What’s Left Behind

Donald Trump becomes President of the United States: Donald Trump has been re-elected as the 47th President of the United States.

Trump’s New Move in Cryptocurrency: Trump Media & Technology Group is in talks to acquire cryptocurrency exchange Bakkt.

SEC Chairman Gary Gensler to Resign: Gensler announced in a post on his X account that he will leave his post on January 20, 2025, the decision resonated greatly in the market.

Powell gave hawkish messages as FED cuts interest rates: While the FED cut interest rates to 4.50%-4.75%, Powell’s hawkish statements raised the dollar and bond yields.

Bitcoin Breaks New Record and Reaches Dominance Peak: After Trump’s victory and the Fed’s interest rate cut, the Bitcoin price ATH at 99,655, reaching the highest dominance level since March 2021 with 61.59%.

First Time for a Pension Fund in the UK: For the first time in the UK, a pension fund invests in Bitcoin

Bitcoin ETF Options Trade on Nasdaq: BlackRock’s IBIT options began trading on Nasdaq, with 73,000 contracts traded. IBIT was among the 20 most active non-index options.

4 New Solana-Focused ETFs Applied for: Bitwise, VanEck, 21Shares and Canary Funds have filed applications for Solana-focused ETFs, with approval expected in August 2025.

Bitcoin Reserve Proposals from Lummis and Saylor: Senator Lummis suggested that the US create a strategic reserve by buying 1 million Bitcoins. Michael Saylor explained that this step could reduce the debt by 45%.

MicroStrategy Continues Investments: The company continued its commitment to its strategy by acquiring 51,780 Bitcoins for $4.6 billion. Its share price increased by 12%, making it one of the top 100 companies in the US, and it increased its bond offering to $2.6 billion.

Bitcoin ETF Options Trade on Nasdaq: BlackRock’s IBIT options began trading on Nasdaq, with 73,000 contracts traded. IBIT was among the 20 most active non-index options.

4 New Solana-Focused ETFs Applied for: Bitwise, VanEck, 21Shares and Canary Funds have filed applications for Solana-focused ETFs, with approval expected in August 2025.

Bitcoin Reserve Proposals from Lummis and Saylor: Senator Lummis suggested that the US create a strategic reserve by buying 1 million Bitcoins. Michael Saylor explained that this step could reduce the debt by 45%.

MicroStrategy Continues Investments: The company continued its commitment to its strategy by acquiring 51,780 Bitcoins for $4.6 billion. Its share price increased by 12%, making it one of the top 100 companies in the US, and it increased its bond offering to $2.6 billion.

What Awaits Us?

Microsoft and Bitcoin

On December 10th, important agenda items will be voted on at the Microsoft shareholder meeting. These include critical issues such as choosing one of the 12 nominees for election to the board of directors and the company’s consideration of the possibility of investing in Bitcoin.

US Macro Data

The dates and times of important US economic data to be released in December 2024 are as follows:

Nonfarm Payrolls:

December 6, 2024, 13:30 UTC

Consumer Price Index (CPI):

December 11, 2024, 13:30 UTC

Personal Consumption Expenditure Price Index (PCE):

December 20, 2024, 13:30 UTC

FED Interest Rate

The interest rate decision following the December FED meeting will be announced on December 18, 2024 at 19:00 UTC. Investors and economists will closely follow this meeting as the FED’s interest rate decisions have a significant impact on global markets.

Crypto Insights

| Market Overview | Current Value | Change (30d) |

|---|---|---|

| Bitcoin Price | 95,007$ | +35.87% 📈 |

| Ethereum Price | 3,597$ | +40.32% 📈 |

| Bitcoin Dominance | 58.18% | -2.46% 📉 |

| Ethereum Dominance | 13.49% | +1.18% 📈 |

| Total Market Cap | $3.22 T | +39.09% 📈 |

| Fear and Greed Index | 77 (Extreme Greed) | 72 (Greed) |

| Crypto ETFs Net Flow | $193.1 M | |

| Open Interest – Perpetuals | $430.98 B | |

| Open Interest – Futures | $5.39 B |

*Prepared on 11.28.2024 at 10:30 A.M. (UTC)

Bitcoin Metrics – November Month in Review

Bitcoin Spot ETF

November was a bullish period for Bitcoin. Led by major investment firms such as BlackRock and Fidelity, Spot BTC ETFs saw net inflows totaling $6.16 billion. BlackRock’s IBIT ETF stood out with an impressive net inflow of $5.46 billion, while Fidelity’s FBTC ETF recorded a net inflow of $911.9 million. In contrast, the Grayscale GBTC ETF posted net outflows of $327 million, while the Bitwise BITB ETF posted net outflows of $121 million. Throughout November, institutional investors’ interest in Spot BTC ETFs continued to grow.

Bitcoin Options Data

Bitcoin options contracts with a total notional value of $11.73 billion expired in November. The put/call ratio for these contracts was 0.72, indicating that investors were more inclined towards calls than puts, signaling a possible bullish expectation in the market. Moreover, the maximum pain point for Bitcoin was set at $95,500.

Bitcoin Liquidation Data

During November, a total of $1.021 billion worth of long positions were liquidated, while $1.511 billion worth of short positions were liquidated. The price decline seen at the beginning of the month led to the liquidation of long positions in the 66,700-68,500 range. With the strong upward movement that followed, short positions in the 92,000-95,000 band were liquidated.

Bitcoin Supply Breakdown

In November, the Bitcoin price surged by more than 40%. Changes in the distribution of addresses during this period clearly showed the interest of large investors in the market. The decline in small trader addresses suggests that individual traders are scaling back their positions or selling profits in the face of rising prices. In contrast, the increase in addresses in the 100-1,000 BTC range showed that large investors are strengthening their confidence in the market. Although periodic selling by whales has increased market volatility, the overall trend suggests that the big players are here to stay.

Expectations of the December

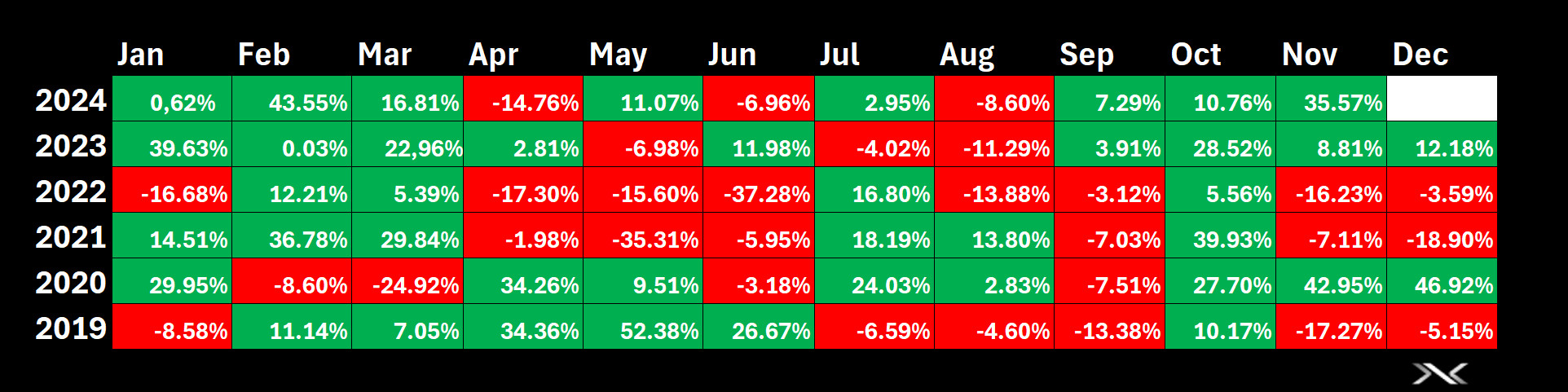

As we approach the end of November, Bitcoin is poised for a strong close, up 35.57% on a monthly basis. According to historical data, Bitcoin, which provides an average return of 45% in November, has performed in line with expectations this year. In particular, October and November were characterized by remarkable rises in Bitcoin and the crypto market.

When we look at December, it is seen that Bitcoin has historically had a lower return compared to these two months. Although there were deep declines from time to time, the overall picture shows an average gain of 5% in December. This data points to a steady growth trend for Bitcoin in the last quarter of the year, with volatile movements.

*Prepared on 11.28.2024 at 10:30 A.M. (UTC)

Source: Darkex Research Department

Microsoft and Bitcoin

December in the Bitcoin market draws attention with an important development, especially from Microsoft. In the market, where giants such as Tesla, MicroStrategy and Marathon Digital Holdings have previously come to the fore with their Bitcoin purchases, this time the possibility of Microsoft investing in Bitcoin is being discussed. According to the company’s official statement to the SEC, at the shareholders’ meeting to be held on December 10, it will be put to a vote whether Microsoft should buy Bitcoin.

May Be the Largest Company to Buy Bitcoin

With a market capitalization of more than $3 trillion, Microsoft, the third largest company in the US, could become a leader in this field, leaving companies such as Tesla and MicroStrategy behind if it invests in Bitcoin. This move will mean that the software giant will gain the title of “the largest company to buy Bitcoin”.

Statement from Microsoft Treasury Department

Microsoft’s Treasury and Investment Services department made the following statement about this possibility:

“Microsoft’s Global Treasury and Investment Services teams analyze a broad range of investable assets. This includes assets with the potential to provide inflation protection and portfolio diversification. Bitcoin and other crypto assets have been evaluated in our previous reviews. We will continue to closely monitor trends and developments in cryptocurrencies for future decisions.”

“Rejection” Recommendation from the Board of Directors

In the statement submitted to the SEC, it was stated that the vote was officially recorded, while it was also announced that the Microsoft Board of Directors recommended a rejection vote to shareholders. This situation also reveals different perspectives on Bitcoin investment within the company.

This critical vote in December could have a decisive impact on the future of not only Microsoft, but the entire Bitcoin market.

Market Pulse

Recent positive developments in the Middle East and renewed tensions between Ukraine and Russia are likely to keep geopolitics on the radar of global markets in the last month of the year. In addition, crypto-friendly President-elect Trump’s choices for Congress and the policies he will implement, especially tariffs, will impact the global economic and trade ecosystem. On the Trump and his team front, the “regulation of crypto assets”, which has been on the agenda more frequently recently, and the related news flow will be closely monitored. Crypto assets, which have managed to attract the attention of traditional investors through ETFs and have the opportunity to be invested, have also opened a positive topic in the shadow of these dynamics (geopolitical news and Trump Trade) with the recent appetite of this audience. The fact that large companies are buying and considering buying Bitcoin as a reserve can also be evaluated under this roof.

In addition to these variables that will affect prices, another issue that will determine investor behavior, including digital assets, will be the interest rate cut path of the US Federal Reserve (FED). Of all the metrics in our forecasting equation, we believe that the Federal Open Market Committee’s (FOMC) monetary policy decisions and guidance will be the biggest variable. In this context, we will be discussing the highlights of the US macro indicators for December and the FED meeting.

US macro indicators – NFP, CPI, PCE

Investors will be watching the Non-Farm Payrolls Change (NFP – December 6) and Consumer Price Index (CPI – December 11) data for the results of the two-day FOMC meeting, which will end on December 18. The PCE and core PCE Price Index (December 20), which the FED says it takes into account to monitor inflation, will contain information about the interest rate cut path for 2025, as it will be published after the FOMC meeting. We will evaluate these indicators and their potential impact on the market separately.

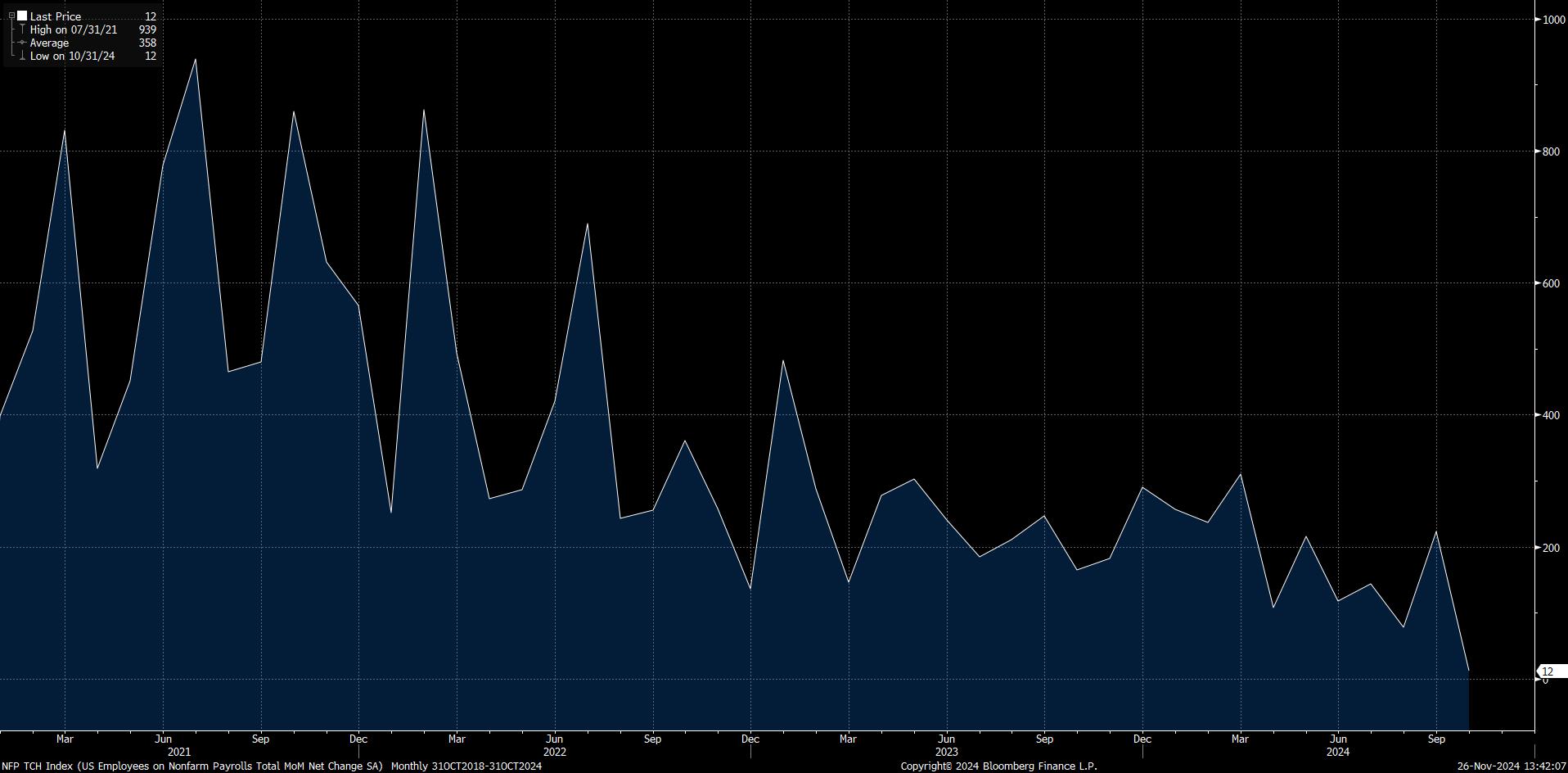

Non-Farm Employment Change

In October, due to the storms that hit the country in October, the US economy was able to increase non-farm payrolls by only 12,000 jobs, well below expectations (106,000). Almost everyone predicted that natural disasters would have an impact on the data. However, such a deep mark was not in anyone’s projections. Nevertheless, the NFP, which was much lower than anticipated, did not disturb the market perception too much and the idea that this was due to a temporary factor was widely accepted. However, it would not be wrong to say that this may not be the case for the November data.

Source: Bloomberg

We expect NFP, which is known to include seasonal effects, to point to a better performance in November after last month’s quiet one-off increase. However, it is important to keep in mind that market expectations will also be in this direction and this will already be reflected in prices. We will be sharing the expectations figures in our weekly and daily bulletins and for now, we will only talk about the possible reaction if the result is contrary to expectations. We will elaborate on the expectations regarding the FED that will be formed with this data in our analysis below.

If the NFP data is below expectations, we think that this will be read as a factor that will ease the Fed’s hand to cut the policy rate and risk appetite in global markets will increase. On the other hand, we expect a higher-than-expected data to have the opposite effect. In other words, the equation of “good data bad market, bad data good market” may work. It should be added that a data that is too high or too low than the consensus figure that will emerge as a result of the surveys may cause us to see a different reaction from this equation.

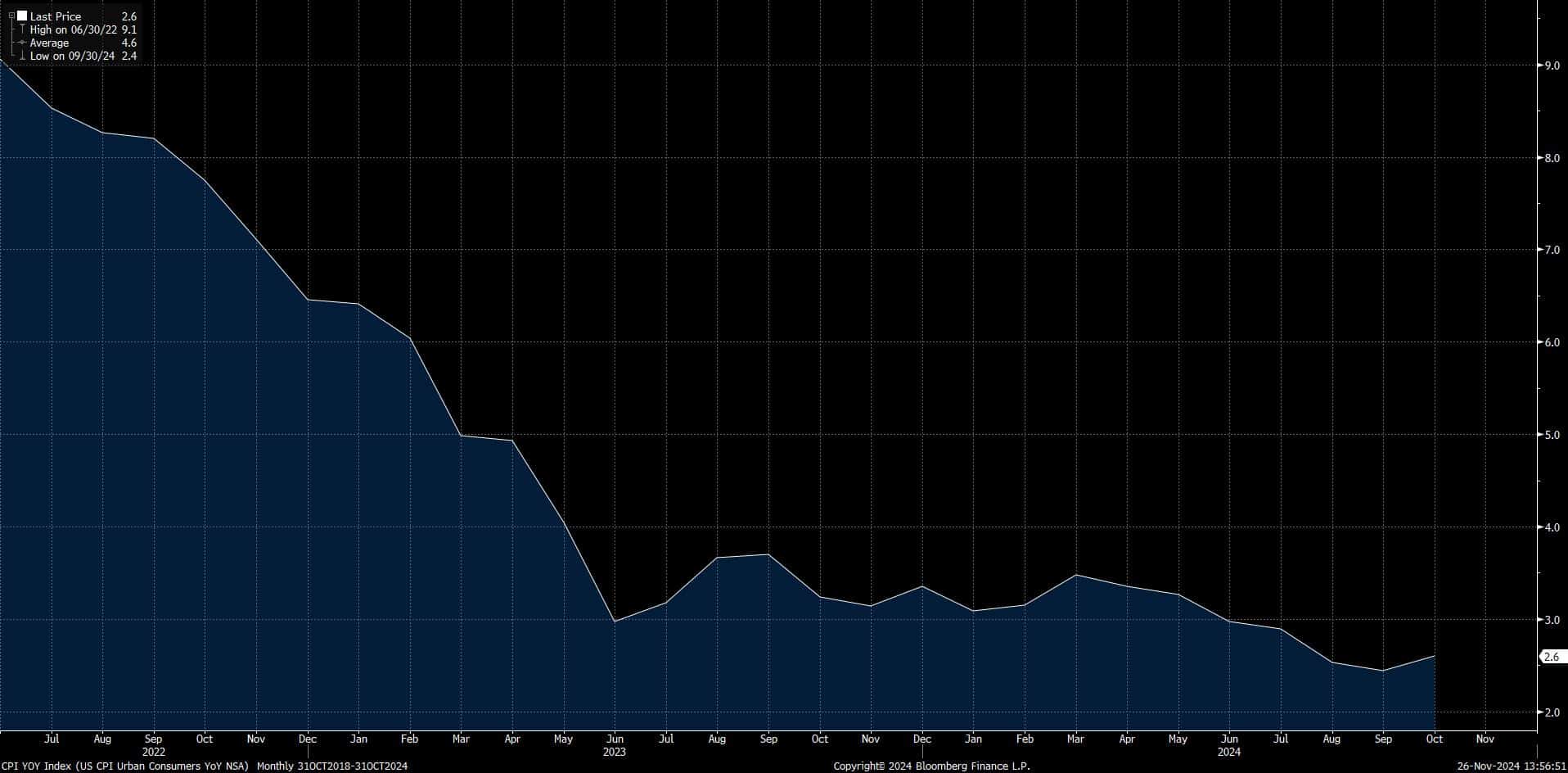

CPI and PCE Price Index

The FED’s main task is to ensure price stability and keep inflation around the desired level of 2%. In this sense, CPI data is as important as employment data.

Source: Bloomberg

On an annual basis, the increase in the consumer price index, which showed a significant decline until mid-2023, followed a relatively more volatile course after this period. We have seen that the increase in prices continued to decelerate after March this year, albeit at a relatively more reasonable pace. However, the 2.6% increase in October, following the 2.4% increase in September, raised questions about whether the decline in the inflation rate has stopped.

In fact, the markets were already expecting to see a 2.6% reading. Still, this was enough to keep the markets on edge. Because a potential figure that would indicate that the rate continues to rise in November could cause the FED to pause interest rate cuts.

We think that a higher-than-expected CPI data set may reduce the risk appetite in the markets, thus bringing a decline in digital assets. In the opposite case, there may be grounds for new rallies. It is worth noting that our assumption at this point, as for NFP, is that we see the data as more likely to shape expectations for the FED’s interest rate cut course.

We think that this pricing behavior will also apply to the PCE price index. The difference is that PCE data will be released on December 20th, after the FOMC meeting. We also think that core PCE data is more important for understanding the Fed’s course. PCE data will shed light on the early part of 2025 for investors. On the market front, we do not write a reaction analysis again as we think that the “good data bad market, bad data good market” formula is the most plausible scenario in terms of the effects of these figures.

FED done or not?

It would not be wrong to say that the most important December development that may move the stones in asset prices will be the results of the FOMC meeting. Of course, the fundamental dynamics that we have mentioned earlier can play a decisive role in the risk appetite by creating surprise developments. However, the tone of financial tightness is likely to continue to play a leading role in global investors’ decision-making process on whether the necessary environment for taking more risk is in place. In this context, we can say that the FED’s monetary policy decision is the main variable.

On December 18, after the FOMC meeting, investors will try to find answers to the following questions.

- Has the interest rate been cut?

- Is there a message in the statement for a new interest rate cut?

- What changes are there in the “Dot Plot” table?

- What will Powell say about the rate cut path and the US economy?

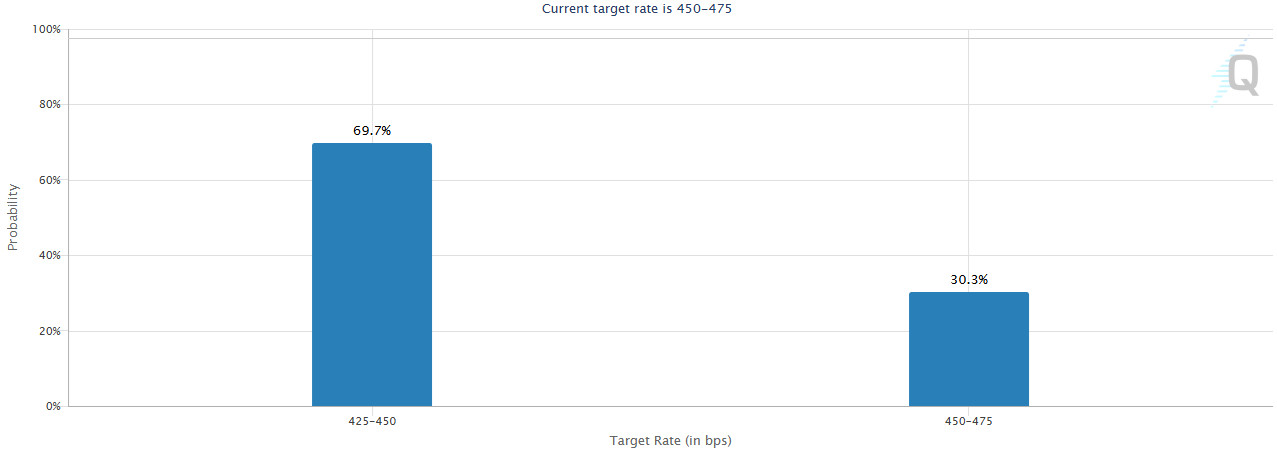

When the statement comes, of course, the first thing we will look for is a rate cut. After the minutes of the FOMC meeting held on November 6-7, markets started to give a 25 basis point rate cut a higher probability. The message between the lines of the minutes was cautious but gradual rate cuts. Therefore, the FED is expected to cut interest rates by 25 basis points on December 18 and we agree with this.

Source: CME Group (Date:)

If the FED cuts interest rates by 25 basis points, we do not expect this to have a deep impact on the markets because this is already priced in. However, if the FOMC makes a surprise decision to leave the interest rate unchanged, we can say that this may negatively affect digital assets. We consider the possibilities other than keeping the interest rate unchanged or lowering it by 25 basis points as very low.

Source: Bloomberg

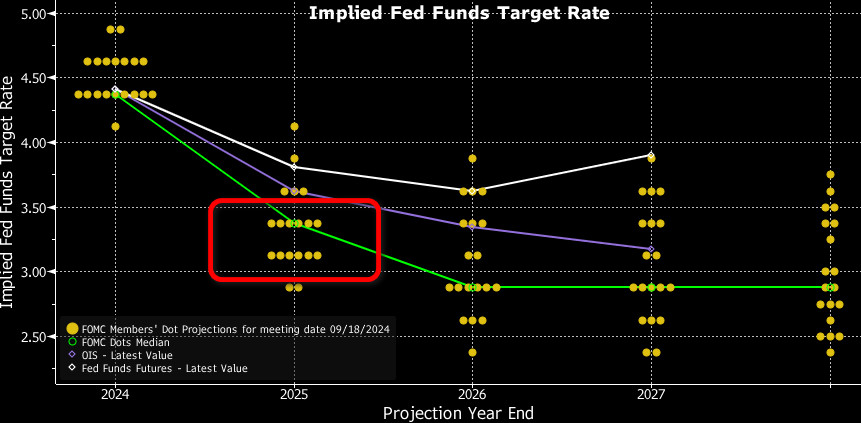

Immediately after the rate decision, the press will simultaneously review the FOMC’s economic projections and the “dot plot” graph showing the members’ expectations for future interest rates. In this flood of information, the dot plot will be our priority.

The policy rate, which is currently in the range of 4.50%-4.75%, is expected by FOMC officials to fall to 4.25%-4.50% by the end of the year, according to the latest documents published in September. So there is room for one more 25 basis point cut. On December 18th, however, we will look at this chart and see what level the interest rate will be at by the end of 2025. In the last dot plot, we see that FOMC officials are concentrated in the 3.0-3.50 range. This implies that, assuming another 25 basis points rate cut in December, there could be another 100-125 basis points of rate cuts in 2025. We will be watching closely to see how this view changes in the upcoming chart. A further rate cut may support expectations of a faster easing of financial tightness in the markets, which in turn may increase risk-taking incentives. In such a case, we would expect digital assets to remain bullish. However, a “dot plot” chart with a slower pace of interest rate cuts could lead to a contrary trend and cause a pullback in cryptocurrencies, even in the short term.

After the release of the statement and the documents, attention will now turn to FED Chairman Powell. He will first read the statement and then answer questions from the participants. We can say that the question and answer session will be the part where volatility will increase once again. Inflation, the labor market, other non-economic risks and the Trump factor… The President will try to answer every question by choosing words that are reasonable and will not shake the markets, but this may not always be possible.

We are all curious about the impact of Trump and his team’s new fiscal policies and how the Fed is preparing for them. In recent speeches, however, Powell has avoided these issues and dodged every question. We expect him to do so again, but we think that journalists will not refrain from pressing the Chairman. It is difficult to analyze the answers to these questions, but we can say that if Powell feels cornered too much, he might be a bit more forceful in stating that they will mind their own business and not Trump’s policies.

The main topic will be the FOMC’s rate cut path in 2025. The dose of financial tightness is very important for the markets and every investor wants to know how fast rates will decline. Powell could lay out a course in this regard. A message that rates could be cut at a fast pace would be a surprise. A similar, but opposite, effect could be seen if he suggests that interest rate cuts should be suspended for a while. We expect Powell to emphasize the health of the US economy and the strength of the labor market, saying that inflation is under control, that they will monitor the data and act accordingly, and that 25 basis points is a reasonable dose of rate cuts “when necessary”. Statements that imply otherwise may cause fluctuations in asset prices. A possible message that the interest rate path will decline at a slower pace may put pressure on digital assets, while the opposite situation may pave the way for new rises.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.