MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | Weekly Change | Monthly Change | YTD Change | Market Cap |

|---|---|---|---|---|---|

| BTC | 94,966.01$ | -5.14% | 1.60% | 116.00% | 1,89 T |

| ETH | 3,276.96$ | -15.79% | 4.62% | 39.07% | 394,04 B |

| XRP | 2.188$ | -5.92% | 97.67% | 248.00% | 125,36 B |

| SOLANA | 180.95$ | -19.87% | -23.87% | 64.86% | 86,52 B |

| DOGE | 0.2967$ | -26.81% | -24.58% | 221.00% | 43,47 B |

| CARDANO | 0.8319$ | -23.95% | -0.70% | 33.09% | 29,12 B |

| TRX | 0.2382$ | -18.20% | 19.94% | 120.00% | 20,46 B |

| AVAX | 36.79$ | -29.21% | 4.21% | -12.04% | 15,09 B |

| LINK | 21.52$ | -24.69% | 45.25% | 38.53% | 13,49 B |

| SHIB | 0.00002046$ | -26.63% | -16.87% | 91.88% | 12,08 B |

| DOT | 6.478$ | -27.61% | 7.56% | -24.17% | 9,98 B |

*Table was prepared on 12.20.2024 at 11:30 (UTC). Weekly values are calculated for 7 days based on Friday.

Fear & Greed Index

Source: Alternative

Change in Fear and Greed Value: -2

Last Week Level: 76

This Week’s Level: 74

This week, the Fear and Greed Index fell from 76 to 74, indicating a decline in risk appetite in the markets. Fed Chairman Jerome Powell stated that rate hikes in 2025 are unlikely, while pointing out that it may take another year or two for inflation to reach the 2% target. These statements may have increased the perception of uncertainty in the markets, causing investors to adopt a more cautious approach.

In addition, the announcement that the Federal Reserve is not allowed to own Bitcoin was an important development for the crypto markets. This news was followed by a 10% decline in Bitcoin prices, which may have led to increased concerns about institutional demand in the markets. The decline in the index reflects the weakness in investor sentiment as a result of these developments.

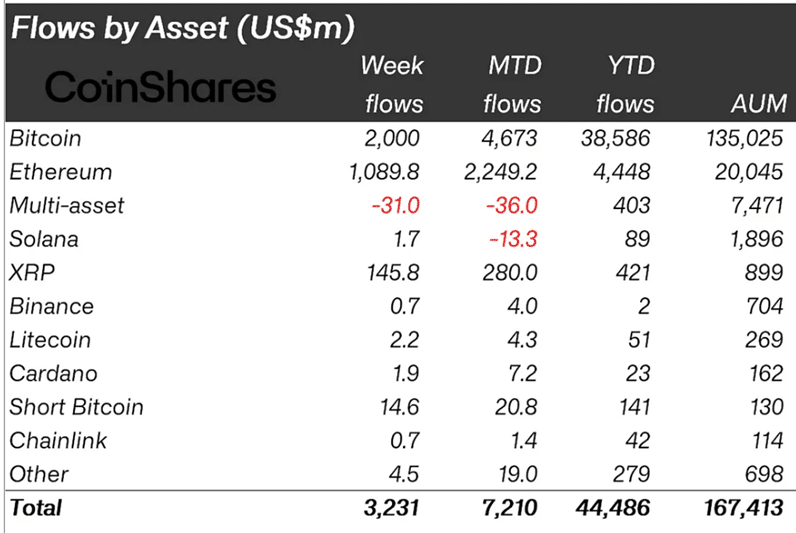

Fund Flow

Source: CoinShares

Overview: Last week, digital asset investment products saw inflows totaling 3.2 billion$ continue for the tenth consecutive week, with inflows so far this year totaling 44.5 billion$ , more than four times that of any other year.

Fund Entries

- Bitcoin (BTC): 2 billion$ inflows, bringing total inflows since the US election to $11.5.

- Ethereum (ETH): 1 billion$ inflows reached.

- XRP: 145 million$ inflows were seen

- Litecoin (LTC): 2 million$ inflows.

- Cardano (ADA): 9 million$ logins

- Solano (SOL): 7 million$ money inflow.

- Other Altcoins: 5 million$ entries.

Fund Outflows

This week, bitcoin set new records and experienced one of the lowest outflows ever. Trading volumes on ETPs rose by an average of 21 billion$ on the week. Outflows were seen in bitcoin short positions, totaling 14.6 million$ following recent price gains.

Evaluation:

Bitcoin investment products saw total inflows of 2 billion$ , bringing total inflows since the US election to 11.5 billion$ .

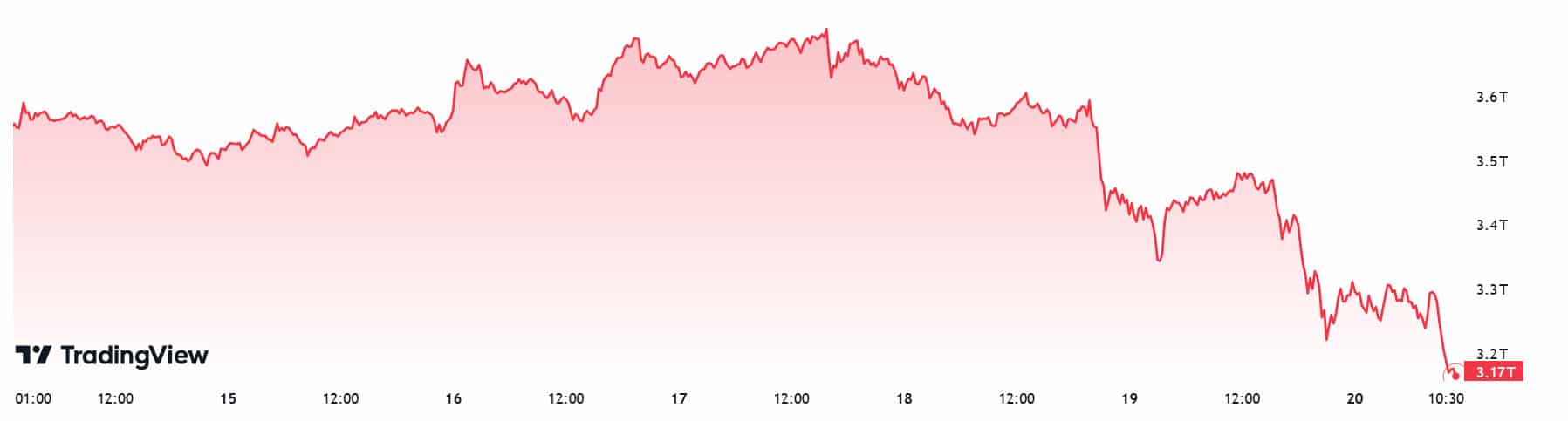

Total MarketCap

Source: Tradingview

- Last Week Market Capitalization: 3.62 trillion Dollars

- Market Capitalization This Week: 3.17 trillion Dollars

The total market capitalization in the cryptocurrency market is poised for its second negative weekly close this week, down 12.57%, after ending its 5-week bullish streak last week with a 0.decline. This week’s market loss of nearly $450 billion before the close has wiped out more than the entire return of the last two weeks of the 5-week uptrend that began in November.

Total 2

When Total 2 is analyzed, there was a 17.01% decline this week, following the 4.10% decline from the previous week. We can say that altcoins have lost much more value than Bitcoin, as this decline, worth about $ 320 billion, is higher in percentage terms than the total market.

Total 3

When Total 3 is analyzed, there was a 16.85% decline on Total 3, with a loss of approximately $ 202 billion. When we interpret this situation specifically for Ethereum, we can say that Ethereum performs weaker than the average of the altcoin market and Bitcoin.

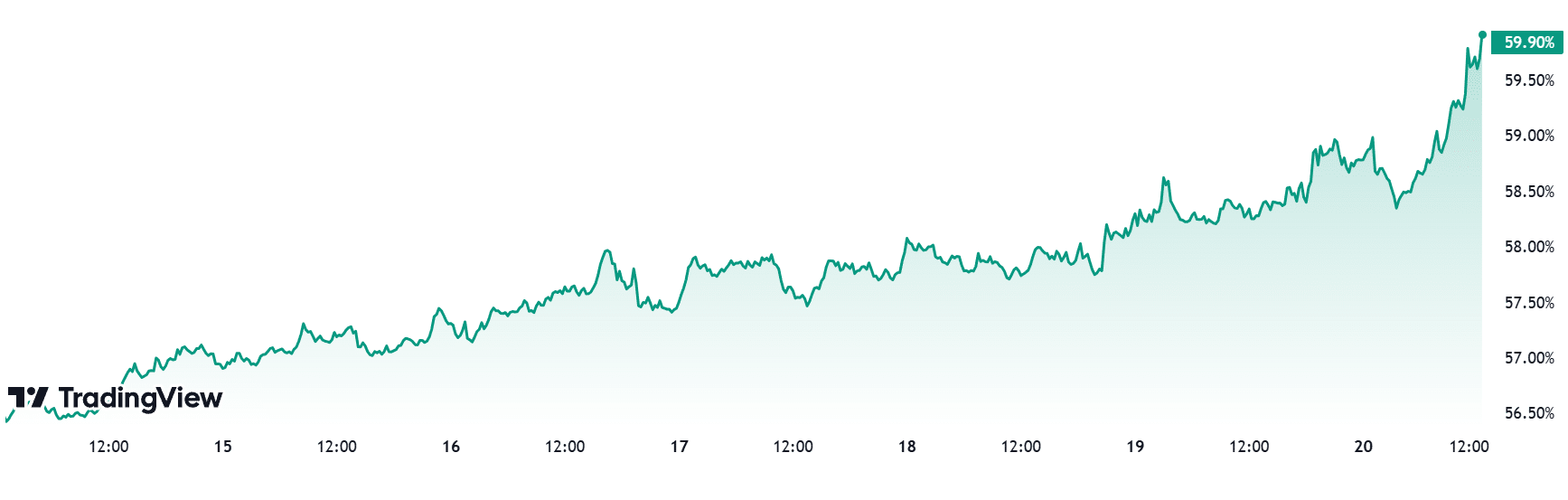

Bitcoin Dominance

Source: Tradingview

Weekly Change:

- Last Week’s Level: 57.18%

- This Week’s Level: 59.90%

Bitcoin dominance, which continued the positive momentum it started last week, continued its upward movement with the new week. In this context, it rose to the 58.50%- 61.50% band range, which we followed as important levels a while ago. Accordingly, while last week’s close was realized at 57.18%, it is moving at 59.90% as of this week.

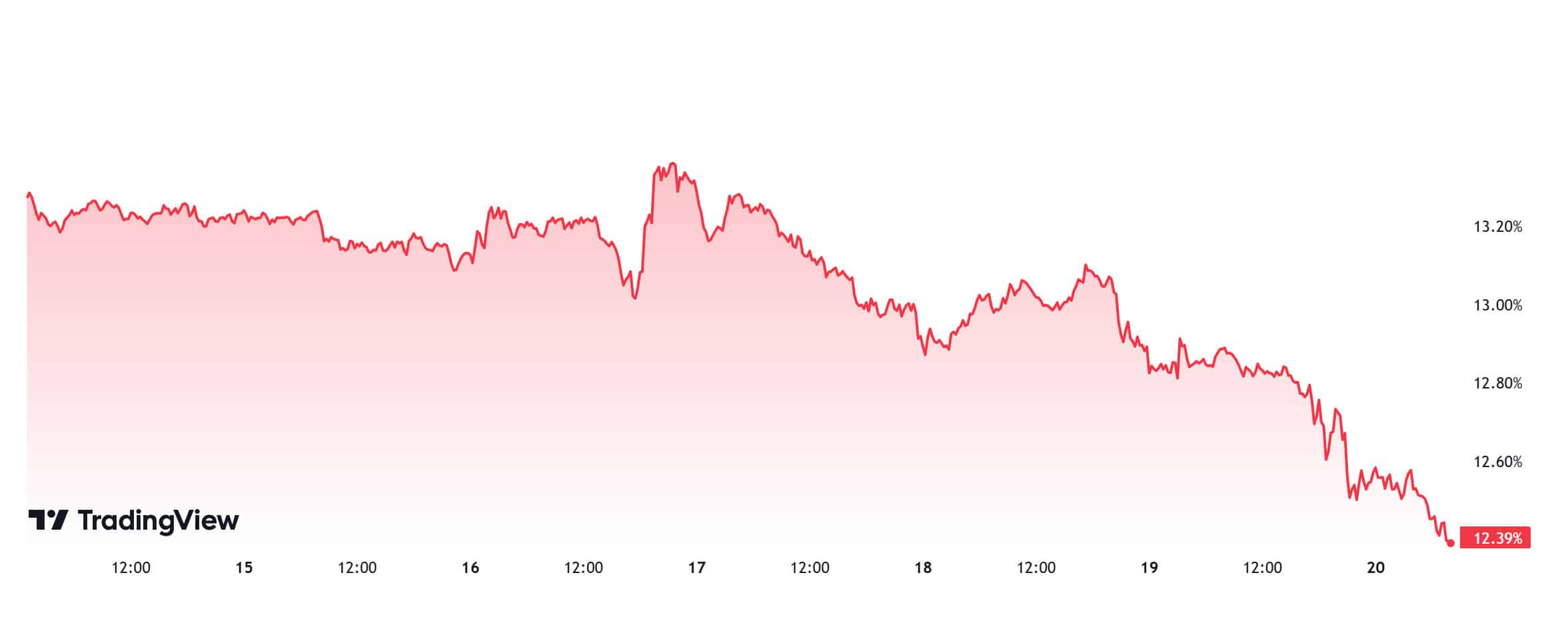

Ethereum Dominance

Source: Tradingview

ETH dominance, which closed last week at 13.19%, rose slightly at the beginning of the new week, but then entered a downtrend. ETH Dominance is currently at 12.39%.

Conference Board (CB) Consumer Confidence and unemployment claims data will be released next week. With the positive evaluation of these data by the market, an increase in ETH dominance can be observed after possible decreases in BTC dominance. As a result of this situation, ETH dominance can be expected to rise to 13% – 13.50% for next week.

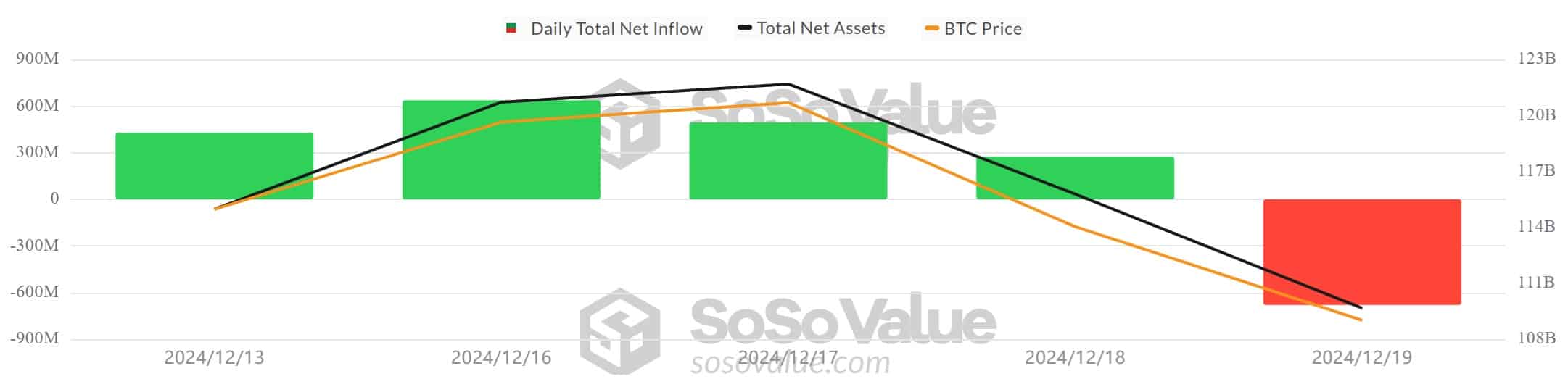

Bitcoin Spot ETF

Source: SosoValue

Featured Developments

Negative Inflow after 15 days: Spot Bitcoin ETFs ended a 15-day streak of positive net inflows. On December 19, 2024, the total net inflow in Spot Bitcoin ETFs was -$671.9 million.

New ATH for Bitcoin and FED’s Summary of Economic Projection: On December 17, 2024, Bitcoin renewed its ATH with a rise above $108,000. During the ATH renewal process, investor interest in Spot Bitcoin ETFs was high. On December 18, 2024, the FED’s Summary of Economic Projection and FED Chairman Powell’s speech caused a sharp decline in the crypto market, while Spot Bitcoin ETFs also saw outflows.

Cumulative Net Inflows: Cumulative net inflows into spot BTC ETFs exceeded $36.3 billion at the end of the 238th trading day.

| DATE | COIN | PRICE Open | PRICE Close | Change % | ETF Flow (mil$) |

|---|---|---|---|---|---|

| 13-Dec-24 | BTC | 99,982 | 101,371 | 1.39% | 428.9 |

| 16-Dec-24 | BTC | 104,460 | 106,023 | 1.50% | 636.9 |

| 17-Dec-24 | BTC | 106,023 | 106,074 | 0.05% | 493.9 |

| 18-Dec-24 | BTC | 106,074 | 100,181 | -5.56% | 275.3 |

| 19-Dec-24 | BTC | 100,181 | 97,434 | -2.74% | -671.9 |

| Total for 13-19 Dec 24 | -2.55% | 1163.1 | |||

Conclusion and Analysis

If we evaluate the December 13-19, 2024 date range as before and after the December 18, 2024 FED Summary of Economic Projection and FED Chairman Powell’s speech, we see that investor interest in Spot Bitcoin ETFs – especially BlackRock IBIT ETF – was high before December 18, 2024, and in this process, Bitcoin renewed ATH with its rise above the $ 108,000 level. On December 18, 2024, Bitcoin and the crypto market fell sharply, especially after Fed Chairman Powell’s speech. This also had an impact on Spot Bitcoin ETFs. On December 19, 2024, total net inflows in Spot Bitcoin ETFs were -$671.9 million, ending a 15-day streak of positive net inflows. In his speech, FED Chairman Powell stated that the FED is prohibited from making Bitcoin reserves and that they are not considering an update to the law on this issue, which caused a sharp decline in Bitcoin price. Considering the posts of Donald Trump, who won the US Presidential elections, about the Bitcoin reserve, there may be a post by Donald Trump on this issue in the coming period. Possible positive shares may support the rise in Bitcoin price and increased investor interest in Spot Bitcoin ETFs.

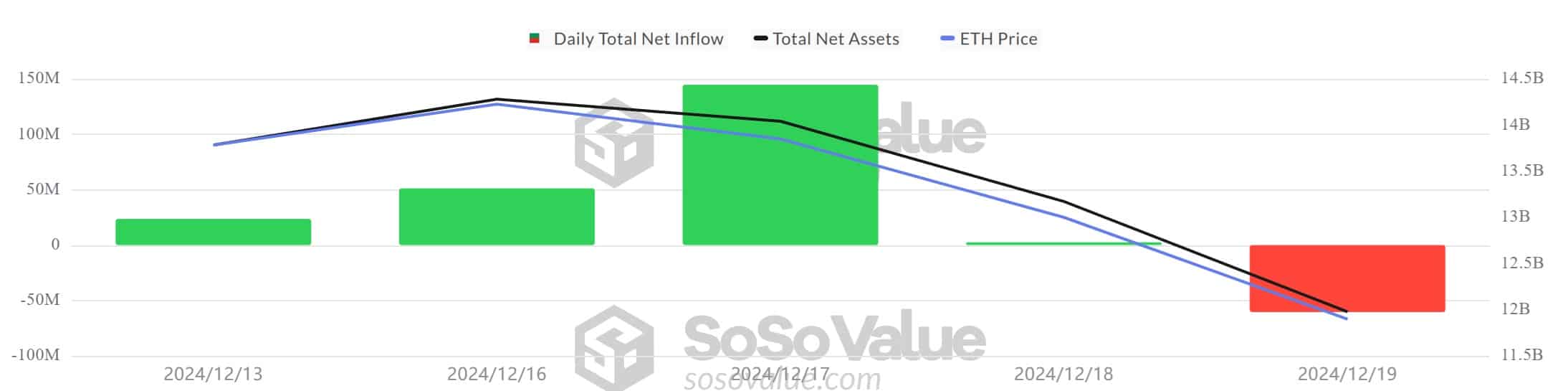

Ethereum spot ETF

Source: SosoValue

Positive Net Inflow Streak Ended: The 18-day streak of positive net inflows in US Spot ETH ETFs ended on December 19, 2024. Total net inflows from US Spot ETH ETFs totaled -$60.5 million on December 19, 2024.

Change in ETH Price: Between December 13-19, ETH fell by about 12% to $3,400.

FED Summary of Economic Projection and Powell Speech: On December 18, 2024, there was a sharp decline in the US stock markets and the crypto market with the “Summary of Economic Projection” shared by the FED and the speech of FED Chairman Powell. Approximately $ 1.5 trillion was deleted from the US stock exchanges. ETH, which opened at $ 3,890 on December 18, 2024, closed at $ 3,416 on December 19, 2024.

Cumulative Net Inflows: At the end of the 106th trading day, cumulative net inflows into US Spot ETH ETFs exceeded $2.4 billion.

| DATE | COIN | PRICE Open | PRICE Close | Change % | ETF Flow (mil$) |

|---|---|---|---|---|---|

| 13-Dec-24 | ETH | 3,880 | 3,905 | 0.64% | 23.6 |

| 16-Dec-24 | ETH | 3,958 | 3,984 | 0.66% | 51.1 |

| 17-Dec-24 | ETH | 3,984 | 3,890 | -2.36% | 144.7 |

| 18-Dec-24 | ETH | 3,890 | 3,625 | -6.81% | 2.5 |

| 19-Dec-24 | ETH | 3,625 | 3,416 | -5.77% | -60.5 |

| Total for 13-19 Dec 24 | -11.96% | 161.4 | |||

Between December 13-19, US Spot ETH ETFs saw a total net inflow of $161.4 million, while the ETH price depreciated by about 12%. On December 18, 2024, before the FED interest rate decision and the sharing of interest rate expectations for the coming years, US Spot ETH ETFs did not record any outflows in 3 days, while the total net inflow on December 19, 2024 was -$60.5 million. The 18-day positive net inflow streak ended on December 19, 2024. Even when the ETH price depreciated ahead of the FED Summary of Economic Projection and Powell Speech, US Spot ETH ETFs continued their positive inflow streak led by BlackRock ETHA ETF.

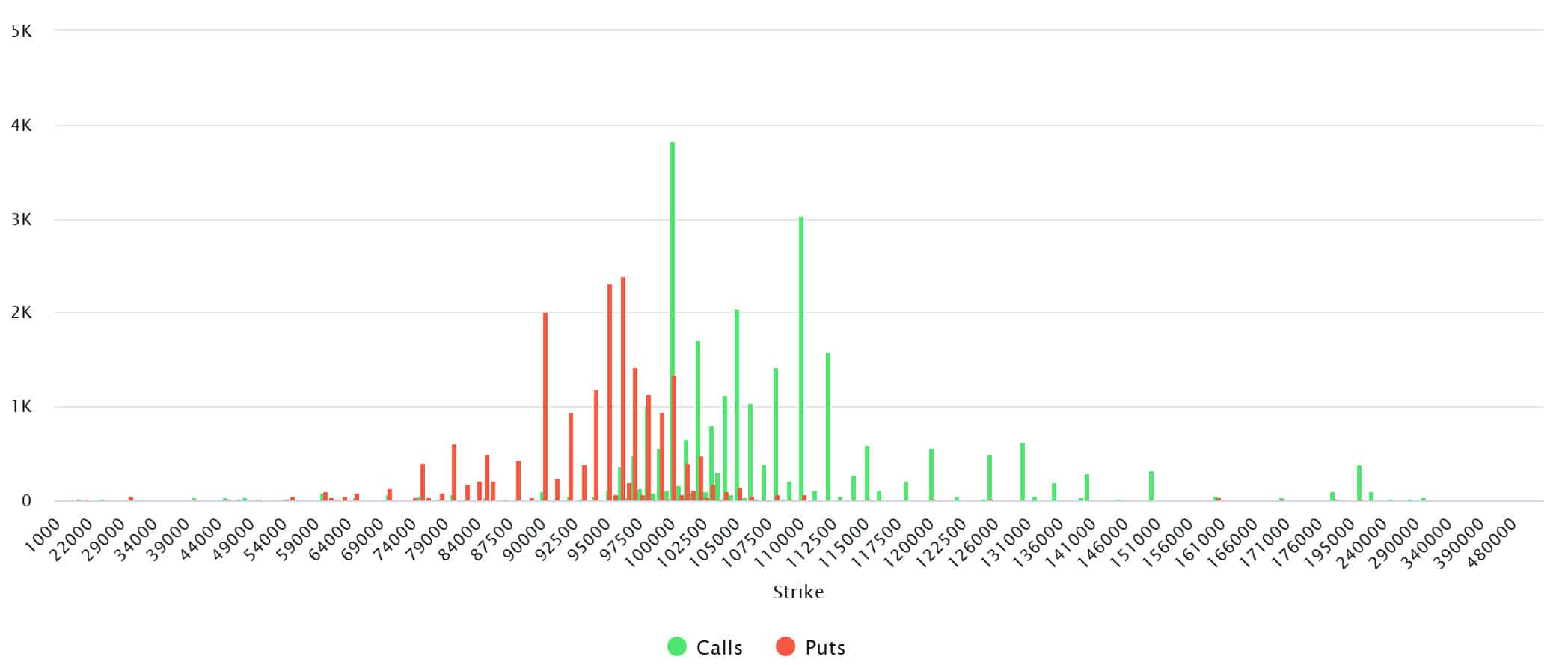

Bitcoin Options Breakdown

Source: Laevitas

When we analyzed the options, it was seen that there was almost no volume in the 19 range. On the other hand, it is seen that call options are dominant this week, albeit slightly. If we look at it from a broad perspective, there is resistance at around 110,000 dollars. This has resulted in low volumes, as traders have found it less favorable to trade at these levels. The options market gave cautious signals due to the fall of Bitcoin. Looking at the chart, we see that call options peaked at $105,000 and there was a general decline in volume after this level.

Deribit Data: 20,728 BTC options contracts with a notional value of $2.02 billion expire today.

Maximum Pain Point: Bitcoin’s maximum pain point is set at $101,000. This shows us that Bitcoin is well below its strike price.

Option Expiration

Put/Call Ratio: The put/call ratio for these options is set at 0.87. A put/call ratio of 0.87 indicates that there is a strong preference for call options over put options among investors and that a possible uptrend in the markets is possible.

WHAT’S LEFT BEHIND

Third Rate Cut from the Fed: The Fed cut its policy rate by 25 basis points to 4.25%-4.5% and announced that it will act more cautiously in the future.

SEC Approves Hashdex ETF: The SEC approved the Hashdex Nasdaq Crypto Index US ETF and Franklin Crypto Index ETF, which focus on Bitcoin and Ethereum.

Bitcoin Reserve Move from Trump: Trump plans to use the $ 200 billion Currency Stabilization Fund to create a strategic Bitcoin reserve.

Bitcoin Reserve Law Move from Ohio: Ohio has introduced a bill to use Bitcoin as a state reserve.

FASB’s Bitcoin Rules in Effect: FASB’s fair value accounting rules have gone into effect, paving the way for Bitcoin to be recognized as an institutional reserve asset.

French Hill Named Chairman of the Financial Services Committee: Pro-crypto French Hill has been appointed as the chairman of the Financial Services Committee.

US Intervenes in North Korea’s Crypto Network: The US shut down a cryptocurrency laundering network that supported North Korea’s nuclear program.

1.4 Billion Dollar Deal from El Salvador and IMF: El Salvador will reduce its participation in Bitcoin projects while reaching a $1.4 billion loan agreement with the IMF.

Bitcoin Reserve Call from Europe: Sarah Knafo, a member of the European Parliament, proposed in the European Parliament that Bitcoin be considered as a strategic reserve asset.

UK Plan to Ban Crypto IPOs: The Financial Conduct Authority (FCA) plans to ban cryptocurrency IPOs, allowing only exempt platforms.

First Ethereum Mainnet Proposal from WLFI Community Approved: The community has approved a proposal to launch the Aave v3-based lending protocol on the Ethereum mainnet.

FTX Restructuring Plan Announced: FTX will complete the first distribution within 60 days with the restructuring plan to take effect on January 3, 2025.

MicroStrategy Acquires 15,350 Bitcoins: MicroStrategy increased its Bitcoin possession by spending $1.5 billion, raising its purchase cost average to $61,725.

Marathon Digital Acquires 1,627 BTC: The company spent $166 million to purchase 1,627 BTC.

World Liberty Acquires 722.2 ETH: World Liberty bought 722.2 ETH by spending 2.5 million USDC.

Riot Platforms Acquires 667 BTC: Riot Platforms acquired 667 BTC, bringing its total assets to 17,429 BTC and its market capitalization to $1.8 billion.

Semler Scientific Increases BTC Holdings: Semler Scientific acquired 211 BTC, bringing its total holdings to 2,084 BTC.

Ripple’s Stablecoin Launched: Ripple launched its dollar-pegged RLUSD stablecoin on December 17.

Lido Terminates Polygon Operations: Lido has decided by community vote to cease operations on the Polygon network and will focus on Ethereum.

Avalanche 9000 Update Active: The Avalanche9000 update improved the functioning of “subnets” and reduced Layer-1 networking costs.

Ethena Launches USDtb Stablecoin: Ethena launched its BlackRock-backed USDtb stablecoin, allocating 90% of its reserves to BUIDL allocation.

Stacks Launches sBTC: Bitcoin launched sBTC on its mainnet, providing support for the DeFi ecosystem.

Tether Invests in StablR: Tether announced an investment in StablR to accelerate stablecoin adoption in Europe.

ESMA Publishes MiCA Guidance: ESMA has released its final guidance for MiCA regulations, but implementation delays are expected in some EU countries.

Quantum Computers: Scientists predict that quantum computers could crack Bitcoin’s encryption within five years.

Solana November Revenue Record: The Solana ecosystem reached an all-time high of $365 million in revenue in November.

TRON Chain Breaks Record: TRON reached its historic peak in November 2024 with $240 million in revenue and 15 million active users.

MicroStrategy May Suspend Bitcoin Purchases: It was claimed that MSTR may stop Bitcoin purchases in January due to the internal trade control period.

Bitcoin Strategy Statement from Michael Saylor: Saylor said that MicroStrategy will change its fund strategy after MicroStrategy’s $42 billion Bitcoin purchase target.

HIGHLIGHTS OF THE WEEK

It was a challenging week for traditional and digital asset markets. The message that the US Federal Reserve (FED) cut interest rates, but that the pace of rate cuts for next year would slow down, did not change the important dynamics of the equation, but made it necessary to recalibrate positions. Accordingly, the dollar appreciated and bond yields rose. While the stones were shifting, major digital assets were negatively affected by this change.

Next week will be a trading period that will include the Christmas holiday. Therefore, it would not be wrong to say that trading volumes will decrease and volatility will increase from time to time. Aside from the fact that the US government is once again facing a partial shutdown, macro indicators from the US, such as this week’s PCE data, will continue to provide clues for possible changes in the FED’s interest rate cut course. However, it should be added that we will not see a very critical data flow due to the Christmas week.

We do not consider the recent declines in digital assets with the FED outside the nature of the market, but we think that the impact of position adjustments and adjustments in the allocation distribution between assets may continue to put pressure with the effect of the year-end. It would not be a surprise to see short rebounds from time to time. In the big picture, we maintain our view that there is a positive outlook for digital assets.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Weekly Onchain Analysis – December 18

Donald Trump’s Digital Cabinet

What awaits the Crypto Sector after the European Union MiCA Regulations come into full force?

What Do Changes in Ethereum TVL and Stake Amount Mean for ETH Price?

Where Are Digital Assets in the Bull Season?

Market Activity and Investor Trends – BTC, ETH and XRP

Is MVRV’s Low Peak Signalling Selling Pressure in Bitcoin?

Net Unrealized Profit/Loss (NUPL) Analysis

Bitcoin: Puell Multiple Analysis

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.