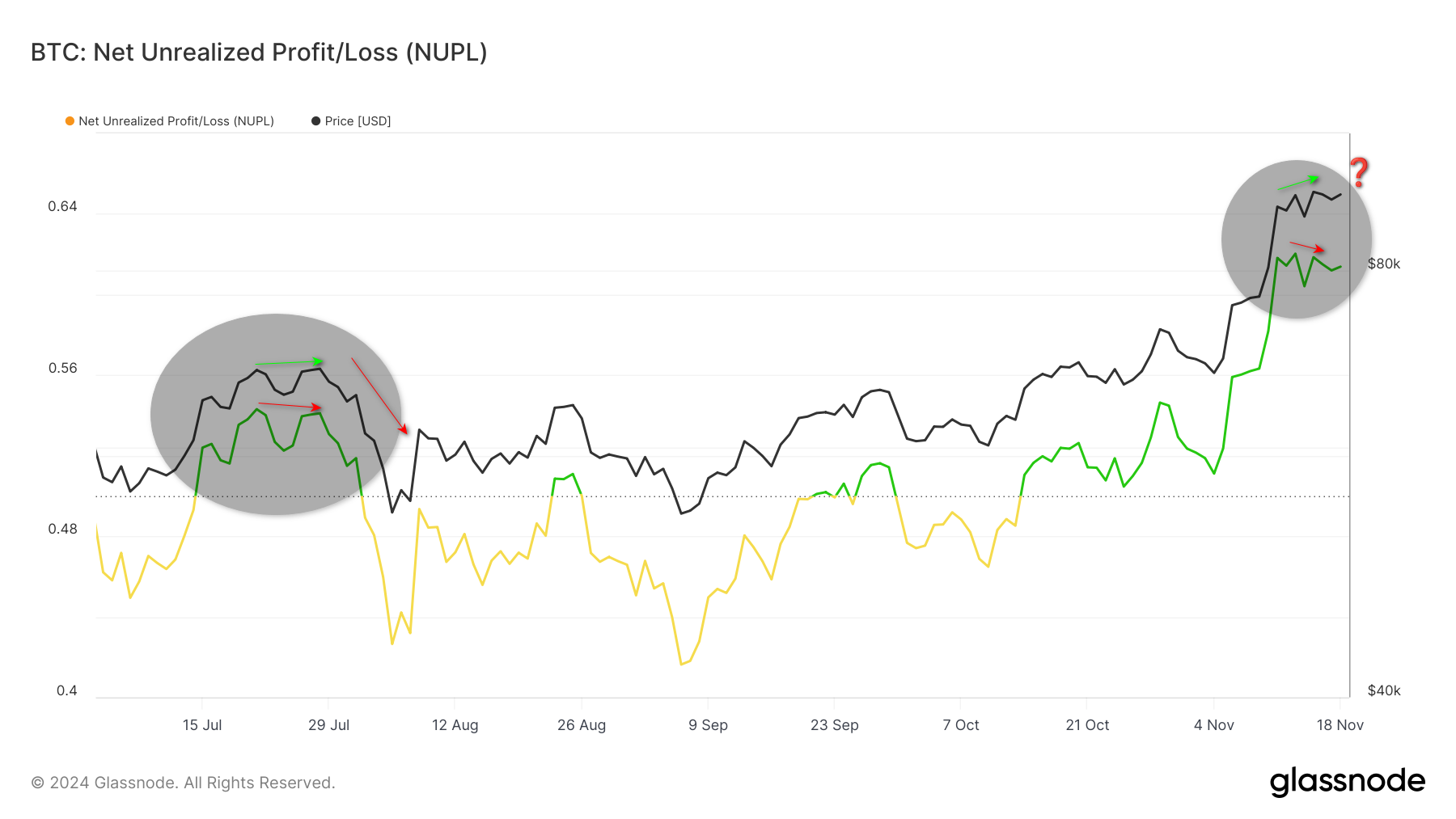

In mid-November, as the Bitcoin price reached a new high of 93,483, the Net Unrealized Profit/Loss (NUPL) metric showed a lower peak, out of sync with the price action. Usually the 0.6 level of NUPL is considered the ‘Belief-Denial’ zone, but these levels can also carry the risk of overbought. Such mismatches can often signal increased selling pressure as investors take profit realizations. A similar mismatch occurred in July and resulted in the price entering a correction. In the current situation, NUPL’s bearish divergence could be taken as a signal that the market is in overbought territory and the risk of a correction is increasing. However, if the price overcomes this mismatch and gains a new bullish momentum, the market perception may continue in a positive direction.