MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 97,052.46 | 2.30% | 57.00% | 1,92 T |

| ETH | 3,227.98 | 1.51% | 11.54% | 389,23 B |

| XRP | 2.850 | 12.62% | 4.87% | 164,16 B |

| SOLANA | 189.08 | 1.61% | 2.72% | 91,67 B |

| DOGE | 0.3606 | 4.96% | 1.58% | 53,25 B |

| CARDANO | 1.0288 | 7.46% | 1.07% | 36,19 B |

| TRX | 0.2239 | 0.24% | 0.57% | 19,29 B |

| AVAX | 36.95 | 4.24% | 0.45% | 15,19 B |

| LINK | 20.52 | 4.88% | 0.39% | 13,09 B |

| SHIB | 0.00002147 | 0.52% | 0.37% | 12,65 B |

| DOT | 6.697 | 4.02% | 0.31% | 10,31 B |

*Prepared on 1.15.2025 at 07:00 (UTC)

WHAT’S LEFT BEHIND

SEC Chairman: We Never Declared Bitcoin and Ethereum to be Securities

In an interview with Yahoo Finance, SEC Chairman Gary Gensler stated that the SEC has never stated that Bitcoin and Ethereum are securities. Gensler said that the SEC has not confirmed the non-securities status of these assets, but that they are not considered securities.

SEC Sues Elon Musk Over Twitter Share Purchase

The SEC sued Elon Musk for failing to properly disclose regulatory information when acquiring more than 9% of Twitter shares. Musk allegedly delayed the purchases by 11 days and continued to buy Twitter shares at low prices, saving $150 million in the process. Musk’s lawyers described the lawsuit as “nonsense”.

WLFI Deposits 11,918 ETH on a Centralized Exchange

Donald Trump’s World Liberty Finance Fund (WLFI) conducted a large-scale transaction on January 15. According to Spot On Chain data, the fund deposited 11,918 ETH (at a trading price of $3.229) on Coinbase Prime, worth approximately $38.5 million.

Deribit’s Valuation Could Reach $5 Billion

Crypto options trading platform Deribit is attracting interest from potential buyers, suggesting it could reach a valuation of $5 billion. The platform is partnering with financial advisor Financial Technology Partners. Dubai-based Deribit FZE provides services to institutional clients, while retail clients are served through the Panama-based company. Founded in 2016, Deribit is headquartered in the Netherlands.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Previous |

|---|---|---|

| Ethena USDe (USDE): DRV Launch | ||

| Sei (SEI): 55.56M Token Unlock | ||

| Starknet (STRK): 64M Token Unlock | ||

| aelf (ELF): V1.12.0 Upgrade | ||

| Livepeer (LPT): Treasury Talk | ||

| Solana (SOL): HackathonSolana event at Alliance in New York | ||

| 13:30 | US CPI (MoM) (Dec) | 0.3% |

| 13:30 | US Core CPI (MoM) (Dec) | 0.3% |

| 13:30 | US CPI (YoY) (Dec) | 2.9% |

| 13:30 | US Core CPI (YoY) (Dec) | 3.3% |

| 13:30 | US NY Empire State Manufacturing Index (Jan) | 2.7 |

| 14:20 | US FOMC Member Barkin Speaks | |

| 15:00 | US FOMC Member Kashkari Speaks | |

| 16:00 | US FOMC Member Williams Speaks | |

| 17:00 | US FOMC Member Goolsbee Speaks | |

| 19:00 | US Beige Book |

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

Focusing on today’s critical Consumer Price Index (CPI) data from the US, global markets had the opportunity to continue recovering their losses after yesterday’s Producer Price Index (PPI) came in below expectations. News that Trump’s team was planning a smooth transition on tariffs had given some relief to the markets ahead of the PPI and today’s set is of great importance for macro indicators to support risk appetite.

Ahead of the data, there is a slightly positive outlook in global stock indices and futures contracts. While the rise in the dollar index and US bond yields was somewhat accretive, we also saw positive reflections on the digital assets front. In major crypto assets, the news flow for XRP provided a higher dose of bullishness, contributing more to the divergence and overall upward movement.

CPI data, which will give important clues about the US Federal Reserve’s (FED) interest rate cut course, will be decisive for asset prices in the rest of the day. You can review our weekly report for detailed information about the possible effects on the market. Click here for Darkex weekly Strategy Report.

From the short term to the big picture.

The victory of former President Trump on November 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our predictions. Afterwards, the appointments made by the president-elect and the increasing regulatory expectations for the crypto ecosystem in the US and the emergence of BTC as a reserve continued to take place in our equation as positive variables. Although it is expected to continue at a slower pace, the preservation of expectations that the FED will continue its interest rate cut cycle (for now) and the volume in ETFs based on crypto assets indicating an increase in institutional investor interest support our upward forecast for the big picture for now. In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional pauses or pullbacks in digital assets. However, at this point, it is worth emphasizing again that we think the fundamental dynamics continue to be bullish.

TECHNICAL ANALYSIS

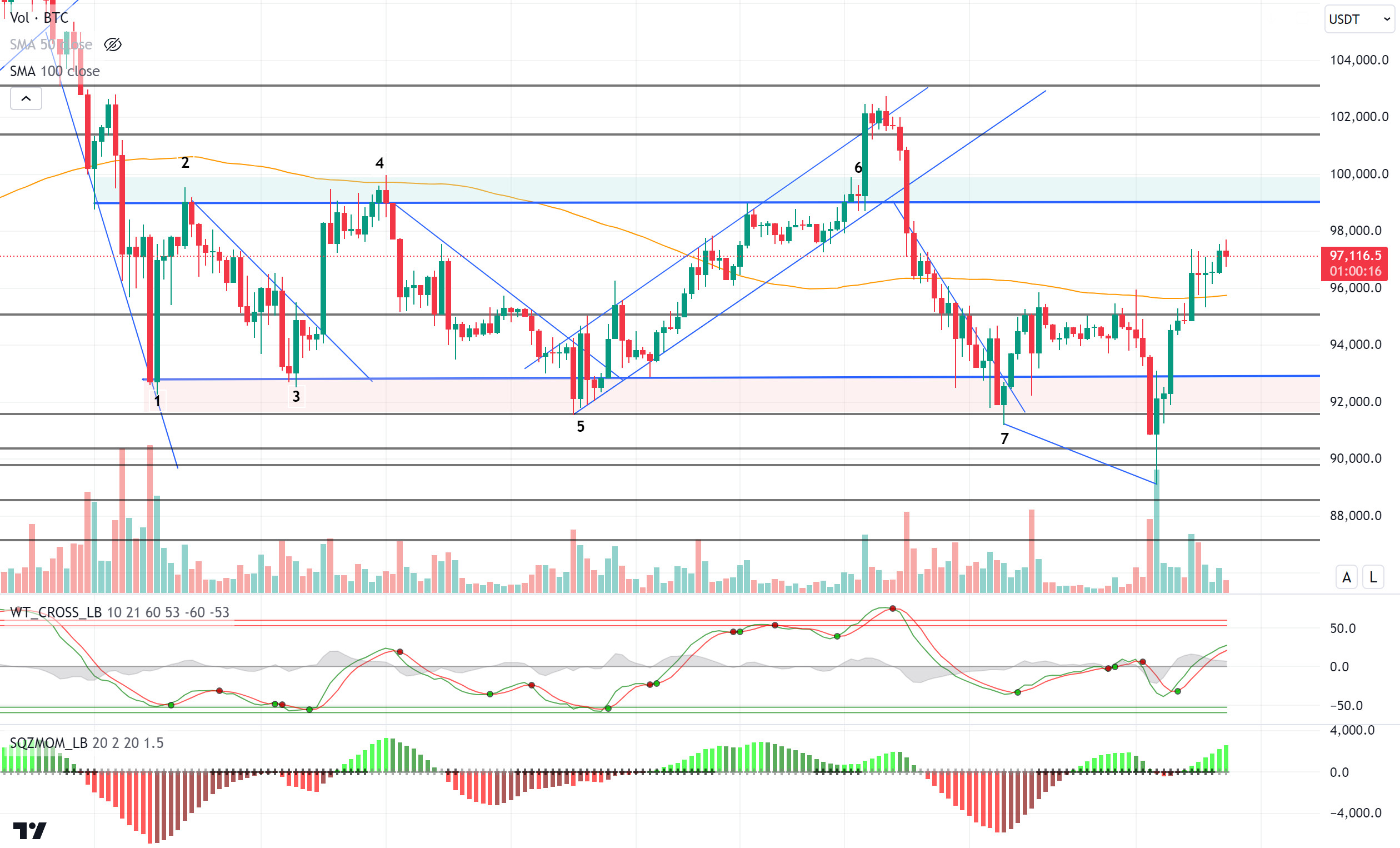

BTC/USDT

FTX’s debt restructuring plan officially went into effect as of January 3, 2025. The first batch of payments will be made within 60 days of the plan coming into effect. Approximately USD 1.2 billion in compensation is expected to be paid in the first phase of the plan, while the total amount of funds to be paid will be USD 16.5 billion. With the payment of these funds, it is considered a strong possibility that new liquidity will enter the market and this will have a positive impact on the market.

On the other hand, US CPI data, one of the factors that will increase volatility, will be released today. According to the data released yesterday, annual PPI was 3.3%, slightly below the expectation of 3.4%, while monthly PPI increased by 0.2%. In addition, the data released last Friday in the US pointed to a strong employment market, leading to a change in easing expectations for the FED.

When we look at the technical outlook, BTC, which caught an uptrend after pinning the 89,100 level, continues to hold on to its recent top. While technical oscillators continue to signal buying in BTC, which is currently trading at 97,100 above the 95,000 point, which is the major resistance level, we see that the momentum indicator is regaining strength. In the continuation of the rise, 98,000 and 99,100 levels can be targeted, which are the regions where the liquidation weekly short transaction accumulation we mentioned earlier. The negative streak of spot ETFs, one of the most important driving forces in testing these levels, may need to end. On a possible pullback, we will monitor whether the price will touch the 95,700 line, the level where the SMA crosses the 100-day moving average.

Supports: : 95,000 – 92,800 – 91,700

Resistances 97,200 – 98,100 – 99,100

ETH/USDT

ETH, which experienced a slight pullback yesterday evening, managed to climb back above the 3,200 level. However, trading volume remained low, indicating a lack of momentum in the market.

The Relative Strength Index (RSI) shows that the negative divergence continues and is moving downwards, indicating that the current momentum of the price is weak. Chaikin Money Flow (CMF), on the other hand, has turned upward despite the downward trend observed yesterday and can be considered as a sign that capital flow may turn positive. According to the Ichimoku indicator, the price is still hovering below the kumo cloud, but the tenkan level crosses the kijun level upwards, indicating the potential for a recovery in the short term.

If ETH can eliminate the negative divergence on the RSI by gaining the 3,293 level, the chances of the uptrend continuing will strengthen. In this case, the next target of the price can be considered as the 3,382 level. However, 3,131 support plays a critical role and a sustained break below this level could trigger a deepening correction, increasing selling pressure. In order for Ethereum to continue its upward movements, an increase in trading volume and the negative divergence in the RSI must be eliminated.

Supports 3,131 – 2,992 – 2,890

Resistances 3,293 – 3,382 – 3,452

XRP/USDT

XRP continues to continue its rally with the strengthening of ETF expectations. XRP, which broke the 2.61 and 2.72 resistance levels with the rise yesterday, managed to rise to 2.85 resistance. Although ETF rumors are likely to drive the price to higher levels, it can be said that there are a few issues that require caution in technical indicators.

First of all, it can be said that the descending triangle breakout supports the positive outlook. However, there may be some retracement as the Relative Strength Index (RSI) indicator enters the overbought zone and is at a very critical resistance zone. Chaikin Money Flow (CMF) can also be listed as one of the factors that strengthen this pullback potential by failing to support the rise. However, a possible break of the 2.85 level with positive news may cancel the negative picture and bring much sharper rises.

Supports 2.7268 – 2.6180 – 2.4702

Resistances 2.8580 – 2.9851 – 3.1991

SOL/USDT

Solana introduces Roam, a decentralized WiFi network designed to transform global connectivity. On-chain analytics firm Bubblemaps announced today the launch of its BMT token on Solana. Meanwhile, FTX/Alameda completed its monthly distribution, transferring $32.35 million worth of SOL out of the stake and distributing it to 20 addresses. Solscan data shows that the account still has 6.47 million SOLs locked up, worth more than $1 billion. Pump.fun celebrated its first birthday by surpassing $400 Million in annual revenue.

Solana has remained sideways since our analysis yesterday. On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be below the 200 EMA (Black Line). At the same time, the 50 EMA is working as resistance to the asset. When we examine the Chaikin Money Flow (CMF)20 indicator, it is seen that it is in the positive zone and money inflows have increased. However, the Relative Strength Index (RSI)14 indicator has moved from the oversold level to the positive zone. At the same time, positive mismatch seems to have worked. The 200.00 level appears to be a very strong resistance point in the rises driven by both the inflation data coming from the US today and the news in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements for the opposite reasons or due to profit sales, the 163.80 support level can be triggered. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 181.75 – 170.72 – 163.80

Resistances 189.54 – 200.00 – 209.93

DOGE/USDT

Doge jumped over 11% from $0.31000 to over $0.35500. According to CoinGecko data, Dogecoin (DOGE) is the fastest growing asset in the top 25, with a market capitalization of over $53 billion. Futures open interest (OI) has increased by 35% in the last 5 days, nearing the previous market peak of $4.51 billion.

Doge has continued its slight uptrend since our analysis yesterday. Looking at the chart, the asset broke the 50 EMA (Blue Line) and 200 EMA (Black Line) to the upside on the 4-hour timeframe. This could be a bullish harbinger. However, the rising wedge pattern should be taken into consideration. This may cause the price to retreat. On the other hand, a double bottom formation has been formed. When we examine the Chaikin Money Flow (CMF)20 indicator, it moved from the negative zone to the positive zone. However, it seems that money outflows have increased slightly. However, Relative Strength Index (RSI)14 retreated slightly from the overbought zone and the bulge was eliminated. The 0.39406 level appears to be a very strong resistance point in the rises due to political reasons, macroeconomic data and innovations in the DOGE coin. In case of possible pullbacks due to political, macroeconomic reasons or negativities in the ecosystem, the 0.28164 level, which is the base level of the trend, is an important support. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.33668 – 0.30545 – 0.28164

Resistances 0.36600 – 0.39406 – 0.42456

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.