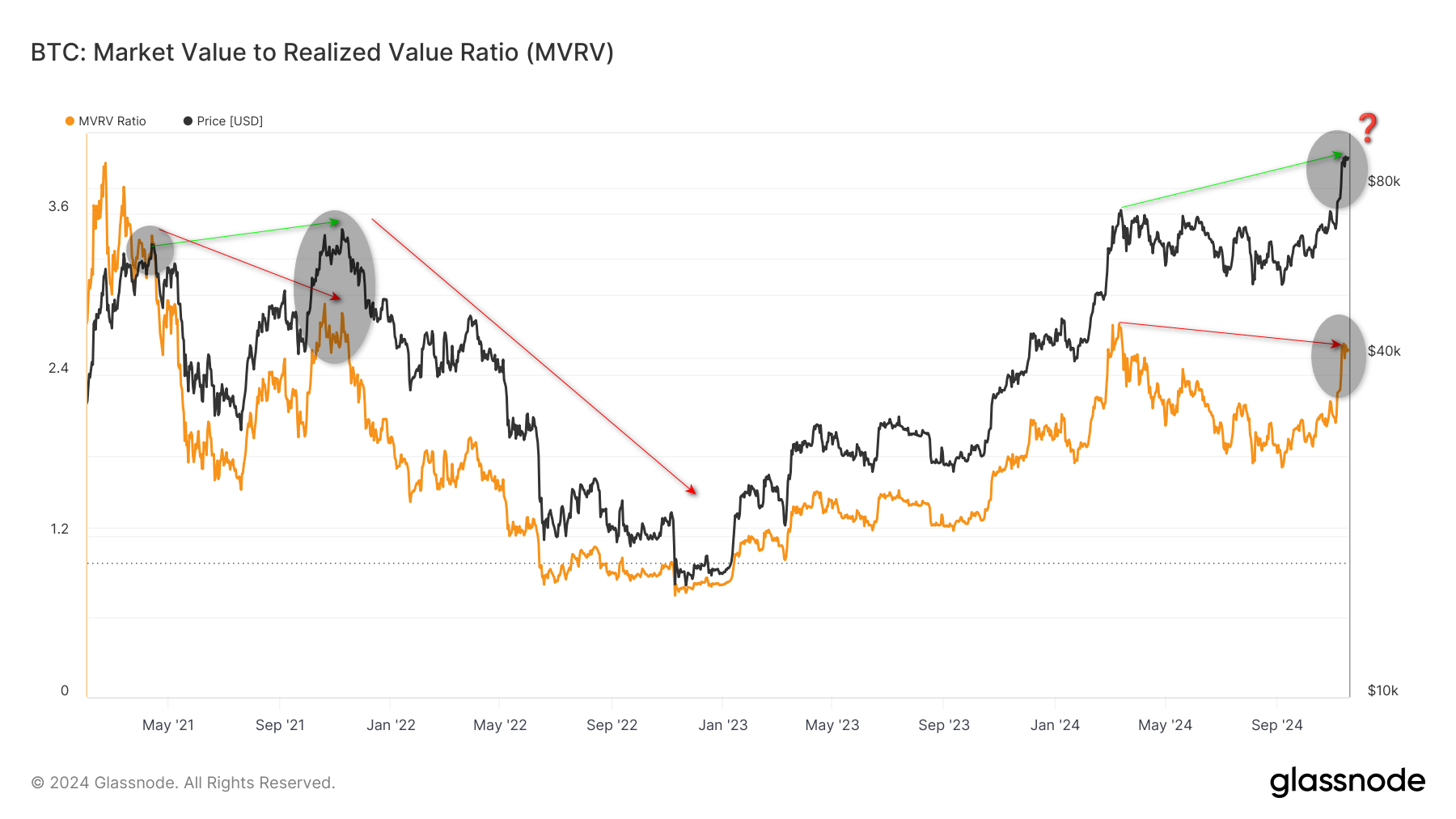

The latest MVRV (Market Value to Realized Value) metric shows signs of weakness in market dynamics despite the rise in Bitcoin price. As the price has moved towards the $100,000 level, the MVRV ratio has formed a lower peak, indicating a weakening balance between market cap and realized value. This suggests a negative divergence between market sentiment and price action. This negative divergence suggests that investors’ realized gains are weakening compared to the current market capitalization and that selling pressure may increase in the market.

Historically, periods when MVRV has formed such low peaks have often coincided with periods of accelerated profit realizations and price corrections. As can be seen on the chart, a similar scenario occurred in 2021. As the price peaked, the MVRV declined, followed by a strong correction.

However, if the price maintains its bullish momentum and the MVRV ratio rises above the previous peak level of 2.78, the positive process in market perception may continue. This could not only push prices to new highs but also allow the market to move in a healthier way. However, the current picture signals an imbalance that needs to be carefully monitored.