MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap |

|---|---|---|---|---|

| BTC | 101,256.51 | -2.34% | 56.96% | 2,00 T |

| ETH | 3,682.32 | -3.76% | 12.61% | 443,72 B |

| XRP | 2.361 | -5.82% | 3.84% | 135,00 B |

| SOLANA | 210.96 | -1.98% | 2.87% | 101,08 B |

| DOGE | 0.3625 | -5.23% | 1.52% | 53,40 B |

| CARDANO | 0.9818 | -3.94% | 0.98% | 34,51 B |

| TRX | 0.2645 | -2.73% | 0.65% | 22,81 B |

| AVAX | 42.63 | -8.28% | 0.50% | 17,50 B |

| LINK | 24.59 | -9.42% | 0.44% | 15,41 B |

| SHIB | 0.00002403 | -6.08% | 0.40% | 14,18 B |

| DOT | 7.611 | -7.32% | 0.33% | 11,65 B |

*Prepared on 12.19.2024 at 07:00 (UTC)

WHAT’S LEFT BEHIND

FED’s Third Interest Rate Cut

The US Federal Reserve (FED) cut its policy rate by 25 basis points at its last meeting of the year, marking the third consecutive rate cut. Interest rates were lowered to a range of 4.25%-4.5%, while expectations for a rate cut in 2025 were reduced from four to two. Fed Chairman Jerome Powell emphasized that the economy remains strong and inflation is approaching the target and that they will be more cautious in future rate cuts.

El Salvador and IMF Sign $1.4 Billion Loan Agreement

El Salvador will receive a $1.4 billion loan over a 40-month period with the IMF. Under the agreement, Bitcoin payments for merchants will be made voluntary and government involvement in Bitcoin projects will be gradually reduced.

Trump Family’s Crypto Project “World Liberty” Partners with Ethena Labs

World Liberty Financial has reached a partnership agreement with Ethena Labs, the company behind the ENA token, on USDe synthetic dollars. The company continues to increase on-chain purchases for the ENA token.

Marathon Digital Buys 1,627 BTC

Marathon Digital has purchased 1,627 BTC worth approximately $166 million in the last 8 hours. The company is pursuing an aggressive strategy to increase its BTC holdings.

Aave Developer Avara Secures $31 Million in Funding for Lens Project

Avara completed a $31 million investment round led by Lightspeed Faction to develop Lens, a decentralized protocol for social and consumer applications.

Solana Ecosystem Generated $365 Million in Revenue in November

Solana’s total DApp revenue reached an all-time high of $365 million in November. Pump.fun stood out with $106 million in monthly revenue, while DeFi apps contributed 83.7% of revenue.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| – | Syrup (SYRUP): SYRUP Claim Starts | – | – |

| – | QuantixAI (QAI): 232.35K Token Unlock | – | – |

| – | Rejuve.AI (RJV): New Year’s Health AMA | – | – |

| – | Arbitrum (ARB): Captain Laserhawk Launch | – | – |

| 13:30 | US GDP (QoQ) (Q3) | 2.8% | 2.8% |

| 13:30 | US Unemployment Claims | 229K | 242K |

| 13:30 | US Philadelphia Fed Manufacturing Index (Dec) | 2.9 | -5.5 |

| 15:00 | US Existing Home Sales (Nov) | 4.09M | 3.96M |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

The last meeting of the year of the Federal Open Market Committee (FOMC), which was eagerly awaited by global markets, was completed yesterday. The FOMC will continue to cut interest rates at a slower pace, but only two 25 basis point rate cuts are expected in 2025, leading to a global appreciation of the dollar and a rise in bond yields. Stock market indices declined, while there are also declines in Asia-Pacific this morning after Wall Street. Meanwhile, we saw that the Bank of Japan (BoJ) kept interest rates unchanged. European futures contracts indicate that the indices will start the new day on the downside.

Although the level of impact may remain low after the FED’s announcements, important US macro data will be released today and it will be useful to follow. A higher-than-expected growth data may put pressure on digital assets, with expectations regarding the FED, while a lower-than-expected data may provide a basis for a rise.

Digital assets retreated sharply amid rising expectations of a slower-than-expected easing of financial tightening in the world’s largest economy and dollar appreciation. We think this may continue with intermediate recoveries. However, with the revitalized regulatory agenda and institutional buying in the US with Trump, we are not yet changing our view that the main trend is upwards and we maintain our basic equation below.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our predictions. Afterwards, the appointments made by the president-elect and the expectations of increased regulation of the crypto ecosystem in the US continued to be a positive variable in our equation. Although expected to continue at a slower pace, the continuation of the FED’s interest rate cut cycle and the volume in BTC ETFs indicating an increase in institutional investor interest (in addition to MicroStrategy’s BTC purchases, BlackRock’s BTC ETF options trading…) support our upward forecast for the big picture for now.

In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional pauses or pullbacks in digital assets. However, at this point, it is worth emphasizing again that the fundamental dynamics continue to be bullish. We think that the declines that took place after the FED’s recent statements are in line with the market fabric and are necessary for healthier rises for the long term.

TECHNICAL ANALYSIS

BTC/USDT

At the last meeting of the year, the FED cut interest rates by 25 basis points in line with market expectations, bringing the federal funds rate to 4.25%-4.5%. Inflation data, which were previously announced above expectations, and growth rates remaining around 3% did not prevent the rate cut. Thus, the institution completed the year 2024 with a 100 basis point cut. On the other hand, FED Chairman Powell’s hawkish statements reduced the expectations for monetary easing in 2025 and reduced interest rate expectations to two. In response to a question about Bitcoin, Powell stated that they are prevented by law from owning Bitcoin and that they have no plans to change this situation.

When we look at the technical outlook with all these developments, BTC, which was priced at 104,000 levels before the interest rate decision, retreated sharply after the interest rate decision and came down to 100,200 levels. Then, the price, which received support from the SMA 100 daily level, recovered a little, but turned its direction down again and pinned the needle to the 98,800 level. BTC, which made a rapid recovery due to market dynamics, reached six-digit levels again. In BTC, which is currently trading at 101,250, we have previously stated that the momentum indicator weakened with the sell signal of technical oscillators. In this direction, we can say that the retreating price works in line with the technical. We continue to see that the sell signal continues and the momentum indicator moves in the negative zone. Although the support zone that we will encounter in a new selling pressure is the 99,100 level, the point that will appear as the resistance level as the price moves into the horizontal band range may be the 102,900 level.

Supports 101,400 – 100,350 – 99,100

Resistances 102,900 – 104,500 – 106,600

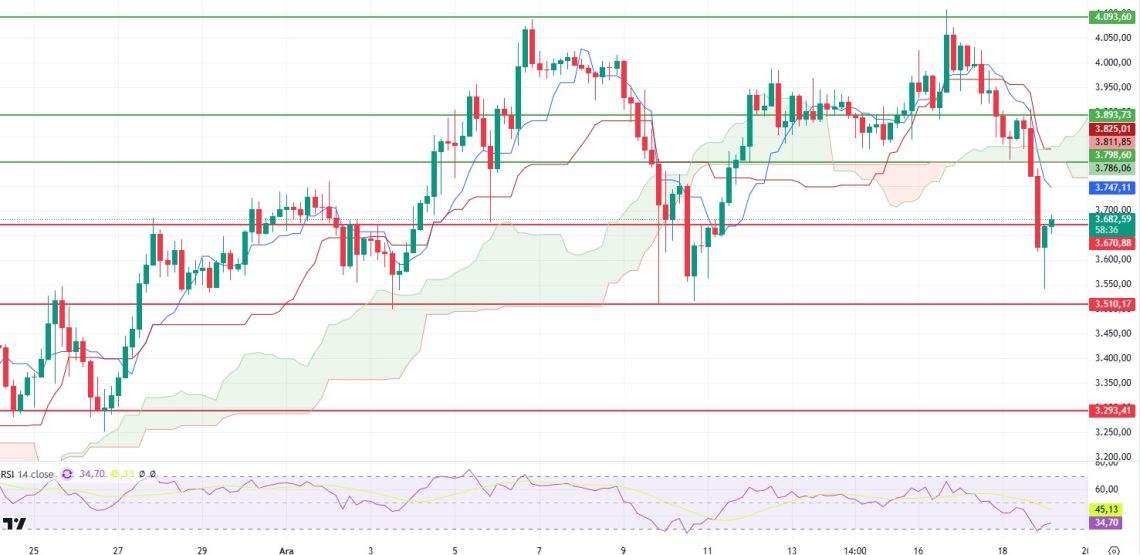

ETH/USDT

Yesterday, there was a sharp retreat in the Ethereum price after the FED’s interest rate decision and Chairman Powell’s hawkish statements. With this movement, ETH fell below the $ 3,670 level and fell to $ 3,542. However, Ethereum, which managed to recover with purchases from this level, managed to regain the $ 3,670 level in the morning hours.

From a technical perspective, the previously mentioned sell signal on the Ichimoku indicator seems to have come into play with the downside break of the kumo cloud level. This suggests that the decline is technically supported and the market is showing weakness at these levels. However, the RSI (Relative Strength Index) quickly recovered after falling into oversold territory and reached 35. This can be considered as a short-term positive reversal signal. In addition, the Cumulative Volume Delta (CVD) data suggests that the rebound was largely driven by spot markets. This supports the idea that the buying is more organic and the market is trying to regain strength.

In the coming period, it is critical for Ethereum to remain above the $3,670 level. Maintaining this level could support the price’s rise towards the kumo cloud resistance at $3,798. However, closes below this level may cause the price to show weakness again and retreat towards the $3.510 band. In the short term, these levels will be decisive for both buyers and sellers. In particular, the volume profile and market reactions will provide important signals about the direction of the price.

Supports 3,670 – 3,510- 3,293

Resistances 3,798 – 3,893 – 4,093

XRP/USDT

Yesterday, there was a significant pullback in XRP price after the Fed’s rate decision and Chairman Powell’s hawkish comments. The price briefly dipped below the kumo cloud support at 2.27, creating a wick, but managed to recover quickly from this area. Despite this rebound, a sell signal was observed at the intersection of the tenkan and kijun levels on the Ichimoku indicator. This signal signals weakness in the short-term direction of the market.

In terms of technical analysis, the kumo cloud support at 2.27 plays a critical role. If the price falls below this level permanently, selling pressure is likely to increase and the price is likely to move towards lower support levels. Especially at this point, a breakout with an increase in volume may lead to deeper declines. On the other hand, the 2.46 level stands out as an important resistance. Breaching this level could neutralize the sell signal in technical terms and signal the beginning of a new uptrend for XRP.

In the current situation, XRP’s movement within the kumo cloud should be carefully monitored. Especially volume and volatility dynamics will be decisive for the positions to be taken at these levels. Maintaining the 2.27 level creates a positive scenario for buyers, while the market sentiment is likely to change positively by exceeding the 2.46 level. However, continued price fluctuations between these two critical levels may indicate that the market will move in uncertainty.

Supports 2.2749 – 1.9101- 1.6309

Resistances 2.4602 – 2.6173 – 2.8528

SOL/USDT

After the Fed’s announcement yesterday, the interest rate was cut by 25 basis points. However, cryptocurrency markets plummeted after Powell’s hawkish comments. SOL has fallen nearly 4% since the announcement and is priced at $209.00 at the time of writing. After this price volatility, $18.1 million in SOL long positions were liquidated.

On Oncahin, the daily transaction volume on the Solana network has increased to over 66.9 million, the highest among all blockchain ecosystems. At the same time, transaction volume has increased recently.

SOL kept pace with the market’s decline and the fall deepened. The asset is in the middle of a broad downtrend and the price is in the middle of a downtrend. On the 4-hour timeframe, the 50 EMA (Blue Line) started to hover below the 200 EMA (Black Line). Will this end the bull in the asset? Although there was downward momentum from the resistance level, the asset managed to stay within the downtrend. When we analyze the Chaikin Money Flow (CMF)20 indicator, the increase in money outflows increases selling pressure. However, Relative Strength Index (RSI)14 is moving from the neutral zone to the oversold zone. On the other hand, there is a mismatch between RSI (14) and the price. This may push the price of SOL higher. The 222.61 level stands out as a very strong resistance point in the rises driven by both the upcoming macroeconomic data and the news in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements for the opposite reasons or due to profit sales, the support levels of 189.54 and 181.75 can be triggered again. If the price hits these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 200.00 – 189.54 – 181.75

Resistances 209.93 – 222.61 – 237.53

DOGE/USDT

After the Fed’s announcement yesterday, the interest rate was cut by 25 basis points. However, cryptocurrency markets plummeted after Powell’s hawkish comments. DOGE has fallen 6.57% since the announcement and is priced at 0.36253 at the time of writing. After this price fluctuation, $22.14 million was liquidated in DOGE long positions.

Since December 8, the asset has been in a downtrend, with the downtrend stemming from BTC’s usual declines in the market. Although it has been moving sideways for a long time, it could not prevent it from breaking the 200 EMA (Black Line) and the 0.36600 level downwards. On the 4-hour timeframe, the 50 EMA (Blue Line) is above the 200 EMA (Black Line). However, when we examine the Chaikin Money Flow (CMF)20 indicator, there are money outflows and suppress the price. However, Relative Strength Index (RSI)14 has reached the oversold zone from the neutral zone level. The 0.42456 level stands out as a very strong resistance point in the rises driven by both the upcoming macroeconomic data and the innovations in the Doge coin. If DOGE catches a new momentum and rises above this level, the rise may continue strongly. In case of possible pullbacks due to macroeconomic reasons or negativities in the ecosystem, the 0.33668 support level is an important support level. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.33668 – 0.28164 – 0.25025

Resistances 0.36600 – 0.42456 – 0.45173

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.