Market Compass

Critical FOMC Week…

Global markets spent last week mostly watching macro data from the US, the world’s largest economy. Although political and geopolitical developments were not insignificant, pricing indicated that investors were focused on the US Federal Reserve’s (FED) decision on September 17. In this context, the data released in the last two months supported the expectations that the Bank may pursue a faster rate cut cycle than previously thought.

The employment data and backward revisions we have seen in the last two months pointed out that the labor market in the country is actually not in a very good condition. In addition, the latest inflation figures did not signal a major deterioration due to tariffs. In this parallel, the markets’ belief that the FED will start taking action and start a cycle of gradual interest rate cuts has increased.

Ounce of gold, which updated its historical peak, had already started to price in the low interest rate environment in the coming period. Stock market indices and digital assets have also made an effort to participate in this pricing despite other challenging factors. Bitcoin was able to retest above the $116,000 level last seen on August 23, while Ethereum found the strength to push the $3,500 barrier again.

The results of the FOMC meeting, which we will witness next week, are important enough to determine the direction of financial markets in the medium term. In parallel, we will elaborate on these results that the whole world will focus on.

September 17 – FOMC Statement in Focus

The most critical issue for global markets in September will undoubtedly be the outcome of the Federal Open Market Committee (FOMC) meeting of the US Federal Reserve. As Donald Trump’s pressure on the FED has increased and the latest employment data came as a nasty surprise, the outcome of the FOMC meeting is eagerly awaited. In the coming period, the FED’s decisions, which will be decisive for the tightness of financial markets, will be closely related to all markets.

US President Donald Trump’s pressure on the FED to cut interest rates is now much clearer and this pressure (developments regarding FED Governor Cook) is increasing. The President is demanding a cut in interest rates. Until his speech at Jackson Hole, FED Chairman Powell had taken a very firm stance against these pressures, but after the employment data released in the last two months, Powell signaled in his speech on August 22nd that a cut in the policy rate might be possible, noting the weak employment indicators.

In the past weeks, we have seen that the Bureau of Labor Statistics made the largest backward revision since Covid-19, which we saw the effects of in 2020, causing doubts about the strength of the labor market to strengthen. We can say that the main reason why Powell signaled a rate cut at the September 16-17 meeting and the markets priced in this direction was the non-farm payrolls data, which came in well below the forecasts. Moreover, the August data also failed to meet expectations.

At the July 29-30 FOMC meeting, FED Governors Michelle Bowman and Christopher Waller voted against the decision to keep interest rates unchanged and argued that the effects of tariffs on inflation would remain limited. The September 17 meeting promises to be more contentious and challenging than before. However, judging from the pricing, markets are almost certain that the FOMC will cut the policy rate by 25 basis points at this meeting. In fact, the expectations that the FOMC may make the same decision in the next two meetings are priced at a level that is too significant to be ignored. On September 17th, let us briefly summarize the process that awaits us.

Decision Day

1- Will the interest rate be cut as expected:

First of all, markets will focus on whether the Fed cuts its policy rate. As mentioned above, according to the CME FedWatch Tool, markets are expecting a 25 basis point cut at the time of writing. With this first document, we will see both the change in the interest rate and the rough reasons for it.

If the FED cuts interest rates by 25 basis points as expected, we do not expect markets to price in this decision. If it leaves it unchanged, we may see a reaction where the dollar appreciates, risk appetite decreases and assets that are considered relatively risky, including crypto assets, lose value. On the other hand, in another surprise scenario, if the FED cuts interest rates by 50 basis points, we may see a positive reflection on digital assets.

2- Economic Projections and Dot Plot Chart:

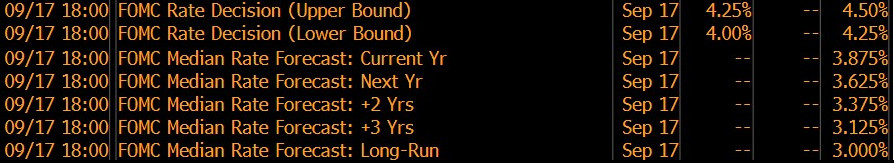

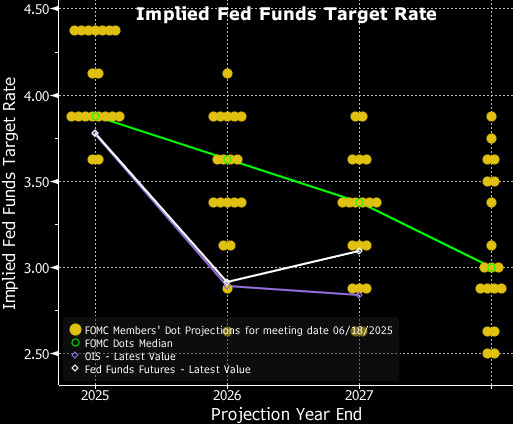

In four of its nine meetings during the year, the FOMC publishes forecasts on some economic indicators and how the policy rate may change in the coming periods. The meeting on September 16-17 will be one of them. Therefore, these documents, which will be published at the same time as the interest rate decision, will be other important information that will affect prices.

In the latest projections, FOMC officials revised down their growth forecasts for the US economy and slightly revised up their inflation forecasts. Changes in their forecasts for these macro indicators will be closely monitored and, in particular, possible revisions to the PCE price index (the Fed’s benchmark for monitoring inflation) will provide information on the path of interest rate cuts. A strong upward revision could mean that the FED will not be too hasty in cutting interest rates in the coming period, while a downward revision could mean relatively faster rate cuts. We see this data as unlikely to be revised downwards.

In the same document, there will be a table known as the “dot plot”, which shows the FOMC members’ forecasts for changes in the policy rate. In the image above, you can see the average expected rates based on the dot plot published at the last meeting in June. Here, too, a general downward revision may complete the equation of a weak dollar and digital assets that will increase demand. Although unlikely, an upward revision may have the opposite effect.

3- FED Chair Powell’s Presentation:

Half an hour after the FOMC statement, policy interest rate decision, economic projections and dot plot table are released, eyes will turn to Chairman Powell’s press conference. Powell will first explain the decisions and the rationale behind them from behind the lectern, and then he will take questions from the press. Volatility in prices may increase in this part.

There will be a lot to talk about (Cook’s dismissal, Trump’s pressure on the Fed to cut interest rates, central bank independence…). Of course, the importance of the Chairman’s speech will depend on the shape of the decisions we have described above. However, after Powell’s speech at Jackson Hole, the messages he will give about how the interest rate cut path will be shaped in the coming periods will be critical. If Powell gives a message that strong rate cuts may be possible for the rest of the year and beyond, we think this will have a positive impact on digital assets, although this situation is somewhat priced in. In the opposite case, there may be pressure. It should be added here that Powell’s term expires in May 2026 and it is clear that Trump will not nominate Powell again. Therefore, it would be more accurate to evaluate Powell’s remarks with this projection and investment horizon.

Other Important Macro Indicators and Developments

September 16 – US Retail Sales Data;

It is an important measure of consumer spending, which accounts for a large part of overall economic activity. It shows the change in the total value of retail-level sales and is published monthly, about 16 days after the end of the month. A separate measure of the change in the total value of retail-level sales excluding automobiles is called core retail sales. The retail sales data set is generally expected to have a positive impact on digital assets if it is below expectations.

Important Economic Calender Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based on UTC (Coordinated Universal Time) time zone. The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.