What’s Left Behind

Trump’s Statements on Economy and Cryptocurrencies

US President Donald Trump announced after his inauguration that he would declare a national emergency and strengthen the economy with new trade policies.

Trump Signs Cryptocurrency Executive Order

Trump signed an executive order evaluating the creation of a national digital asset reserve and banning central bank digital currency (CBDC).

SEC Withdraws SAB 121 Policy

The US Securities and Exchange Commission (SEC) has rescinded guidance for the SAB 121 policy on accounting for crypto assets.

FED Keeps Interest Rates Steady

The US Federal Reserve (Fed) left interest rates unchanged between 4.25% – 4.50% at its first meeting of 2025. Fed Chairman Jerome Powell said that inflation is still high and there will be no rush to cut interest rates.

SEC Accepts Litecoin ETF Application

The SEC has approved the Litecoin ETF application submitted by Canary Capital, opening a 21-day public comment period.

Tether Responds to EU Regulations, Exchanges Delist USDT

Tether has expressed concerns about exchanges removing USDT due to the EU’s MiCA regulations.

FTX Launches Restructuring Process

FTX’s restructuring plan took effect as of January 3, 2025.

Czechia’s Central Bank Evaluates Bitcoin Reserve

The Czech National Bank is considering the inclusion of Bitcoin in its reserve strategy.

ECB Rejects Bitcoin as a Reserve Asset

ECB President Christine Lagarde announced that Bitcoin will not be included in central bank reserves. It was stated that Bitcoin is not a suitable reserve asset due to its lack of liquidity, security and regulatory oversight.

Tether Obtains License in El Salvador

Tether is preparing to expand its operations in El Salvador by obtaining a Digital Asset Service Provider license.

Senator Lummis Named Chairman of the Digital Assets Subcommittee

Senator Cynthia Lummis stated that she supports the US strategy to strengthen Bitcoin reserves and that a comprehensive legal framework for digital assets should be established.

What Awaits Us?

US Macro Data

Non-Farm Payrolls (NFP)

📅 February 7 -🕒 13:30 pm UTC

US Consumer Price Index (CPI)

📅 February 12 -🕒 13:30 pm UTC

FOMC Meeting Minutes

📅 February 19 -🕒 19:00 pm UTC

US Personal Consumption Expenditures (PCE)

📅 February 28 -🕒 13:30 pm UTC

Crypto Insigth

| Market Overview | Current Value | Change (30d) |

|---|---|---|

| Bitcoin Price | $ 104,468 | 11.62% 📈 |

| Ethereum Price | $ 3,242 | -2.67% 📉 |

| Bitcoin Dominance | 59.27 % | 2.07% 📈 |

| Ethereum Dominance | 11.19 % | -11.18% 📉 |

| Total Market Cap | $ 3.49 T | 9.62% 📈 |

| Fear and Greed Index | 76 (Extreme Greed) | 66 (Greed) |

| Crypto ETFs Net Flow | + $ 254.5 M | |

| Open Interest – Perpetuals | $ 651.2 B | |

| Open Interest – Futures | $ 4.52 B |

*Prepared on 01.31.2025 at 06:20 A.M. (UTC)

Summarize of the January

Flow by Asset

| Asset | Week 1 (January) | Week 2 (January) | Week 3 (January) | Week 4 (January) | Total ($) |

|---|---|---|---|---|---|

| Bitcoin (BTC) | 130.0 | 214.0 | 1,900.0 | 1,600.0 | 3,844.0 |

| Ethereum (ETH) | 18.6 | -255.4 | 246.0 | 205.0 | 214.2 |

| XRP (Ripple) | 0.93 | 41.2 | 31.0 | 18.5 | 91.6 |

| Chainlink (LINK) | 0.098 | 1.2 | 2.8 | 6.9 | 11.0 |

| Other | 0.016 | 0.0048 | 2.2 | 8.2 | 10.4 |

January 2025 was a strong period for monthly inflows into digital assets. Total inflows increased from $37 billion to $44 billion, up 16.28% since 2024. Bitcoin saw total inflows of $3.8 billion in January, while Ethereum saw an increase of $214 million compared to the previous month. Ripple (XRP) stood out with inflows of $91 million and Chainlink (LINK) with $10 million.

Total Market Cap

The total value of the cryptocurrency market increased from $3.19 trillion in January to $3.50 trillion with a net inflow of $309.45 billion. While there was an increase of 9.80% in this process, the market capitalization fluctuated between 3.02 trillion and 3.69 trillion dollars. The crypto market, which closed January with a positive performance, followed a positive course.

Spot ETF

In terms of spot Bitcoin ETFs, net inflows were strong across January. Total ETF inflows for the month totaled $4,349.2 million. During this period, the price of Bitcoin gained 10.85%, rising from $93,548 to $103,698. The BlackRock IBIT ETF, in particular, was the most heavily invested fund with inflows of $2,545.9 million.

January 2025 was a weak period for spot Ethereum ETFs. ETH lost 6.71%, falling from $3,336 to $3,112. ETF inflows totaled only $5.9 million. The BlackRock ETHA ETF performed positively with inflows of $474.9 million, while the Fidelity FETH ETF experienced net outflows of $179.1 million

Options Data

BTC options with a notional value of around $17.19 billion will expire in January. The put/call ratio for the options is 0.79, indicating a relatively higher preference for call options by investors and a possible bullish expectation. Last January, 459.88K call and 284.47K put options were opened on Laevitas, while the maximum pain point was set at $98,000, concentrated in the $97,000 – $102,500 band. For the next month, there are currently 3.4K call and 3.3K put options available, with put options dominating in the first half of the month and the pain point at $100,000.

Ethereum options worth $1.93 billion will expire in January. With a put/call ratio of 0.42, Call options are more preferred. 178,556K Put options traded against 423,176K Calls, with the maximum pain point set at $3,300. For the next month, 3.3K Call and 3.33K Put options are open. Put options dominated in the first half of the month, with the maximum pain point at $3,400.

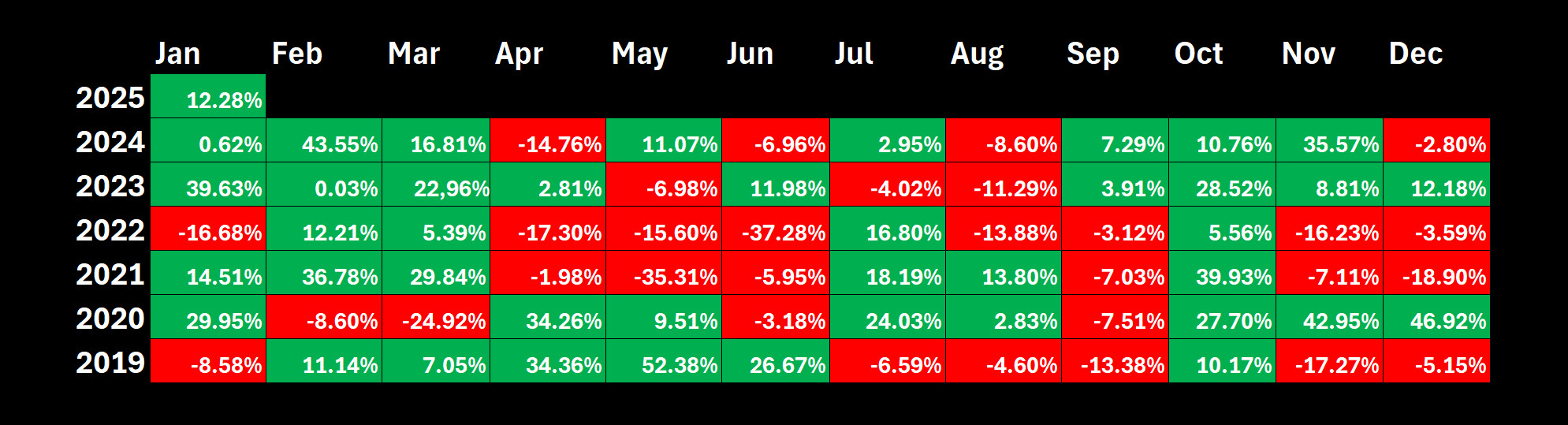

Expectations of the February

As we approach the end of January, Bitcoin has managed to rebound from deep declines at times, hitting the 89,000 level, and is poised to close 4.50% away from its all-time high (ATH) of 109,700. Bitcoin, which is up 12.28% on a monthly basis, is leaving behind a strong month. According to historical data, the leading cryptocurrency, which averaged a return of 4.04% in January, has outperformed expectations this year

When we look at February, the second month of the year, we see that Bitcoin has historically performed better than January. Although there were deep declines from time to time, the overall picture shows an average gain of 15.66% in February. This data shows that Bitcoin has shown a steady growth trend in the second month of the year, with volatile movements. Although there were no major developments in the crypto market in February, the developments regarding Altcoin Spot ETFs and the Macro Data in the rest of the report will have a significant impact on the market.

Source: Darkex Research Department

Altcoin Spot ETF Applications

Important developments continue to take place in the cryptocurrency world. With regulatory processes gaining momentum, new opportunities are emerging for investors. Prominent altcoin ETF applications and important developments in the market in the coming period:

Litecoin (LTC) ETF Application

Canary Capital has filed for a spot ETF based on Litecoin (LTC). The US Securities and Exchange Commission (SEC) has reviewed the application and requested public comments. The fact that Litecoin has been stable in the market for a long time suggests that this ETF could be attractive to investors.

Hedera (HBAR) ETF Application

Canary Capital Group has filed for an ETF based on HBAR, the native cryptocurrency of the Hedera Network. This is the first HBAR-specific ETF application, proving the growing interest in altcoins.

Solana (SOL) and XRP ETF Applications

ProShares has filed an application with the SEC for an ETF based on Solana futures. This application follows a similar filing by VolatilityShares in December 2024. Also, Tuttle Capital has filed with the SEC for leveraged ETFs based on altcoins such as XRP and Solana. These moves mark important steps towards integrating popular altcoins into exchange-traded funds.

Conclusion

As cryptocurrency markets continue to change rapidly, ETFs are emerging as a more secure and regulated investment vehicle for investors. These developments, which are likely to take place in February 2025, may increase investor interest in the altcoin market. However, completing the regulatory processes and considering market fluctuations are among the important elements that investors should pay attention to.

Market Pulse

The first month of the year was quite challenging for global markets. New President Trump’s tariff policy and the steps and statements he made on digital assets have been one of the main determinants of asset prices. It does not look like the rest of the year will be much different. On the other hand, the rise of China’s DeepSeek, which called into question the superiority of the US in artificial intelligence technology, was one of the remarkable developments of January. Nevertheless, expectations regarding the US Federal Reserve’s (FED) monetary policy decisions seem to continue to dominate investor behavior.

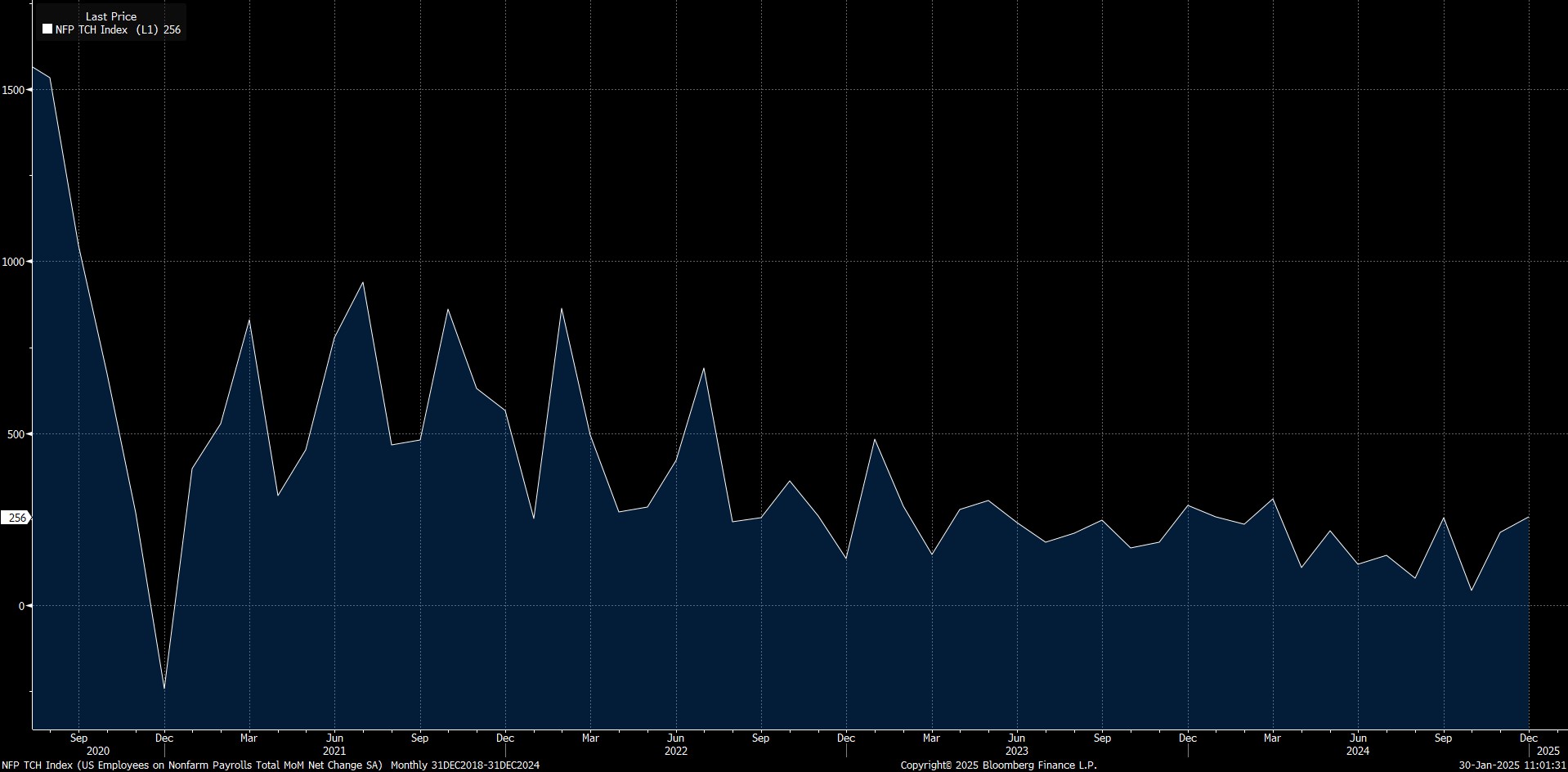

We start the month without FOMC with NFP

After the FOMC passed the first Federal Open Market Committee (FOMC) meeting of the year in January by keeping interest rates unchanged, the next FOMC meeting will be held on March 18-19. We will not see an FOMC meeting in February, but the labor market data to be released on the 7th will give important clues for the interest rate decision in March.

In the last month of last year, the US economy added 256,000 jobs in the non-farm sector. This change was well above the expectations of 164 thousand and supported the expectations that the pace of interest rate cuts by the FED would slow down.

Source: Bloomberg

Recently we have seen a fluctuation in the NFP due to some external factors, strikes and natural disasters being among the main ones. In the first months of the year, in order to understand whether things are on track in the world’s largest economy, we need data that is free of such effects. We think that the first of these could be the January data.

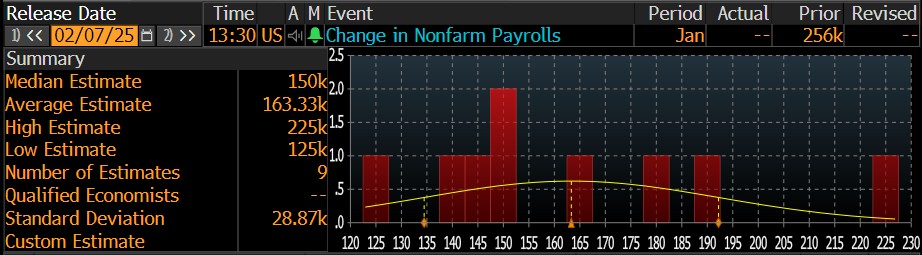

Considering the Bloomberg survey last analyzed on January 31, the median NFP forecast of economists for the first month of the year is seen at 150 thousand. The average of the forecasts is around 161 thousand. The forecast range varies between 225 thousand and 125 thousand.

Source: Bloomberg

*Note: The results of labor market data such as NFP and unemployment rate should be evaluated together. You can follow the expectation figures formed by the surveys in our daily analysis reports.

Let us underline once again that not only the NFP data, but also indicators such as average hourly earnings and the unemployment rate, which will be released with this report, should be closely monitored, but this time, we think that the revisions to the NFP for the previous months should also be looked at . Potential large downward revisions could call into question the strength of the labor market.

Let’s turn to the NFP data for January. A lower-than-expected data may increase risk appetite as it may strengthen the FED’s hand for interest rate cuts, which may have a positive impact on digital assets. In the opposite case, we may see pressure on cryptocurrencies.

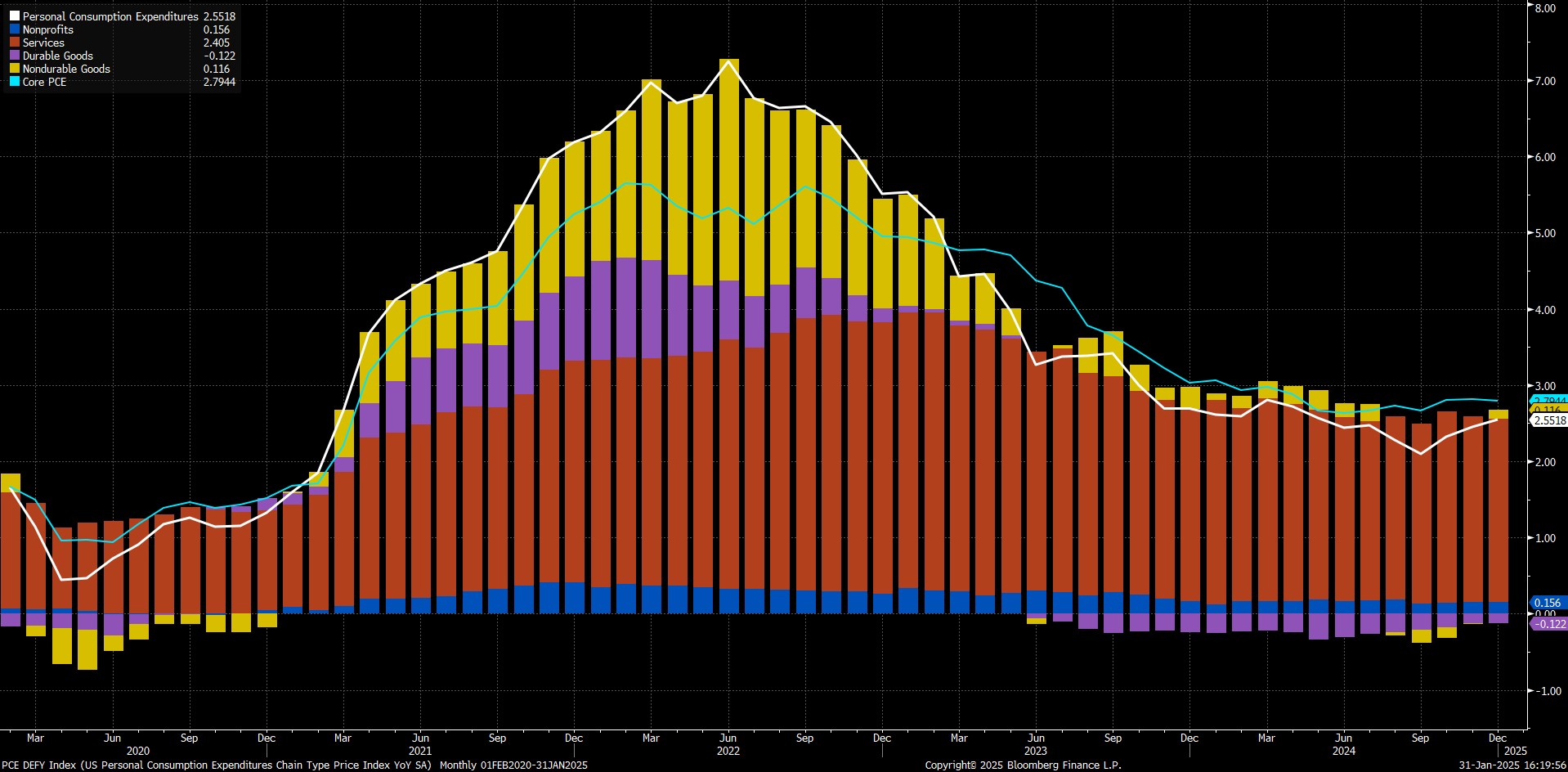

Will Inflation Be a Problem?

Among the US inflation indicators for January, the Consumer Price Index (CPI) will be released on February 12th and the PCE Price Index on February 28th. In addition to labor market data, inflation indicators, which can be considered as the pulse of the economy, will continue to be extremely important in the FED’s interest rate cut decisions. Therefore, we can say that the dose of financial tightening for the rest of the year will be determined by the course of inflation in the world’s largest economy.

In December, the annualized CPI rose to 2.9%, returning to the rate of increase in July. In September, we saw the lowest CPI data in recent times with 2.4%. There are fears that Trump’s tariffs could lead to higher inflation in the country and exacerbate the already rising momentum in the general level of prices. On this subject, FED chairman Powell had recently stated that they were prepared for this and similar situations. Let’s move from the significant rise in CPI to the PCE data, the measure used by the FED to monitor inflation.

Source: Bloomberg

In January, the monthly increase in the core PCE Price index was in line with expectations at 0.2%. Annual headline data rose to 2.6%. It was 2.4% in November. CPI aside, if the PCE index continues to rise later in the year, the Fed’s previous rate cuts will indeed become more questionable. In such a scenario, we believe that the Bank will take a long pause in rate cuts, which risks permanently disrupting risk appetite.

Of course, we are assuming that the FED’s recent uptick in inflation may be temporary. Because if this is not the case, there will be no other explanation for starting the rate cut cycle with a “Jumbo” step. If we see a stabilization in the PCE Index later in the year and a convergence trend back to 2%, Powell and his team may feel comfortable to make easier rate cut decisions. This could have a positive impact on digital assets.

Can FOMC Minutes Set New Direction?

At the January 29 FOMC meeting, almost the entire market already believed that the FED would not cut interest rates. And so it was, with the Bank pausing the rate cut cycle and keeping the policy rate unchanged. The timing of the next rate cut will be a matter of curiosity and a determining factor in the markets. The next FOMC meeting will be held on March 18-19, and before that, on February 19, we will see the minutes of the meeting completed on January 29. Between the lines of the minutes, investors will be looking for clues as to when the next rate cut will take place.

Among the outcomes of the first FOMC meeting of the year, we were most interested in the omission of the reference sentence “Inflation has made progress towards the Committee’s 2% target” from the decision text. We can’t say that this was a big surprise because we expected this correction to be necessary after the recent trend in CPI data. If the sticky inflation persists, the FED is likely to be in more trouble. But for now, it is too early to say that this is the case. We will look for member views on inflation rather than employment in the minutes and try to understand the extent of FOMC officials’ concerns about the consumer price index. Because this will tell us whether the FED is taking a break from the interest rate cut cycle or whether it has already ended it.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.