Market Compass – October 03 – 10, 2025

“Uptober” in Digital Assets

After leaving a difficult month behind with a difficult week, digital asset investors started October with a breath of fresh air. Bitcoin, the largest cryptocurrency, which had the opportunity to mitigate some of its losses in the last days of September, recorded significant premiums in the first days of the historically positive October.

In periods when the expectations that the US Federal Reserve (FED) will start to cut interest rates come to the fore and start to cut them, we generally see that the markets’ demand for assets that are considered relatively risky increases in an environment of abundant liquidity, and that assets where the dollar is the “counter” instrument also gain value. The FED’s interest rate cut is not a new topic, but we have witnessed a period when Wall Street indices and ounces of gold broke historic records, while digital assets lagged far behind. So what happened that allowed these cryptocurrencies to take off in the final stretch of the race and how should this be interpreted for the future?

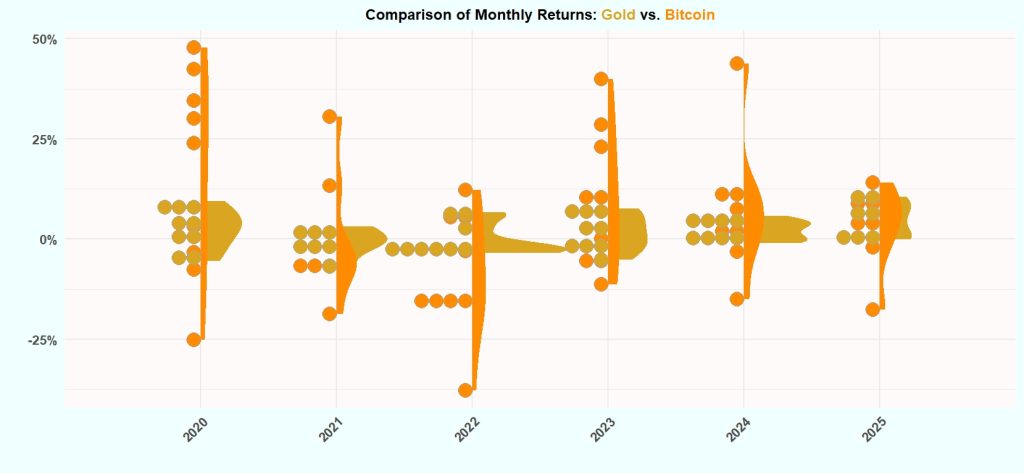

*In recent years, BTC has not lagged behind Gold in monthly rises. Especially in the last two years, gold and bitcoin have converged in terms of monthly return distribution.

Source: Darkex Research, R-Bloggers

In fact, no new dynamics have been added to the equation. The negative impact of the US government shutdown on the economy and the blindness created by the non-release of the data set that could provide information on the labor market increased the belief in the Bank’s interest rate cuts, while digital assets had the chance to reduce the premium gap between them and their counterparts. Also, at a time when the government was unable to release labor statistics, the ADP non-farm payrolls change, which shows private sector data, stood out a bit more and was expected to show that the US economy added 52,000 jobs in September, while it pointed to a decline of 32,000. In addition, the liquidation of leveraged “long” trades accumulated in futures transactions after September 17, when the FED announced the rate cut, made it easier for the bullish corridor to be covered more easily.

*Despite a challenging second half, the Bitcoin price ended September on a bullish note.

Source: Darkex Research

On the other hand, it would be inaccurate for traders to say that the past month was a bad one just by remembering the sharp declines in the second half of September. Yes, the post-FED losses due to the tightness in the futures markets will remain in the memory, but it will not change the fact that Bitcoin closed September with a premium of approximately 5%.

Now the question is; will the rise continue? As we have mentioned before, October is known as “Uptober” and it is a period when Bitcoin usually records a significant rise. There’s a chance we’ll see the same again, but we don’t expect a breathless bullish rally after the significant premiums recorded in a short period of time in the first days of October. The road ahead may be more challenging this time. A prolonged US government shutdown could increase uncertainties and could justify a faster pace of interest rate cuts by the Fed. On the other hand, the growth pressure on the world’s largest economy is also an important dynamic that could prove problematic going forward, and a prolonged government shutdown could make this even more problematic.

Next week, in particular, we will keep an eye on when the US government will be able to start funding public institutions. The release of economic data will also depend on this. However, there are a few developments that may provide clues for the FED’s policy rate path and we elaborate on them below.

October 8 – FOMC Meeting Minutes

The US Federal Reserve (FED) holds eight Federal Open Market Committee (FOMC) meetings each year and publishes the minutes three weeks after each meeting. As a detailed document of the FOMC meeting, these minutes allow us to see what economic and financial factors influenced the vote to set interest rates and can provide clues about the Fed’s next move. A more “hawkish” stance than expected could weigh on digital asset prices, while minutes with relatively “dovish” messages could support gains.

The minutes of the September 16-17 meeting, where the policy rate was cut by 25 basis points, will be an important document to look for clues on whether the Fed will continue to cut rates. The minutes, which can be read as a roadmap for whether a rate cut decision will be taken at the upcoming FOMC meetings in October and December, may have a greater impact on financial markets than usual in an environment where the partial shutdown of the US government has led to the non-release of vital employment data, which FOMC members use to monitor economic developments.

October 9 – FED Chair Powell’s Speech

The uncertainty surrounding the lack of critical macro data due to the US government shutdown has also clouded expectations regarding the US Federal Reserve’s rate cut path. Although, according to the CME FedWatch Tool, markets are almost certain to see a rate cut of 25 basis points each in the last two meetings for the rest of the year, the forecasting horizon of the markets has narrowed somewhat with the unreleased data. Therefore, the speech of Fed Chairman Powell, the most authoritative figure on interest rates, will be important as it may shed some light on this outlook.

Powell will deliver a pre-recorded video keynote speech at the Federal Reserve’s Community Bank Conference in Washington DC. Due to the title of the event, the Chairman may not make in-depth remarks on monetary policy, and the fact that the speech will be presented in a pre-recorded video may limit its impact on the markets. However, it is important to remember that no matter what happens, a Fed Chairman’s speech is always important for the markets.

Other Key Macro Indicators and Developments

October 10 – US Prelim UoM Consumer Sentiment is a survey of approximately 420 consumers conducted by the University of Michigan (UoM), asking respondents to assess the relative level of current and future economic conditions. Financial confidence is a leading indicator of consumer spending, which accounts for a large share of overall economic activity. It has two cycles 14 days apart: Leading and Revised. “Leading” data is usually relatively more influential on prices and is released in the middle of each month. If the data comes in below expectations, it may have a positive impact on cryptocurrencies with expectations of an interest rate cut by the FED.

Important Economic Calender Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.