MARKET COMPASS

Tariff Impact Continues

- Following Trump’s tariffs, investor sentiment remains on the risk-off side.

- The European Commission has announced countermeasures. French President Macron urged French companies to halt planned investments in the US.

- Germany’s outgoing economy minister predicted that Trump would “buckle under pressure” if Europe could react as a whole.

- US President Donald Trump, who shook the world trade and markets with his reciprocal tariff announcement, signaled that he is open to negotiations on a country-by-country basis.

- The dollar index (DXY) dipped below 102 on Friday after falling nearly 2% in the previous session and rebounded slightly during European trading as concerns grew that President Donald Trump’s aggressive tariffs and possible retaliation from key trading partners could push the global economy into recession.

- The yield on the US 10-year Treasury bond fell below 4% today, hitting a six-month low. Wall Street sold off sharply yesterday and futures contracts indicate that the indices will start today with losses as well. Losses in European stock markets ranged from 1.5% to around 3.20%.

- Digital assets have been affected by the perception in global markets. After the declines in major cryptocurrencies, we are seeing some wound healing tendency. In order for this movement to continue, we think that there should be a meaningful change in the current conjuncture and we do not rule out the possibility that the sellers may come to the fore again.

- Markets seem to have reacted to Trump’s tariffs by pricing in higher inflation, slower growth and more Federal Reserve rate cuts.

- According to the CME FedWatch Tool, investors expect the Bank to cut rates by 25 basis points four times this year, the first in June.

- The US employment report for March, which will be released today, may provide a little more clarity on expectations regarding the FED. FED Chair Powell’s statements will also be important.

US Labor Market Statistics

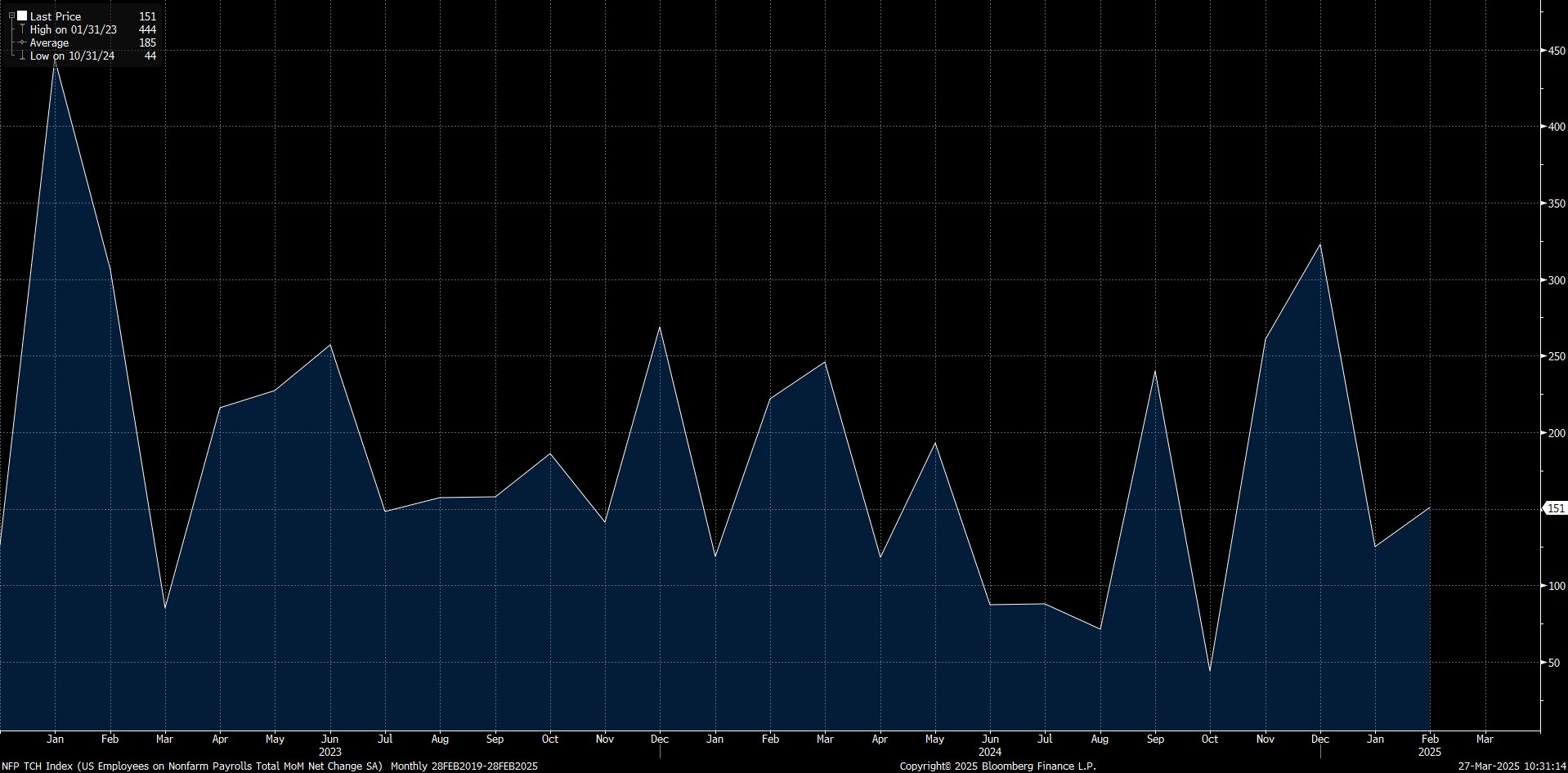

Today, we will be receiving the Non-Farm Payrolls (NFP) data for March, which will provide clues about the US Federal Reserve’s rate cut path and the tightness of the financial ecosystem in the coming period. In addition, March figures such as average hourly earnings and the unemployment rate will also be monitored.

In February, the US economy added 151K jobs in line with our expectations (Market Expectation: 159K, Our Expectation: 150K).

Source: Bloomberg

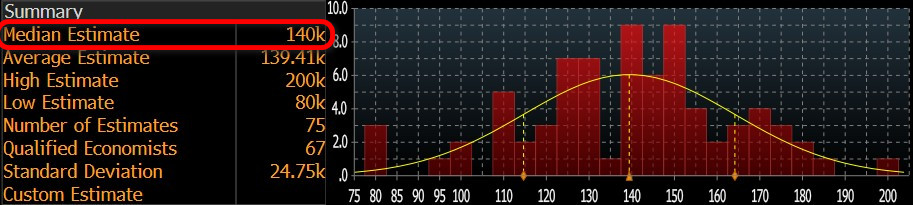

Our forecast for the highly sensitive NFP data is that the US economy added approximately 148K new jobs in the non-farm sectors in March. At the time of writing, the consensus on the Bloomberg terminal is more pessimistic, around 140K. In the surveys, we also see results averaging around 137 thousand.

Source: Bloomberg

We believe that if the March NFP data, which will be published in the shadow of the deterioration that Trump’s tariff-centered foreign policy may create domestically, is slightly below expectations, this will be priced as a metric that may create an expectation that the FED may act more boldly to lower the interest rate, thus increasing the risk appetite and having a positive impact on financial instruments, including digital assets. We think that a slightly higher-than-expected data may have a similar but opposite effect. However, a much lower than expected NFP data could reignite concerns about stagflation with a commentary on the health of the US economy, which could put selling pressure on assets considered to be risky. It should be noted here that we also expect a much better-than-anticipated reading to have a positive impact. It is worth noting that we anticipate these effects by taking into account the current state of market sentiment.

FED Chair Powell’s Speech

FED Chairman Jerome Powell is expected to deliver a speech today at the Society for Advancing Business Editing and Writing Annual Conference in Arlington. Powell’s guidance will be important after the pricing following the employment data. In particular, we will closely follow what he will say about the new economic ecosystem that will be shaped by tariffs and how the FED will follow a path in the face of this.

According to the CME Fedwatch Tool, at the time of writing, markets were pricing in a 62% chance that the Federal Open Market Committee (FOMC) would cut rates by 25 basis points at its meeting on June 18. Potential statements from the chairman could lead to a change in this expectation, which could cause markets to price hard. If Powell sends a message that there should be no rush to cut rates, this could cause risk appetite to decline and digital assets to extend their depreciation. However, if the Chairman emphasizes the necessity of rate cuts, we may see the opposite effect. At this point, it is worth underlining the following. If Powell is more concerned than before about the potential impact of Trump’s policies on the US economy, this could have the effect of both increasing the rate cut and reducing risk appetite in the markets. In this respect, we think it is important to understand the Fed Chairman’s attitude as well as his words.

Digital Compass

We consider it a very important development that a strategic crypto reserve is on the agenda in the US, the locomotive of the world economy. However, the fact that the markets had already priced in the “best case scenario” combined with the “less than perfect” news on this issue put pressure on digital assets. We continue to keep the strategic reserve issue in our equation as a positive variable for cryptocurrencies in the long run. On the other hand, we think that we may continue to see pressure in the medium term with the lack of new news flow that will create enthusiasm in the crypto market and further concerns that economic activity may slow down in global markets, especially with Trump’s tariffs. In the short term (in general), markets will continue to be sensitive to macro indicators and Trump’s actions regarding the announced tariffs.

Click here for a detailed review of our twice daily technical analysis report and the latest developments in digital assets.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News / Event | Expectation | Previous |

|---|---|---|---|

| 12:30 | US Average Hourly Earnings (MoM) (Mar) | 0.3% | 0.3% |

| 12:30 | US Nonfarm Payrolls (Mar) | 137K | 151K |

| 12:30 | US Unemployment Rate (Mar) | 4.1% | 4.1% |

| 15:25 | FED Chair Powell Speaks | — | |

| 15:25 | FOMC Member Barr Speaks | — | |

| 16:45 | FOMC Member Waller Speaks | — | |

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Darkex Monthly Strategy Report – April

JP Morgan Forecast: Tether’s Possible Strategy Under Stablecoin Bills

Global Economic Uncertainties, the ONS Gold Price and Bitcoin’s Lack of

2025 First Quarter: Bitcoin Market Volatility and Macroeconomic

Intent-Based Solutions and De-Fi Liquidity

The 5 Altcoins Least Affected by the Drop in

Click here for all our other Market Pulse reports.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.