MARKET COMPASS

Agenda Ahead of FOMC Decisions

- Tariff uncertainty and geopolitical agenda continue.

- Macro indicators are monitored in order to predict the health of global economic growth and the next moves of central banks.

- Putin rejected Trump’s offer of a ceasefire for Ukraine but agreed to limit attacks.

- It remains to be seen whether tensions in the Middle East will increase.

- Germany’s Bundestag has passed a bill paving the way for state borrowing for defense and infrastructure spending. The bill will be voted in the Bundestag on Friday.

- The Bank of Japan (BoJ) kept its benchmark interest rate unchanged amid concerns over the possible impact of US tariff policies and signaled that it is not in a rush to raise rates for the time being.

Ahead of today’s critical Federal Open Market Committee (FOMC) decisions of the US Federal Reserve (FED), global markets have been pricing in a mixed pattern with the agenda items mentioned above. The dollar index has recovered its recent losses in the Asian and European trading so far. The yield on the US 10-year treasury bond is around 4.29 and not much changed. Major digital assets continued the conservative loss-cutting move that started in the European session yesterday, albeit in a weaker tone. Later in the day, FOMC’s decisions and FED Chair Powell’s statements may be influential on pricing behavior.

Critical FOMC Meeting!

The US Federal Reserve’s (FED) second Federal Open Market Committee (FOMC) meeting of the year will be held on March 18-19 and the decisions will be published today. The eyes and ears of global markets and digital currency investors will be on the FED. The bank interrupted the interest rate cut cycle, which started in September last year, with its decision in January. Markets are wondering how long this break will continue.

The FOMC is almost certain to leave the policy rate unchanged at 4.25%-4.5%. In fact, a rate cut is not expected at the May FOMC meeting either. There are expectations of a rate cut in the second half of the year, but there is no consensus on whether it will be in June, July or even September, and it changes frequently depending on the conjuncture. According to the CME FedWatch Tool, at the time of writing, markets were pricing in a 53% chance of the FED cutting rates by 25 basis points in June.

Today, markets will be looking for clues that could lead to a major change in these expectations. First, they will look to see whether the interest rate is left unchanged as expected. The FOMC members’ interest rate forecasts, i.e. the “dot plot” table and the projection table showing their predictions for economic indicators, which will be published at the same time, will be closely scrutinized. Half an hour after the release of these decisions and documents, Fed Chairman Powell will take the podium and hold a press conference.

1-Will interest rates change?

As we mentioned, we do not expect a rate cut from the Committee after the recent developments and the statements of the FOMC members. There may be a surprise decision to cut interest rates, which we see as a very low probability. We define a rate hike as unlikely.

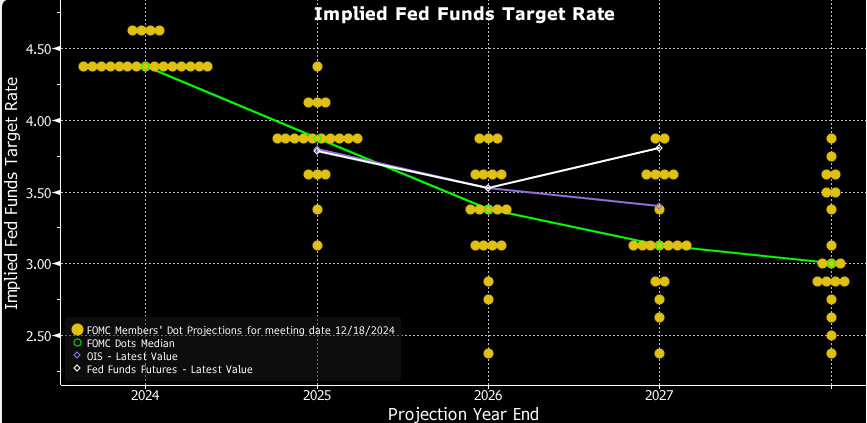

2-What will the “Dot Plot” table tell us?

The FOMC meets eight times a year, every six weeks, and in four of these meetings, it publishes the so-called “dot plot” table and the members’ projections of their forecasts for the economy. In this respect, the March meeting will be one of the most important meetings where these documents are published.

Source: Bloomberg

The table above, which was last released at the December meeting, shows each FOMC member’s forecasts for the policy rate. The Fed’s current policy rate is set at a range of 4.25-4.50%. We see that the majority of members think that this rate will be reduced to the 3.75-4.00 band by the end of 2025. This implies a total of 50 basis points of rate cuts during the year, whereas the FED usually changes interest rates in steps of 25 basis points each. This means that we could see rate cuts at two of the six meetings in the rest of the year (assuming no rate cut at the March meeting ). The potential changes that we will see in the newly published dot plot may lead to a reshaping of market expectations and significant price changes. We see a downward shift in the number of rate cuts more likely by the end of the year. Of course, there may be no change at all and this is actually our main expectation.

According to the CME FedWatch Tool, the pricing in the markets is not very different from the expectations of the FOMC members. In other words, we can say that a 50 basis point cut until the end of the year is reflected in prices. Therefore, if we do not see a change in the picture, we will not consider this as an important dynamic that will create price changes (Maybe it may have some positive impact on the dollar). However, if the rate cut forecasts indicate only a 25 basis point cut, this could be interpreted as a tighter global financial tightening than previously anticipated, which could cause the dollar to appreciate, risk appetite to decline, and stock markets and digital currencies to depreciate.

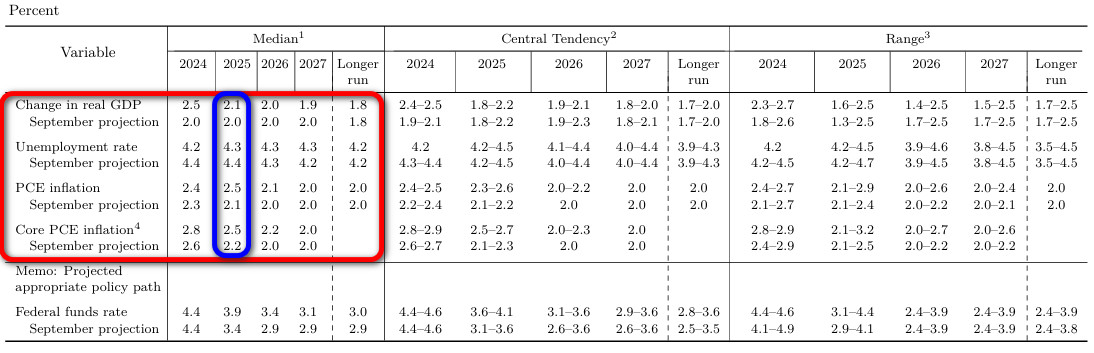

3-Economic Projections

Along with the “dot plot”, another important and potentially influential piece of information that will be published in the same document will be the FOMC’s projections reflecting its expectations for the economy. Of course, every detail is important, but for short-term pricing, we will pay close attention to the data in the last table published on December 18 for 2025.

This table includes data on Change in real GDP (which can be defined as economic growth), unemployment rate, PCE inflation and core PCE.

Source: Federal Reserve

Finally, among these macro indicators, we prefer to analyze possible projection changes for GDP and core PCE data, which were announced at the December meeting. A moderate upward revision in growth may have a positive impact on the markets. A downward revision may have a negative impact on risk sentiment. On the other hand, an upward revision in core PCE may strengthen the perception that the FED will not be too eager to cut interest rates, which may negatively affect risk appetite. A potential downward revision in this data may have a positive impact on instruments considered to be relatively risky, including digital assets.

4-Powell’s Press Conference

Today, FED Chairman Jerome H. Powell will speak at a press conference, as he does half an hour after the decisions are published after each FOMC meeting. Powell will first read the text of the decision and explain the reasons for the decisions taken. Then, the press conference will be followed by a question and answer (Q&A) session where press members’ questions will be answered. Volatility in the markets may increase a little more in this part.

Of course, the interest rate decision, the dot plot and the projections may change the significance of the Chairman’s Q&A. We do not expect a major change in the stance Powell has taken in his recent speeches. Last time, the chairman argued that the break in the rate cut cycle was justified and that their decisions would not be affected by the consequences of the fiscal policies expected to be implemented by the new US administration. In sum, a relatively moderate, hawkish tone.

In the face of questions from the press, Powell’s more hawkish stance than before may reinforce expectations and pricing that the FED will not rush to restart interest rate cuts. This may have a negative impact on digital assets. However, the fact that he talked about the necessity of a new interest rate cut with evaluations regarding economic growth and the labor market, and that he also gave messages that more than 50 basis points could be cut by the end of the year may increase the risk appetite and this may have positive effects on cryptocurrencies.

(Friday, March 21) – Quadruple witching refers to the simultaneous expiration of derivative contracts for stock options, index futures and index futures options four times a year. In fact, it is now called “triple witching”. This is because single stock futures, the fourth type of contract included in quadruple witching, have not been traded in the US since 2020. This period occurs on the third Friday of March, June, September and December. In the markets, volatility and volume increase on triple witching days, especially towards the end of the session… This is why it is closely monitored by investors.

Compass

We consider it a very important development that a strategic crypto reserve is on the agenda in the US, the locomotive of the world economy. However, the fact that the markets had already priced in the “best case scenario” combined with the less than perfect news put pressure on digital assets. We continue to keep this in our equation as a positive variable for cryptocurrencies in the long run. On the other hand, we think that we may continue to see pressure in the medium term if there is no new news flow to create enthusiasm in the market and if concerns about slowing economic activity in global markets increase. We emphasize that there is no problem in spot asset accumulation, but caution should be exercised in leveraged long transactions. In the short term, markets will continue to be sensitive to macro indicators and Trump’s actions on tariffs, which may keep volatility high.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| Aptos (APT) – AIP Community Review | |||

| 18:00 | FOMC Economic Projections | – | – |

| 18:00 | FOMC Statement | – | – |

| 18:00 | FED Interest Rate Decision | 4.50% | 4.50% |

| 18:30 | FOMC Press Conference | – | – |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Darkex Monthly Strategy Report – March

Dynamics and Expectations in Investor Positions

Tariffs to be Imposed by the US: Potential Impact on Technology-Focused Companies

Circle and Tether’s Competition in the US and Europe

Stablecoin Issuers Approved Under MiCA Regulation and Market Impacts

Click here for all our other Market Pulse reports.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.