MARKET SUMMARY

Latest Situation in Crypto Assets

| Asset | Last Price | |||

|---|---|---|---|---|

| 24h | Dominance | Market Cap. | ||

| BTC | 63,954.00 | -0.13% | 56.35% | 1.26 T |

| ETH | 2,747.00 | -0.38% | 14.72% | 329.99 B |

| XRP | 0.5958 | -1.60% | 1.49% | 33.47 B |

| SOLANA | 159.50 | +1.04% | 3.31% | 74.28 B |

| CARDANO | 0.3812 | -0.92% | 0.61% | 13.72 B |

| DOGE | 0.1087 | -1.42% | 0.71% | 15.87 B |

*Prepared on 26.08.2024 at 09:00 (UTC)

WHAT’S LEFT BEHIND

Bitcoin and the Economic Outlook: Will Interest Rate Cuts Save Us from a 2024 Recession?

The prospect of lower federal funds interest rates has renewed interest from cryptocurrency investors. Market analysts are divided on whether these cuts will have a significant impact on the broader economy or prevent a looming recession. According to Garry Evans of BCA Research, market optimism contrasts sharply with rising recession indicators. The scheduled FOMC meeting in September is attracting attention as analysts are predicting a 25 basis point cut in the federal funds rate. According to data from CME’s Fedwatch tool, this scenario has a 76% probability of occurring. Such rate adjustments are critical for positioning in various investment sectors, including cryptocurrencies, as they can affect investors’ risk appetite in search of high returns.

Ethereum Foundation Under Scrutiny Over $96.9 Million ETH Transfer Amid Financial Transparency Requests

The Ethereum Foundation recently transferred a large amount of ETH, sparking debate in the crypto community about its financial transparency. The transaction, worth approximately $96.9 million, has raised questions about the foundation’s treasury management practices, especially during a period of heightened scrutiny.

Tether Brings UAE Dirham Stablecoin to $150 Billion Market

Tether, the leader in the digital asset industry, announced the launch of a new stablecoin, aAED, pegged to the United Arab Emirates Dirham (AED).

TON ecosystem coins fall hard after news of Telegram CEO’s detention

Cryptocurrencies belonging to The Open Network (TON) blockchain ecosystem, developed by the team behind Telegram, fell sharply with the news that Telegram CEO Pavel Durov was detained in France. Toncoin (TON) lost 23 percent of its value in the first hours, retreating to $5.24. Telegram game Notcoin’s token NOT suffered a similar drop. The cryptocurrency lost 23.5 percent in parallel with TON

HIGHLIGHTS OF THE DAY

Important Economic Calendar Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| A mainnet upgrade will take place on the altcoin StarkNet (STRK). | |||

| 12:30 | US Core Durable Goods Orders (Mo) (Jul) | 0.0% | 0.4% |

| 12:30 | US Durable Goods Orders (Mo) (Jul) | 4.9% | -6.7% |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

COMPASS OF THE MARKET

While global asset prices continue to be driven mainly by the changes in the monetary policy stance of central banks, we recently watched the repercussions of FED Chairman Powell’s speech at the Jackson Hole meeting. Powell gave a clear signal regarding interest rate cuts. In this context, US stock markets ended the day with an increase on Friday, and crypto assets, which have not been able to accompany the positive risk appetite for a while, also gained value.

This morning, we are watching a negative divergence in Asian stock markets. The country’s appreciating currency yen pulled Japanese stocks down. We generally see green numbers within the mixed outlook. European stock markets are expected to start the day slightly negative amid renewed tensions in the Middle East. Over the weekend, there were reports that Israel struck South Lebanon. In addition to macro dynamics and geopolitical tensions, the news flow that attracted attention for the crypto world came from France. The country’s press reported that Telegram’s founder Pavel Durov was detained at the airport. In parallel, deep losses were observed in TON over the weekend.

As we start the new week with these headlines, we can say that we will follow another trading period in which macro indicators that may shape the expectations regarding the FED’s changes in monetary policy will be monitored. After Powell’s data-driven speech, which clearly opened the door to a rate cut, macro indicators that may affect the risk appetite of the markets will be under scrutiny. For detailed information about the data coming from the US during the week, you can review our “Darkex Weekly Strategy Report” and “Darkex Economic Calendar”. Today, durable goods orders figures, which may affect the health of the US economy and expectations regarding the FED’s interest rate cut course, will be closely monitored.

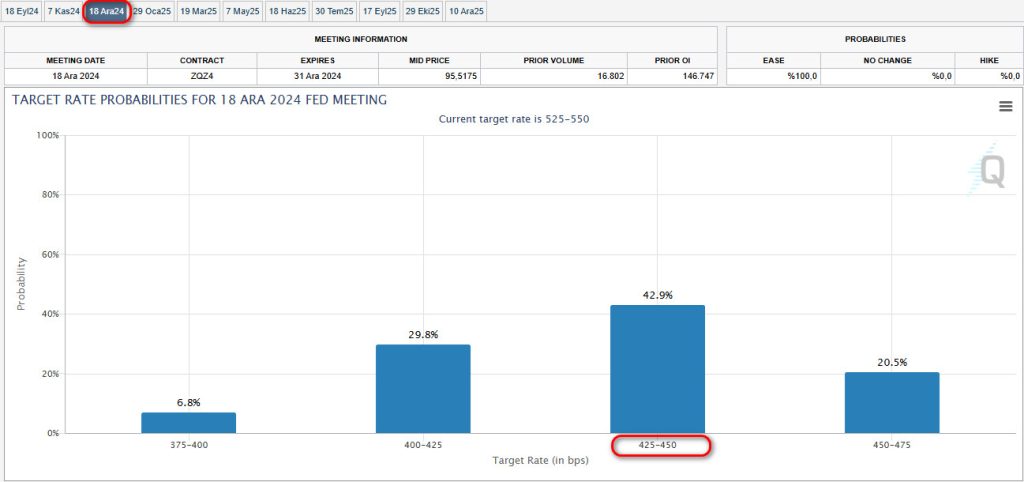

According to CME FedWatch, markets expect the Federal Open Market Committee (FOMC) to cut rates by a total of 100 basis points over the remaining three meetings of the year. This implies a “Jumbo” rate cut of 50 basis points at any given meeting. To confirm this, global investors will be closely watching US macro data, such as today’s durable goods orders. While higher-than-expected figures could negatively impact crypto assets by raising expectations that the Fed may not be in a hurry to cut interest rates, a lower-than-expected data set could support rate cuts and provide some bullish support for digital currencies.

TECHNICAL ANALYSIS

BTC/USDT

Powell effect on Bitcoin! Last week, FED Chairman Powell’s optimistic statements about the expectation of interest rate cuts revitalized the cryptocurrency market, attracting the attention of investors. Powell, who pointed to interest rate cuts with the statements “We are closer to the target in the fight against inflation, the balance of risk to our authorities has changed”, did not provide any data on the level of interest rate cuts. After it is seen as certain to start the series of interest rate cuts in September, investors still have a question mark as to whether the reason for the price increase in Bitcoin will be 25bz points or 50bz points. In both scenarios, if 50bz points are pricing the expectation with the pricing of 50bz points, there may not seem to be a problem for the market. If the market prices 50bz and 25bz discount comes, Bitcoin may face a retreat. On the contrary, if 25bz is priced and 50bz points come, the best scenario we expect may come true and momentum may accelerate upwards, which reinforces the optimistic mood in the long term. In the BTC 4-hour technical analysis, with the price breaking the falling trend line, we see that the rises gained momentum with the crossing of the psychological resistance zone of 60,650 and 60,850 levels and consolidated to 64,000 levels. For the continuation of the rises, the break of the 64,400 intermediate resistance level can carry us to our next band range. With the opening of the US markets, data from there may create volatility in pricing, 63,300 may be our support zone in a possible retreat.

Supports 63,300 – 61,700 – 60,650

Resistances 64,400 – 65,100- 66,000

ETH/USDT

Stagnation in Ethereum! After the FED chairman Powell reinforced the expectation of interest rate cuts, Ethereum saw a rise in Ethereum, but we see that this rise was limited and did not meet expectations. Although there are many reasons behind the limited movements, with the latest development, the Ethereum foundation has been under scrutiny with the large amount of ETH transfers it has made recently, raising a question mark in the minds of investors. With the inclusion of the Ethereum foundation in the ‘FUD’ pressure, which we have mentioned many times before, we see that it is reflected in the Ethereum price. In the ETH 4-hour technical analysis, we see that the price, which fluctuated between the 2,600 and 2,680 support resistance levels for a long time, broke upwards and reached the 2,740 resistance level. Pricing above this level can be perceived as positive for Ethereum and may allow us to see the continuation of upward movements. In case of a pullback, the down break of the 2,680 support level may cause it to move in a horizontal band range again. Our technical indicator RSI is in the oversold zone and the level we expect to meet us in an upward movement may be the 2,900 resistance level.

Supports 2,680 – 2,600 – 2,550

Resistances 2,740 – 2,900 – 2,960

SOLUSDT

With Powell’s statements at the Jackson Hole meeting, a rate cut seems almost certain. According to data from the CME, the 25 basis point rate cut is now 61.5%. Therefore, the market has gained positive momentum. This price increase explains the rising open interest and funding rates in the futures market. According to Coinglass, SOL’s short position was $2.37 billion today, up from $2.09 billion on the last day of last week. However, the detention of Telegram founder Durov has unsettled the market. Durov, the founder of the TON network, faces multiple charges. The SEC withdrew Solana’s request for classification as a security. This was considered a strategic move. Despite this, SOL has risen 8% since last week. When we look at the chart, it needs to break the 162.94 – 167.91 resistances to continue its uptrend. If investors’ appetite for profit realization increases, it may test the support levels of 157.63 – 152.32.

Supports 157.63 – 152.32 – 147.82

Resistances 162.94 – 167.91 – 178.06

ADAUSDT

Powell’s speech at the Jackson Hole meeting was as expected. It seems almost certain that the FED will cut interest rates in September. However, Cardano suffered a development problem as the Chang hard fork was delayed for four days. This reduced ADA’s bullish momentum. This has affected investor confidence. It would not be surprising if ADA, which has been accumulating for a long time, rises if the update is successful. The asset is trading at 0.3841, down 2.51% in the last 24 hours. The ratio of selling positions to buying positions is 1.33. This shows that selling pressure is strong. ADA is currently trading at 0.3808, stuck in the 0.3875 – 0.3787 band. If possible rises continue, 0.3875 – 0.4190 levels can be followed. In a possible profit realization decision of investors, 0.3787 – 0.3596 levels can be followed as support.

Supports 0.3787 – 0.3596 – 0.3397

Resistances 0.3875 – 0.4190 – 0.4292

AVAX/USDT

Last week, we saw a bullish market after FED chairman Powell’s speech on Friday. AVAX also took its share of this rally and rose as high as 28.00.

In the new week, we will follow the US gross domestic product, unemployment claims data and core personal consumption expenditures price index data. AVAX, which closed the week at 26.92, is trading at 26.70 in the new week. It continues its movement within the ascending channel and moves towards the lower band of the channel on the 4-hour chart. It is currently trying to break the 26.64 support and may rise towards the middle band of the channel with a reaction from here. In such a case, it may want to break the 27.32 and 27.73 resistances. If it breaks the lower band of the channel with voluminous sales, it may test 25.93 and 25.70 supports.

Supports 26.64 – 25.93- 25.70

Resistances 27.32 – 27.73 – 28.42

TRX/USDT

TRX, which has been on the rise over the past week with the SunPump platform attracting attention, continued to rise with the speech of FED chairman Powell and closed the week at 0.1664. This week, it may want to continue its rise with the contribution of data from the US and the SunPump platform. It is currently trading at 0.1656 and is in the upper Bollinger band on the 4-hour chart. A downward movement can be expected from here. If such a decline comes, it may test the supports of 0.1641 and 0.1603 and may rise again with the reaction from the Bollinger middle band. If it continues to rise from the Bollinger upper band, it may test the 0.1666 and 0.1700 resistances.

Supports 0.1641 – 0.1603 – 0.1575

Resistances 0.1666 – 0.1700 – 0.1779

DOT/USDT

“Polkadot (DOT) broke the previous week’s high after the positive atmosphere at the Jackson Hole symposium. DOT, which broke the psychological resistance level of $5, was sold at 5,100, which we set as the resistance level. DOT, which is currently correcting this rise, continues to retreat with the reaction it received from the previous resistance level of 4,749. With the 4,749 level broken down, we can expect it to retreat to 4,684 levels. If it stays above the 4,749 level, it may want to test the 5,100 levels again.

(Blue line: EMA50, Red line: EMA200) “

Supports 4.749 – 4.684 – 4.591

Resistances 5.100 – 5.290 – 5.776

SHIB/USDT

The marketing manager of Shiba Inu (SHIB) shared a DAO plan that will allow SHIB holders to have a say on the future direction of the project. This news decentralization of the project will allow SHIB holders to vote on future initiatives.

As for the SHIB chart, the positive atmosphere at the Jackson Hole symposium also had an impact on the cryptocurrency market. SHIB, which broke the Hugh level of the previous week, rose to our resistance level of 0.00001606. SHIB, which corrected from 0.00001606, found support by reacting from our previous resistance level of 0.00001469. If the price cannot hold at 0.00001469 levels, it may retreat to 0.00001433 support. If the price holds above 0.00001469, it may want to test 0.00001606 levels again.

(Blue line: EMA50, Red line: EMA200)

Supports 0.00001469 – 0.00001433 – 0.00001358

Resistances 0.00001606 – 0.00001678 – 0.00001797

XRP/USDT

After starting the new week at 0.5996, XRP lost about 0.7% and is currently trading at 0.5961.

While XRP continued its movement in the horizontal channel it created last week FED Chairman Powell’s speech on August 23 caused fluctuations in the crypto market, as well as in the XRP price. After rising to 0.6311, XRP fell and when we examine the 4-hour analysis, we can see that the horizontal movement in the 0.59-0.60 band has continued in the last 6 candles. As we mentioned in previous reports, XRP can offer opportunities in short-term trading with short-term declines and rises during its horizontal movement.

While the horizontal movement in XRP continues, it may test the resistance levels of 0.6022-0.6113-0.6241 in case it starts to rise again with positive developments and news that may come. On the contrary, if the decline continues with negative news, it may test the support levels of 0.5936-0.5838-0.5748.

Supports 0,5936 – 0,5838 – 0,5748

Resistances 0,6022 – 0,6113 – 0,6241

DOGE/USDT

DOGE, which started the new week at 0.1095, is currently trading at 0.1088 with a 0.7% depreciation.

After FED Chairman Powell’s speech on August 23, there was activity in the crypto markets and coins started to rise. In this process, DOGE, which moved in parallel with the crypto market, rose to 0.1154 and then fell.

As seen in the 4-hour analysis, DOGE continues to be traded in the bullish channel, which continues with a gradual rise and decline after Powell’s speech. If the downtrend ends and starts to rise, it may test the resistance levels of 0.1101 – 0.1122 – 0.1149. If the decline continues, it may test the support levels of 0.1080 – 0.1054 – 0.1031.

Supports 0,1080 – 0,1054 – 0,1031

Resistances 0,1101 – 0,1122 – 0,1149

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.