MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | Weekly Change (%) | Monthly Change (%) | Change Since the Beginning of the Year (%) | Market Cap. |

|---|---|---|---|---|---|

| BTC | 69,415.64$ | 2.59% | 12.51% | 57.09% | 1.37 T |

| ETH | 2,503.69$ | -1.03% | 1.22% | 6.34% | 301.19 B |

| SOLANA | 166.01$ | -3.22% | 12.48% | 51.51% | 78.10 B |

| XRP | 0.5199$ | -0.90% | -13.19% | -17.62% | 29.52 B |

| DOGE | 0.1584$ | 15.08% | 46.35% | 72.17% | 23.23 B |

| TRX | 0.1669$ | 1.17% | 8.21% | 54.84% | 14.43 B |

| CARDANO | 0.3465$ | 1.59% | -2.88% | -44.48% | 12.11 B |

| SHIB | 0.00001731$ | -2.28% | 3.00% | 62.02% | 10.20 B |

| AVAX | 24.88$ | -5.63% | -6.02% | -40.57% | 10.13 B |

| LINK | 11.31$ | -4.47% | 0.96% |

*Table was prepared on 11.1.2024 at 14:30 (UTC). Weekly values are calculated for 7 days based on Friday.

Fear & Greed Index

This week’s lower-than-expected US GDP growth rate of 2.8% may have reinforced expectations of a low-interest rate environment, potentially boosting demand for risky assets. The lower-than-expected jobless claims of 216K may indicate that the labor market remains strong and supports investor confidence.

While MicroStrategy’s below-expected earnings announcement created short-term uncertainty, the company’s $42 billion BTC purchase plan suggests that long-term institutional demand may remain strong. The rise in the index from 72 to 75 indicates that risk appetite in the markets has increased and investor confidence has recovered.

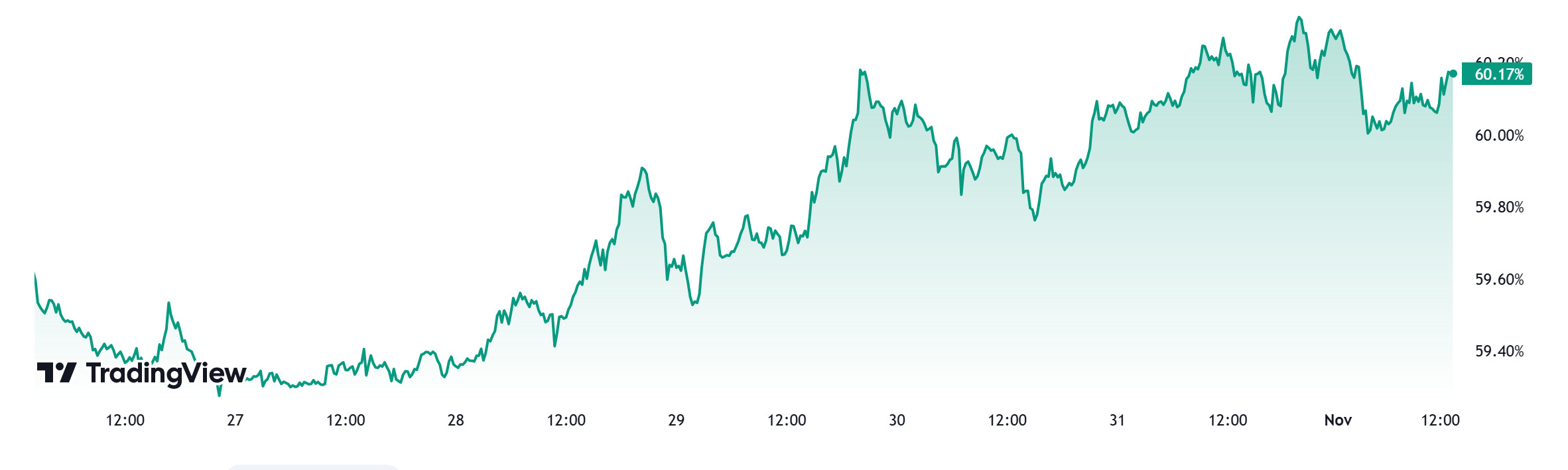

Bitcoin Dominance

Source: Tradingview

When we look at the past week, we see that the dominance rate has decreased slightly. As a matter of fact, with this decline in the altcoin market, bullish movements attracted attention from time to time. This week, with the intense ETF interest of institutional investors, dominance rose above 60% again after a long break. Bitcoin, on the other hand, has been approaching the ATH level since March, reaching over $73,000.

The Shift in Bitcoin Dominance

Last Week’s Level: 59.01

Institutional Interest and Strong Investor Demand

Institutional investors’ interest in Bitcoin ETFs has increased the demand for BTC, boosting its dominance rate. The fact that institutional funds in particular are turning to Bitcoin shows that the market’s leading asset is perceived as a safer investment and that there is strong confidence in BTC.

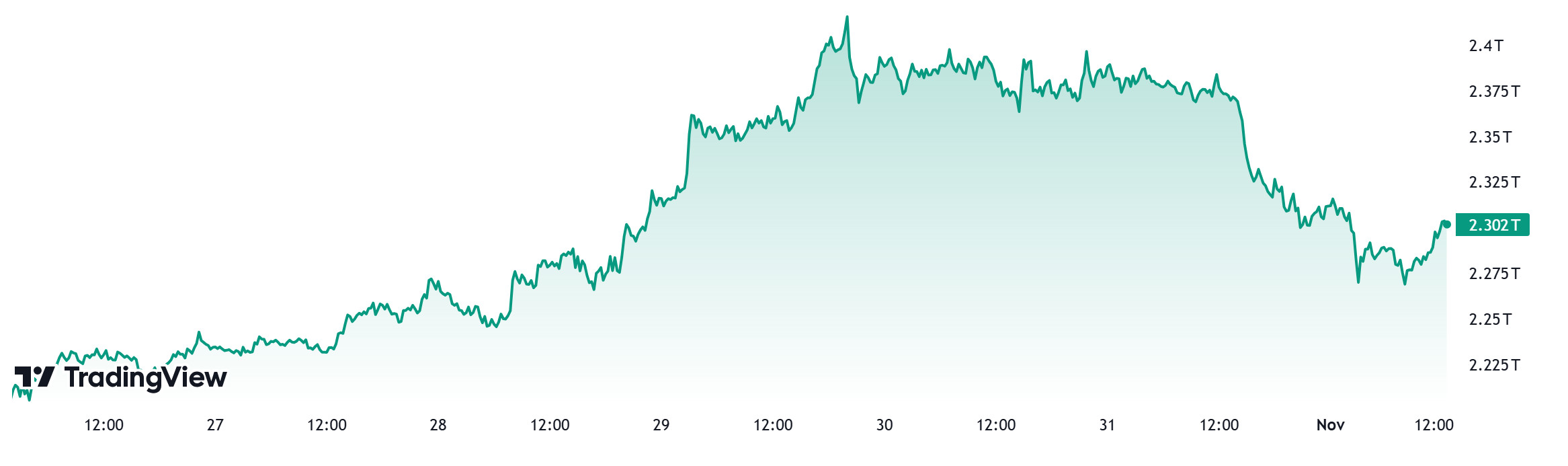

Total MarketCap

Source: Tradingview

The fluctuations in total crypto market capitalization over the past week reveal investors’ sensitivity to geopolitical developments. First of all, the market capitalization reached $2.400 trillion on the back of optimistic sentiment; however, investors became more defensive on news of Iran’s preparations to retaliate against Israel, causing the market to fall to $2.302 trillion, giving back some of its gains.

Change in Market Value:

- Market Capitalization in the Last Week: $2.272 Trillion

- This Week’s Market Cap: $2.302 Trillion

The Meaning of Changes in Market Capitalization

Geopolitical Risk Sensitivity

Tensions between Iran and Israel have increased global risk factors, driving investors towards safe assets. Such geopolitical uncertainties can lead to selling pressure in the crypto market, as investors seek to reduce volatility by withdrawing from risky assets. This can trigger sudden drops in the crypto market.

Fluctuations in Investor Confidence

Although there was an uptrend in the market at the beginning of the week due to optimism, the sudden decline following the developments shows that the market is sensitive to fluctuations in investor confidence. Especially when high market capitalizations are reached, news can have a strong enough impact to create sudden price changes.

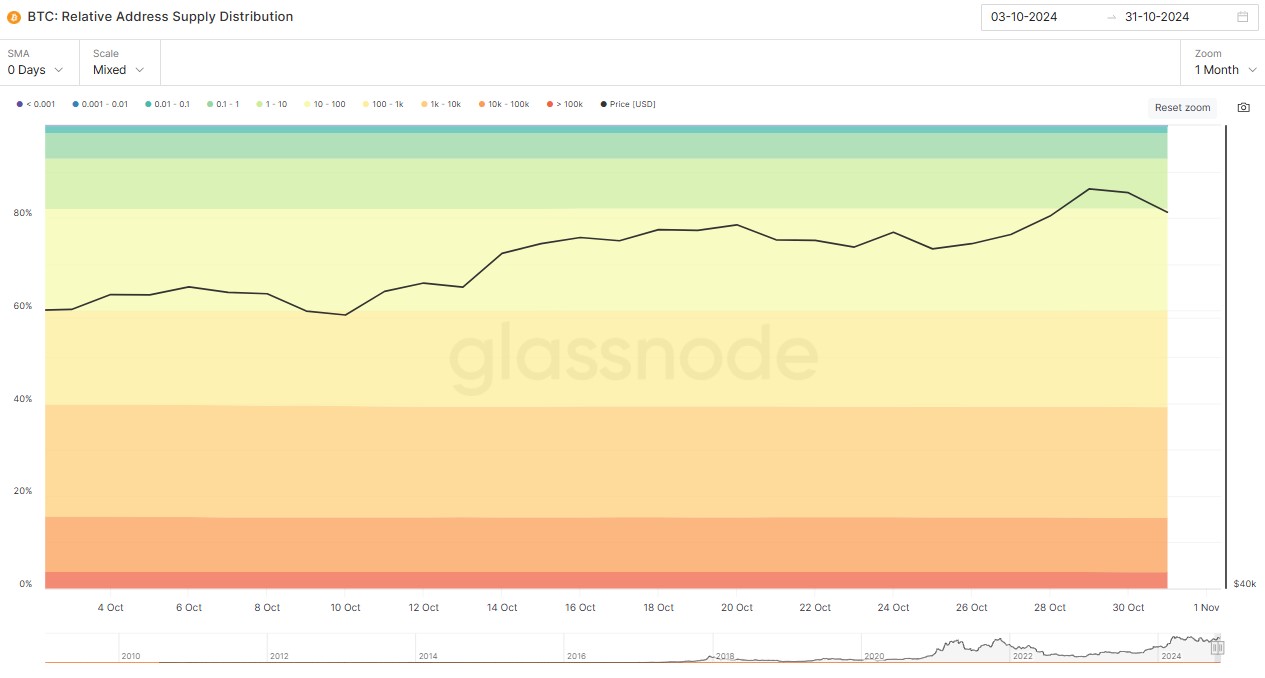

Bitcoin Supply Breakdown

| Address Range | 24.10.2024 | 31.10.2024 | Change | Analysis |

|---|---|---|---|---|

| 0.01 – 0.1 BTC | 1,399% | 1,395% | Decline | There was also a small decline in this range. Small-scale traders may have partially sold despite the increase in the BTC price. This suggests that there may be a profit-taking trend among those who invested small amounts. |

| 0.1 – 1 BTC | 5,571% | 5,565% | Decline | There is a slight decrease in addresses with moderate BTC holdings. Addresses selling at this level may have cashed out some of their holdings, taking advantage of the rise in the BTC price. |

| 1 – 10 BTC | 10,812% | 10,787% | Decline | Addresses with between 1 and 10 BTC also saw a slight decline. Some of the traders in this category may have taken advantage of the market volatility to make a profit. |

| 10 – 100 BTC | 21,993% | 21,961% | Decline | There is a slight decline in this range as well. It gives the impression that especially medium-sized investors are responding to the volatility in the market and reducing their positions. |

| 100 – 1k BTC | 20,744% | 20,873% | Increase | There is a small increase in this group. Some addresses holding large amounts of BTC have increased their holdings, meaning that some addresses approaching the whale category continue to accumulate BTC. This could be a strong sign of confidence, especially despite the price drop. |

| 1k – 10k BTC | 23,840% | 23,900% | Increase | There is also a slight increase in addresses holding 1k to 10k BTC. The fact that large-scale investors or whales have collected more BTC in this process can be considered as a long-term confidence signal. |

| 10k – 100k BTC | 11,817% | 11,715% | Decline | There is a slight decline in this range. Some of the big whales may have taken advantage of the rise in the BTC price to take profits. |

| > 100k BTC | 3,579% | 3,565% | Decline | The top-tier addresses are also seeing a small decline. These addresses are usually controlled by institutional investors or big whales, and this decrease suggests that some BTC was sold to take advantage of the price increase. |

General Evaluation

Looking at data from October 24 to October 31, it appears that some small and mid-level traders took profit realizations as the price rallied, while large whales (1k – 10k BTC range) and some high BTC holders continued to accumulate. This suggests that the market in general is signaling strong confidence, but smaller investors remain cautious.

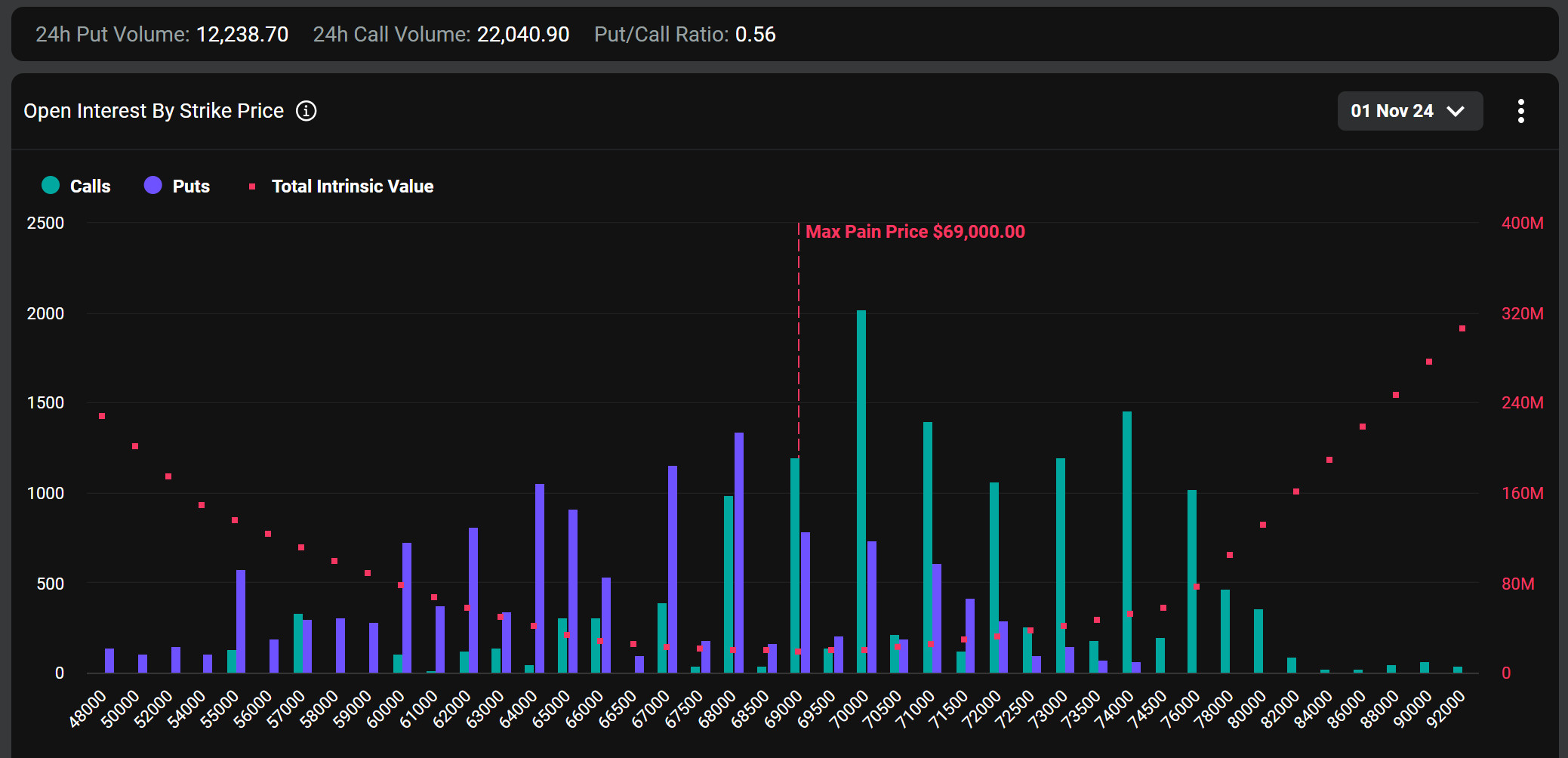

Bitcoin Options Breakdown

Source: Deribit

In news this week, Joshua Lim, head of derivatives at Arbelos Markets, observed that CME Bitcoin options experienced some of the biggest volume days ever ahead of the US elections. “It’s great to see institutions sizing up like this on the CME,” Lim said, noting that there was massive contract buying for the $85,000 strike price, which translates to “a very bullish position heading into the election.”

Deribit Data: Nearly 28,000 Bitcoin options contracts expire today, with a notional value of nearly $2 billion. Today’s option expiration is much smaller than last week’s month-end, when more than twice the value of BTC options expired. Therefore, the impact on spot markets is likely to be small.

Maximum Pain Point: Bitcoin’s maximum pain point is set at $69,000.

Option Expiration

Call/Sell Ratio: The call/put ratio for these options is set at 0.56. A call/put ratio of 0.56 indicates that there is a strong preference for call options over put options among investors and that a possible upturn in the markets may be in question.

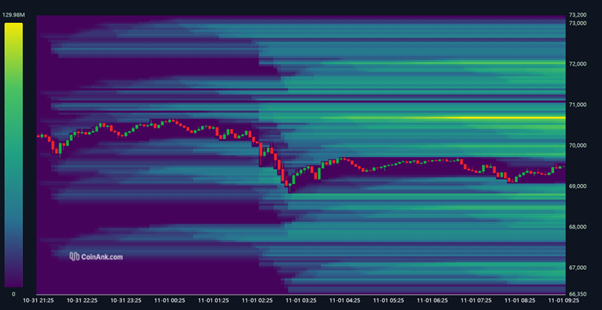

Bitcoin Liquidation Chart

Source: CoinAnk

When the liquidation heat map for BTC is examined, it is seen that short positions were liquidated by clearing the area between 68,800 and 69,400 and then between 72,100 and 72,600 during the week, and then the liquidation value of long transactions between 71,000 and 71,400 and 69,400 and 69,400 and 69,800 was reached.

Currently, there is a significant liquidation area between 70,500 and 70,800 for short transactions and may want to clear the area in this price range in the coming period. For long trades, liquidations seem to have accumulated between 68,400 and 68,800 and between 66,800 and 67,100. These levels can be seen with the downward movement of the price and long transactions may be liquidated.

When the weekly liquidation amounts of Bitcoin are analyzed, a total of 99.72 million dollars of long transactions were liquidated between October 28 and 31, and the amount of short transactions liquidated between the same dates was 162.67 million dollars.

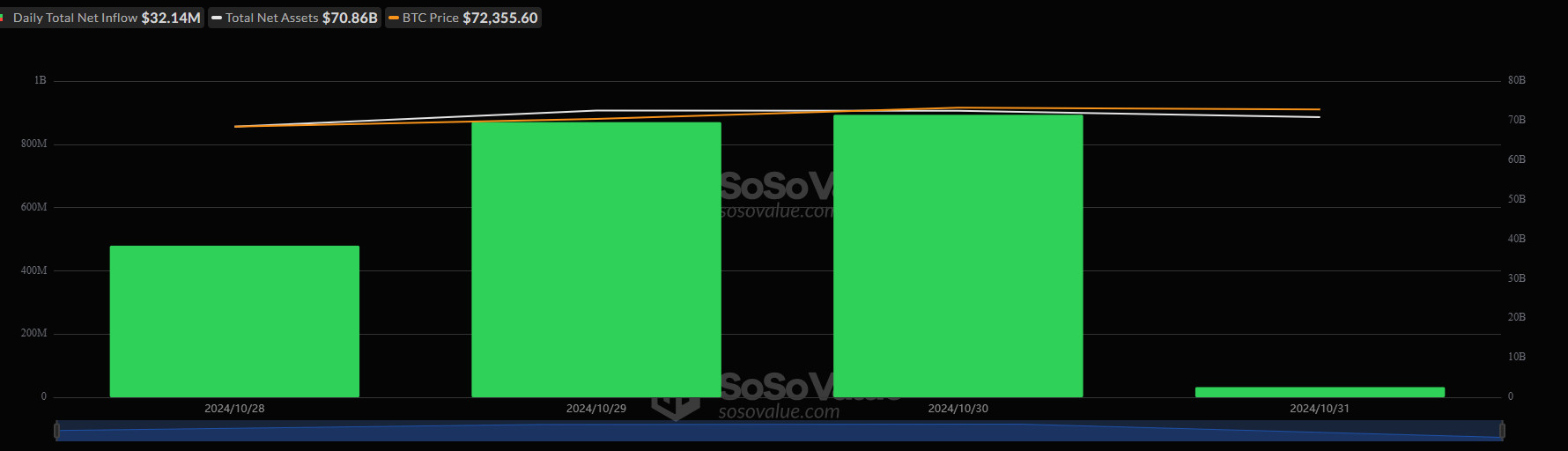

Bitcoin Spot ETF

Source: SosoValue

General Status

- Positive Net Inflow Series

The positive net inflows in the Spot BTC ETF, which started on October 23, continued until October 31. Net inflows of $870.02 million and $893.21 million between October 29-30 were recorded as the 1st and 3rd largest daily net inflows since March 12.

- Blackrock IBIT ETF Net Inflows

Between October 28-31, Blackrock IBIT Spot BTC ETF net total inflows increased by $2.15 billion. Blackrock IBIT Spot BTC ETF value reached $26.14 billion with this week’s increase.

Featured Situation

- Market Impact

The net inflows in spot ETFs, which have positively impacted BTC’s price gains this week, also point to a growing interest in Bitcoin from institutional investors.

- BTC Price Change

BTC, which changed by 8.88% between October 28-31, reflected its bullish performance by 3.34%.

Conclusion and Analysis

Total Net Inflows and Outflows

Between October 28-31, Spot BTC ETFs saw an increase in net inflows, with net inflows totaling $2.27 billion.

Price Impact

This week saw a 3.34% increase in BTC price, while Spot BTC ETFs attracted a lot of interest from institutional investors. All Spot BTC ETFs saw net inflows between October 28-31. It was a very positive week for ETFs and Bitcoin price.

WHAT’S LEFT BEHIND

Bitcoin Breaks $73,000 for the First Time Since March

Bitcoin experienced a significant jump with increased institutional interest, reaching $73

,000.

Microsoft Bitcoin Investment Microsoft is considering investing in Bitcoin, according to a

US Securities and Exchange Commission filing. The company put the issue as a “voting item” at the next shareholder meeting scheduled for December 10.

The date of the China Standing Committee meeting, which the world is eagerly waiting for, has been announced

It was announced that the parliamentary meeting, which financial markets have been eagerly awaiting and where important decisions on China’s monetary easing policies could be taken, will be held between November 4-8. Investors were especially curious about the possible monetary easing period, the details of which have not been announced recently.

Tether, US Federal Investigation Allegations The Wall Street Journal reported on Friday that the federal investigation is being conducted by prosecutors from the Manhattan US attorney’s office. Paolo Ardoino, CEO of cryptocurrency company Tether, stated that the company has not received any indication that it is under investigation by US federal authorities.

Escalating Tensions in the Middle East

Rear Admiral Daniel Hagari, spokesman for the Israel Defense Forces, confirmed Israel’s strikes against Iran and stated that these operations have been successful. If Iran responds to the strikes and escalates tensions, Israel will respond, he said.

Tether Announces $5.58 Billion Bitcoin Reserves!

Tether CEO Paolo Ardoino announced at the Plan B event in Lugano, Switzerland that the company has 48 tons of gold and 82 thousand Bitcoin in its reserves

Japanese Company Metaplanet

Japan-based investment firm Metaplanet continued its strategic investments in the leading cryptocurrency Bitcoin (BTC). The company made an additional purchase of 156.78 BTC.

Hong Kong Stock Exchange Cryptocurrency Index

The Hong Kong Stock Exchange announced on November 15 that it will introduce a new crypto asset index that tracks Bitcoin and Ethereum prices.

Critical Economic Data Announced in the US

US Gross Domestic Product and Core Personal Consumption Expenditures were announced.

Technology Companies Balance Sheets

Microsoft, Meta, Apple and Amazon shared their balance sheets for the third quarter.

MicroStrategy More Bitcoin Steps

MicroStrategy aimed to raise $42 billion for

Bitcoin purchases.

Canary Capital Formally Files with SEC for Spot Solana ETF

Canary has filed with the SEC for its

spot Solana ETF, kicking off the IPO process in the US.

HIGHLIGHTS OF THE WEEK

We are entering the most critical week of the year. Both the US presidential elections and the Federal Reserve’s interest rate decision will take place this week, and they are critical for the markets. So, if ever there was a week for digital asset traders to be on their toes, this is it.

Trump or Harris?

The US presidential elections stand out as a “game changer” that sets the pulse of not only politics but also global financial markets. From cryptocurrencies to exchange rates, the power of this influence is felt in all areas, and it is especially noteworthy for crypto investors. The results of this election could lead to massive fluctuations in digital currency markets. Throughout 2024, the U.S. elections have attracted a lot of attention and curiosity in the crypto world.

You can find our analysis on this subject in our report titled “Darkex Monthly Strategy Report – November”. Click here to review the report.

Is Another Rate Cut Coming from The FOMC?

The Federal Open Market Committee (FOMC) of the US Federal Reserve (FED) on November 7th will be a decisive development for the markets. The next move of the bank, which started the interest rate cut cycle with 50 basis points in September, is eagerly awaited. Expectations are weighted towards a 25 basis point rate cut this time.

The size of the rate cut Chairman Powell’s statements and the guidance for the next interest rate level will be the main topics that will shape the markets.

You can find our analysis on this subject in our report titled “Darkex Monthly Strategy Report – November”. Click here to review the report.

After Everything

The two main issues that we mentioned above are really important in shaping the markets. In addition, and independently, we remain bullish on major digital assets in the long term. However, for BTC to hit new record highs, it will of course be critical that these two main factors are supportive. Therefore, we will then review our expectation model.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Click here to review our Darkex Monthly Strategy Report – November.

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.