to operate in the digital asset sector are not excluded solely on the basis of their field of activity, and facilitating competition and innovation are considered critical. It is also recommended that banking regulators develop technology-neutral applications in risk management and provide transparent and predictable criteria for licensing processes for new players. In conclusion, the U.S.’s new digital asset policy strengthens cooperation between the banking and crypto sectors, paves the way for financial innovation, and reinforces the U.S.’s leadership in global financial technologies.

Digital Assets and Illegal Finance

Digital assets offer speed, transparency, and accessibility to the financial world, but they also create new grounds for illegal financial activity. The anonymity, borderless transfer capabilities, and decentralized structure of cryptocurrencies pose serious risks for criminal activities such as money laundering and terrorist financing. Increasing cyberattacks in recent years, the use of digital assets by non-state actors such as North Korea to finance illegal activities, and global regulatory gaps have made it necessary to fundamentally review AML/CFT (Anti-Money Laundering and Countering the Financing of Terrorism) systems.

The US has adopted two key objectives in addressing these risks: preventing digital assets from being used for illicit activities and enabling law-abiding, innovative financial technologies. With this in mind, the report focuses on the following principles:

- The right of U.S. citizens and entrepreneurs to use digital assets for lawful purposes must be protected; blockchain-based innovation should be encouraged.

- The AML/CFT framework must be strengthened and standardized at the international level to prevent the use of digital assets in illicit finance.

- Cryptocurrency exchanges and service providers should be subject to the Bank Secrecy Act (BSA) and related federal regulations; standards such as customer identification (KYC), suspicious activity reporting (SAR), and information sharing should be strengthened.

The central role of the US financial system is forcing not only American institutions but all global actors to comply with stricter oversight and compliance. The widespread adoption of FATF standards, the licensing of crypto service providers, the strengthening of blockchain-based audit infrastructure, and the risk-based monitoring of anonymity tools are among the key issues. For areas that are difficult to control, such as DeFi and self-custody, global compliance and user information are critical. The report highlights the need to include new-generation applications such as decentralized finance (DeFi) and self-custody in the scope of regulation and the importance of the US adopting a technology-neutral approach.

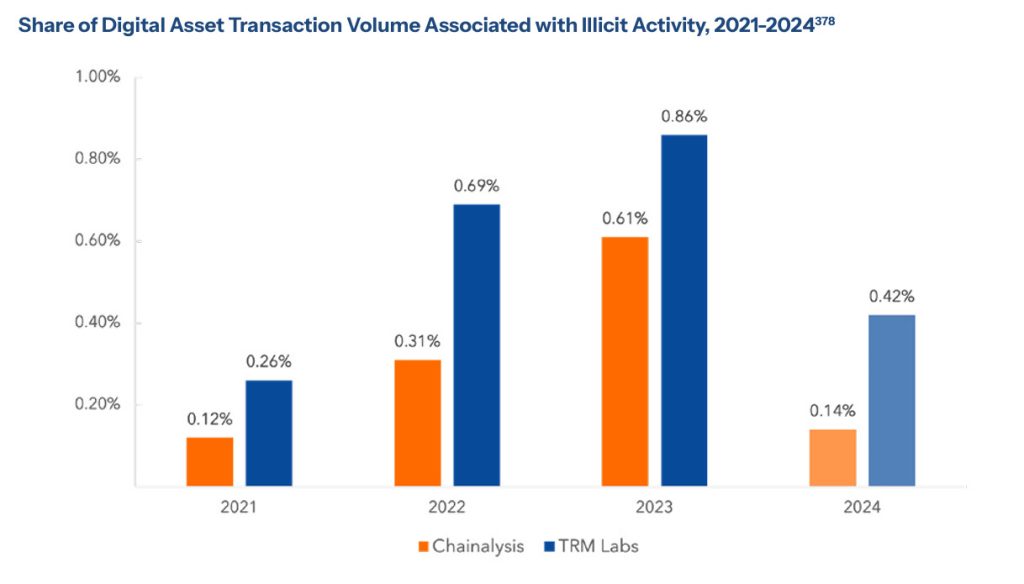

The chart below compares the proportion of digital asset transactions linked to illicit activities over the past four years, based on data from two major analysis companies (Chainalysis and TRM Labs). Between 2021 and 2024, the ratio of illicit transactions to total volume fluctuated between 0.1% and 0.8%. The rates, which peaked in 2023, appear to have declined significantly in 2024. This picture shows that risks are beginning to be brought under control more effectively as regulation and oversight capabilities improve. However, it should not be forgotten that the volume corresponds to billions of dollars; therefore, global risk management and cross-sector cooperation are becoming even more critical.

Source: Strengthening American Leadership In Digital Financial Technology / Countering Illicit Finance

The report highlights the following recommendations: Legal users and innovation should not be penalized, and regulators and law enforcement agencies should be given more tools and powers to combat crimes committed through digital assets. These tools should not restrict the legal activities of innocent citizens, and more effective data sharing and cooperation between the public and private sectors should be ensured. Other key points include the US taking the lead in promoting AML/CFT and sanctions standards internationally and updating guidelines for the digital asset sector.

In summary, the US approach seeks to promote the innovation and individual freedoms offered by digital assets while adopting a deterrent and multi-layered strategy against illicit financial activities. Updating the Bank Secrecy Act (BSA) and related federal regulations for crypto exchanges and service providers, as well as tightening customer identification (KYC), suspicious transaction reporting (SAR), and effective information sharing practices are at the forefront. Victim compensation, updating forfeiture processes, and enhancing the traceability of criminal proceeds are key elements of the reform agenda. The ultimate goal is to conduct a global, inclusive, and sustainable fight against illegal financial activity while protecting innovation and user rights.

Taxation of Digital Assets

The Trump administration has adopted an innovative and entrepreneur-friendly approach to digital assets and has made it a priority to remove elements of federal tax legislation that hinder this approach. In line with this, a decision signed into law in April 2025 (H.J. Res. 25) canceled the Biden administration’s attempt to classify certain DeFi developers as “brokers.” The rationale provided was that these developers and their software never exercise custody authority over users’ digital assets.

Critical questions are being asked about the taxation of digital assets. Digital asset transactions are quite different from traditional assets and vary over time, so there is uncertainty about how existing tax laws apply to these transactions. Therefore, answers to some fundamental questions are of great importance for the taxation of digital asset income:

- Timing: When income is deemed to have been earned, i.e., when it becomes taxable.

- Source: Determining the tax jurisdiction from which the income originates (e.g., within or outside the United States).

- Character: Determining the type of income (e.g., capital gain or ordinary income).

- Application of Laws: How existing legal regulations will be applied to digital asset transactions.

According to the report, clarifying these questions will help taxpayers fulfill their tax obligations correctly and enable the digital asset ecosystem to develop in a more predictable manner in the US.

There is currently no clear and comprehensive framework in the U.S. regarding whether digital assets are subject to income tax, how they should be taxed, their valuation, and reporting obligations. The Internal Revenue Service (IRS) classified digital assets as “property” rather than “money” in Notice 2014-21, issued in 2014, and adopted capital gains taxation as the basis for taxation. However, current legislation does not provide a clear tax framework for digital assets. Some tax practices pose challenges for investors, others for digital asset exchanges, and still others for the United States itself.

In short, there is a strong expectation that outdated, technology-unfriendly, and restrictive tax laws that hinder development will be simplified and streamlined in a way that does not deter investors. The Trump administration, through this report, has made it clear that it is working toward this transformation of the digital asset ecosystem. This report clearly commits to promoting the widespread adoption of digital assets and supporting investors by reducing the tax burden, clarifying the scope, and simplifying calculations.

The key recommendations for the U.S. Congress and tax authorities are as follows:

- A separate tax asset class should be created for digital assets, distinct from “securities” or “commodities”; existing legal definitions should be revised to align with the dynamic nature of digital assets.

- The tax status of stablecoins should be clarified, particularly for stablecoins used for payment purposes, which should be treated as debt, and exceptions should be made to wash sale rules for small-value transactions.

- Rules to prevent wash sale abuse in digital assets should be extended to digital assets; however, these regulations should be designed to exclude stablecoins.

- A tax-exempt status similar to securities lending should be established for crypto asset lending transactions; mark-to-market rules should be updated to cover actively traded digital assets.

- Regarding the taxation of mining and staking income, only large-value transactions should continue to be subject to immediate taxation, while taxation of low-value (de minimis) income should be deferred until the time of sale.

- Regarding international information sharing (CARF), third-party reporting, and the tracking of offshore accounts, a more integrated and harmonized reporting infrastructure should be established, taking into account both transparency and the burden on taxpayers.

In conclusion, the current system for taxing digital assets in the United States is not fully aligned with the rapidly evolving sector. Investors and industry representatives are calling for a predictable, fair, and easy-to-implement tax system. The new roadmap outlined by the Trump administration offers a vision that supports the widespread adoption of digital assets, reduces uncertainty, and aims to position the US as a leader in the global crypto ecosystem.

Overall Assessment

Overall, the US is leaving behind old patterns in the digital finance arena and preparing to rewrite the rules of the game. It is no longer just about leading technological development; the ambition to set the rules for the industry is now much clearer.

The US’s new roadmap is the first time the claim that “America will be the center of digital assets” has been put forward in such a clear and systematic way. With moves such as the future of stablecoins and Bitcoin’s place in financial reserves, the dollar’s international role is being strengthened in the new generation of financial systems. In particular, the support provided to digital finance initiatives labeled “Made in USA” through the ” ” clearly demonstrates the goal of transforming the United States into a hub for both capital and brain drain.

From tax policies to the banking system, from innovation incentives to combating illegal finance, there is a more practical and transparent approach than in the past. Issues such as reducing complexity in tax regulations, opening up opportunities for investors and entrepreneurs, and creating a clear status for stablecoins indicate that the US aims to create a more predictable and sustainable environment in its digital asset ecosystem.

In conclusion, the U.S.’s new vision for digital assets is not merely a technical or legal transformation; it also embodies a significant claim to global leadership and a call for innovation. The dual focus on protecting individual freedoms and the U.S.’s desire to set the standards in this field is likely to shape the future of digital finance to a large extent in the coming years.