Market Compass

FED in the Shadow of Geopolitical Agenda

- In global markets marked by the war between Iran and Israel, eyes are turning to the US Federal Reserve (FED) today.

- After President Trump’s recent statements, one wonders whether the US will directly participate in the war.

- After the mixed outlook in Asian stock markets, European indices are flat, as are Wall Street futures. The situation is not very different in major digital asset prices.

- Following the recent weak macro indicators for the US, the FED is not expected to change its rate cut path, but clues this evening could potentially be a game changer. Therefore, in addition to geopolitical developments, the Federal Open Market Committee (FOMC) decisions will be important for the markets today.

We maintain our expectation that digital assets may struggle to rise in the short term. For the medium and long term, we partially change our “upside view” to “flat” for the medium term. The main determinant of this change in our view is our expectation that the revived geopolitical risks will remain on the agenda of the markets for a while. For the long term, we see no reason to change our bullish outlook.

Eyes on FOMC Meeting

The US Federal Reserve’s (FED) fourth Federal Open Market Committee (FOMC) meeting of the year started yesterday and the decisions will be announced today. The Fed is not expected to change its policy interest rate. In fact, according to the CME FedWatch Tool, the Bank is not expected to decide on a rate cut before September. However, what makes the June meeting important is that we may get clues about the timing of the rate cut.

Today, the markets will mostly be looking for clues that could lead to a major change in expectations. The first thing to look for is whether the interest rate is left unchanged as expected. At the same time, the FOMC members’ interest rate forecasts, i.e. the “dot plot” chart and the projection chart showing their predictions on economic indicators will be closely scrutinized. Half an hour after the release of these decisions and documents, FED Chairman Powell will step behind the lectern and hold a press conference.

1-Will interest rates change?

As we mentioned, we do not expect a rate cut from the Committee after the recent developments and the statements of the FOMC members. There may be a surprise decision to cut interest rates, which we see as a very low probability. We define a rate hike as unlikely.

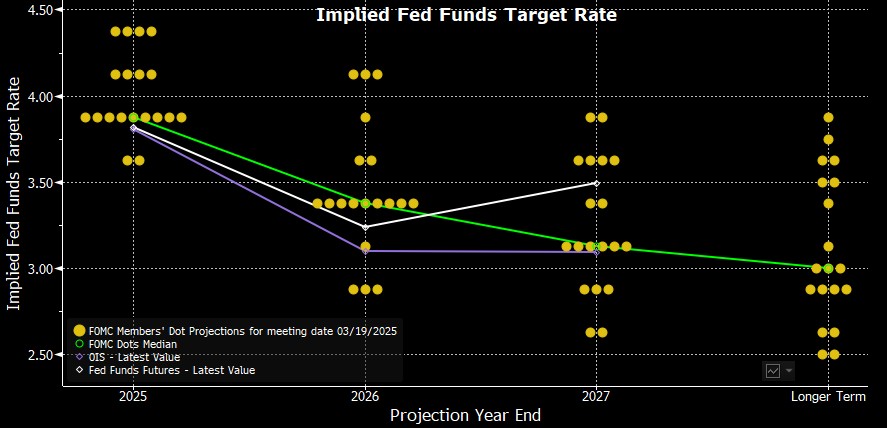

2-What will the “Dot Plot” Table tell us?

The FOMC meets eight times a year, every six weeks, and at four of these meetings it publishes the so-called “dot plot” table and the members’ projections of their forecasts for the economy. In this respect, the June meeting will be one of the most important meetings where these documents are published.

Source: Bloomberg

The table above, which was last released at the March meeting, shows each FOMC member’s forecasts for the policy rate. The FED’s current policy rate is set at a range of 4.25-4.50. We see that the majority of members think that this rate will be reduced to the 3.75-4.00 band by the end of 2025. This implies a total of 50 basis points of rate cuts during the year, whereas the FED usually changes interest rates in steps of 25 basis points each. This means that we could see rate cuts at two of the four meetings in the rest of the year (assuming no rate cut at the June meeting). The potential changes we will see in the upcoming dot plot may cause market expectations to be reshaped and we may see significant price changes.

According to the CME FedWatch Tool, the pricing in the markets is not very different from the expectations of the FOMC members. In other words, we can say that a 50 basis point cut until the end of the year is reflected in prices. Therefore, if we do not see a change in the picture, we will not consider this as an important dynamic that will create price changes. However, if the rate cut forecasts indicate only a 25 basis point cut, this could be interpreted as a sign that global financial tightness will remain at these levels for longer than previously anticipated, which could lead to dollar appreciation, lower risk appetite, and depreciation of stock markets and digital currencies.

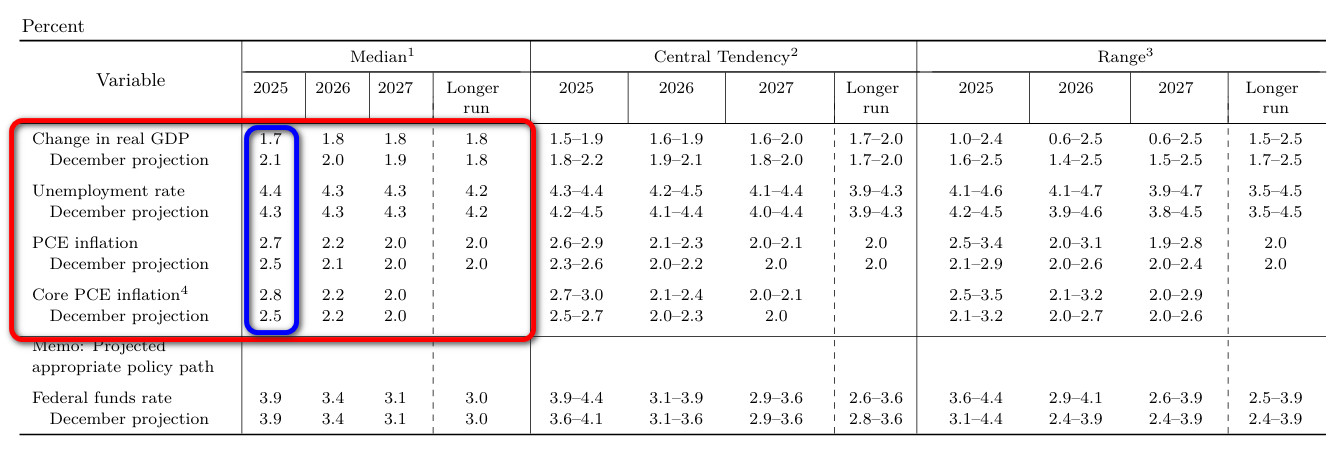

3-Economic Projections

Along with the “dot plot”, another important and potentially influential piece of information that will be published in the same document will be the FOMC’s projections reflecting its expectations for the economy. Of course, every detail is important, but for short-term pricing, we will carefully examine the changes in the data for 2025 in the last table published on March 19.

This table includes data on Change in real GDP (which can be defined as economic growth), unemployment rate, PCE inflation and core PCE.

Source: Federal Reserve

Finally, among these macro indicators, we prefer to analyze the possible projection changes for GDP and core PCE data, which were announced at the March meeting. A moderate upward revision of growth may have a positive impact on the markets (we see this as unlikely). A downward revision could have a negative impact on risk sentiment. On the other hand, an upward revision in core PCE may strengthen the perception that the FED will not be too eager to cut interest rates, which may negatively affect risk appetite. A potential downward revision in this data may have a positive impact on instruments considered to be relatively risky, including digital assets.

4-Powell’s Press Conference

As is the case after every FOMC meeting, FED Chairman Jerome H. Powell will speak at a press conference on June 18, half an hour after the decisions are published. Powell will first read the text of the decision and explain the reasons for the decisions taken. Then there will be a question and answer session where press members’ questions will be answered. Volatility in the markets may increase a little more in this part.

Of course, the interest rate decision, the dot plot and the projections may change the significance of the Chairman’s Q&A. We do not expect a major change in the stance Powell has taken in recent speeches. Last time, the chairman argued that the break in the rate cut cycle was justified and that their decisions would not be affected by the consequences of the fiscal policies implemented by the new US administration. In short, he set a relatively moderate, hawkish tone. He also maintained his stance that they needed more data to get a clearer picture of the impact of the tariffs. Lastly, we can add to this his possible comments on the impact of the Israel-Iran friction and rising oil prices on inflation.

In the face of questions from the press, Powell’s more hawkish stance than before may reinforce expectations and pricing that the FED will not rush to restart interest rate cuts. This may have a negative impact on digital assets. However, his assessments on economic growth and the labor market, his mention of the necessity of a new interest rate cut, and his messages that more than 50 basis points of interest rate cuts could be made by the end of the year may increase the risk appetite and this may have positive effects on cryptocurrencies.

For a detailed review of our twice-daily technical analysis report and the latest developments in digital assets click here.

Highlights of the Day

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| Nordic Blockchain Conference Stockholm, Sweden | |||

| SuperAI Event Singapore | |||

| Sonic (S) 47.63MM Token Unlock | |||

| Fasttoken (FTN) 20MM Token Unlock | |||

| 12:00 | Unemployment Claims | 245K | 248K |

| 18:00 | FOMC Economic Projections | ||

| 18:00 | FOMC Statement | ||

| 18:00 | FED Interest Rate Decision | 4.50% | 4.50% |

| 18:30 | FOMC Press Conference |

Information

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

Darkex Research Department Current Studies

Monthly Crypto Market Analysis Report

Robinhood’s RWA Move: A New Financial Era?

Stars of Social Media: 5 Altcoins Shining in the Recent Bitcoin Rally

Effects of FED’s Interest Rate Decisions on Cryptocurrency Markets

Bitcoin and BlackRock: Decentralization at Risk?

Click here for all our other Market Pulse reports.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.