MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap |

|---|---|---|---|---|

| BTC | 95,558.14 | 2.63% | 57.07% | 1,89 T |

| ETH | 3,595.59 | 4.92% | 13.05% | 433,31 B |

| SOLANA | 238.56 | 3.34% | 3.41% | 113,31 B |

| XRP | 1.485 | 7.75% | 2.55% | 84,78 B |

| DOGE | 0.4060 | 3.54% | 1.80% | 59,68 B |

| CARDANO | 1.0060 | 4.43% | 1.06% | 35,32 B |

| AVAX | 43.07 | 1.61% | 0.53% | 17,64 B |

| TRX | 0.2002 | 1.11% | 0.52% | 17,28 B |

| SHIB | 0.00002554 | 3.90% | 0.45% | 15,06 B |

| DOT | 8.213 | 1.11% | 0.38% | 12,52 B |

| LINK | 17.98 | -0.42% | 0.34% | 11,28 B |

*Prepared on 11.28.2024 at 07:00 (UTC)

WHAT’S LEFT BEHIND

Crypto-Loyal Cabinet Members in the Trump Administration

Donald Trump’s new cabinet consists of senior officials who look favourably on cryptocurrencies. In particular, former SEC Commissioner Paul Atkins is on the agenda as a candidate to replace Gary Gensler as SEC chairman. However, it is noteworthy that there are well-known names in the crypto markets among the new ministers.

New Purchases from Bitcoin Miner MARA

MARA Holdings purchased 703 more Bitcoins, bringing its total holdings to 34,794 BTC. The company stated that it made these Bitcoin purchases through $1 billion of zero-coupon convertible senior notes. The average purchase cost was announced as 95,395 dollars.

50 Million Dollar Bitcoin Purchase from Chinese Company SOS Limited

China-based SOS Limited announced that it will purchase $50 million worth of Bitcoin in order to evaluate Bitcoin as a long-term reserve asset. The company announced that this move was approved by the board of directors.

“Bitcoin Reserve” Step in Brazil

Following Bitcoin reserve plans in the US, a Brazilian lawmaker has introduced a bill stating that Bitcoin is critical for economic resilience. This bill envisages the country creating a Bitcoin reserve.

Former CFTC Chairman: “Bitcoin Reserves are Very Important”

The former head of the US CFTC said that creating Bitcoin reserves is a logical and necessary step. He emphasized the strategic importance of Bitcoin as “the world’s first digital commodity”.

Strategic Partnership between Aave and Instadapp

The Aave community has launched a strategic partnership proposal with Instadapp by investing in INST tokens. The offer includes Aave DAO strengthening its collaboration with Instadapp in the DeFi space by investing $4 million.

Tether Halts EUR₮ issuance

Tether announced that it will stop supporting the euro stablecoin EUR₮ due to the complexity of the regulatory environment. The company announced that while it will not process new requests, it will prioritize new stablecoin projects such as MiCAR-compliant EURQ and USDQ.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| All Day | Holiday – United States – Thanksgiving Day | – | – |

| – | FLOKI Valhalla Mainnet Release | – | – |

| 14:00 | Qubic Ecosystem Call | – | – |

| 16:00 | Nosana (NOS) Community Call: Join the Nosvember Awards and get updates on the Mainnet launch | – | – |

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

Markets will be closed today due to the Thanksgiving holiday in the US and this may cause a drop in volume in digital assets. Before that, Wall Street indices closed on the negative side yesterday. Asian stock markets have a mixed outlook and Europe is expected to start the day slightly positive. In cryptocurrencies, the declines following Trump’s statements on tariffs were replaced by rises with regulatory expectations, and we think it will continue after a respite. It is worth noting that volatility in the market may increase from time to time due to the weakness in volume today and derivative products approaching expiration.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our forecasts. In the aftermath, the president-elect’s appointments to Congress and the increased regulatory expectations for the crypto ecosystem in the US have maintained their place in our equation as a positive variable. Despite Powell’s cautious messages in his last speech, the continuation of the FED’s interest rate cut cycle, and the volume in BTC ETFs, indicating an increase in institutional investor interest (in addition, MicroStrategy’s BTC purchases, Microsoft’s start to evaluate the purchase issue, BlackRock’s BTC ETF options start trading …), support our upward forecast for the big picture for now.

In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional respite or pullbacks in digital assets. However, at this point, it would be useful to underline again that the fundamental dynamics continue to be bullish.

TECHNICAL ANALYSIS

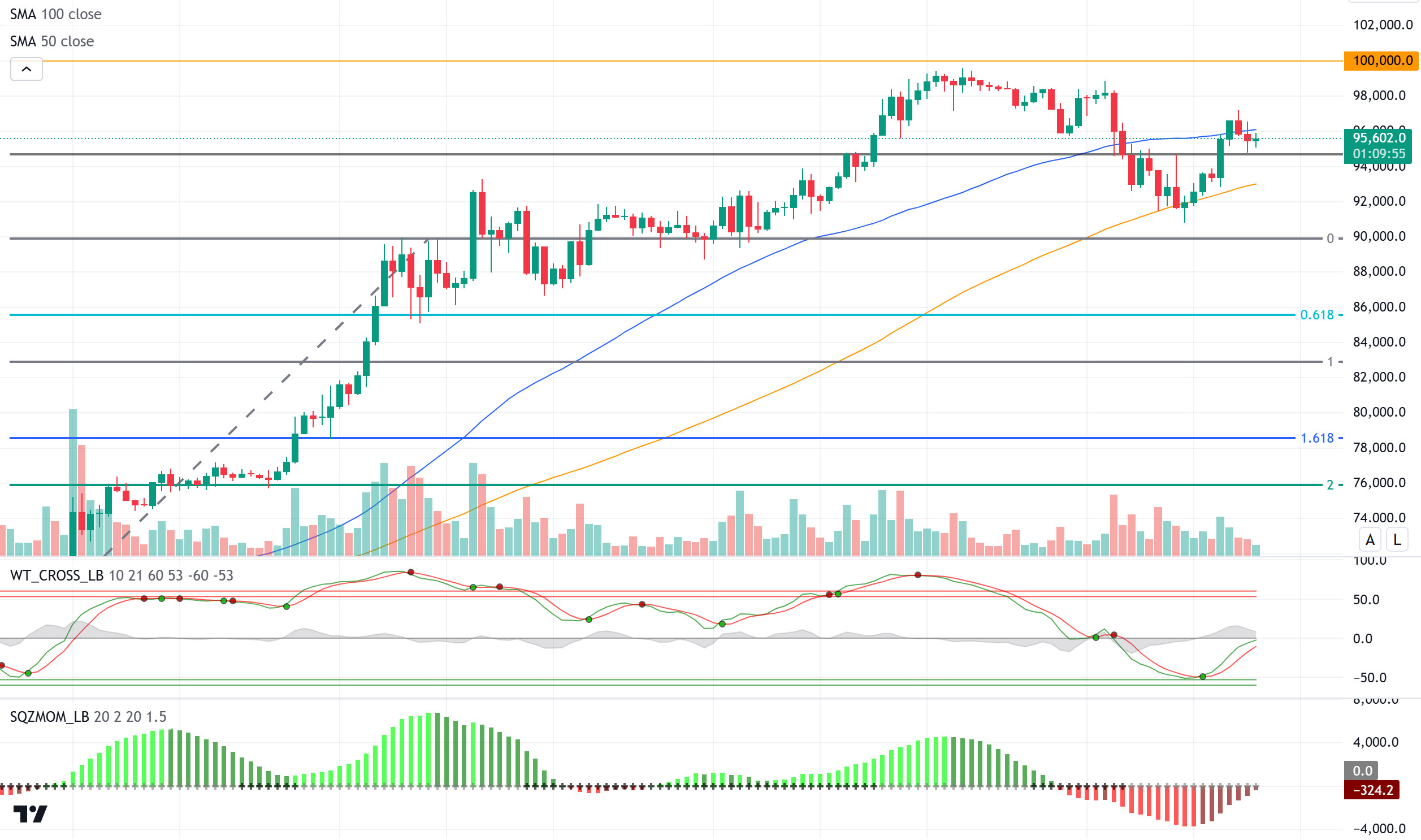

BTC/USDT

While US President Donald Trump continues to negotiate with critical pro-Bitcoin figures for his new cabinet, Bitcoin purchases by corporate companies continue unabated. Finally, mining company MARA Holding bought 703 more Bitcoins, bringing its total Bitcoin holdings to 34,794 BTC. In addition to these developments, China-based companies have also started to join the Bitcoin trend. SOS Limited announced that it will purchase $50 million worth of Bitcoin in line with its plans to consider Bitcoin as a long-term reserve asset.

While optimistic developments for Bitcoin continue to be on the agenda, when we look at the technical outlook, we see that the price has exceeded the resistance point of 95,000 with support from the 100-day SMA (orange) line. In our previous analysis, we stated that technical oscillators signaled buying and the momentum indicator regained strength. BTC, which is currently trading at 95,500, tested the 97,000 level during the day, but retreated back below the 50-day SMA (blue) line. We can say that pricing above the support level of 95,000 is targeting six-digit levels again. Indeed, technical oscillators, momentum indicator and spot ETF inflows turning positive continue to support this. In case this level is crossed below, we will watch the price to get support from the 100-day SMA line again.

Supports 95,000 – 92,500 – 90,000

Resistances 99,655 – 100,000 – 105,000

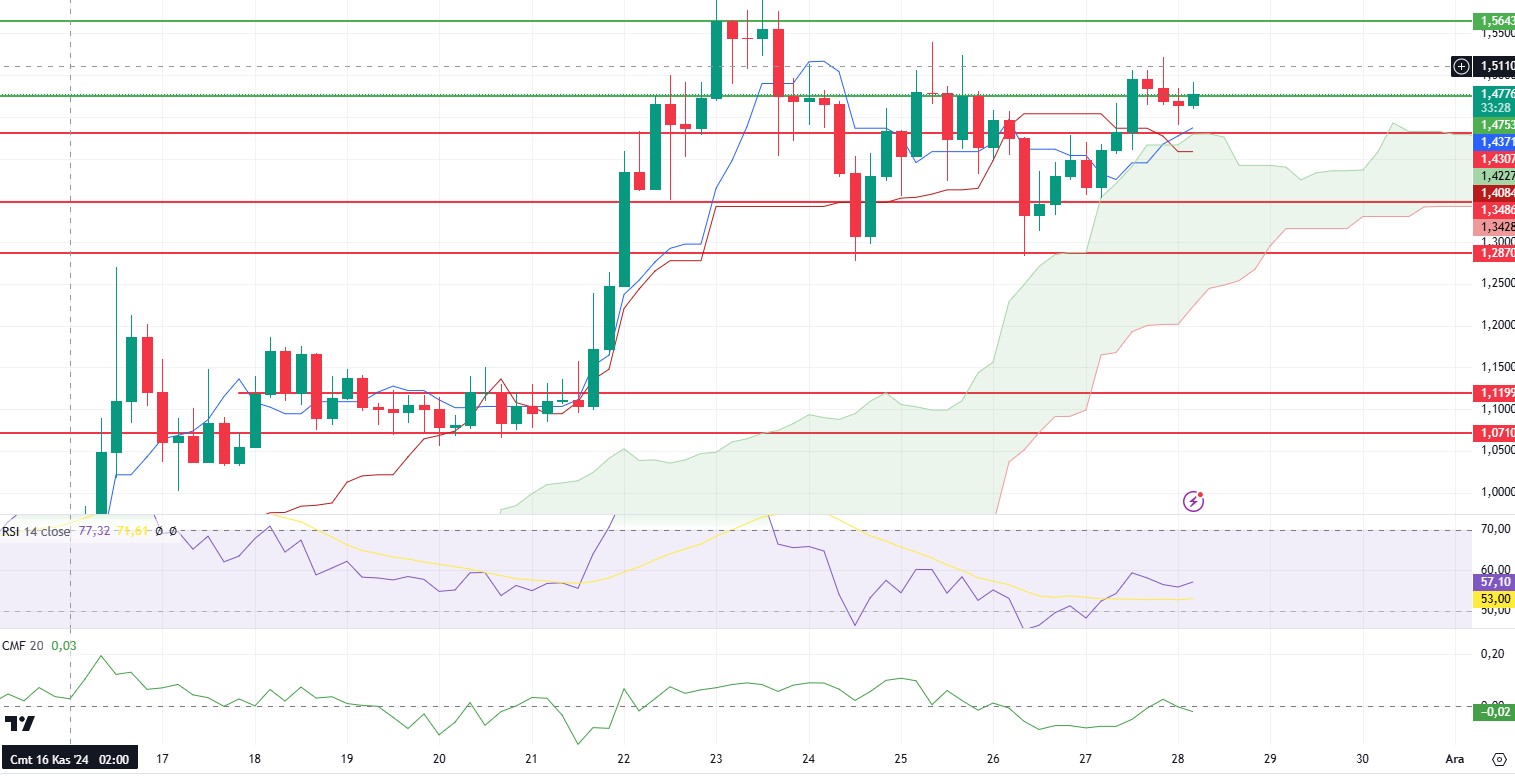

ETH/USDT

ETH managed to rise to the level of 3,650 after rising to 3,534 yesterday. The Relative Strength Index (RSI), which came to the overbought zone after this rise, has started a horizontal movement by leaving the region with the correction on the price in the morning hours. Chaikin Money Flow (CMF) is seen to have reached up to 0.18. In Cumulative Volume Delta (CVD), spot-weighted purchases continue. In the light of all these data, it can be said that the upward momentum may continue. Provided that the 3,534 level is not broken, exceeding the 3,653 zone can quickly bring rises up to 3,717 and then 3,839 levels. With the break of the 3,534 level, we can see the price retreating to the 3,393 regions.

Supports 3,459 – 3,393 – 3,256

Resistances 3,534 – 3,622 – 3,717

XRP/USDT

XRP rose above the 1.48 level after the upward movement of BTC in the evening hours last night. XRP, which lost the region again with the sales from this region, managed to stay above the region with a slight rise in the morning hours. The negative outlook on the Relative Strength Index (RSI) has completely disappeared and started to look positive. However, Chaikin Money Flow (CMF) entering the negative zone and heading down looks negative for the next 4 hours. However, looking at the Ichimoku indicator, we see the buy signal formed by the tenkan level crossing the kijun line upwards. With this signal, we can see rises up to 1.56, provided that the 1.43 kumo cloud support is not broken. A break of the 1.43 level may bring declines up to 1.34.

Supports 1.4753 – 1.3486 – 1.2870

Resistances 1.4922 – 1.5643 – 1.7043

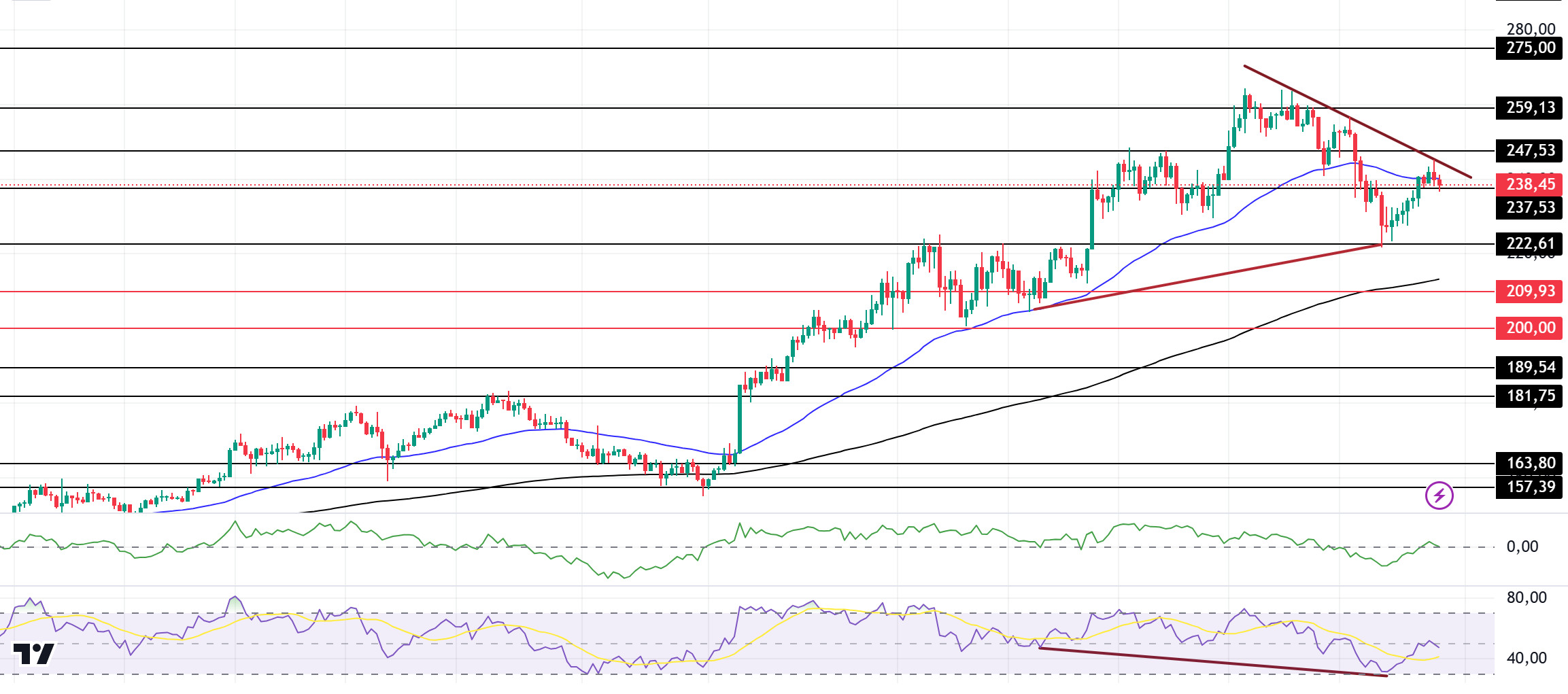

SOL/USDT

Solana (SOL) has been facing increasing selling pressure since hitting an all-time high of $264.63 on November 24. The coin changed hands at $237.86 at the time of writing, down 12% since then. On the other hand, Pump Fun, a memecoin launchpad based on Solana, sold 99,999 SOLs worth about $22.74 million. Also according to Coinglass, the total value of Solana short positions in the last 24 hours reached $6 billion, significantly outpacing long positions worth $5.38 billion.

On the 4-hour timeframe, the 50 EMA (Blue Line) is above the 200 EMA (Black Line). Since November 22, SOL, which has been in a downtrend, continues its downward movement. However, when we examine the Chaikin Money Flow (CMF)20 indicator, money inflows have turned negative after a long time, but there is a horizontal impression in inflows. At the same time, Relative Strength Index (RSI)14 is moving back towards the overbought zone, although it rises from the overbought zone to the neutral level. However, there is a mismatch. This can be shown as a bullish signal. The 259.13 level is a very strong resistance point in the uptrend driven by both macroeconomic conditions and innovations in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements due to possible macroeconomic reasons or profit sales, support levels 222.61 and 189.54 can be triggered again. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 222.61 – 209.93 – 200.00

Resistances 237.53 – 247.53 – 259.13

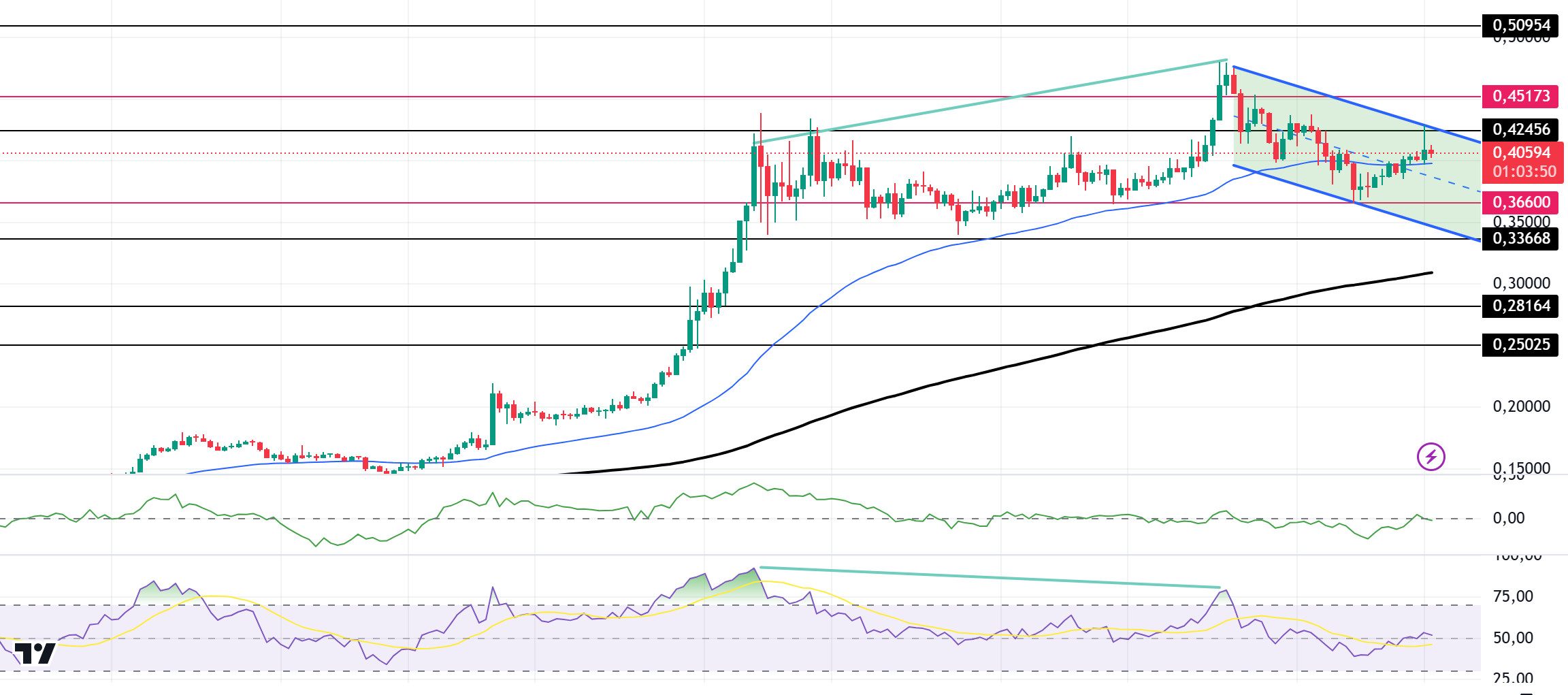

DOGE/USDT

Thanks to Musk’s influence and the Foundation’s ambitious plans to scale Dogecoin globally, speculation about the future value of the meme coin is on the rise. The Dogecoin Foundation recently unveiled “Dogebox”, an initiative aimed at accelerating the adoption of Dogecoin ($DOGE) by small and medium-sized businesses. The Dogecoin Foundation recently announced at X that they are continuing their open source efforts as they further develop the new Dogebox decentralized infrastructure system. Dogebox is expected to play a crucial role as a tool for one million retailers to accept DOGE payments.

Technically, the Relative Strength Index (RSI) 14 seems to have worked inconsistently with the chart. If the upward momentum is weak, pullbacks may deepen. On the 4-hour timeframe, the 50 EMA (Blue Line) is above the 200 EMA (Black Line). But the gap between the two averages is still too wide. This may cause pullbacks. On the other hand, when we look at some indicators, RSI 14 has moved from the overbought zone to the neutral level. However, when we examine the Chaikin Money Flow (CMF)20 indicator, it has turned negative. This shows us that there are money outflows, indicating that the pullbacks may deepen. The 0.50954 level appears to be a very strong resistance place in the rises due to both macroeconomic conditions and innovations in Doge coin. If DOGE maintains its momentum and rises above this level, the rise may continue strongly. In case of retracements due to possible macroeconomic reasons or profit sales, the support levels of 0.36600 and 0.33668 can be triggered again. If the price hits these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.36600 – 0.33668 – 0.28164

Resistances 0.42456 – 0.45173 – 0.50954

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.