MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 96,290.47 | 5.84% | 57.40% | 1,91 T |

| ETH | 3,209.19 | 4.93% | 11.64% | 387,87 B |

| XRP | 2.573 | 8.05% | 4.44% | 148,12 B |

| SOLANA | 187.83 | 6.78% | 2.73% | 91,18 B |

| DOGE | 0.3503 | 9.87% | 1.55% | 51,81 B |

| CARDANO | 0.9719 | 7.44% | 1.02% | 34,20 B |

| TRX | 0.2242 | 1.69% | 0.58% | 19,34 B |

| AVAX | 36.13 | 6.59% | 0.45% | 14,89 B |

| LINK | 20.10 | 9.30% | 0.38% | 12,82 B |

| SHIB | 0.00002150 | 6.39% | 0.38% | 12,67 B |

| DOT | 6.477 | 4.97% | 0.30% | 9,96 B |

*Prepared on 1.14.2025 at 14:00 (UTC)

WHAT’S LEFT BEHIND

US Producer Price Index (PPI) was announced as 3.3% yoy.

Expectation: 3.5%

Previous: 3

BlackRock Expands Bitcoin ETF

BlackRock (BLK) Wealth Management has launched the first Bitcoin ETF in Canada on Cboe Canada. The iShares Bitcoin ETF will trade under the symbols IBIT (Canadian dollar) and IBIT.U (US dollar), providing the ability to invest without directly owning Bitcoin. This product aims to make it easier for retail investors to access crypto assets.

Average Bitcoin Cost for Companies Exceeds $81,000 After Trump Elected

Two months after Trump’s election victory, the average holding cost of Bitcoin for listed companies reportedly exceeded $81,000. MicroStrategy’s average cost was $62,691, 23% lower than other companies. In contrast, the average cost per Bitcoin of other companies was recorded as $81,352.

El Salvador President Plans to Install Bitcoin Nodes in Every Home

According to Bitcoin Magazine, El Salvador President Nayib Bukele is working on a plan to install a Bitcoin node in every household in the country. This move could contribute to the country’s goal of playing a leading role in the global adoption of Bitcoin.

Sony’s Layer 2 Project Soneium Criticized for Blacklisting Meme Coins

Sony’s Layer 2 project Soneium was heavily criticized by the community for allegedly blacklisting some Meme coins during its mainnet launch. Coins blacklisted for suspected intellectual property violations could not be traded on the official block scanner. This was met with disappointment by many users on the X platform and led to criticism of the project’s centralization.

TON Foundation Appoints Manuel Stotz as New President

The TON Foundation has appointed Manuel Stotz as its new president and shifted its strategic focus to growth in the US market. It is anticipated that the new Trump-led US government may offer a friendly regulatory environment. TON has close ties with Telegram Messenger LLP and sees this step as an important opportunity for blockchain expansion in the US.

Warning from US, Japan and South Korea against North Korean Crypto Hacking Threats

North Korea-linked hackers reportedly stole at least $1.34 billion worth of digital assets in 2024. The US, Japan and South Korea have warned of the need for increased international cooperation against these threats.

Intesa Sanpaolo CEO: Bank’s Bitcoin Purchase Was a Test

Carlo Messina, CEO of Italian banking giant Intesa Sanpaolo, described the purchase of 11 Bitcoins by the bank’s proprietary trading department as a test. Speaking at an event in Milan, Messina stated that this step was an experiment to understand Bitcoin’s potential and market dynamics. He also stated that he personally does not hold Bitcoin.

Elon Musk Solution for TikTok

TikTok, which is perceived as a threat to national security by some politicians in the US, is now on the agenda for sale to prevent the closure of its US subsidiary… As in many issues, Elon Musk’s name comes to the fore here. TikTok’s much-debated algorithm will not be included in the “new application”.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| 20:05 | US FOMC Member Williams Speaks | – | – |

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations

MARKET COMPASS

In global markets, the agenda regarding the US economy continues to be a determining factor in asset prices. Markets, which started the week by refraining from taking risks as the expectations that the Federal Reserve (FED) would slow down or even stop interest rate cuts gained weight, had the opportunity to recover with the news that Trump could make tariff increases in a “gradual” manner after taking office. The US Producer Price Index (PPI) data for December announced today was below expectations. After the European stock markets, which are green except for the UK, Wall Street is expected to start the new day with a rise, albeit close to flat.

This week, important macro indicators from the US are being monitored and especially tomorrow’s Consumer Price Index (CPI) may be decisive for prices. Click here to review our weekly report on this subject.

In the continuation of the day, we can say that the above area for short-term transactions has been limited after the last rise, but the market has left a little room for upside. After possible narrow pullbacks, if the current mood in the traditional markets is maintained, there may be an opportunity to rise again.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our predictions. Afterwards, the appointments made by the president-elect and the increasing regulatory expectations for the crypto ecosystem in the US and the emergence of BTC as a reserve continued to take place in our equation as positive variables. Although it is expected to continue at a slower pace, the preservation of expectations that the FED will continue its interest rate cut cycle and the volume in crypto asset-based ETFs indicating an increase in institutional investor interest support our upward forecast for the big picture for now. In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional pauses or pullbacks in digital assets. However, at this point, it is worth emphasizing again that we think the fundamental dynamics continue to be bullish.

TECHNICAL ANALYSIS

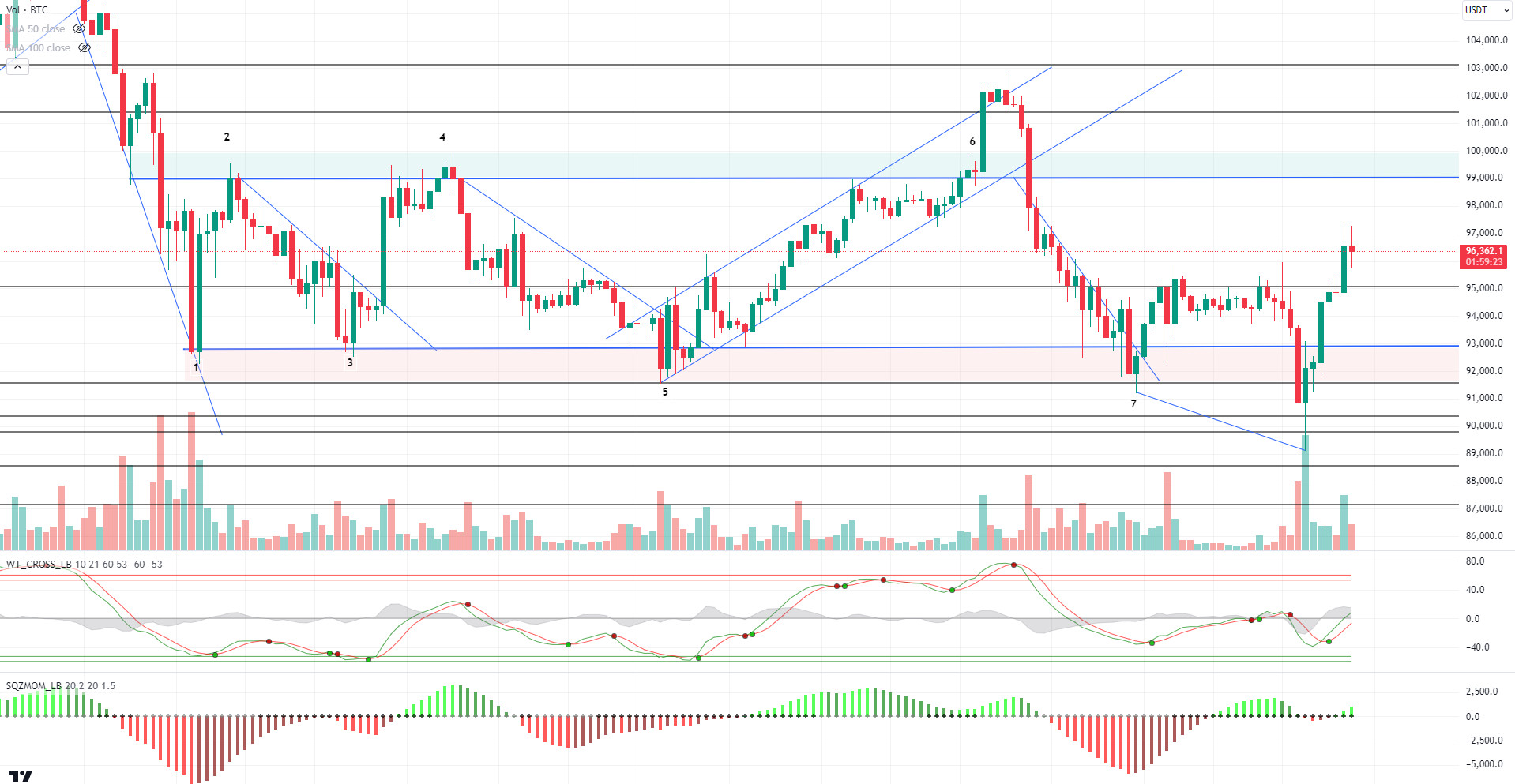

BTC/USDT

According to BlackRock’s latest report, the pace of adoption of Bitcoin since its launch in 2009 has outpaced other breakthrough technologies such as the Internet and cell phones. The number of crypto users reached 300 million in 12 years, while the Internet and cell phones took 15 and 20 years respectively to reach that level. According to research, 56% of new investors will be added to the growing investor base since D. Trump’s election as US president, according to research, 56% in the first year of his tenure. Indeed, two months after Trump’s election victory, along with institutional investors, it was reported that the average holding cost of listed companies for Bitcoin exceeded $ 81,000.

When we look at the technical outlook with all these developments, as we mentioned in the previous analysis, the price tested the 97,500 level by exceeding the critical major resistance level of 95,000. In the weekly liquidation chart, we stated that these levels could be targeted for short accumulation. As of now, BTC, which is trading at 96,500, continues to signal technical oscillators in the direction of buying, while the momentum indicator has gained some more strength. In the continuation of the rise, short trades at 98,000 can be expected to be targeted. In case of a possible pullback, the 95,000 level is critical to stay in the positive zone.

Supports: : 95,000 – 92,800 – 91,700

Resistances 97,200 – 98,100 – 99,100

ETH/USDT

Ethereum rose to the 3,250 region after exceeding the 3,131 level with the rise in the morning hours, but there was a retreat with selling pressure from this level. The announcement of the US Producer Price Index at 3.3%, below expectations, caused Ethereum to rise above the 3,200 level again.

Looking at the technical indicators, the 3,293 level stands out as an important resistance point. Failure to exceed this level will cause the price to retreat, while the 3,131 level stands out as a critical support. The negative divergence observed in the RSI indicator indicates that the upside momentum has weakened, and the price is under bearish pressure. In addition, the fact that Chaikin Money Flow (CMF) data does not support the upside suggests that fund inflows from market participants are limited and the sustainability of the upward movement is low. On the Ichimoku indicator, the Tenkan line fell below the Kijun line, confirming that the current technical outlook is negative.

A break above 3,293 could remove the negative outlook and start a new uptrend towards 3,382 and 3,452. However, a break of the 3,131 level could pull the price back to the 3,050-3,000 band and a loss of this zone could lead to deeper declines.

Supports 3,131 – 2,992 – 2,890

Resistances 3,293 – 3,382 – 3,452

XRP/USDT

XRP is trending sideways with relatively low volume after a weekend rally. While the price continues to move in the critical zone between 2.47 and 2.61, some shifts in technical indicators are noteworthy.

The Relative Strength Index (RSI) indicator is showing a negative mismatch as the price is back above the 2.57 level. However, the Chaikin Money Flow (CMF) indicator is not bullish, as noted in the morning analysis, suggesting that buyers are not present in the market strongly enough. However, a healthy rise in the momentum indicator could be considered a positive technical signal.

The current technical outlook suggests that although the price remains above the 2.57 level, there is a risk of some retracement from this area. Breaching the 2.61 resistance is critical for a positive scenario. If this level is broken, XRP can be expected to accelerate its upward movement by entering a new bullish wave.

Supports 2.4702 – 2.3236 – 2.2525

Resistances 2.6180 – 2.7267 – 2.8528

SOL/USDT

Solana has remained bullish since our analysis in the morning. On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be below the 200 EMA (Black Line). At the same time, the 50 EMA is working as resistance to the asset. When we examine the Chaikin Money Flow (CMF)20 indicator, it is seen that money inflows are intense by moving from the negative zone to the positive zone. However, the Relative Strength Index (RSI)14 indicator is in the neutral zone from the oversold level. At the same time, positive mismatch seems to have worked. The 200.00 level appears to be a very strong resistance place in the rises driven by both the upcoming macroeconomic and Solana ecosystem news. If it breaks here, the rise may continue. In case of retracements for the opposite reasons or due to profit sales, the 163.80 support level can be triggered. If the price comes to these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 181.75 – 170.72 – 163.80

Resistances 189.54 – 200.00 – 209.93

DOGE/USDT

According to Coinglass, the DOGE long/short ratio shows largely bullish positions, with 81.9% favoring long positions. This supports traders’ apparent optimism about Dogecoin’s price recovery. Looking at Inflows/Outflows, approximately $54 million worth of DOGE has exited the exchanges in the last 48 hours.

Doge has started slightly bullish since our morning analysis. Looking at the chart, the asset is between the 50 EMA (Blue Line) and the 200 EMA (Black Line) on the 4-hour timeframe. At the time of writing, the price is also testing the 200 EMA as resistance with support from the 50 EMA. When we examine the Chaikin Money Flow (CMF)20 indicator, it switched from negative to positive territory. However, money outflows seem to have increased slightly. However, Relative Strength Index (RSI)14 has moved from the oversold zone to the positive zone. The 0.39406 level appears to be a very strong resistance point in the rises due to political reasons, macroeconomic data and innovations in the DOGE coin. In case of possible pullbacks due to political, macroeconomic reasons or negativities in the ecosystem, the 0.28164 level, which is the base level of the trend, is an important support. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.33668 – 0.30545 – 0.28164

Resistances 0.36600 – 0.39406 – 0.42456

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.