What Awaits Us?

Macroeconomic Data

US Non-Farm Payrolls (NFP) – April 4

NFP data, one of the most important indicators of the health of the labor market, is critical for the Fed’s interest rate policies.

FED Chair Powell’s Speech – April 4

Fed Chairman Jerome Powell is expected to speak at the Society for Advancing Business Editing and Writing Annual Conference in Arlington.

US Consumer Price Index (CPI) – April 10

This data, which clarifies the inflation outlook, directly affects interest rate expectations in the markets.

European Central Bank (ECB) Interest Rate Decision – April 17

Economic recovery in Europe and the decisions to be taken in the fight against inflation may be decisive on the euro and global risk appetite. President Lagarde’s statements will also be carefully monitored.

US Gross Domestic Product (GDP) – April 30

A growth rate in line with expectations could support the economic soft-landing scenario. However, low growth could raise recession concerns.

US Personal Consumption Expenditures (PCE) – April 30

PCE, which is the Fed’s primary measure of inflation, will be decisive for the future of monetary policy. Deviations in the data may create volatility in the markets.

Other Developments

Trump’s Remarks on Tariffs – April 2

Donald Trump’s campaign rhetoric on trade policies may have an impact on global trade balances and market risk perception.

Discussions on New Regulatory Framework for Crypto Investments – April 11

Unclear regulatory uncertainties for crypto assets in the US may gain a new direction with this meeting. It is an important reference for institutional investors.

SEC Second Roundtable – April 25

This meeting, where the US Securities and Exchange Commission will continue its regulatory discussions on the crypto market, is critical for the future of the markets. ETF approval process and securities definitions may come to the fore.

Ethereum Testnet Pectra – April 30

Ethereum’s core developer Terence announced that the test network, called Pectra, is scheduled to go mainnet on April 30, 2025.

Crypto Insigth

| Market Overview | Current Value | Change (30d) |

|---|---|---|

| Bitcoin Price | 86,921 $ | -5.03% 📉 |

| Ethereum Price | 2,012 $ | -19.89% 📉 |

| Bitcoin Dominance | 61.70% | +0.33% 📈 |

| Ethereum Dominance | 8.70% | -15.85% 📉 |

| Total Market Cap | $2.8 T | -4.67% 📉 |

| Fear and Greed Index | Fear (40) | Extreme Fear (25) |

| Crypto ETFs Net Flow | $83.7 M | — |

| Open Interest – Perpetuals | $372.25 B | — |

| Open Interest – Futures | $4.01 B | — |

*Prepared on 27.03.2025 at 13:00 pm. (UTC)

Metrics – Summarize of the March

Flow by Asset

| Asset | Week 1 ($m) | Week 2 ($m) | Week 3 ($m) | Week 4 ($m) | Total ($m) |

|---|---|---|---|---|---|

| Bitcoin (BTC) | -2,598 | -756 | -978 | 724 | -140 |

| Ethereum (ETH) | -300 | -89.2 | -176 | -86 | -51 |

| XRP (Ripple) | 5.0 | 5.6 | 1.8 | 6.7 | 19.1 |

| Solana (SOL) | -7.4 | 16.4 | -2.2 | 6.4 | 13.2 |

| Litecoin (LTC) | 1.0 | — | -0.3 | — | 0.7 |

| Cardano (ADA) | -1.2 | -1.9 | 0.4 | 0.1 | 2.6 |

| SUI (SUI) | 15.5 | 2.7 | -0.6 | -1.3 | 16.3 |

| Other’s | 20.4 | -36.1 | -1.6 | -2.2 | -19.5 |

March got off to a weak start in terms of inflows into digital assets. While investor interest remained limited in the first half of the month, buying picked up in the second half and markets gained upward momentum.Net inflows into digital assets totaled $954 billion in March, down nearly 70% from the previous month. This reflected investors’ cautious stance at the beginning of the month.

Total Market Cap

The total value of the cryptocurrency market fell below an important threshold level of $3 trillion at the beginning of March. Following this decline, the market reached a monthly low of $2.44 trillion on March 11. At this point, there was a pullback of around 11.05%. However, a recovery began, and the market capitalization rose as high as $2.86 trillion. Currently, the total value of the cryptocurrency market is around $2.77 trillion. This represents an increase of 1.51% and a gain of approximately $39.38 billion for the month of March.

Spot ETF

As we reached the end of March, Bitcoin ETFs saw a net outflow of $615.2 million. In the first half of the month, the BTC price dropped to $76,750 due to serious fund outflows of approximately $1.6 billion, while the Bitcoin price recovered in the second half of the month with a positive fund flow of approximately $1 billion. April will be critical for Bitcoin ETFs.

Spot Ethereum ETFs saw net outflows totaling $395.9 million in March. During the month, the Ethereum price fell 22.35% to $1,756 from $2,236 at the start of the month. Due to market uncertainty, Ethereum ETFs saw negative net flows on almost every trading day during March, bringing the total cumulative net inflows of Ethereum ETFs since launch to $2.4 billion, with outflows. In April, ETF inflows can be expected to turn positive again with the fundamental developments in the rest of the report.

Options Data

While about $2.36 million worth of Bitcoin options contracts expired in the first week of March, this figure rose to $12.18 billion by the end of the month. The end of the first quarter of the year seems to be effective in this increase. Call options were mainly concentrated in the $90,000-$93,000 band with a total of 420.26 thousand expiry transactions. Put options stood out in the $80,000-$83,000 range with 307.98 thousand transactions. Put/Call ratio was realized at 0.89, while the maximum pain point was realized at $85,000 on average.

In the Ethereum options market last month, it was noteworthy that Put options were more intense than Call options. While there was a significant volume of Put options, especially at the $1,980 level, this region stood out as an important support point. On the other hand, the $2,100 level, where Call options were concentrated, was considered as the resistance zone in the market. The maximum pain point during the month was recorded at $2,030, while the Put/Call ratio stood at 0.51.

CryptoSide – Expectations of the April

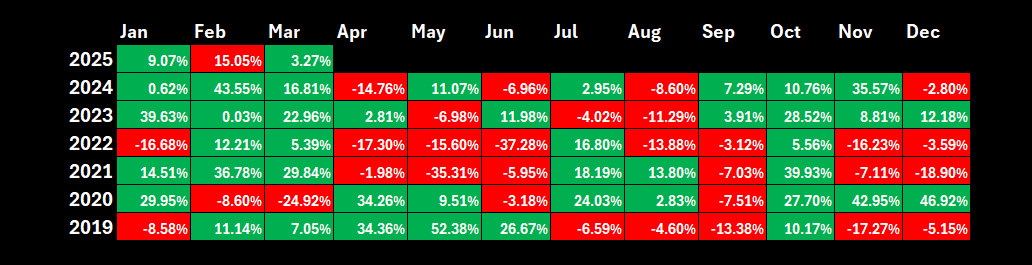

Nearing the end of March, Bitcoin fell sharply during the month to around $76,750. On a monthly basis, Bitcoin, which is in line with its March performances in previous years, is preparing for a positive month close with +3.27% despite this decline

Looking at the data of the last five years, April stands out as a period when declines are generally at the forefront. However, according to historical averages, Bitcoin returned an average of 12.98% in this month. What is noteworthy is that in April, when there are bullish months, there are usually strong and significant increases; on the other hand, declines are mostly limited. Last year in April, Bitcoin lost 14.76% of its value, it the second hardest declining month of the year. This year, the sharp pullbacks experienced in March make April performance more critical. In addition to the macroeconomic developments, we discuss in the rest of the report, the issue of tariffs that Trump has recently brought to the agenda stands out as the development that we expect to play a decisive role on Bitcoin price in April.

*Prepared on 27.03.2025 at 13:33 pm. (UTC)

Source: Darkex Research Department

Trump’s Tariffs

Expected to be announced on April 2, the new tariff plans are being closely monitored both in cryptocurrency markets and traditional financial markets. It is stated that these regulations, which are on the agenda of US President Donald Trump, will focus especially on countries and economic blocs with trade imbalances. Countries such as China, the European Union, Mexico, Vietnam, Taiwan, Taiwan, Japan, South Korea, Canada and India stand out among the countries likely to be targeted.

Content of Tariffs

The White House has reshaped its approach to tariffs, the Wall Street Journal reported on Monday. While the US administration has suspended for the time being comprehensive tariffs on automobiles, pharmaceuticals and semiconductors, it plans to continue with reciprocal tariffs. The previously proposed approach of categorizing countries into high, medium and low tariff levels has been shelved. Instead, the aim is to set tariff rates specific to each country.

Possible Effects of Tariffs on Markets

The new tariffs are expected to put pressure on US imports, leading to an increase in the prices of imported goods and thus having a negative impact on consumer spending. This could increase the risk of a global trade war and put upward pressure on inflation. Fed official Musalem’s warning that the impact of the tariffs may not be temporary further deepens the fragility in the markets.

Crypto markets have also been directly affected by this uncertainty. Bitcoin, in particular, has lost more than 30 percent of its historical peak in recent weeks. Although the markets show signs of recovery from time to time, selling pressure continues due to increasing uncertainty. While new tariff decisions from Trump in early April are expected to have a high impact on the market, the more flexible implementation of tariffs remains on the agenda. New statements from the parties will be decisive on the direction of the market. While short-term declines are likely in unfavourable scenarios, if the worst is left behind later in the month, the possibility of a gradual recovery in crypto assets may gain strength.

Market Pulse

Introduction and Summary – On the Brink of April 2nd: New Era Begins with Tariff Uncertainty

Global markets continue to experience how important developments in the massive US economy are. After a challenging month, the digital asset ecosystem is preparing for a new and high-risk April. Of course, the most important variable is the “tariff uncertainty” that started with Donald Trump…

The new US President remains firmly committed to the “America First” policy. However, the rapidity with which his decisions change puts a strain on financial markets and investors, who must take new positions every day. If there are no new developments and everything proceeds as previously discussed, the US’s high tariff rates will be implemented on April 2. But last-minute talks, potential deals and negotiations are likely to continue. Still, the President’s course will be bumpy. We will see more clearly in the coming period whether the world economy can avoid a global trade war.

Geopolitical developments in the Middle East, Europe and in Ukraine, Trump’s tariff threats, recession (perhaps stagflation) and expectations regarding the US Federal Reserve’s monetary policy course will continue to be the determining dynamics in capital markets. For now, the wait for a “new catalyst” for cryptocurrencies seems to continue. Because it seems that the US will follow a path of not selling what it has captured rather than buying new BTC on the Strategic Crypto Reserve. Perhaps a potential change in this issue could form the basis for a new wave of uptrend in digital assets. However, in this process, the equation regarding the global economy will need to be supportive. In this respect, macro indicators from the US are giving mixed signals. Meanwhile, we believe that the deterioration in the country’s consumer confidence should also be taken seriously.

We continue to stand by the following points that we underlined in our strategy report last month and we are not making any major changes in the course we have drawn for April.

“To summarize all this, we will continue to watch the macro indicators for the US economy. Both as a “reason” to see the “consequences” of Trump uncertainty and as a “reason” to predict what the Fed’s next step will be…”

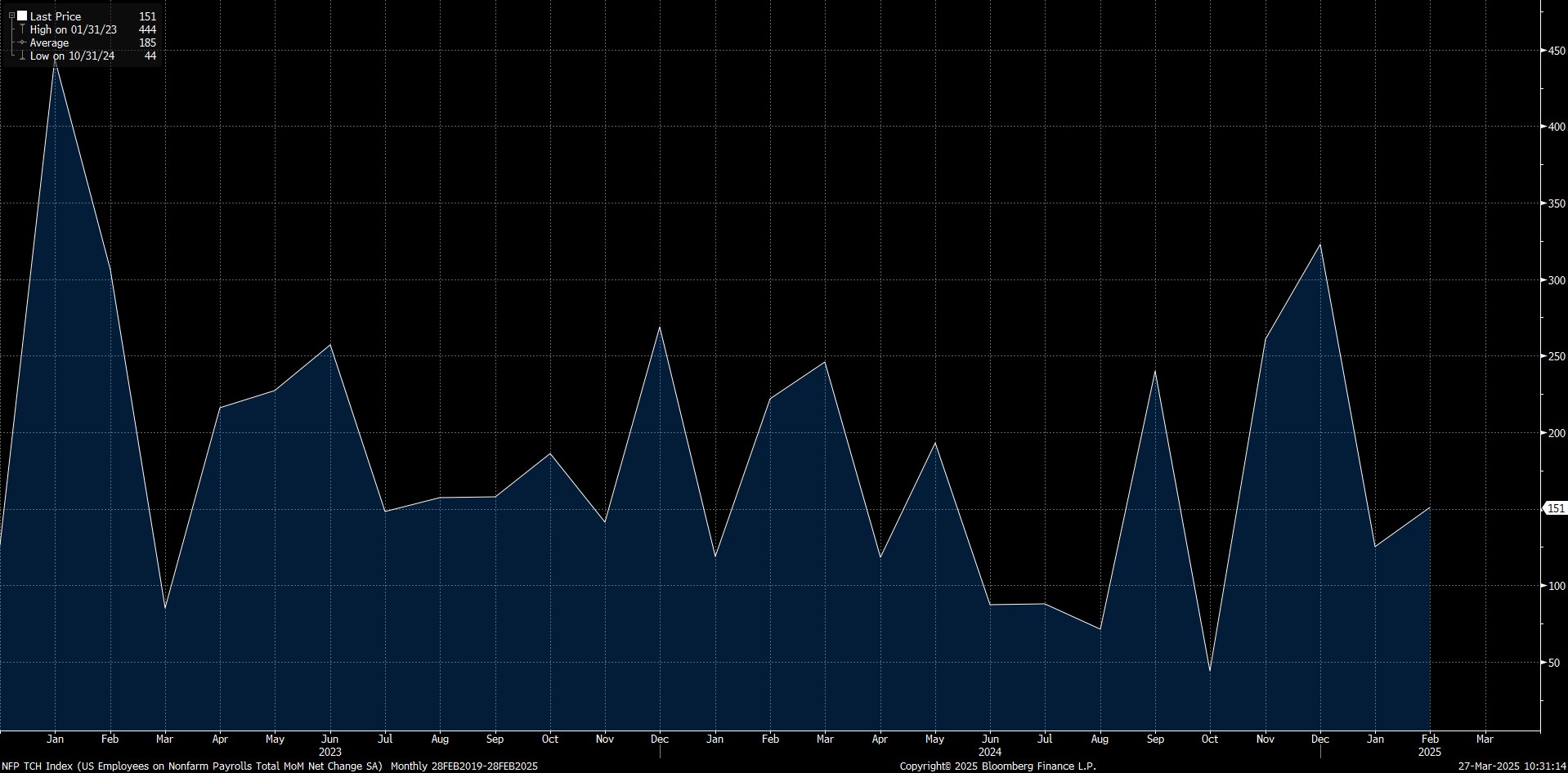

April 4 – US Labor Market Statistics

At the beginning of the fourth month of the year, on April 4th, we will be receiving the Non-Farm Payrolls (NFP) data for March, which will provide clues about the US Federal Reserve’s rate cut path and the tightness of the financial ecosystem in the coming period. In addition, March figures such as average hourly earnings and the unemployment rate will also be monitored.

In February, the US economy added 151K jobs in line with our expectations (Market Expectation: 159K, Our Expectation: 150K).

Source: Bloomberg

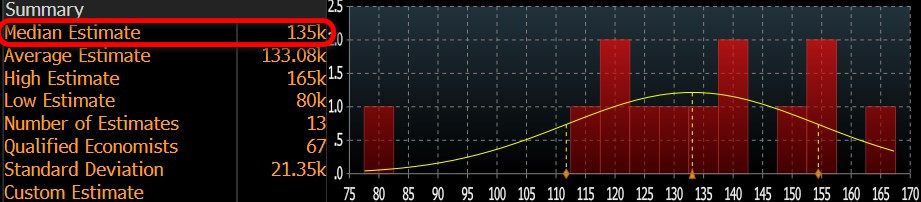

Our forecast for the highly sensitive NFP data is that the US economy added approximately 148K new jobs in the non-farm sectors in March. At the time of writing, although the number of forecasts entered is small, we see that the consensus on the Bloomberg terminal is more pessimistic, around 135 thousand.

Source: Bloomberg

We believe that if the March NFP data, which will be published in the shadow of the deterioration that Trump’s tariff-centered foreign policy may create domestically, is slightly below expectations, this will be priced as a metric that may create an expectation that the FED may act more boldly to lower the interest rate, thus increasing the risk appetite and having a positive impact on financial instruments, including digital assets. We think that a slightly higher-than-expected data may have a similar but opposite effect. However, a much lower than expected NFP data could reignite concerns about stagflation with a commentary on the health of the US economy, which could put selling pressure on assets considered to be risky. It should be noted here that we also expect a much better-than-anticipated reading to have a positive impact. It is worth noting that we anticipate these effects by considering the current state of market sentiment.

April 4 – FED Chair Powell’s Speech

On April 4, FED Chairman Jerome Powell is expected to deliver a speech at the Society for Advancing Business Editing and Writing Annual Conference in Arlington. Powell’s guidance will be important after the pricing following the employment data. We will closely follow what he will say about the new economic ecosystem that will be shaped by tariffs and how the FED will follow a path in the face of this.

According to the CME Fedwatch Tool, at the time of writing, markets were pricing in a 61% chance that the Federal Open Market Committee (FOMC) would cut rates by 25 basis points at its meeting on June 18. Potential statements from the chairman could lead to a change in this expectation, which could cause markets to price in some harsh pricing. If Powell sends a message that there should be no rush to cut rates, this could lead to a decline in risk appetite and widen the depreciation of digital assets. However, if the Chairman emphasizes the necessity of rate cuts, we may see the opposite effect. At this point, it is worth underlining the following. If Powell is more concerned than before about the potential impact of Trump’s policies on the US economy, this could have the effect of both increasing the rate cut and reducing risk appetite in the markets. In this respect, we think it is important to understand the Fed Chairman’s attitude as well as his words.

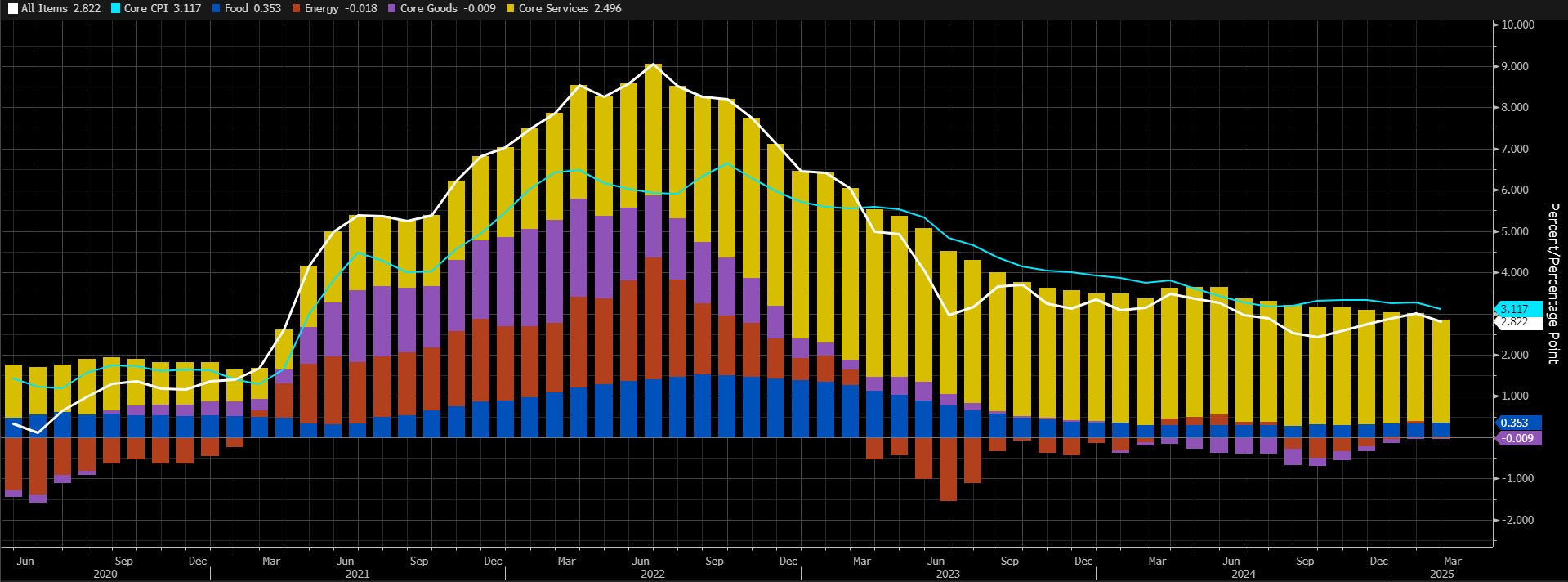

April 10 – US Consumer Price Index: CPI

The Consumer Price Index (CPI) change in February came in at 2.8% year-on-year. This was already in September 2024, when a reading of 2.4% marked the lowest inflation increase since February 2021. So since September, the CPI has been pointing to higher increases, until the February data. We can say that the FED has followed a criticizable path on inflation recently. The interest rate cuts last year, which shifted the focus from controlling inflation to the labour market, seem to have disrupted the control on price increases. Moreover, the new US President Trump’s pro-economic growth and pro-spending stance and the additional costs that tariffs may bring increase the risk of inflation becoming a bigger problem in the future. Still, the February data broke a streak of 4 consecutive months of rising inflation and perhaps gave Powell and his team some relief. However, we think it is not right to say anything based on only one data for now.

Source: Bloomberg

As can be seen in the chart above, core services continue to have the largest share in the overall price level. Our expectation is for a monthly increase of 0.15% and an annual CPI of around 2.73%. Still, let us remind that the market will react according to the consensus expectation.

A lower-than-expected CPI reading could mean that the FED will be in a better position to cut interest rates, which could have a positive impact on digital assets. A figure that exceeds forecasts, on the other hand, has the potential to exert pressure by reinforcing expectations that the FED will not rush into another rate cut.

April 30 – FED’s Favorite Inflation Indicator PCE

US Federal Reserve Chairman Powell’s speech at the Jackson Hole Symposium last year led to a significant shift in the equation. Powell shifted the focus from inflation to the strength of the labour market and signalled that the FED would now give more importance to the strength of the labour market in its decisions. Or at least that is how the markets interpreted the statements. Recent months have shown that this may not be the right approach.

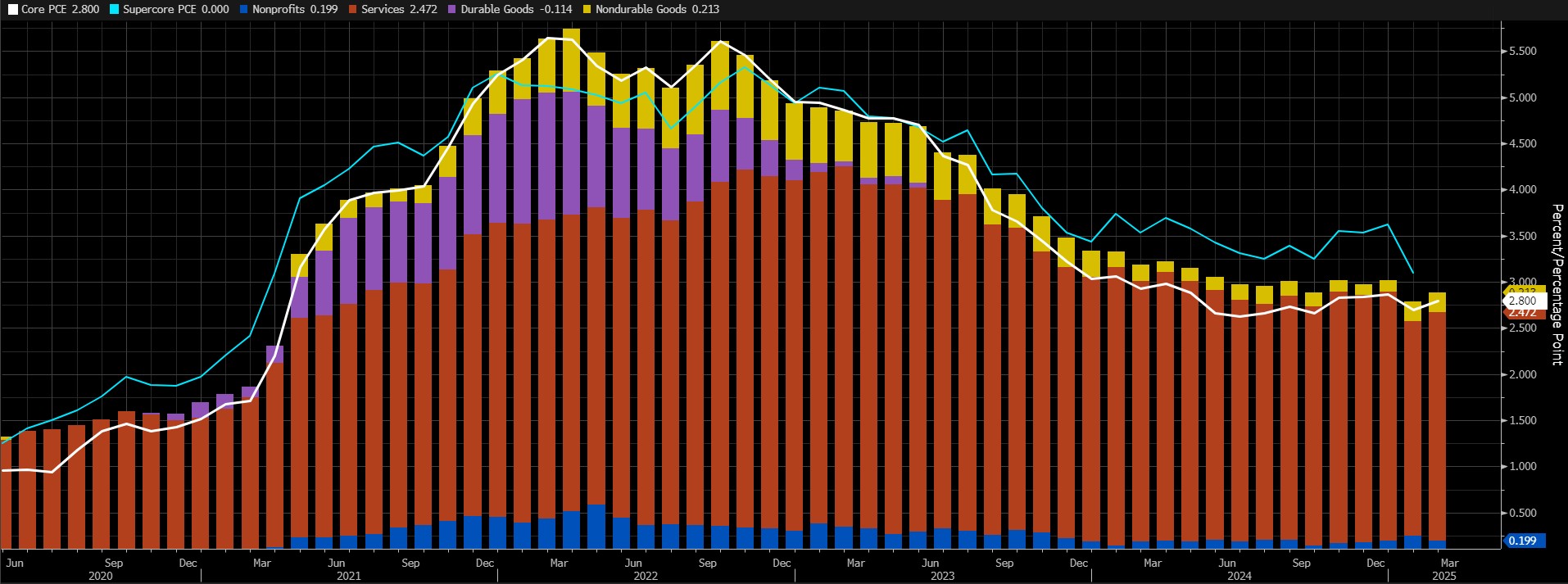

Source: Bloomberg

For March, we will evaluate the annualized core Personal Consumption Expenditures (PCE) data. In January, the index came in at 2.6% (revised to 2.7% in the latest report), down from 2.9% in December (up from 2.9% in December) due to the impact of the services sector, returning to the June 2024 level of increase. Finally, in February, it pointed to a change of 2.8%, exceeding market expectations. The increase in prices in the service sector compared to the previous period seems to have caused inflation to rise again in February.

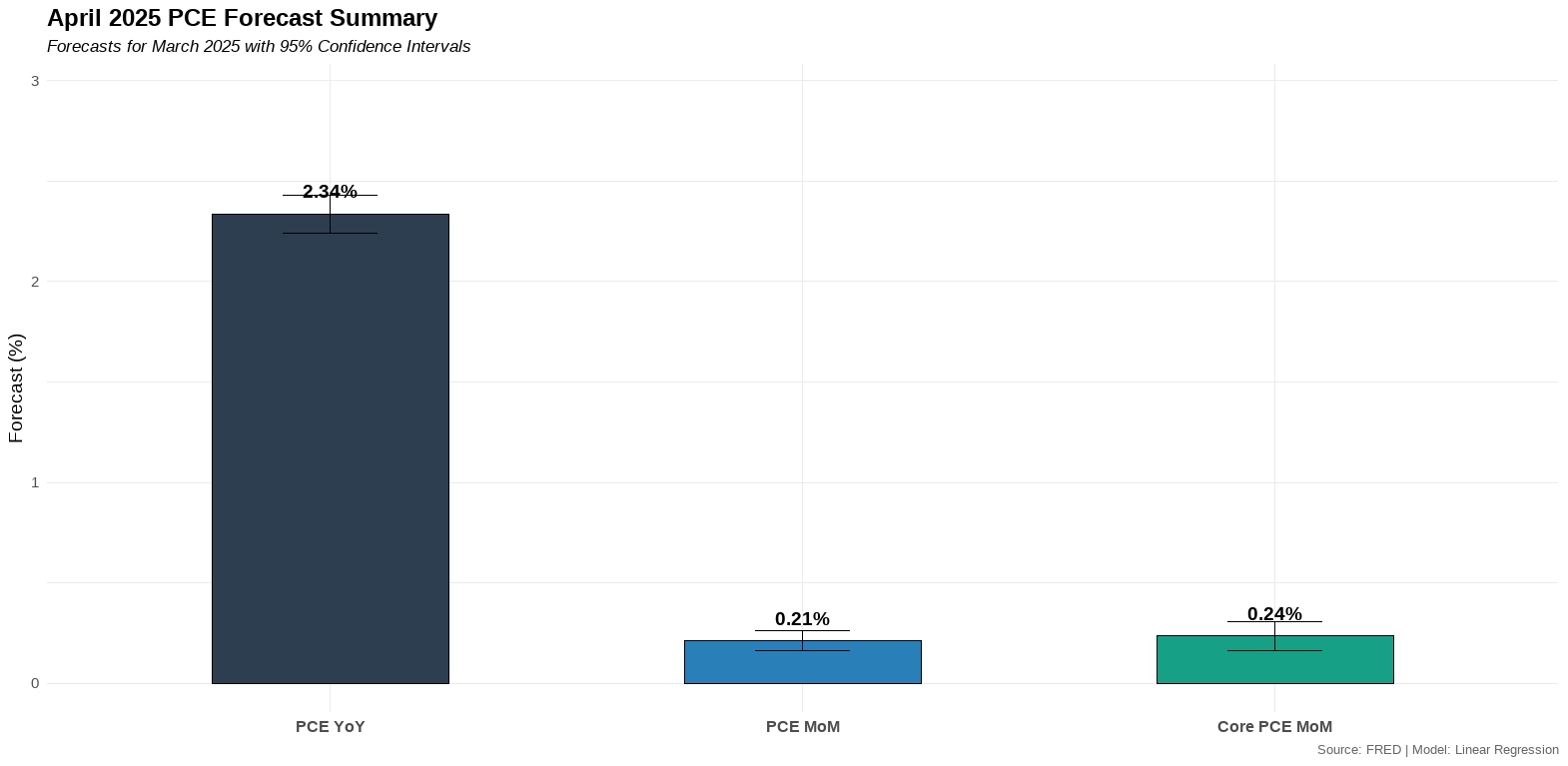

Source: FRED and Darkex Research Department

When we look at the headline PCE Price Index, we see that the 2.6% in December came down to 2.5% in January and February. Our forecast for March is 2.34%. In other words, the rate of increase in prices will remain limited and we will feel the impact of Trump uncertainty. You can see our monthly forecasts in the table above.

A higher-than-expected data may support expectations that the FED will maintain its cautious stance on interest rate cuts, reducing risk appetite and putting pressure on digital assets. A lower-than-expected data may have the opposite effect and pave the way for value gains.

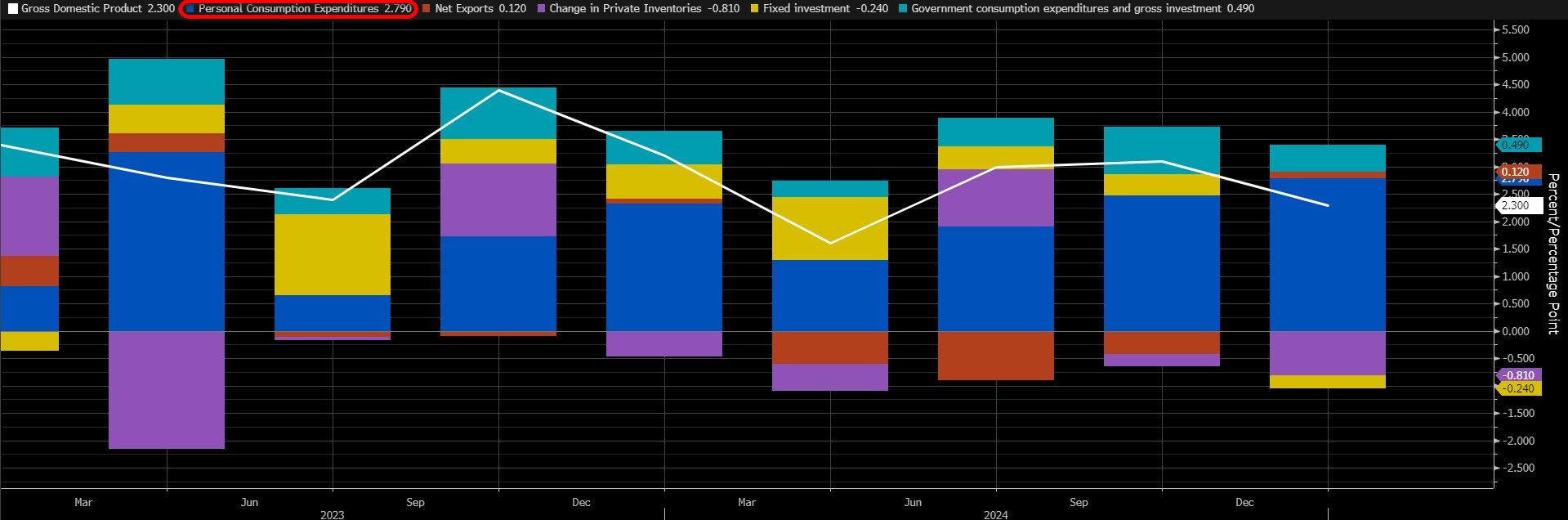

April 30 – US GDP Change

Donald Trump’s unpredictable policy choices are a challenging factor for the entire world. Economic actors are also facing the challenges of this highly uncertain environment as they formulate their expectations and plans for the future. There are some outcomes of this situation. The most important one is the possibility of a slowdown in economic activity. In this respect, it will be very important to see how much the US economy grows in the first quarter of the year, including the period after January 20, when Trunp takes over in the Oval Office.

Source: Bloomberg

According to data released on March 27, the US economy grew by 2.4% in the last quarter of 2024. The previous estimate was 2.3% and a small upward revision was made. Our expectation for the new data, which will be important in terms of the first data to be announced for the first quarter of the current year, is 2.37% according to our model. This indicates that the Trump effect will not yet be clearly felt. However, it is worth noting that the risks to this forecast are on the downside. This is because the monthly frequency data on consumer spending, which accounts for about 70% of the US economy, published in the relevant quarter pointed to a deterioration in consumer confidence. It seems difficult to quantify and measure this behaviour now. The data to be released will allow for healthier and longer-term projections regarding the direction of economic growth.

In terms of immediate market reaction, we think that a data above the consensus expectation may have a positive impact on digital assets by increasing risk appetite. A lower-than-expected GDP data, on the other hand, may have a negative impact from this perspective.

*General Information About Forecasts

The non-farm payrolls (NFP), personal consumption expenditures (PCE) and GDP growth forecasts presented in this report are based on econometric modelling tools developed by our research department. Different structures were considered for each indicator, and appropriate regression models were constructed in line with data frequency (monthly/quarterly), leading economic indicators and data history.

The basic approach in all models is to interpret historical relationships based on data and to produce forecasts that have predictive power with current data. The performance of the models used is measured by standard metrics such as mean absolute error (MAE) and is regularly re-evaluated and improved. While the outputs of the models guide our economic analysis, they also aim to contribute to strategic decision-making processes for our investors and business partners.

Data is sourced directly from the FRED (Federal Reserve Economic Data) platform in an up-to-date and automated manner, so that every forecast is based on the latest economic data. As the research department, we are also working on artificial intelligence-based modelling methods (e.g. Random Forest, Lasso/Ridge regressions, ensemble models) to improve forecast accuracy and react more sensitively to market dynamics. The macroeconomic context should be considered in the interpretation of model outputs, and it should be kept in mind that there may be deviations in forecast performance due to economic shocks, policy changes and unforeseen external factors. With this monthly updated working set, we aim to provide a more transparent, consistent and data-driven basis for monitoring the macroeconomic outlook and strengthening decision support processes.

Legal Notice

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions considering the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.