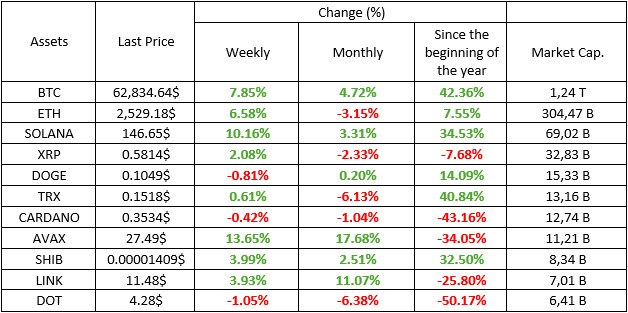

MARKET SUMMARY

Latest Situation in Crypto Assets

*Table was prepared on 20.09.2024 at 14:30 (UTC). Weekly values are calculated for 7 days based on Friday.

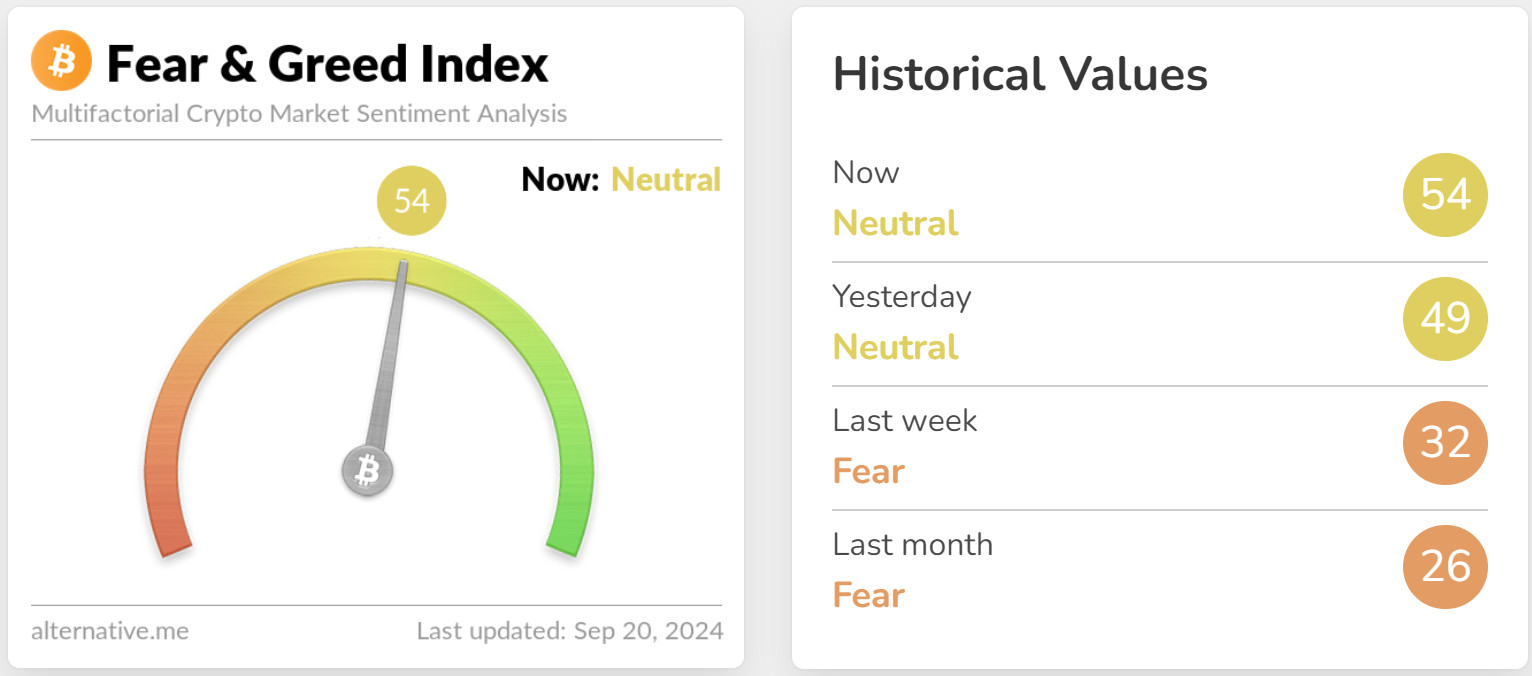

Fear & Greed Index

Source: Alternative

The confidence index, which was 32 last week, rose to 54 this week, indicating that there is significant optimism in the markets. There are several important developments behind this increase:

FED’s Interest Rate Cut

The US Federal Reserve’s (FED) interest rate cut by 50 basis points created a positive sentiment in the crypto markets. Low interest rates have a positive impact on market dynamics by encouraging investors to turn to risky assets.

Crypto VC Ventures

Crypto investment firm Dragonfly’s targeting of a new $500 million fund may have boosted confidence in the sector. Such initiatives show that investments in the crypto ecosystem continue and support the sector’s growth potential.

Bank of Japan’s Decision

The Bank of Japan’s decision to keep interest rates unchanged stands out as an important development for maintaining global economic stability.

Cryptocurrency Adoption

Donald Trump’s payment with Bitcoin is considered a remarkable step towards the adoption of cryptocurrencies.

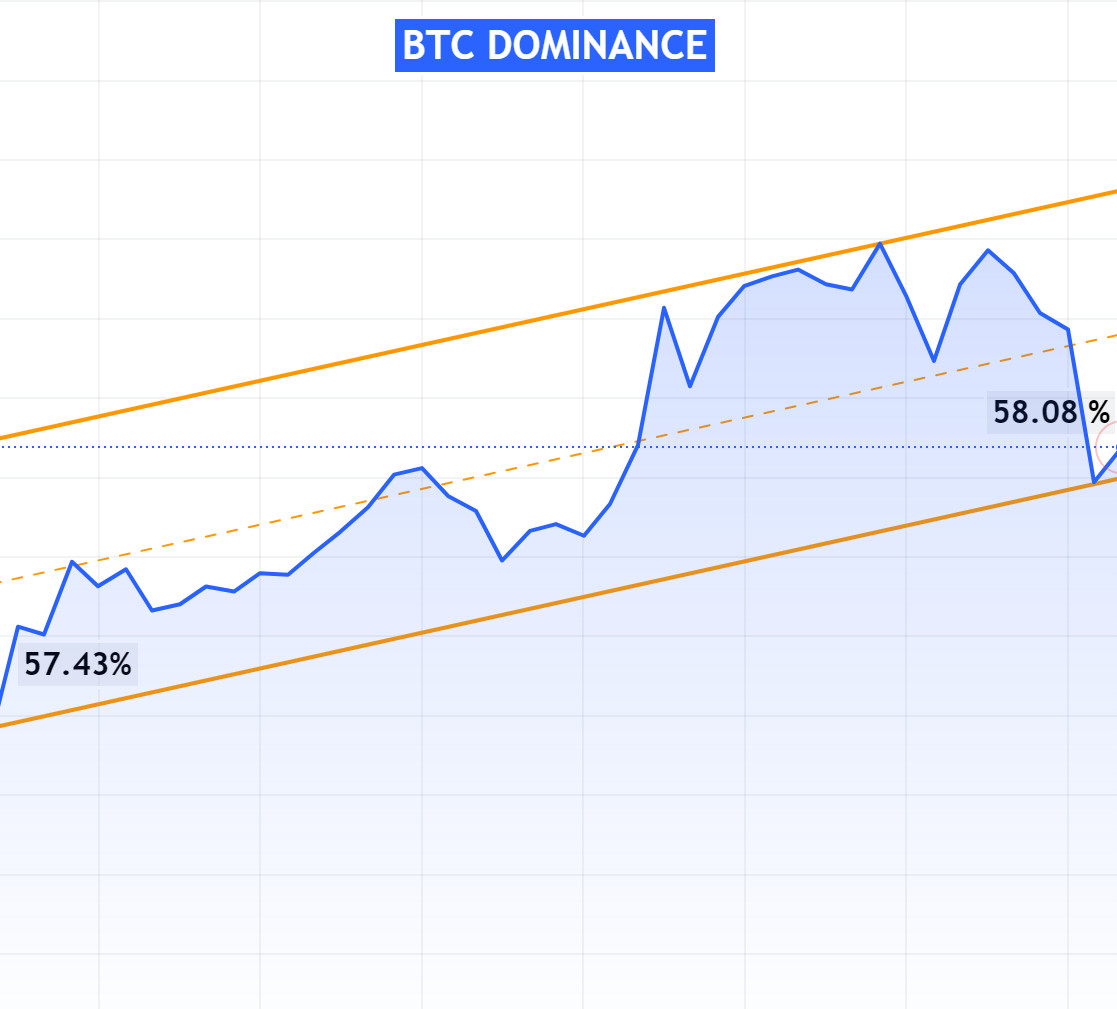

Bitcoin Dominance

Source: Tradingview

Last week, there was a slight increase in Bitcoin dominance. This week, with MicroStrategy’s Bitcoin purchases and ETF inflows, Bitcoin dominance increased. After 3.5 years, Bitcoin dominance reached 58%.

The Shift in Bitcoin Dominance

- Last Week’s Level: 57.43

- This Week’s Level: 58.08

Market Confidence and the Shift to Bitcoin

Bitcoin purchases by large companies like MicroStrategy are an indication of institutional investors’ confidence in Bitcoin. Such moves signal that the market’s interest in Bitcoin is growing, and long-term investments are strengthening.

Impact of ETF Inflows

This week’s ETF inflows have increased the liquidity of the market by making it easier for investors to access Bitcoin. ETFs have boosted demand for Bitcoin by providing a safe and regulated investment opportunity in Bitcoin, especially for more traditional investors.

Macroeconomic Impacts

It is conceivable that the US Federal Reserve’s policies, inflation and interest rate decisions are driving investors to cryptocurrencies. Bitcoin, as a digital store of value, becomes more attractive in times of economic uncertainty.

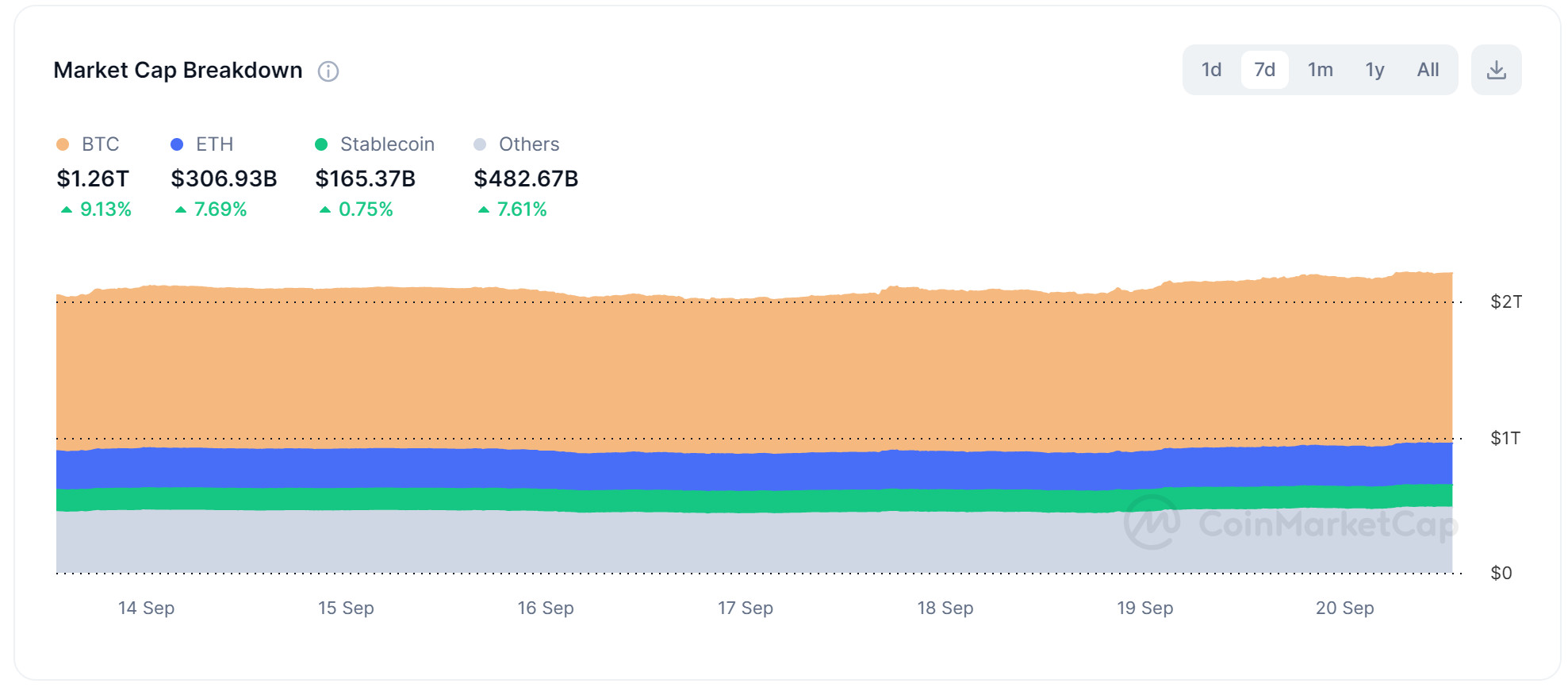

Total MarketCap

Source: Tradingview

Last week, the market recovered and appreciated as macroeconomic data came in line with expectations. This week, the FED’s 50 basis point rate cut supported the uptrend in the market and accelerated the appreciation.

Market Value

Change in Market Value

- Market Capitalization in the Last Week: $1.995 Trillion

- This Week’s Market Cap: $2.162 Trillion

Increase in Market Value

The market capitalization increased by about 8.37% from the previous week, from $1.995 trillion to $2.162 trillion. This marks a huge appreciation in the crypto market amid growing demand from investors.

The Role of Macroeconomic Data

Last week’s macroeconomic data releases were in line with market expectations, strengthening signs of economic stability. These data boosted investor confidence and helped the market to recover.

The Impact of the Fed’s Rate Cut

The FED’s 50 basis point interest rate cut led to increased liquidity in the markets. Lower interest rates have helped investors move into riskier assets and contributed to the continuation of the uptrend in the crypto market. Lower borrowing costs encouraged both individual and institutional investors to invest more in the market.

Weekly Crypto Market Breakdown

Source: CoinMarketCap

Bitcoin Performance

- This Week’s Increase: 9.13 %

- Market Capitalization: $1.260 Trillion

Bitcoin, up 9.13% this week, has strengthened its position as the crypto market leader with a market capitalization of $1.260 trillion, indicating that investors’ confidence in Bitcoin is growing.

Ethereum Performance

- Increase this week: 7,69 %

- Market Capitalization: $306.93 Billion

Ethereum performed strongly, rising 7.69% to reach a market capitalization of $306.93 billion, which could signal the start of an uptrend for Ethereum.

Stablecoin Performance

- Increase this week: 0.75 %

- Market Capitalization: $165.37 Billion

Stablecoins, which experienced a modest increase of 0.75%, reached a market capitalization of $165.37 billion and continued its steady growth; we can say that this is the effect of the FED’s 50 basis point cut.

Altcoin Performance

- Increase this week: 7.61 %

Market Capitalization: $482.68 Billion

Altcoins continued to attract investors’ attention with a 7.61% increase to a market capitalization of $482.68 billion, indicating that the crypto ecosystem is diversifying and interest in new projects is growing.

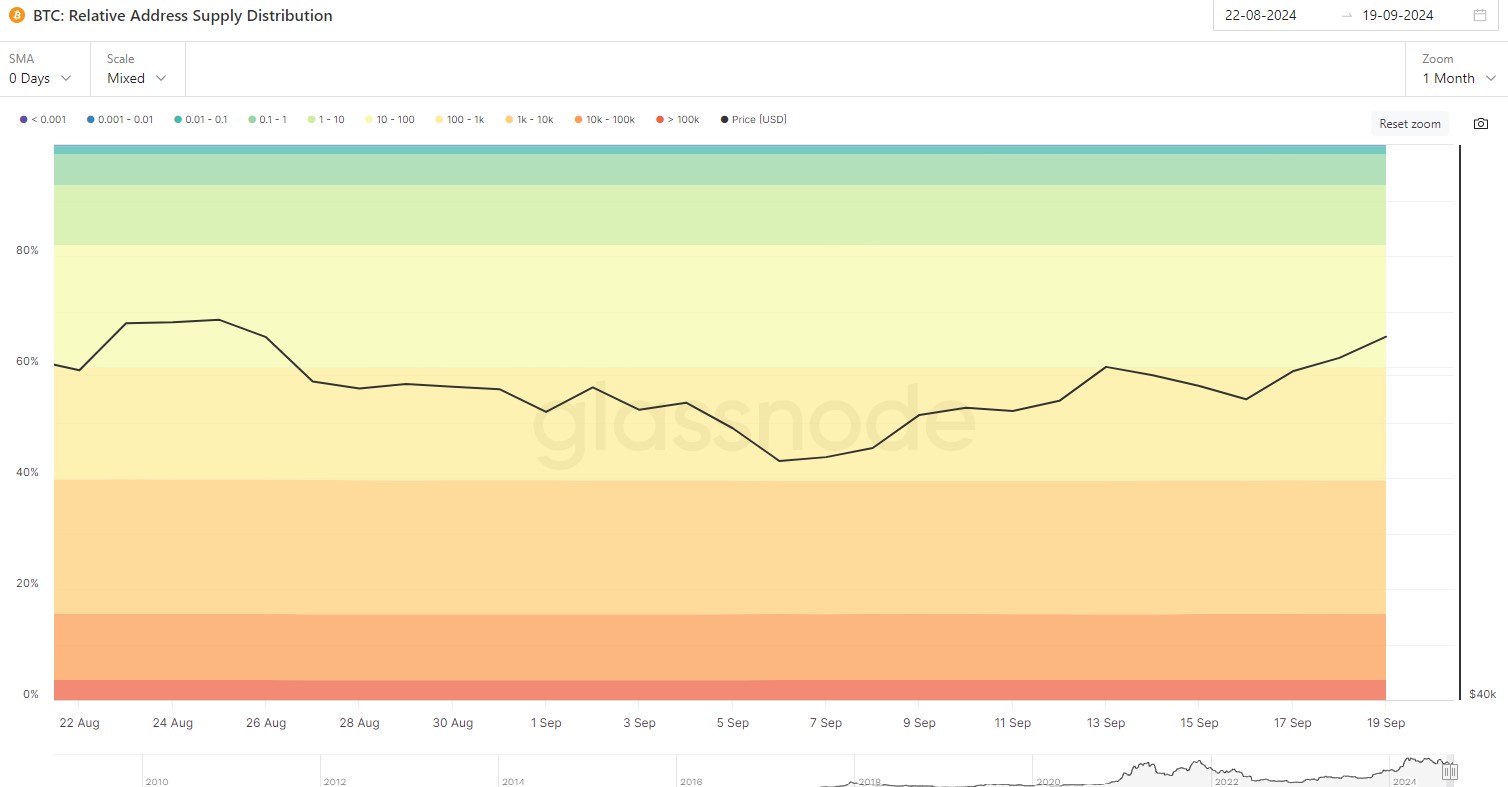

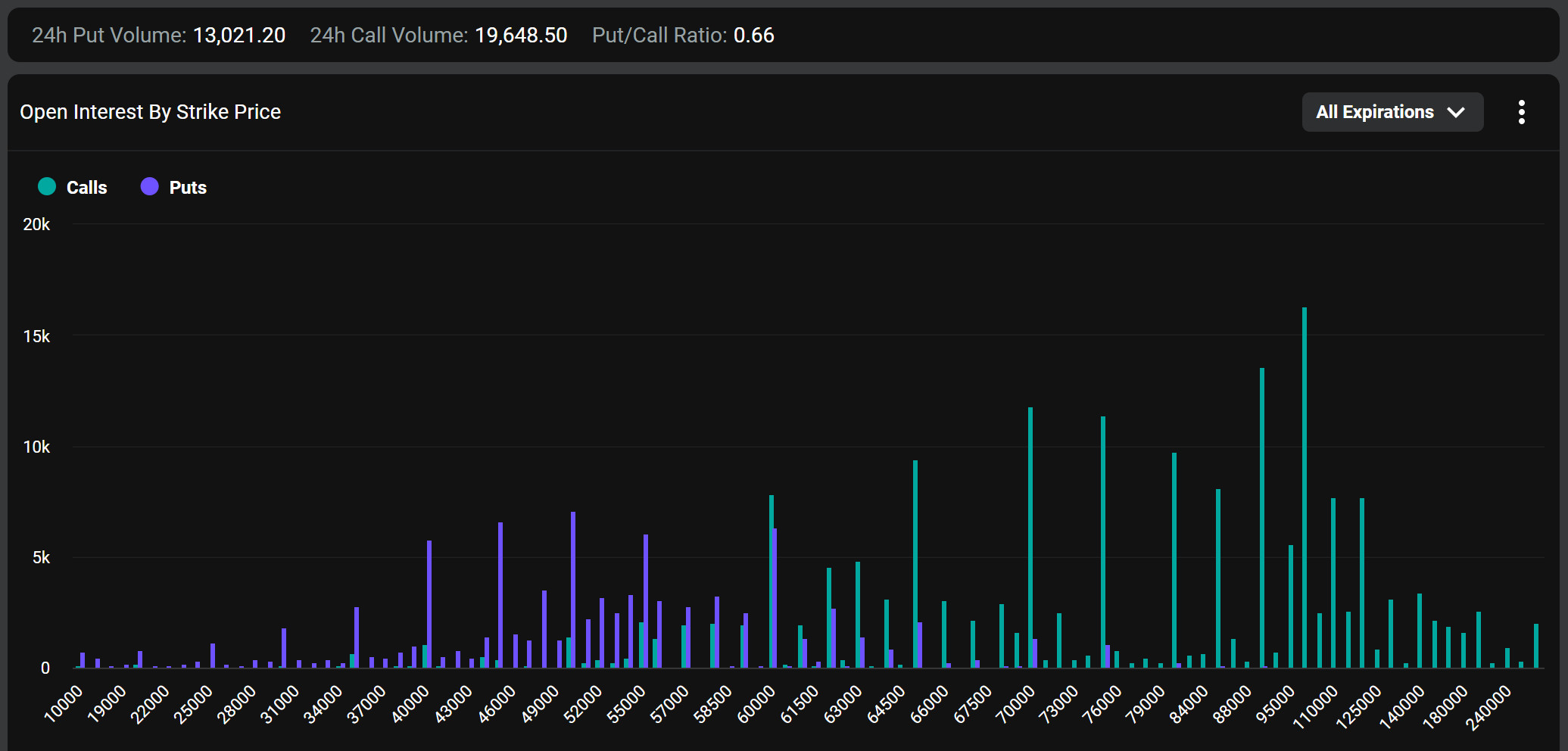

Bitcoin Supply Breakdown

Source: Glassnode

General Evaluation

Small and medium-sized retail investors (those holding less than1 BTC) showed limited activity. In particular, a slight decrease was seen in the 0.01-0.1 BTC range, which may indicate that investors made some trades to take profits or reorganize their portfolios.

Both small and large institutional investors (1-10k BTC range) made small increases in their portfolios. This suggests that they are expecting higher price movements in the market in the future and are therefore strengthening their positions.

Whales: Large investors with more than 100,000 BTC in assets have largely held their positions steady. This suggests that they have a long-term commitment to the market and are more patient with short-term price fluctuations.

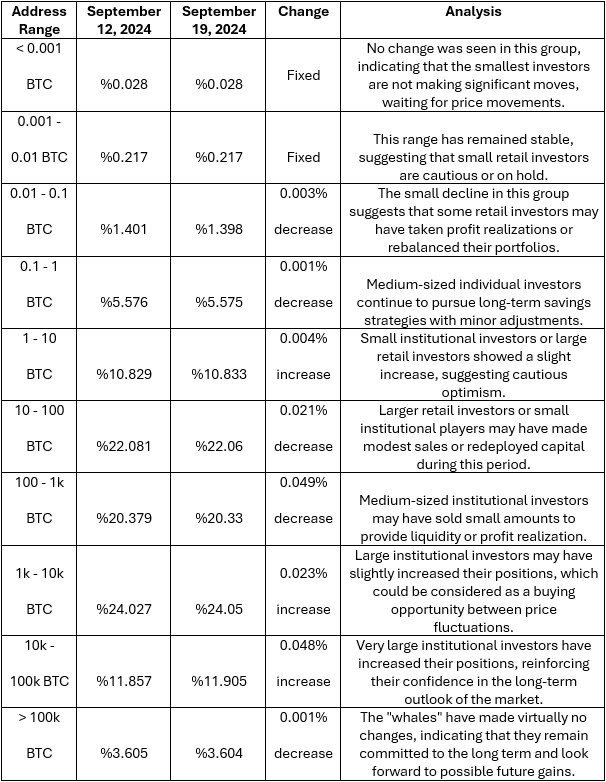

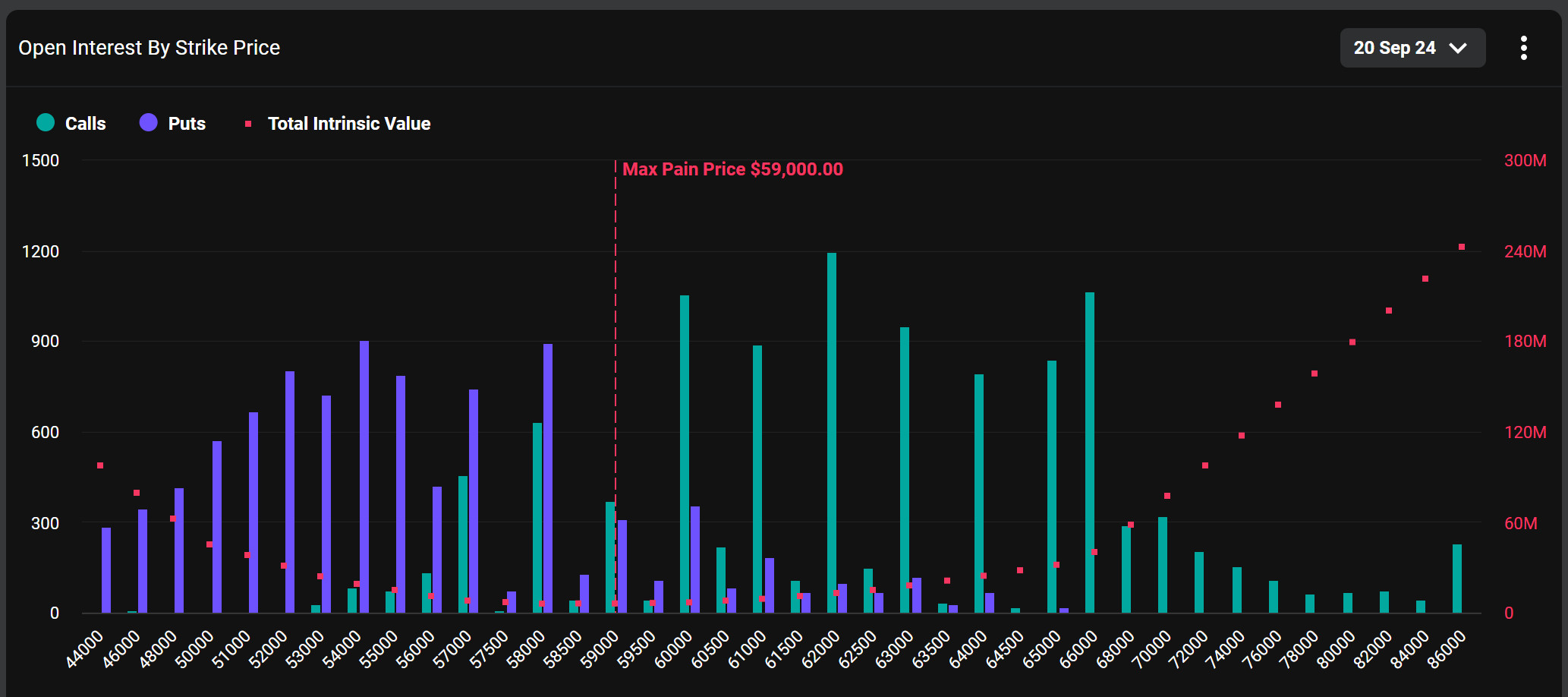

Bitcoin Options Breakdown

Deribit Data

Maximum Pain Point: Bitcoin’s maximum pain point is set at $59,000.

Source: Deribit

Option Expiration

According to data from Deribit, 20,037 Bitcoin options contracts worth approximately $1.26 billion will expire today. Expirations after the Fed rate cut may cause volatility.

Call/Sell Ratio

The call/put ratio for these options is set at 0.66. A call/put ratio of 0.66 indicates that there is a preference for call options over put options among investors and a possible rise in the markets.

Source: Deribit

Source: Deribit

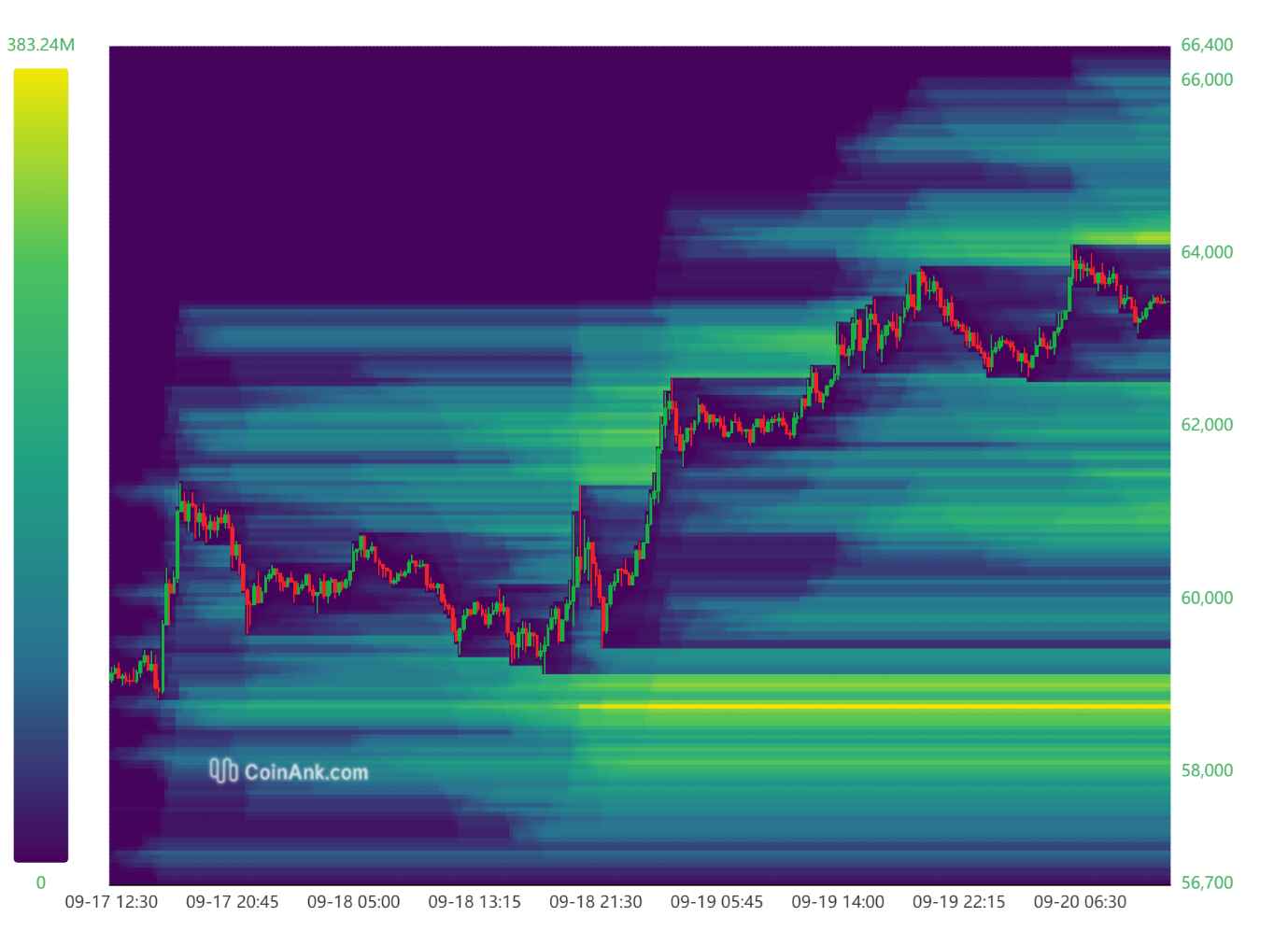

Bitcoin Liquidation Chart

Source: CoinAnk

General Situation

At the beginning of the week, the area between $57,400 and $58,100 was cleared and long positions were liquidated. Then, the price reached the liquidation value of shorts between $60,600 and $61,000 and between $61,400 and $62,400.

Available Liquidation Areas

Short Transactions

The key liquidation area is located between $64,100 and $64,400. It is thought that the price may look to clear this level.

Long Transactions

The areas where liquidations are accumulating for long trades are between $62,000 and $62,500 and especially between $58,600 and $59,100. If the price moves down, these levels are likely to be tested, and long positions are likely to be liquidated.

Weekly Liquidation Amounts

Between September 16 and 19, a total of $77.91 million worth of long trades were liquidated, while the amount of short trades liquidated during the same period was $128.65 million. This shows that short positions were under more pressure.

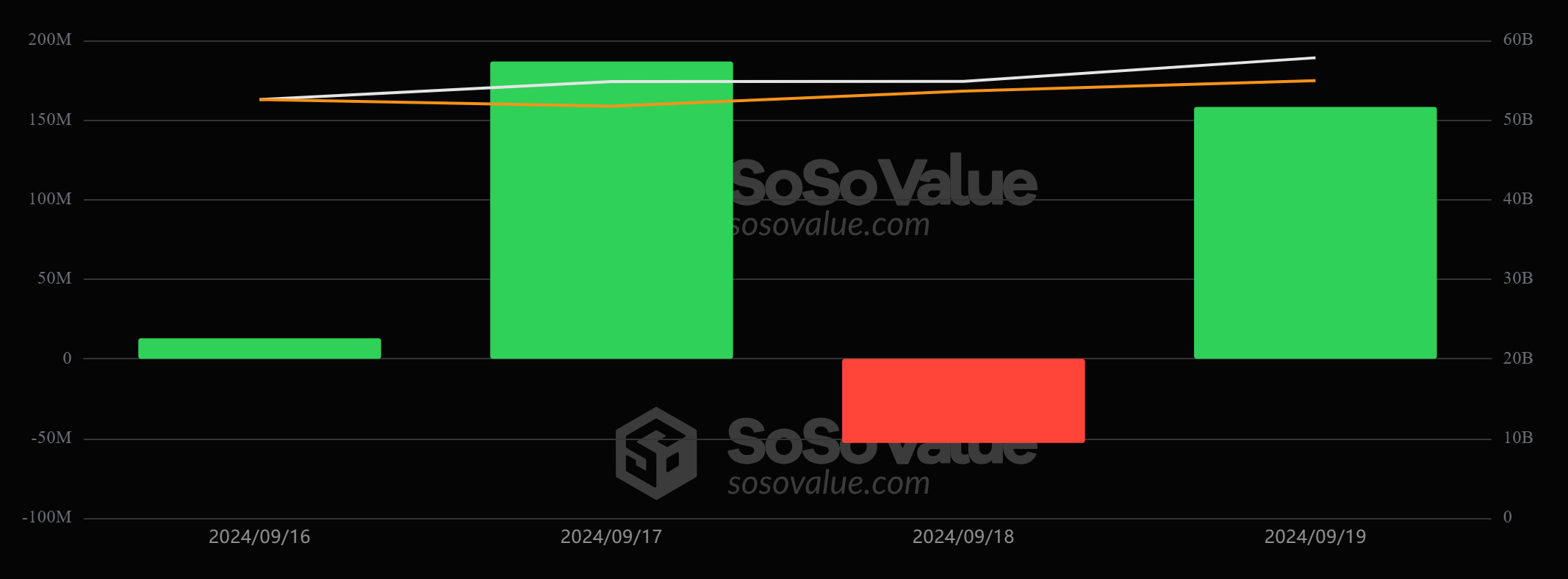

Bitcoin Spot ETF

Source: SosoValue

Source: SosoValue

General Status

Weekly Net Inflows Positive

Spot BTC ETF saw a total net inflow of $305.2 million between September 16-19.

Featured Situation

- Blackrock Silence Continues: Blackrock IBIT ETF, which stands out in net inflows in spot BTC ETFs, has seen a total net inflow of 0 for 3 days after seeing a net inflow of $ 15.8 million on September 16. For the last 2 weeks, net inflow data has differed only on Mondays.

- FED Interest Rate Decision: On September 18, outflows were observed in Spot BTC ETFs ahead of the FED interest rate decision announced on September 18, with outflows of $52.7 million on September 18. Afterwards, net inflows increased as the FED cut the interest rate by 50 basis points.

Final Performance

- Total Net Inflows: Spot BTC ETFs saw a total net inflow of $305.2 million between September 16-19.

- BTC Price: There was a 6.47% increase in the Bitcoin price during the time period in question.

Conclusion and Analysis

Total Net Inflows

Spot BTC ETFs saw positive net inflows on 3 days and negative net inflows on 1 day this week. In the week that started positively, outflows were observed in the Spot BTC ETF on September 18, when the FED interest rate decision was announced, and the total net outflow on the day of the interest rate decision was $ 52.7 million. On September 19, net inflows totaled $158.3 million after the FED cut the interest rate by 50 basis points. Before the closing day of the week, there was a total net inflow of 305.2 million dollars.

Price Impact

BTC price also increased between September 16-19, with a total net inflow of $ 305.2 million in Spot BTC ETFs. BTC, which continued to rise with the FED’s interest rate cut by 50 basis points, increased by 6.47% between September 16-19.

WHAT’S LEFT BEHIND

Critical FED Rate Cut Decision Announced

The Fed cut interest rates by 50 basis points to 5%.

MicroStrategy

MicroStrategy expanded its portfolio with a $1.1 billion Bitcoin investment.

Kamala Harris

Kamala Harris leads Trump by 5 points in Reuters poll

Former President Donald Trump

An assassination attempt on Trump failed, a suspect is in custody.

Bitcoin Dominance

Bitcoin’s market dominance reached 58% after 3.5 years.

Bitcoin warning from Robert Kiyosaki

Kiyosaki once again stated that those who hold Bitcoin and gold will get richer.

Ripple and SEC Case Ended

Ripple settled the SEC case by paying a $25 million fine.

Asia’s Smallest Country Bhutan

It was revealed that Bhutan mined 760 million dollars’ worth of Bitcoin.

Former US President Donald Trump

Trump made a payment transaction with Bitcoin for the first time.

German Bank Commerzbank

Commerzbank has partnered with Crypto Finance to offer Bitcoin and Ether transactions.

Rate Cut Forecasts from Citi

Citi expects a 125-basis point rate cut in 2024.

Bank of Japan

The Bank of Japan left its policy rate unchanged at 0.25%.

Terraform Labs

Terraform Labs has settled with the SEC and completed the bankruptcy process.

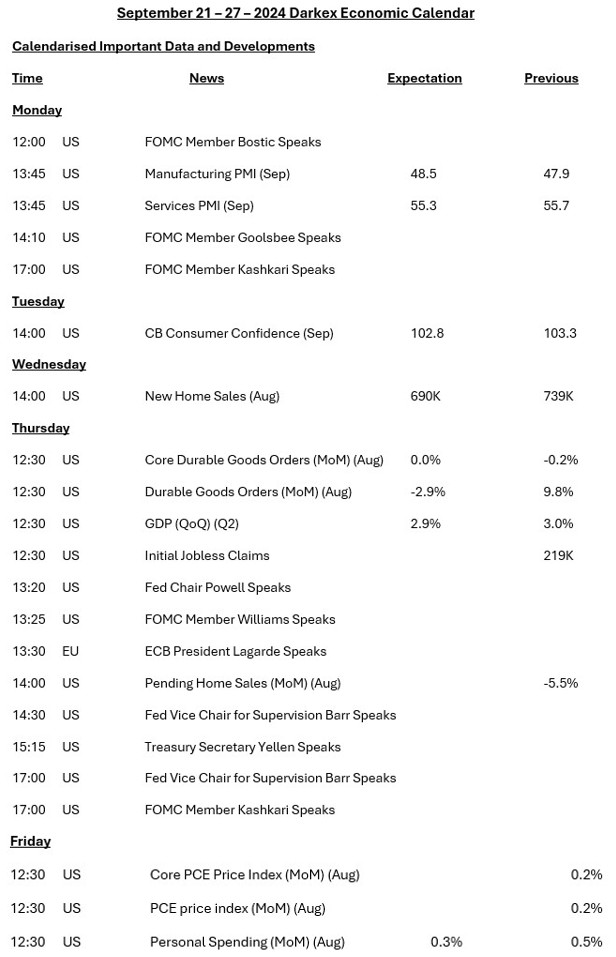

HIGHLIGHTS OF THE WEEK

Leaving behind the US Federal Reserve’s (FED) highly anticipated interest rate decision, markets are preparing to enter the last quarter of the year. The Federal Open Market Committee (FOMC), which decided to cut interest rates after nearly four years, is expected to continue these moves in the coming period. After the announcement of the FED’s decisions, we saw a relief in the markets. The question as we start the new week is whether this mood will continue.

Will the Weather that Started with the FED Continue?

In recent weeks, the dynamic that has been driving the prices of financial instruments has been the expectations regarding the FED’s interest rate cut. This may continue for some time. Of course, other factors such as developments in the Middle East and the presidential election in the US will be in the spotlight. But the main variable in the equation will be the pace at which the FED loosens financial conditions and the expectations about it. In this regard, as we enter the new week, the statements of FOMC officials and US macroeconomic indicators will be on our desk.

After the FED’s “Jumbo” rate cut decision, we saw an increase in risk appetite in global markets. Accordingly, digital assets also had some breathing space. In order for this situation to continue, the FOMC needs to continue with the rate cuts as in the roadmap they have drawn. In fact, it seems that whether the cuts will be 50 or 25 basis points will remain on the agenda before each meeting. The main factors that will shape these expectations will be the statements of FOMC officials and US data that we will watch this week. These headlines will determine whether the rise in crypto assets will continue. For now, although we think there is still room for upside for the recent rises, we anticipate that most of the expectation has been priced in. In other words, intermediate corrections will be important bends that the markets will face.

Macro Indicators and FOMC Officials’ Statements

Among the data on the health of the US economy this week, purchasing managers’ indices (PMI) will be monitored first on Monday. Among a group of data to be released on Wednesday, economic growth (GDP), Initial Jobless Claims and durable goods orders stand out. On the last trading day of the week, the PCE Price Index, which the FED uses to monitor inflation, will be important. In addition to these data, many FOMC members will make statements in various places this week. You can find information about them in the economic calendar. Among these, Chairman Powell’s evaluations on Thursday will be under scrutiny.

After Powell’s recent statements, recession concerns seem to have been suppressed in the markets. In other words, the “bad data is good market” equation may work and negative figures on the US economy may increase expectations that the FED may cut interest rates with faster steps and stimulate demand for risky assets. We can expect this to be reflected in digital assets as well. The bad data needs to be bad enough to trigger fears that the US economy is not in really good shape again. After Powell’s set, recession pricing may be avoided for a while. Therefore, if the US data points to a vibrant economy, we think that only a negative impact may arise from possible rises in the dollar.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

*In addition to the daily bulletins, special reports prepared by the Research Department will be shared in this section.

IMPORTANT ECONOMIC CALENDAR DATA

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone. The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.