MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | Change (%) Weekly | Change (%) Monthly | Change (%) YTD | Market Cap |

|---|---|---|---|---|---|

| BTC | 89,237.26$ | 17.31% | 32.44% | 102.00% | 1,77 T |

| ETH | 3,096.26$ | 6.21% | 18.36% | 31.65% | 372.93 B |

| SOLANA | 213.12$ | 5.27% | 37.27% | 94.73% | 100.64 B |

| DOGE | 0.3733$ | 89.65% | 195.00% | 307.00% | 55.01 B |

| XRP | 0.8132$ | 47.83% | 49.86% | 28.90% | 46.24 B |

| CARDANO | 0.6216$ | 44.13% | 74.54% | -0.36% | 21.74 B |

| TRX | 0.1809$ | 12.09% | 13.54% | 67.87% | 15.64 B |

| SHIB | 0.00002409$ | 26.98% | 27.58% | 126.00% | 14.20 B |

| AVAX | 32.26$ | 16.42% | 16.82% | -22.92% | 13.14 B |

| LINK | 13.45$ | 4.09% | 18.46% | -13.39% | 8.43 B |

| DOT | 4.938$ | 14.76% | 13.73% | -42.56% | 6.54 B |

*Table was prepared on 11.15.2024 at 12:30 (UTC). Weekly values are calculated for 7 days based on Friday.

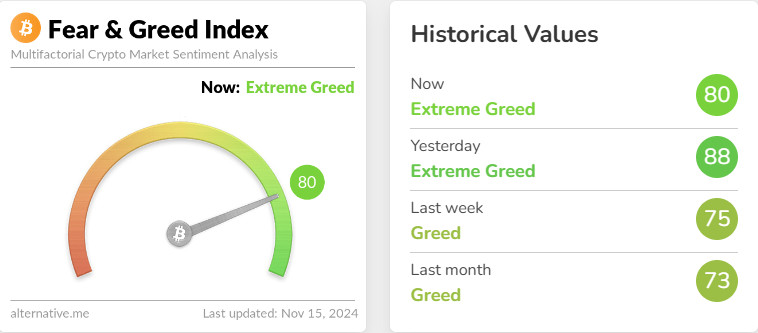

Fear & Greed Index

Source: Alternative

This week, the Fear & Greed Index rose to 80, indicating that investor confidence has increased and the market’s interest in risky assets has strengthened. Fed Chairman Powell emphasized that there should be no rush to cut interest rates, which weakened the possibility of a 25 basis point rate cut in December. Moreover, CPI and PPI data released in the US came in line with expectations, reinforcing the perception that inflation is stable at current levels.

In the crypto market, MicroStrategy’s 27,200 BTC purchase and $3 billion USDT minting increased liquidity, strengthening interest in cryptocurrencies and market dynamics. The rise of the index this week can be considered as a direct result of both macroeconomic developments and increased interest in cryptocurrencies.

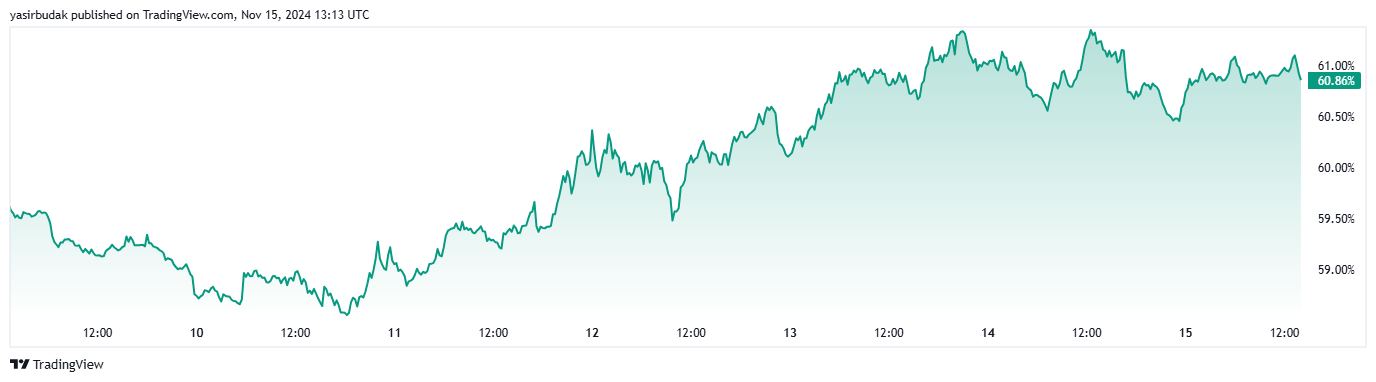

Bitcoin Dominance

The rise in Bitcoin dominance until the beginning of last week saw a realization with the election results. Bitcoin dominance, which has regained positive momentum as of this week, is moving at levels last seen in March 2021. In this respect, Bitcoin dominance, which was 59.0% as of last week’s close, is moving at 60.89% this week.

The Shift in Bitcoin Dominance:

- Last Week’s Level: 59.0%

- This Week’s Level: 60.86%

Hawkish Rhetoric in the US Fed Interest Rate Decision

Commenting after the announcement of the US Fed’s November interest rate decision, Powell said, “The economy is not sending any signals that we should rush to lower interest rates. The strength we see in the economy right now allows us to approach our decisions with caution.” He said. After Powell’s hawkish rhetoric, Bitcoin dominance, which had seen a retreat in the previous week, rose again and reached the level of 60.89% last seen in March 2021.

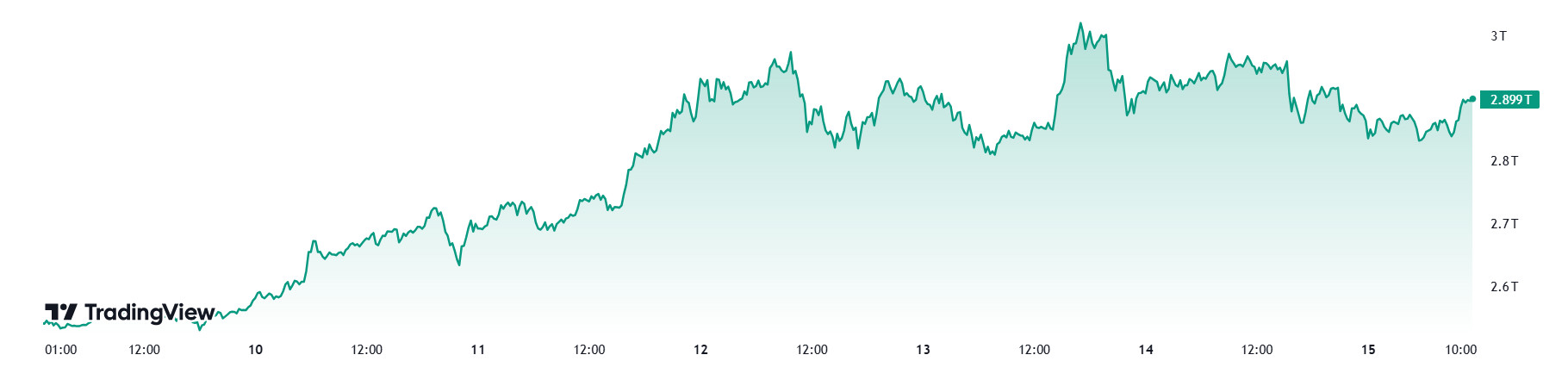

Total MarketCap

Source: Tradingview

“totalmarketcap Image to be Added”

The impact of Trump’s election on the cryptocurrency market continues. This week, the market gained serious bullish momentum, with the total market capitalization reaching $3.038 trillion, the highest level in its history. Bitcoin has also recorded new highs, surpassing the $90,000 level, while most altcoins have not lagged behind this uptrend. The strong performance of cryptocurrencies has been attributed to Trump’s economic policies and interest in digital assets, with many investors turning to cryptocurrencies as a hedge against inflation and central bank policies.

Change in Market Value:

- Market Capitalization in the Last Week: $2.695 Trillion

- This Week’s Market Cap: $2.899 Trillion

With a market capitalization of $3 trillion, cryptocurrencies are maturing and gaining a more permanent place in the traditional financial system. Altcoins have also benefited from this growth and experienced significant increases. This shows that not only speculative investors, but also a wider audience and investors from different sectors are turning to cryptocurrencies.

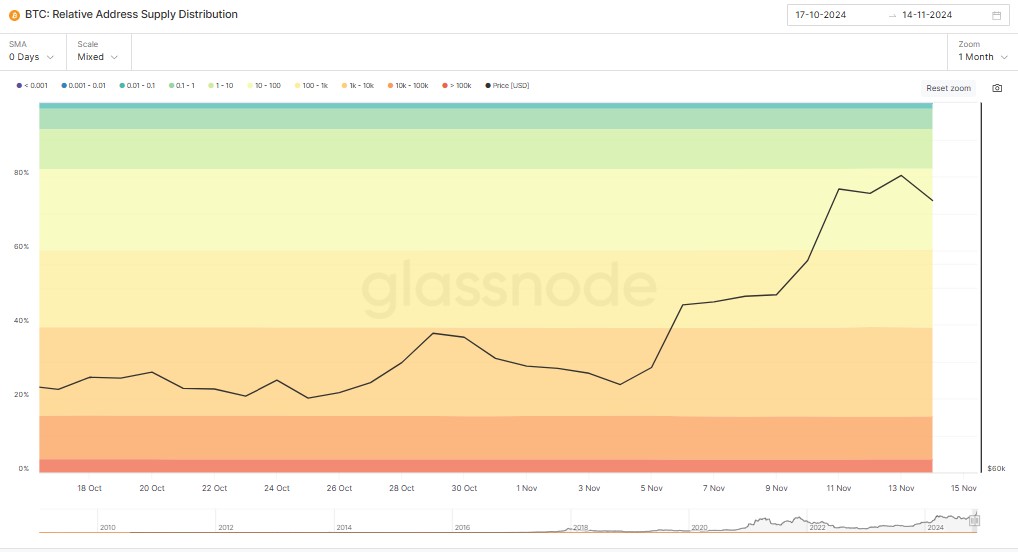

Bitcoin Supply Breakdown

General Evaluation

As a result, the biggest trend in the breakdown by market capitalization is that wallets in the middle and upper classes tend to accumulate. The increase in whales and higher wallet holders can be considered as a positive indicator of confidence in the market.

Source: Glassnode

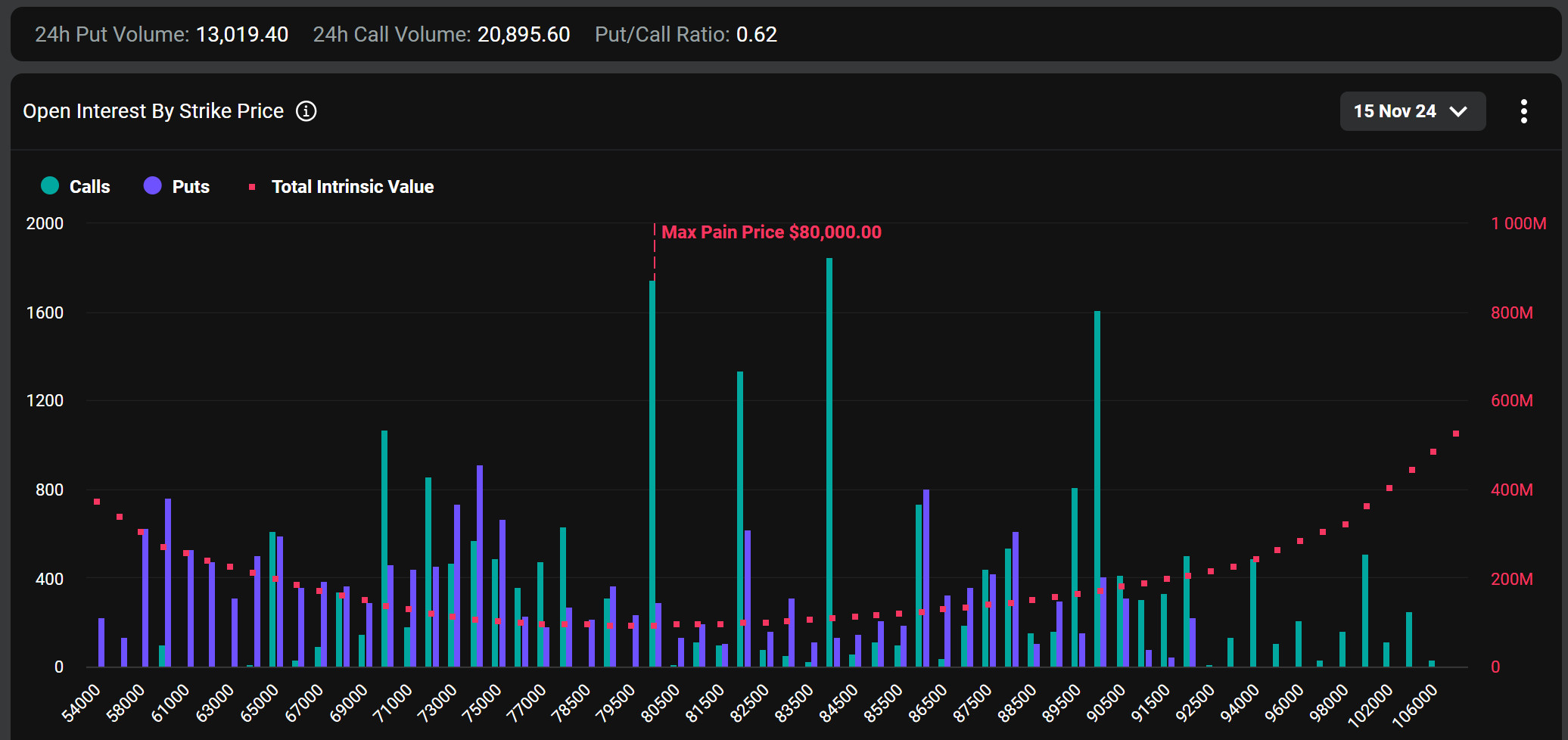

Bitcoin Options Breakdown

Bitcoin traders appear to be buying the $100,000 call option on the CME, CF Benchmarks told CoinDesk. Similar bullish sentiment is being observed on Deribit. As the largest cryptocurrency broke through the $90,000 resistance level to set a new record above $93,000, traders on the Chicago Mercantile Exchange (CME) turned to options to profit from prices soaring into six figures. According to CF Benchmarks, traders are flocking to the $100,000 call option on the CME, a position favored by institutional investors. “According to CF Benchmarks’ data, the 30-day fixed futures 25 delta skew has now crossed the 5 vol threshold, which means there is much more demand for upside risk,” Thomas Erdösi, CF Benchmarks’ product manager, said in an email to CoinDesk. The 25 delta skew provides an insight into market sentiment by measuring the relative bullishness of call options relative to put options. A volatility threshold of 5 in a positive case indicates that calls are more expensive than puts, which give the right to sell at a given price, and traders are bracing for BTC to rise further. According to CF Benchmarks data, it is witnessing an increase in requests above $100,000.

Deribit Data: Deribit options open interest hits all-time high amid growing demand for bitcoin calls. The derivatives exchange’s CEO said it hit an all-time high, driven by increased institutional and retail interest in crypto options. Bitcoin options trading volumes also rose, with the asset hovering around $90,000, reflecting a bullish trend with increased demand for both call options and positive funding rates. About $3.39 billion worth of Bitcoin options contracts expire today, according to data from Deribit. Most Bitcoin call contracts are in profit, while put contracts are at a significant loss.

Maximum Pain Point: Bitcoin’s maximum pain point is set at $80,000.

Source: Deribit

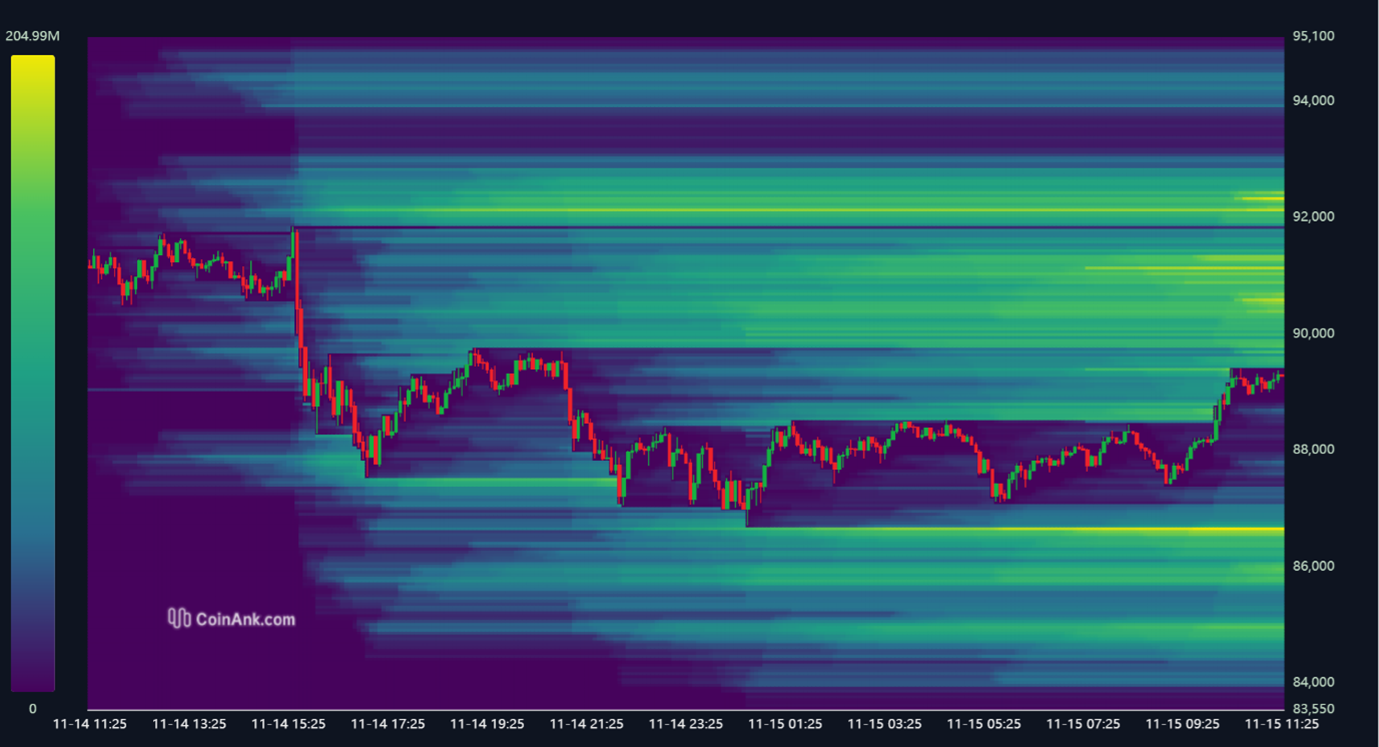

Bitcoin Liquidation Chart

Source: CoinAnk

When the liquidation heat map for BTC is examined, it is seen that short positions were liquidated by clearing the area between 90,000 and 91,000 during the week, and as a result of the decline it experienced afterwards, long transactions between 88,000 and 88,600 reached the liquidation value.

Currently, there is a significant liquidation area between 90,500 and 92,500 for short transactions and may want to clear the area in this price range in the coming period. For long transactions, liquidations seem to have accumulated between 86,000 and 86,700. These levels can be seen with the downward movement of the price and long transactions may be liquidated.

When the weekly liquidation amounts of Bitcoin are analyzed, a total of 342.42 million dollars of long transactions were liquidated between November 11 and 14, and the amount of short transactions liquidated between the same dates was 446.58 million dollars.

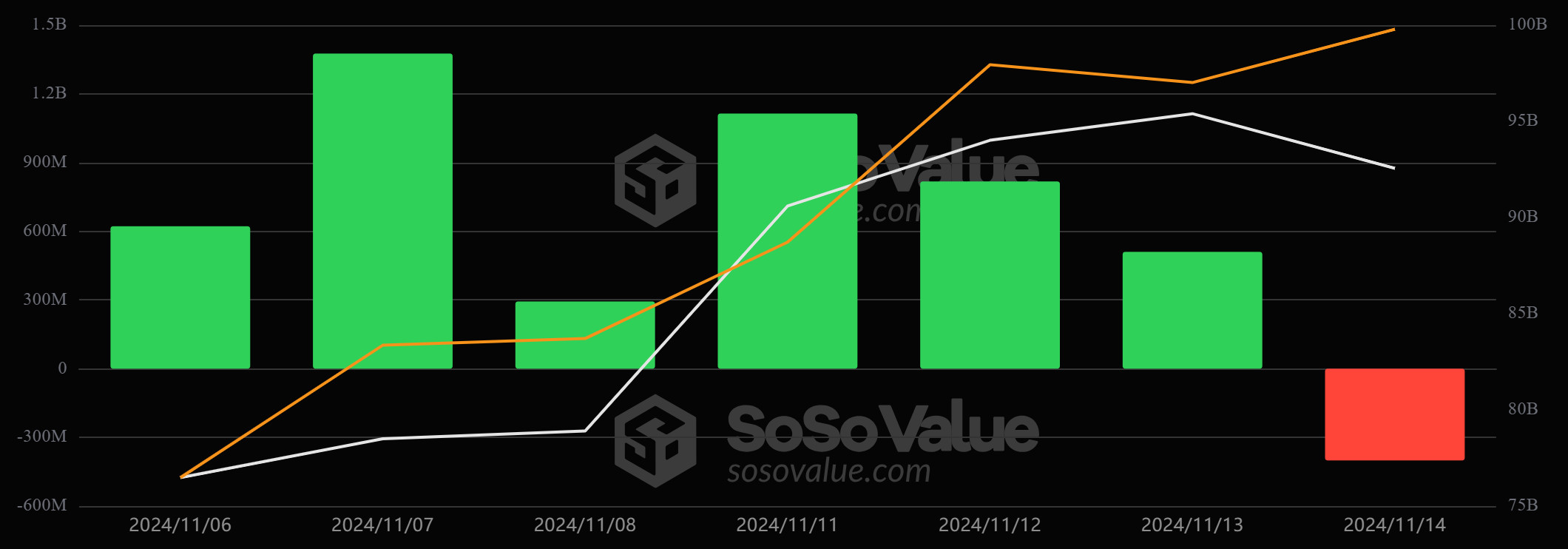

Bitcoin Spot ETF

Source: SosoValue

“SosoValue Image to be Added”

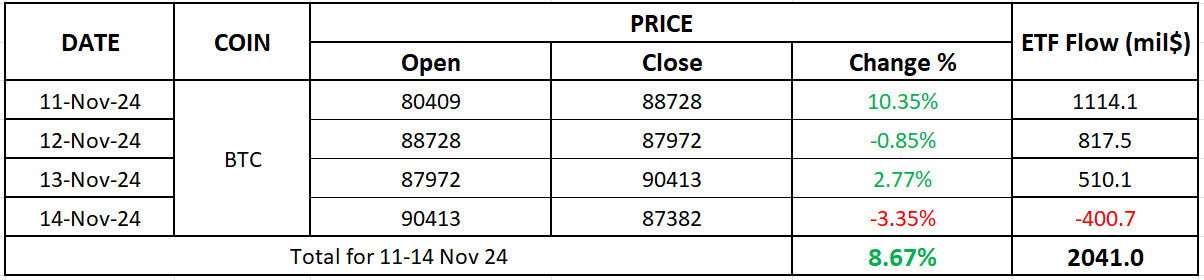

General Status:

- Positive Net Inflow Streak Ends: The positive net inflow streak in the Spot BTC ETF that started on November 6 lasted for 6 days. On November 14, total net outflows from Spot BTC ETFs totaled $400.7 million, ending the positive streak.

- Cumulative Total Net Inflows: Spot BTC ETFs saw cumulative total net inflows reach $27.8 billion after 214 trading days. Spot ETH ETFs reached positive cumulative total net inflows for the first time this week, with cumulative total net inflows totaling $246 million.

- Blackrock IBIT ETF Net Inflows: Between November 11-14, the Blackrock IBIT Spot BTC ETF net total inflows reached $1.89 billion. And Blackrock’s BTC holdings totaled 471,327 BTC ($41.57 billion).

Featured Situation:

- Market Impact: Following the US elections, Spot BTC ETFs saw their highest trading volume since March with $7.22 billion. Spot BTC ETFs saw a total net inflow of $2.04 billion during this period.

- BTC Price Change: There was an 8.67% increase in Bitcoin price between November 11-14.

Conclusion and Analysis

Total Net Inflows and Outflows: Net inflows in Spot BTC ETFs attracted attention between November 11-14. While net inflows were generally seen in Spot BTC ETFs during this period, net inflows totaled 2.041 billion dollars in the said time period.

Price Impact: This week saw an 8.67% price increase in BTC price and increased interest from institutional investors in Spot BTC ETFs. Total net inflows in Spot BTC ETFs exceeded $2 billion between November 11-14. This shows that Spot BTC ETF purchases increased as BTC price rose.

WHAT’S LEFT BEHIND

Bitcoin Price Exceeds $90,000: Bitcoin hit 93,434, setting a new ATH record.

Mt. Gox’s Big Bitcoin Transfer: The 30,371 BTC transfer marked a milestone in the repayment process.

Elon Musk Supports Ending the Fed: Musk supported Utah Senator Mike Lee’s call to abolish the Fed.

Powell’s Hawkish Speech: Dollar and bond yields rose as the chances of a rate cut diminished.

Crypto Market Correction: Bitcoin and Ethereum decline while XRP and HBAR rise.

Bitcoin Reserve Proposal by Michael Saylor: He said that the US’s creation of a strategic reserve could reduce the debt by 45%.

US Producer Inflation Announced: Annual PPI rose by 2.4% and 0.2% mom, exceeding expectations.

Bitcoin Spot ETF Volume Exceeds $500 Billion: ETFs saw net inflows of $2.4 billion.

Bitcoin Dominance Hits Record: 61.39%, the highest level since March 2021.

New Development in FTX Case: US aims to seize $16 million Binance account.

Crypto Regulation Plan from the United Kingdom: The UK aims to make the sector attractive against the US.

Tether Treasury Mint 2 billion USDT: Transactions took place on TRON and Ethereum networks.

China Commentary by Hashey CEO: Trump’s crypto policies could push China back into the industry.

BlackRock’s BUIDL Fund Expands: Announced expansion to chains including Aptos, Arbitrum and Polygon.

US Inflation Announced: Consumer inflation came in at 2.6% yoy, 0.2% mom; Fed cut expectations increased.

Trump’s nominees for Treasury Secretary: Howard Lutnick could play a leading role in the possible selection.

Beam Chain Announcement at Ethereum Devcon: Justin Drake’s statements left a mark on the agenda.

BRICS and Crypto Partnership: BRICS countries are embracing crypto in cross-border transactions.

DOGE Initiative from the Trump Administration: Elon Musk introduced the DOGE logo with a Shiba Inu image.

Cardano and Ripple Collaboration Claims: Potential partnerships between the two projects came to the agenda.

HIGHLIGHTS OF THE WEEK

The US presidential elections, the November 7 Federal Open Market Committee (FOMC) meeting, which clarified the US Federal Reserve’s course after its 50 basis point “jumbo” interest rate cut, and the diminishing impact of geopolitical risks, particularly in the Middle East, on asset prices… The first week of November was a critical juncture for global markets, and for most investors it was not easy to turn. Digital assets were the instrument group that benefited the most from this turn. Last week, we watched the price changes in the “aftermath” of these important developments. We do not think that the new week will be much different from this, unless a surprising and different dynamic emerges. However, smaller details may keep investors busy and affect prices for a short period of time.

After a few records…

The dose of global financial tightening (or loosening) is likely to remain the dominant dynamic in asset prices for some time to come. In this context, US macro indicators and the statements of FOMC members, which may provide clues about the FED’s rate cut path, will be one of the determining factors in investors’ risk perception in the coming period. In addition, we will closely monitor the expectations about the repercussions of Trump’s policies that he has stated that he will implement when he becomes president, such as raising tariffs, lowering taxes and deregulation, which may fuel growth and inflation, and the preparations that major investors will continue to make on this issue.

The victory of former President Trump, one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our forecasts. The continuation of the Fed’s rate-cutting cycle (albeit with cautious messages from Powell…) and the inflows into BTC ETFs, indicating increased institutional investor interest (in addition to MicroStrategy’s BTC purchases, Microsoft starting to consider buying…), continue to support our big picture upside forecast for now.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Special reports prepared by Darkex Research Department will be shared in this section.

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone. The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.