MARKET SUMMARY

Latest Situation in Crypto Assets

Cryptocurrency Market Data

| Assets | Last Price | 24h Change | Dominance | Market Cap |

|---|---|---|---|---|

| BTC | 60,579.00 | -0.61% | 56.46% | 1.20 T |

| ETH | 2,404.00 | 0.09% | 13.65% | 289.45 B |

| SOLANA | 141.08 | 0.45% | 3.12% | 66.24 B |

| XRP | 0.5339 | 1.23% | 1.43% | 30.25 B |

| DOGE | 0.1076 | -0.47% | 0.74% | 15.75 B |

| TRX | 0.1588 | -0.49% | 0.65% | 13.75 B |

| CARDANO | 0.3420 | 0.70% | 0.56% | 11.96 B |

| AVAX | 25.97 | -0.58% | 0.50% | 10.56 B |

| SHIB | 0.00001678 | -1.93% | 0.47% | 9.89 B |

| LINK | 10.60 | -0.79% | 0.31% | 6.64 B |

| DOT | 4.076 | 0.31% | 0.29% | 6.13 B |

*Prepared on 10.11.2024 at 06:00 (UTC)

WHAT’S LEFT BEHIND

US September CPI

US September CPI rose faster than expected, disappointing, and there is talk that the possibility of a pause at the Fed’s meeting in November may increase.

BlackRock Has a Competitor!

Fidelity Investments is planning to launch a money market fund that can trade using Blockchain technology. The move comes as competition heats up after BlackRock launched a similar product.

Mt. Gox Bitcoin Refunds

Crypto exchange Mt. Gox, with court approval, extended the repayment period for creditors after the 2014 attack until October 31, 2025. This extension aims to ensure that creditors receive their compensation.

HIGHLIGHTS OF THE DAY

Important Economic Calendar Data

| Time | Country | News | Expectation | Previous |

|---|---|---|---|---|

| World Blockchain Summit Continues | ||||

| Token Unlock: 11.31M Aptos (APT) | ||||

| 12:30 | US | Core PPI (MoM) (Sep) | 0.2% | 0.3% |

| 12:30 | US | PPI (MoM) (Sep) | 0.1% | 0.2% |

| 13:45 | US | FOMC Member Goolsbee Speaks | ||

| 14:00 | US | Michigan Consumer Sentiment (Oct) | 70.9 | 70.1 |

| 14:45 | US | FOMC Member Logan Speaks | ||

| 17:10 | US | FOMC Member Bowman Speaks |

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

Yesterday, US September inflation and Jobless Claims data, which came in above market expectations, were followed by losses in equity markets and digital assets. Although they did not cause a major change in market expectations, investors seem to be worried about inflation and the labor market after these data releases. US indices closed in the red yesterday, while Asia was relatively mixed. European indices are expected to start the day with a slight sell-off.

The US dollar fluctuated after yesterday’s data and continues to hold on to its recent gains. Expectations for another rate cut by the Federal Reserve (FED) on November 7th remain unchanged. According to the CME Fedwatch Tool, the probability of the Fed cutting interest rates by 25 basis points on November 7th is around 88%. The evaluations of the FED officials who made speeches after the inflation figures also gave the impression that interest rate cuts may continue. However, only Atlanta Fed President Raphael Bostic made a statement that a rate cut could be passed in November. Producer Price Index (PPI) data to be released today will be closely monitored as it may have an impact on asset prices on the last trading day of the week for traditional markets.

In addition to these headlines in the world’s largest economy, markets are also following China. The country is expected to announce new and strong fiscal stimulus on Saturday. According to a Bloomberg survey, the size of the stimulus is estimated to be around 2 trillion yuan ($283 billion). There is also talk that Beijing may wait until next month’s National People’s Congress to announce new fiscal stimulus measures. With so many market expectations, we don’t think Beijing will skip Saturday. However, there are still details to pay attention to. If the size of the announced package is below market expectations, this may suppress risk appetite and increase pressure on digital assets. Therefore, it seems necessary to see a package at or around the size of market expectations for a recovery after recent losses.

After the inflation data, the losses in digital assets during the US session were recovered with some recovery. However, today’s US PPI data and tomorrow’s Chinese Finance Ministry announcements are important for this uptrend to continue. Although we think that there is a positive outlook for the long term, it seems necessary for the short-term direction that these two developments have a tone that will support the risk appetite.

TECHNICAL ANALYSIS

BTC/USDT

Inflation data that came above expectations with the US September CPI caused a retreat in crypto assets. The deviation in inflation expectations has reduced the FED’s interest rate cut rate in November to 25 basis points for the time being. Although it is unlikely, it was claimed that some authorities were talking about the possibility of a pause in interest rate cuts in November. As the middle of October approaches, a very intense agenda that will affect the crypto market will be waiting for us. In this process, volatility in the values of digital assets can be expected to increase.

In the BTC 4-hour technical analysis chart, we drew attention to the 59,000 levels where “long” transactions were predominant in our previous analysis. With the breakout of the support level of 60,650, BTC experienced a pullback towards the 59,000 level, causing a high level of liquidation. BTC, which took a short time to recover from this region, came back above 60,000 levels and is currently pricing at the resistance level of 60,650. As a matter of fact, our technical indicator wave trend oscillator may be producing a buy signal, indicating that the trend may reverse. BTC, which is priced within the falling trend channel, crossing the fibonacci 0.236 (61,365) level may end the falling trend channel and create a new bullish channel. In the possible sales wave with the news flow that may be experienced on the agenda, the support level we will encounter may be 59,780 points.

Supports 59,780 – 58,350 – 56,400

Resistances 60,650 – 61,365 – 62,350

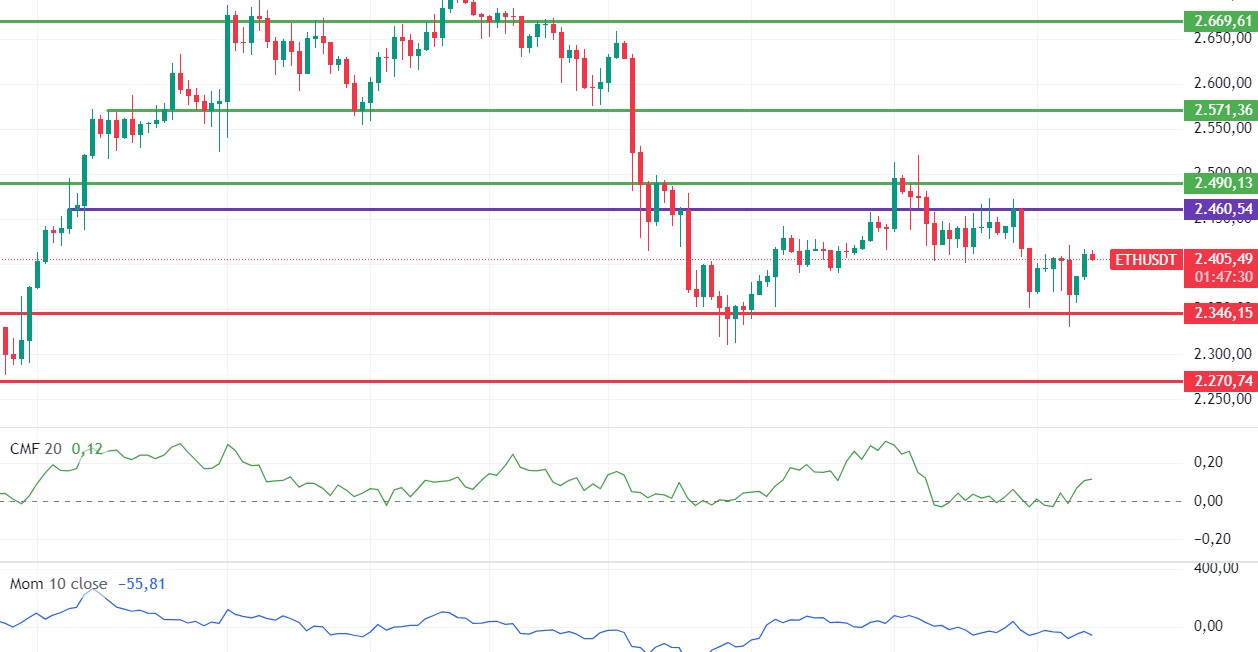

ETH/USDT

Ethereum, which fell to the 2,346-support level with the loss of the 2,400 level, is pricing above 2,400, taking a reaction from this region, with Bitcoin exceeding the 60,000 level again. The most striking thing is that CMF has moved up after a long time. Recent purchases in CVDs seem to be spot weighted. In addition, the deep decline in the Long/Short Ratio can be seen as one of the catalysts that will have a significant positive impact on the price. We may see rises up to 2,460 levels during the day. However, the momentum turned negative again, indicating that closes below 2,400 may bring rapid declines to 2,346 levels.

Supports 2,400 – 2,346 – 2,270

Resistances 2,460 – 2,490 – 2,571

LINK/USDT

Although LINK fell below the main support level of 10.52, it quickly recovered and rose to the lower band of the rising channel again. With positive mismatches on RSI and MFI, a positive outlook has been formed on CMF. The kijun level for LINK, which has risen above the Tenkan level, also seems to have approached the 10.92 resistance. Provided that the 10.52 level is not lost, rises to 10.98 levels can be expected during the day. Loss of the 10.52 level may bring new lows.

Supports 10.52 – 10.17 – 9.89

Resistances 10.98 – 10.36 – 11.66

SOL/USDT

Increased trading volume in the Solana ecosystem indicates growing market interest and the potential for Solana’s recovery. According to data from Coinglass, Solana’s Open Interest (OI) has seen a notable increase. This increase in OI contributes to the bullish outlook by signaling an increase in investor confidence. A look at the CMF (20) indicator shows that inflows have been quite high. A break above 151.12 can be expected to confirm a significant bullish trend. The price has been accumulating in the 127.17 – 161.63 band since August 8. It encountered resistance from the Fibonacci retracement at 0.618 (151.12). On the 4-hour chart, the 50 EMA has broken the 200 EMA to the downside. This could mean that the decline could deepen. The 151.12 level stands out as a strong resistance place in the uptrend driven by both macroeconomic conditions and innovations in the Solana ecosystem. If it rises above this level, the rise may continue. In the sales that investors will make due to political and macroeconomic conditions, the support level of 131.80, which is the place of retreat, should be followed. If the price comes to these support levels, a potential bullish opportunity may arise.

Supports 137.77 – 135.18 – 131.80

Resistances 143.64 – 147.40 – 151.12

ADA/USDT

In the Cardano ecosystem, Cardano founder Charles Hoskinson emphasized that the negative perception is not due to failure but to the new Voltaire era. In a statement made on October 10 on the X platform, the founder discussed why negative sentiment about the network he founded has increased. Hoskinson stated that he thought he knew the reason for this increase in negative perception and clarified this situation in a long post published on X today. According to him, this is linked to the beginning of the Voltaire era, he emphasized, adding that the issues include “accumulated grievances, unprocessed roadmap elements, unfunded growth strategies, and necessary partnerships.” According to IntoTheBlock’s data, the ADA coin holding period has decreased by about 50% in the last seven days, indicating that many investors have sold the token. Technically, on the 4-hour chart, both the 50 EMA broke the 200 EMA to the downside and the strong support band of 0.3469 – 0.3444. This could be a sign that the decline may deepen. However, the price seems to have made a double bottom. If this pattern works, traders may consider this as a place to add to their positions. When we look at the CMF (20) indicator, we see that money inflows are quite high. ADA 0.3301- 0.3228 levels appear as a strong support in retracements with possible political and macroeconomic news. If whale purchases in the ecosystem continue, the 0.3651 level should be followed as a strong resistance.

Supports 0.3301 – 0.3228 – 0.3166

Resistances 0.3444 – 0.3469 – 0.3596

AVAX/USDT

AVAX, which opened yesterday at 25.76, rose slightly during the day and closed the day at 25.86. Producer price index data will be released by the US today. A decline in the producer price index above expectations may be priced positively. In addition, news flows from the Middle East will be important for the market.

AVAX, currently trading at 26.00, is moving in the upper band of the falling channel on the 4-hour chart. With the RSI value of 46, it can be expected to move from here to the middle band. In such a case, it may test the 25.60 support. Purchases may increase if there is a decline in the producer price index above expectations or positive news about the easing of tension in the Middle East. In such a case, it may test the 26.54 resistance. As long as it stays above 24.65 support during the day, the desire to rise may continue. With the break of 24.65 support, sales may increase.

Supports 25.60 – 24.65 – 23.90

Resistances 26.54 – 27.20 – 28.00

TRX/USDT

TRX, which started yesterday at 0.1605, fell 1% during the day and closed the day at 0.1588. Today, US producer price index data will be released. The market will also be closely following the news flows regarding the tension in the Middle East.

TRX, which is still trading at 0.1588, is moving in the Bollinger middle band on the 4-hour chart. With the RSI 53 value, it can be expected to rise slightly from its current level. In such a case, it may move to the Bollinger upper band and test the 0.1603 resistance. If the tension in the Middle East increases, it may test 0.1575 support with future sales. As long as TRX stays above 0.1482 support, the desire to rise may continue. If this support is broken downwards, sales can be expected to increase.

Supports 0.1575 – 0.1550 – 0.1532

Resistances 0.1603 – 0.1641 – 0.1687

XRP/USDT

After falling to 0.52 yesterday, XRP rose with the incoming purchases and the daily close was realized at 0.5303. Continuing its rise today, XRP tested the 0.5351 level after breaking the EMA20 level. In the 4-hour analysis, XRP continues to test the 0.5351 resistance level and may test the 0.5431-0.5515 resistance levels if it continues to rise with the candle closing above the resistance level. XRP may test the 0.5231-0.5131-0.5026 support levels with its decline if it fails to break the 0.5351 resistance level and declines with the sales that may come in its rise.

On the upside, XRP may fall with possible sales at EMA50 and 0.5431 and may offer a short trading opportunity. In its decline, it may rise with possible purchases at 0.52 and may offer a long trading opportunity.

EMA20 (Blue Line) – EMA50 (Green Line) – EMA200 (Purple Line)

Supports 0.5231 – 0. 5131 – 0.5026

Resistances 0.5351 – 0.5431 – 0.5515

DOGE/USDT

After falling to 0.1030 yesterday, DOGE closed the day at 0.1059 with the purchases. DOGE, which started today with a rise, rose to 0.1081 and then fell below the EMA20 level with the incoming sales. In the 4-hour analysis, DOGE, which tested the EMA20 level in the last candle, declined with incoming sales and is currently trading at 0.1077. If DOGE closes the candle above the EMA20 and 0.1080 resistance level with its rise, it may test the resistance levels of 0.1101-0.1122 in the continuation of the rise. With the sales that may come at these levels, it may test the support levels of 0.1054-0.1035-0.1013 in the continuation of the decline.

DOGE may decline on the rise with possible sales at EMA50 and EMA200 levels and may offer a short trading opportunity. In its decline, it may rise with possible purchases at 0.1035 and may offer a long trading opportunity.

EMA20 (Blue Line) – EMA50 (Green Line) – EMA200 (Purple Line)

Supports 0.1054 – 0.1035 – 0.1013

Resistances 0.1080 – 0.1101 – 0.1122

DOT/USDT

When we examine the Polkadot chart, the price broke the 4,080 resistance level upwards with the upward break of the descending channel on the RSI. If the price maintains above the 4.080 level, its next target may be the 4.180 level. On the other hand, if the 4.080 level is lost with increasing selling pressure, we can expect 4.010 support levels to be tested.

Supports 4.010 – 3.975 – 3.875

Resistances 4.080 – 4.180 – 4.210

SHIB/USDT

When we examine the chart of Shiba Inu (SHIB), the price is moving towards the upper band of the channel with the reaction from the lower band of the descending channel. If the RSI line breaks the descending channel upwards, we can expect the price to move towards 0.00001765 levels. On the other hand, if the selling pressure at 0.00001690 cannot be broken, the price may want to test 0.00001630 levels again.

Supports 0.00001630 – 0.00001565 – 0.00001505

Resistances 0.00001690 – 0.00001765 – 0.00001810

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.