MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | Change (%) | Market Cap |

|---|---|---|---|

| BTC | 98,525.56$ | Weekly: 10.45% | Monthly: 48.61% | Year: 123.00% | 1,95 T |

| ETH | 3,359.78$ | Weekly: 8.23% | Monthly: 30.54% | Year: 43.16% | 405,54 B |

| SOLANA | 258.96$ | Weekly: 21.39% | Monthly: 56.96% | Year: 130.00% | 122,93 B |

| XRP | 1.386$ | Weekly: 72.51% | Monthly: 164.00% | Year: 120.00% | 79,00 B |

| DOGE | 0.3901$ | Weekly: 3.72% | Monthly: 184.00% | Year: 324.00% | 57,30 B |

| CARDANO | 0.8620$ | Weekly: 44.90% | Monthly: 141.00% | Year: 38.26% | 30,20 B |

| TRX | 0.1987$ | Weekly: 9.62% | Monthly: 24.30% | Year: 84.36% | 17,16 B |

| AVAX | 36.28$ | Weekly: 11.88% | Monthly: 35.65% | Year: -13.53% | 14,81 B |

| SHIB | 0.00002484$ | Weekly: 2.17% | Monthly: 40.10% | Year: 133.00% | 14,64 B |

| LINK | 15.20$ | Weekly: 12.85% | Monthly: 33.20% | Year: -2.10% | 9,53 B |

| DOT | 6.086$ | Weekly: 23.34% | Monthly: 43.88% | Year: -29.23% | 9,26 B |

*Table was prepared on 11.22.2024 at 12:30 (UTC). Weekly values are calculated for 7 days based on Friday.

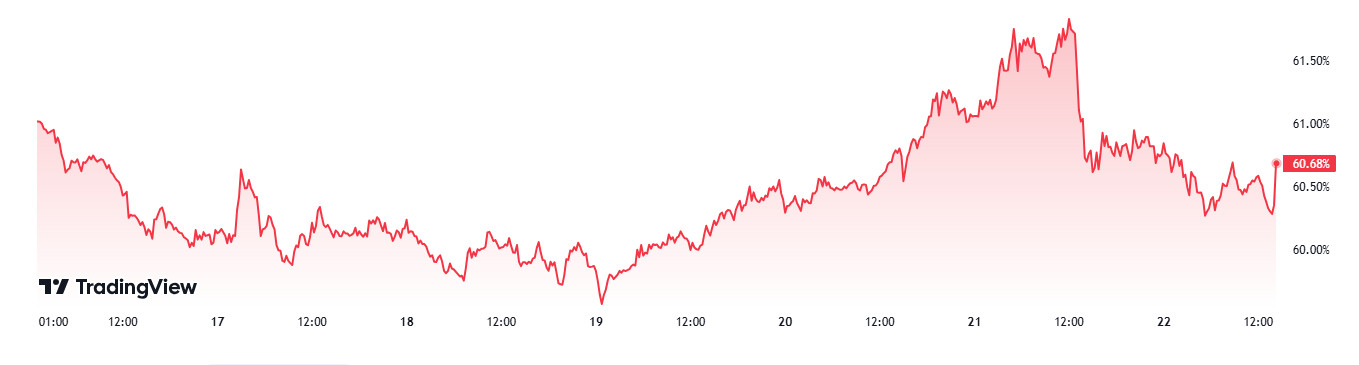

Fear & Greed Index

Source: Alternative

Change in Fear & Greed Index: +14

Last Week Level: 80

This Week Level: 94

The Fear & Greed Index rose to 94 this week from 80 last week, indicating a marked increase in investor confidence and a strengthening risk appetite. This rise is due to increased interest in Bitcoin, especially from institutional investors.

The main developments that led to these changes are as follows:

MicroStrategy’s Bitcoin Investment

MicroStrategy’s $3 billion issuance of 0% interest rate convertible bonds due 2029 confirms the increase in institutional demand. The company’s move to buy Bitcoin increases the liquidity of the market.

BlackRock Bitcoin ETF

The BlackRock Bitcoin ETF (IBIT) generated $1.9 billion in trading volume on its first day of trading, indicating strong demand for the ETF and institutional interest in Bitcoin. This continues to strengthen liquidity in the market.

Regulatory Expectations

SEC Chairman Gary Gensler will step down on January 20th, creating expectations for positive change in the crypto market. Gensler’s strict regulatory policies have been negatively received by investors, and this change could reduce regulatory uncertainty and raise hopes for a more flexible regulatory environment.

Macroeconomic Indicators

Applications for Unemployment Benefits in the US remained below expectations with 213K, an indicator that supports economic stability.

In a nutshell, the Fear & Greed Index’s rise to 94 has been driven by factors such as institutional investor interest, positive macroeconomic data and the anticipation of regulatory change. These factors are contributing to increased investor confidence and strengthening risk appetite, helping to support the ongoing bull market in the cryptocurrency market.

Bitcoin Dominance

Source: Tradingview

Bitcoin dominance, which accelerated positively last week, is moving at levels last seen in March 2021. This week, there is a slight decline in the dominance level. Heavy ETF inflows, BTC purchases by corporates and President D. Trump’s crypto initiatives continue to keep the dominance level strong.

The Shift in Bitcoin Dominance:

- Last Week’s Level: 60.86%

- This Week’s Level: 60.71%

Conclusion

All in all, a 0.15% decline, a slight change in market dynamics. While interest in altcoins has increased, Bitcoin continues to dominate the market. Investors should take into account the long-term effects that ETF developments and institutiona although seemingly small, indicatesl movements may have on Bitcoin.

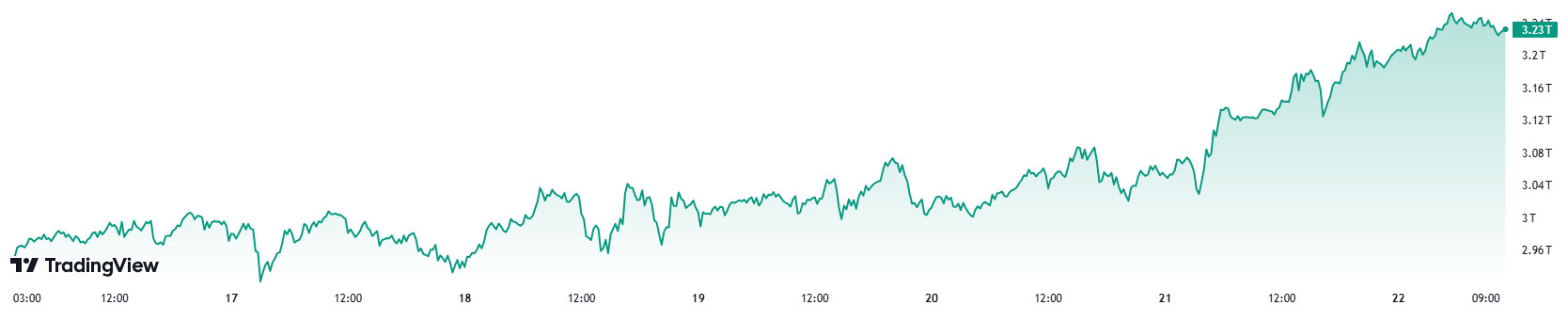

Total MarketCap

Source: Tradingview

The bull run on the cryptocurrency market is in full swing. This week, the market did not lose its bullish momentum, and the total market capitalization reached an all-time high of $3.27 trillion. The current market capitalization of $3.23 trillion sets a very positive tone for the crypto market. While BTC recorded new highs above the $99,000 level, altcoins also followed BTC’s uptrend.

Change in Market Value:

- Last Week’s Market Capitalization: 2.96 trillion Dollars

- This Week’s Market Capitalization: 3.23 trillion Dollars

The fact that the market capitalization has surpassed $3 trillion and hit new highs shows that cryptocurrencies are maturing and gaining a more permanent place in the financial system. This situation reveals that not only BTC but also altcoins have experienced serious increases. This is an important indicator that not only speculative investors but also a wider audience and investors from different sectors are turning to cryptocurrencies.

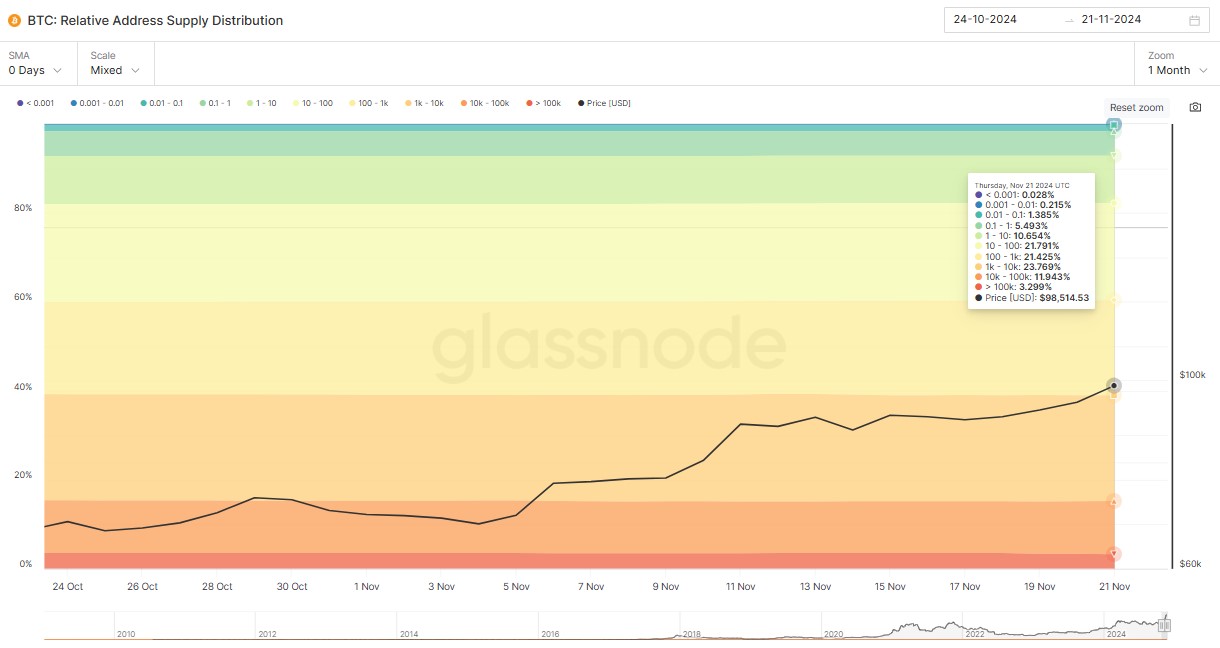

Bitcoin Supply Breakdown

Source: Glassnode

| Address Range | 14.11.2024 | 21.11.2024 | Change | Analysis |

|---|---|---|---|---|

| 0.1 – 1 BTC | 5,512% | 5,493% | Decline | The rate decreased slightly from 5.512% to 5.493%. Mid-cap investors may have sold. |

| 1 – 10 BTC | 10,692% | 10,654% | Decline | This group has shown a stable movement. The decline may signal profit-taking. |

| 10 – 100 BTC | 21,860% | 21,791% | Decline | Medium-sized investors preferred to sell during the price increase. It can be considered profit-taking. |

| 100 – 1k BTC | 21,121% | 21,425% | Increase | It indicates that institutional investors’ confidence in the market has increased, and long-term expectations continue. |

| Address Range | 14.11.2024 | 21.11.2024 | Change | Analysis |

|---|---|---|---|---|

| 0.1 – 1 BTC | 5,512% | 5,493% | Decline | The rate decreased slightly from 5.512% to 5.493%. Mid-cap investors may have sold. |

| 1 – 10 BTC | 10,692% | 10,654% | Decline | This group has shown a stable movement. The decline may signal profit-taking. |

| 10 – 100 BTC | 21,860% | 21,791% | Decline | Medium-sized investors preferred to sell during the price increase. It can be considered profit-taking. |

| 100 – 1k BTC | 21,121% | 21,425% | Increase | It indicates that institutional investors’ confidence in the market has increased, and long-term expectations continue. |

General Evaluation

Institutional Interest: The increase in the 100-1k BTC and 10k-100k BTC ranges clearly shows that the market is attracting interest from institutional investors. The fact that these groups accumulated more BTC, especially during the price increase, may indicate that they have confidence in the market.

Profit Realization: Declines in the 1k-10k and >100k BTC categories suggest that some of the larger traders took advantage of the price increase to take profits.

Small Investors: Very small changes in the 0.001-1 BTC range suggest that individual investors are not making big moves and are following a more passive strategy.

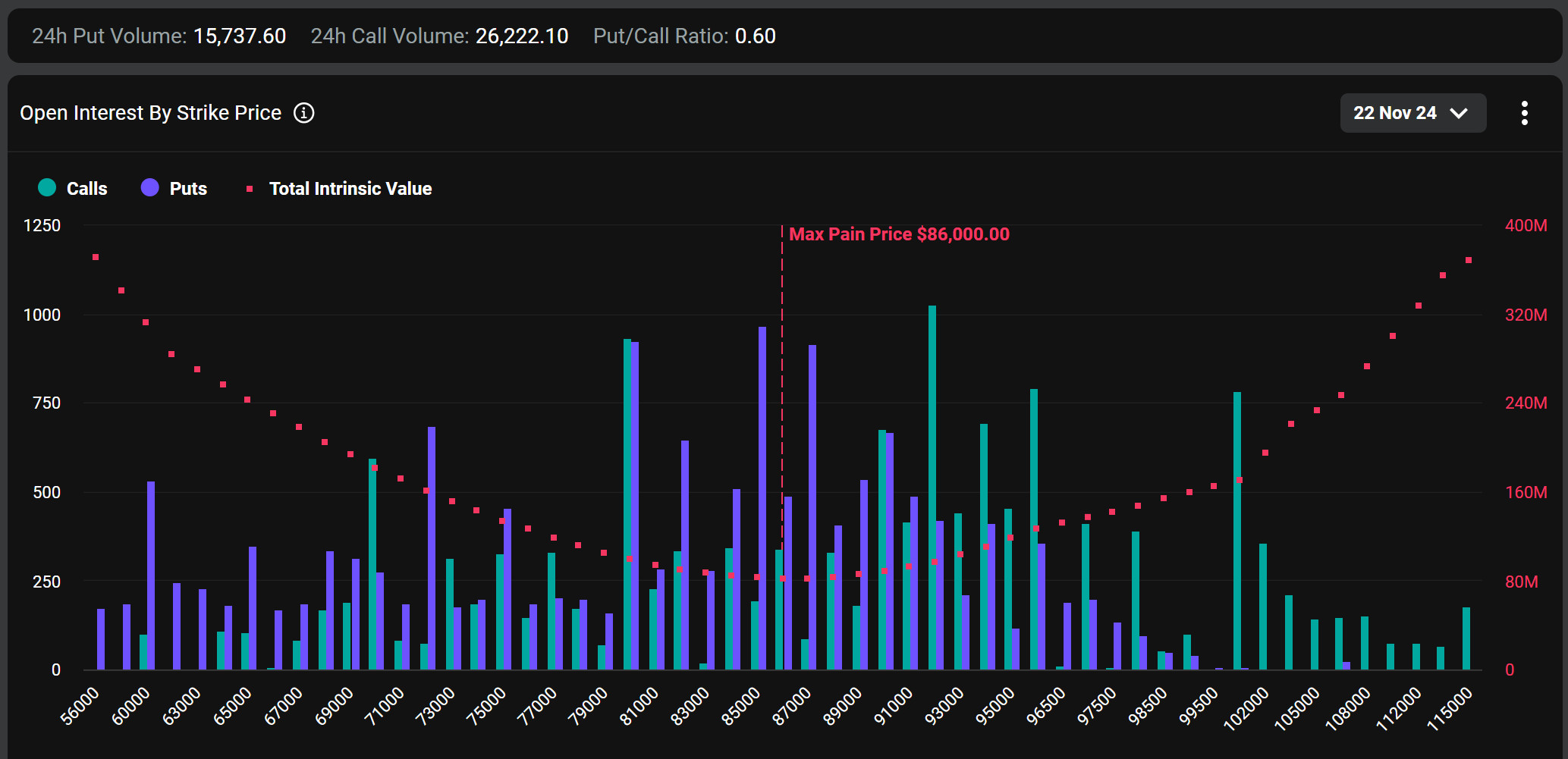

Bitcoin Options Breakdown

Source: Deribit

Options Trading on GBTC and Bitcoin Mini Trusts started Thursday. According to ChainCatcher, Grayscale announced that GBTC (Grayscale Bitcoin Trust) and BTC (Bitcoin Mini Trust) options products officially started Thursday. On the other hand, Nasdaq listed BlackRock’s Bitcoin ETF options. Indeed, the Blackrock Bitcoin ETF (IBIT) generated about $1.9 billion in volume on its first options day.

ETF analysts described this as an “unprecedented success”.

Deribit Data: BTC-denominated options contracts with a notional value of USD 2.639 billion expire today.

Maximum Pain Point: Bitcoin’s maximum pain point is set at $86,000.

Option Expiration:

Call/Sell Ratio: The call/put ratio for these options is set at 0.60. A call/put ratio of 0.60 indicates that there is a strong preference for call options over put options among investors and that a possible upturn in the markets is possible.

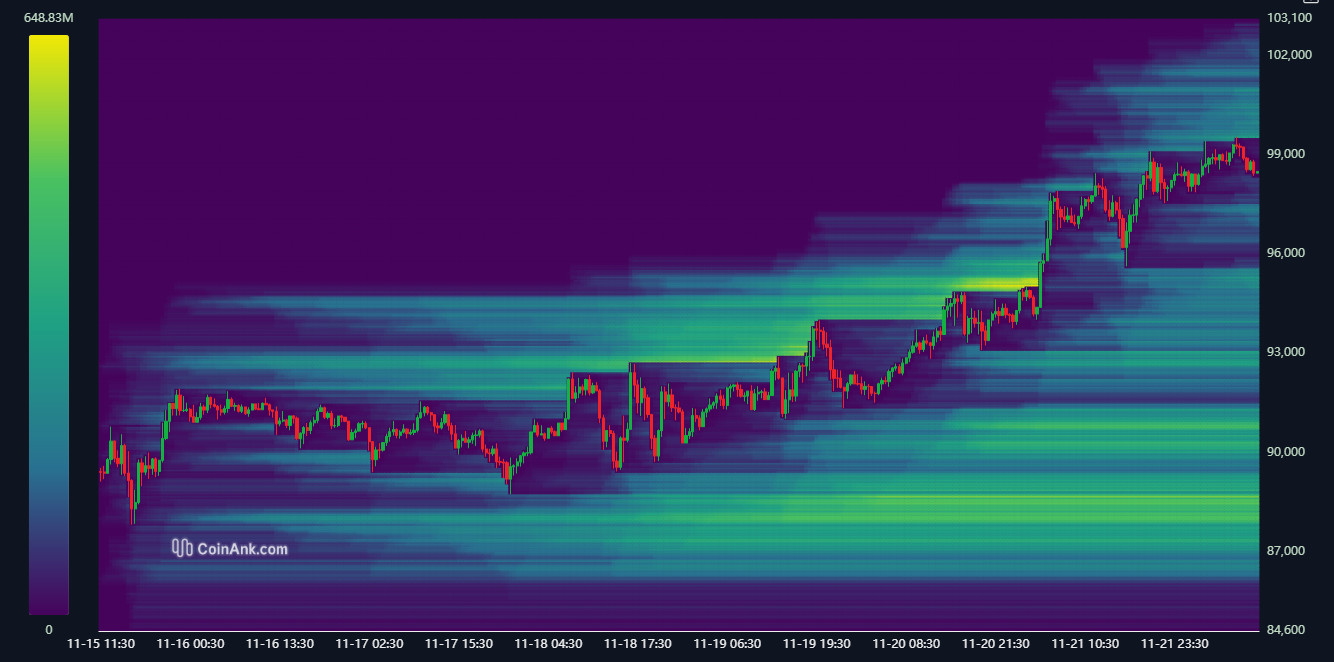

Bitcoin Liquidation Chart

Source: CoinAnk

When the liquidation heat map for BTC is examined, it is seen that short positions were liquidated by clearing the area between 92,900 and 93,500 during the week, and as a result of the decline it experienced afterwards, long transactions between 91,500 and 91,800 reached the liquidation value.

Currently, there is a significant liquidation area between 99.500 and 100.500 for short transactions and may want to clear the area in this price range in the coming period. For long transactions, liquidations seem to have accumulated between 96,500 and 97,500. These levels can be seen with the downward movement of the price and long transactions may be liquidated.

When the weekly liquidation amounts of Bitcoin are analyzed, a total of 128.99 million dollars of long transactions were liquidated between November 18 and 21, and the amount of short transactions liquidated between the same dates was 248.7 million dollars.

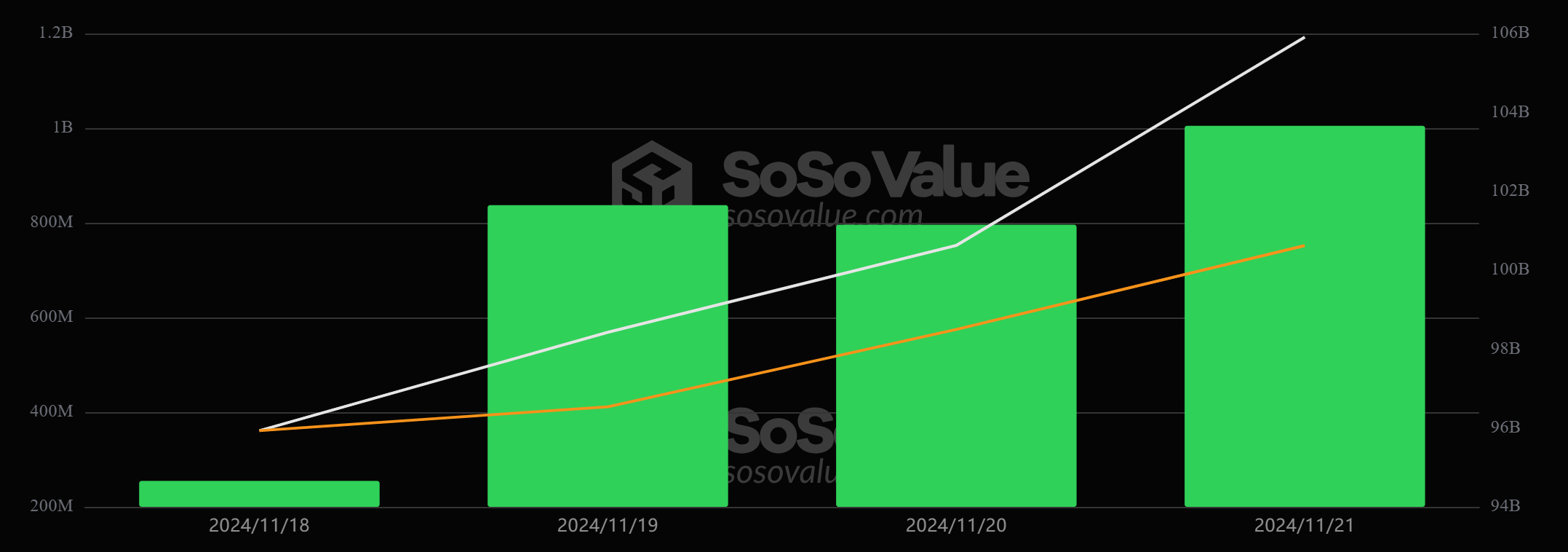

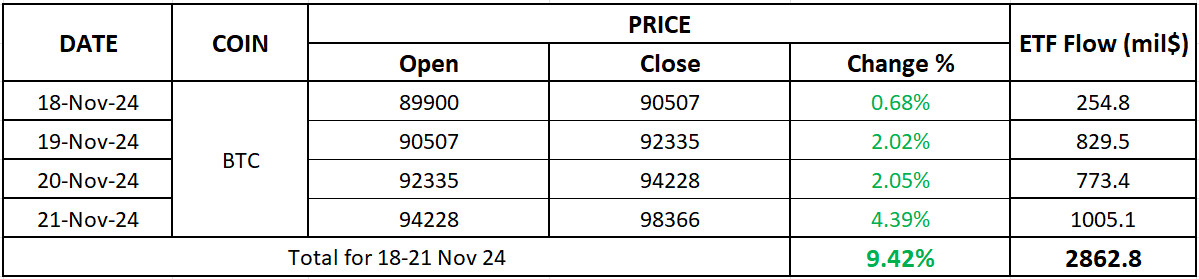

Bitcoin Spot ETF

Source: SosoValue

General Status:

- Positive Net Inflows Series Again: The positive net inflow streak, which ended on Friday last week, started again this week. In the week when Bitcoin hit an all-time high, the positive net inflow series in the Spot BTC ETF increased to 4 days.

- Cumulative Total Net Inflows: Spot BTC ETFs saw a total net inflow of $2.86 billion this week, while the cumulative total net inflow reached $30.38 billion at the end of the 219th trading day.

- Blackrock IBIT ETF Rise Continues: Between November 18-21, the Blackrock IBIT Spot BTC ETF saw net inflows of nearly $1.5 billion. Blackrock added 16,069 units to its Bitcoin reserves this week and now holds a total of 487,398 BTC.

- Blackrock IBIT ETF Options Trading: BlackRock Spot ETF (IBIT) Options went live on Tuesday, November 19th. On the first day, IBIT ETF options traded a total of 354,000 contracts with a notional turnover of $1.86 billion. IBIT ETF options, which started the first day with great interest, also showed its effect on IBIT trading volume and IBIT’s trading volume increased by 32% compared to the previous day.

Featured Situation:

- Market Impact: With Bitcoin hitting all-time highs, interest in Spot BTC ETFs is on the rise and Spot BTC ETFs continue to see high trading volumes each day. In total, Spot BTC ETFs saw net inflows totaling $2.86 billion this week.

- BTC Price Change: There was a 9.42% increase in Bitcoin price between November 18-21.

Conclusion and Analysis:

- Total Net Inflows and Outflows: As Bitcoin continues to renew its records with its rise, net inflows in Spot BTC ETFs attracted attention this week. While net inflows were generally seen in Spot BTC ETFs in this process, the total net inflow totaled 2.86 billion dollars in the said time period.

- Price Impact: Bitcoin continued to rise this week, as it did last week, and continued to renew its all-time high. This week saw a 9.42% price increase in BTC price, while institutional investor interest in Spot BTC ETFs continues to increase. This shows that Spot BTC ETF purchases increased as BTC price rose.

WHAT’S LEFT BEHIND

Record Investment Inflows to Crypto Funds: According to a CoinShares report, crypto funds saw $2.2 billion in inflows, while total fund value hit a record high of $138 billion.

Increased Institutional Demand for Bitcoin from US Companies: Hoth Therapeutics and Acurx Pharmaceuticals bought $2 million worth of Bitcoin.

Charles Schwab’s Crypto Attack: Charles Schwab aims to offer investors a wide range of products by entering the spot cryptocurrency market.

MARA Holdings Raises $1 Billion: Bitcoin mining company MARA raised $1 billion from convertible bond sales and will use the proceeds for Bitcoin purchases.

Semler Scientific Purchased 215 More Bitcoins: It spent $17.7 million, bringing its total Bitcoin reserves to 1,273 BTC and generating a 37.3% return.

4 Million Dollar Bitcoin Purchase from Genius Group: Genius Group aims to increase its total reserves to 153 BTC by purchasing 4 million dollars of Bitcoin and keeping 90% of it in Bitcoin.

Bitcoin-Focused Bond Move from Metaplanet Inc: The company announced that it will use its 1.75-billion-yen bond proceeds to buy Bitcoin.

MicroStrategy Buys Bitcoin with $4.6 Billion: MicroStrategy reiterated its commitment to its strategy by buying 51,780 Bitcoin with proceeds from share sales.

MicroStrategy Becomes the Center of Wall Street’s Attention: MicroStrategy, the world’s largest Bitcoin investor, has started to attract Wall Street’s attention with an increase in the number of institutional investors.

MicroStrategy Raises Bond Offering: MicroStrategy raised its 2029 bond offering to $2.6 billion and plans to use some of the proceeds for Bitcoin purchases.

MicroStrategy Ranked in the Top 100 Companies: With a 12% increase in share value, MicroStrategy ranked 97th among the top 100 public companies in the US.

Nasdaq to Start Listing Bitcoin ETF Options: Nasdaq will list BlackRock’s Bitcoin ETF options, allowing investors to trade derivatives and manage risk.

ETF Commentary from QCP Capital: BlackRock’s Bitcoin spot ETF options, launched on Nasdaq, could usher in a new wave of institutional investment in Bitcoin, analysts at QCP Capital said.

Record Increase in USDT Inflows: According to CryptoQuant data, $3.2 billion worth of USDT has been entered into centralized cryptocurrency exchanges, marking a rapid increase in the use of stablecoins.

Trump’s Move in Cryptocurrency: Trump Media & Technology Group is in talks to acquire cryptocurrency exchange Bakkt.

Trump’s Crypto Payment Service Application: Trump Media & Technology Group has filed a trademark application for the TruthFi crypto payment platform.

Trump’s Bakkt Move Send Stocks Skyrocketing: The news that Donald Trump’s media company will buy all of Bakkt’s shares led to a 162% increase in the stock market.

Trump’s Position for Cryptocurrency for the White House: The new administration is considering creating a special White House position to focus on cryptocurrency policy.

Bitcoin Reserve Bill for the US by Senator Cynthia Lummis: Lummis proposed creating a strategic reserve of 1 million Bitcoin by selling the Federal Reserve’s gold.

Teresa Goody Option for SEC Chair: Trump is considering appointing blockchain expert Teresa Goody Guillén as SEC chair.

SEC Chairman Gary Gensler’s Resignation Post: Gensler announced on his X account that he will step down on January 20, 2025, a decision that reverberated in the market.

New Europe-Only Stablecoins from Tether: Tether made a strong push into the European market with the introduction of MiCA-compliant USDQ and EURQ stablecoins.

Poland Pledges Support for Bitcoin Reserves: Presidential candidate Menzen promised to create strategic Bitcoin reserves if elected.

South Korea Bans Cryptocurrency ETFs: South Korea continues to reject cryptocurrency ETFs.

Record Open Position in the XRP Futures Market: The XRP futures market peaked at $2 billion in open interest, with prices surpassing $1.20 for a weekly gain of 87%.

4 New Solana-Focused ETF Applications: Bitwise, VanEck, 21Shares and Canary Funds have filed applications for Solana-focused ETFs on the Cboe BZX, with approval expected in August 2025.

FLOKI’s Big Marketing Move: FLOKI launched an extensive marketing campaign in Delhi for its PlayToEarn MMORPG game Valhalla, but it did not have an impact on price.

Sui network restarted after a 2-hour outage; the outage dropped SUI token by 10%, the problem has been fixed.

Dogecoin and Bitcoin Statement from Elon Musk: Musk reiterated his support for cryptocurrencies, stating that he protects Dogecoin and Bitcoin assets.

Record Financial Results from Nvidia: Revenue of $35.1 billion and net profit of $19.31 billion in the third quarter of fiscal 2025, Data center revenues up 112% to $30.8 billion

HIGHLIGHTS OF THE WEEK

It has been another week of record highs for Bitcoin. The “post-Trump Era” has maintained its impact on digital assets and we have seen other major cryptocurrencies start to accompany the upward trend. Trump’s promise to pursue policies that would loosen regulations and make Congressional appointments in this direction was the basis of the gains. In addition, institutional investors’ increased demand for products with BTC as the underlying asset and the increase in product diversity (the start of options trading) supported the rise, which we think is also based on expectations for the Trump era. Despite the escalation of geopolitical tensions, investors’ risk appetite, at least for digital assets, does not seem to have suffered.

Signs that the pace of interest rate cuts by the US Federal Reserve (FED) may slow down, like the rising geopolitical tensions, have not been a factor to push prices down. The fact that the macro data flow was not too intense to pick up any new clues may have played a role, but it is important to note that some Federal Open Market Committee (FOMC) members were skeptical about the necessity of rate cuts. Next week will bring more important macro data releases. However, towards the end of the week, volumes in the US markets may decrease due to the Thanksgiving holiday and position adjustments for maturing derivatives may lead to increased volatility. Thus, we can say that a much more active market awaits us, especially in the last trading days of the week and month.

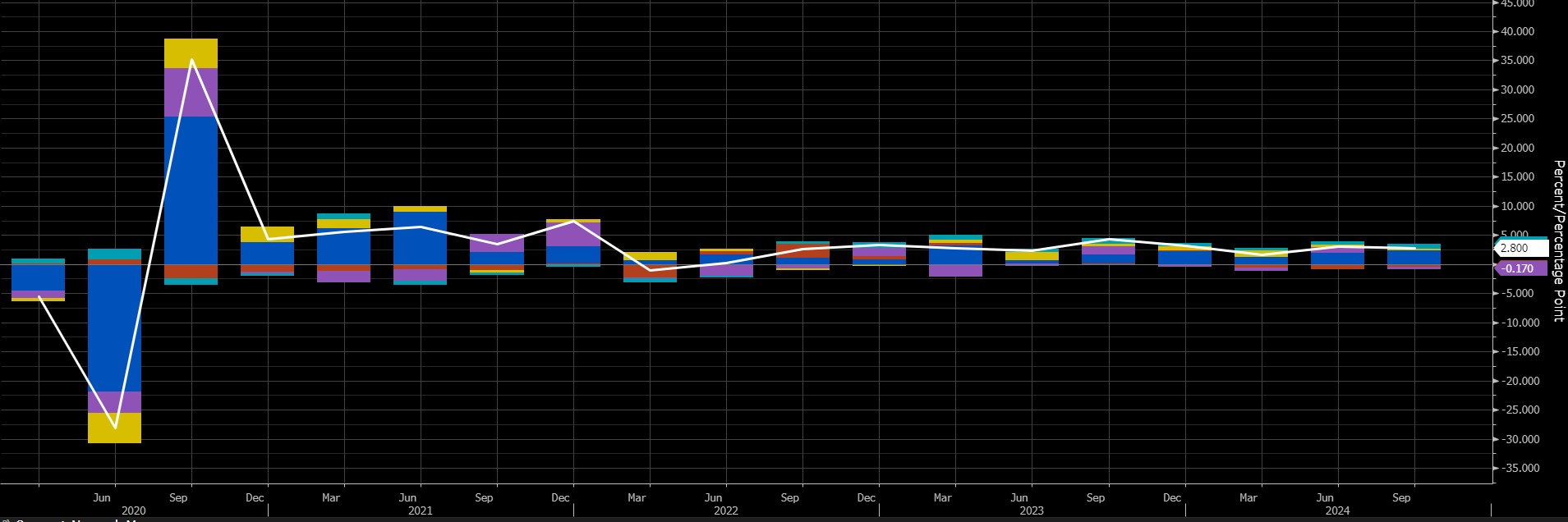

Inflation and growth in the US under scrutiny…

The minutes of the last FOMC meeting, which will be published next week, will shed light on the Fed’s rate cut path. However, among the data set to be released, the GDP growth (GDP) and PCE Price Index will provide information about how comfortable the Bank will be for rate cuts and may have an impact on asset prices.

Source: Bloomberg

The world’s largest economy grew by 2.8% in the third quarter of the year, according to the first estimate. In the second quarter, the economy grew by 3%. The 2.8% rate announced for the third quarter is not expected to be revised, but a surprise figure could cause the stones to shift. Still, for this to happen, we are really waiting for a very distant 2.8%.

Source: Bloomberg

According to the latest report, personal consumption expenditures, which account for about 675% of the US economy, were again the largest contributor to growth. While the change in private inventories contributed to growth last quarter, it was a negative component in the calculation in the third quarter. As a feature of the pre-election period, government spending increased, limiting the decline in growth from 3% to 2.8%. We do not expect a major revision in the changes in these items. Therefore, our expectation is that there will be no major change in the first figure announced. However, a downside surprise could fuel expectations that the FED might be bold in cutting interest rates, providing an excuse for the recent rally in the market. A higher-than-expected figure, on the other hand, may have a restraining effect on risk appetite.

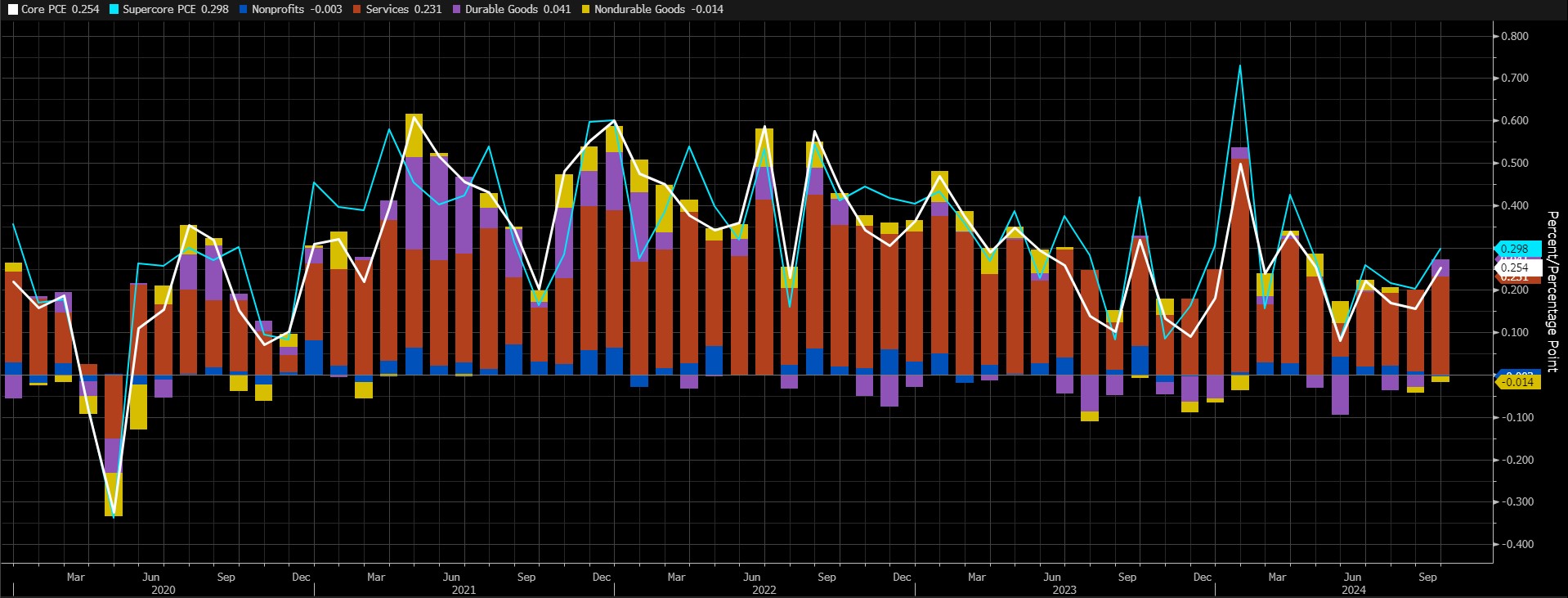

An hour and a half after the growth data, all eyes will turn to the PCE Price Index, which is used by the FED to monitor inflation. Since we think that a more micro perspective is needed, we think it would be better to consider the core PCE figures on a monthly basis for this month’s data.

Source: Bloomberg

This figure had pointed to an increase of around 0.3% in September. Expectations are for the same level in October. Services inflation seems to be the item that will make the highest contribution to the index again. A higher-than-expected data may suggest that the FED should put the brakes on interest rate cuts and we think this may reduce risk appetite. On the other hand, a lower data may provide a basis for a rise in digital assets.

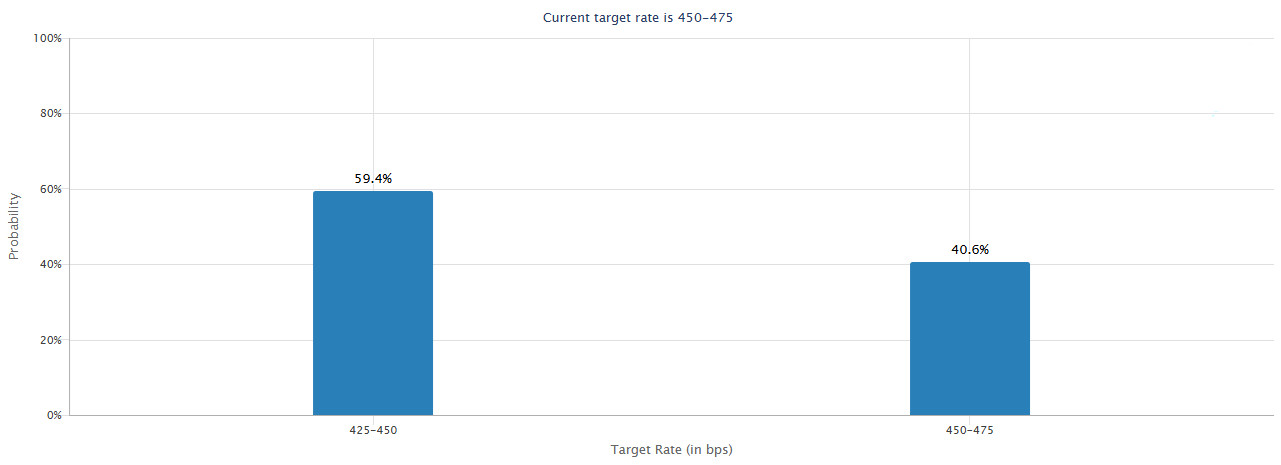

Source: CME Group

At the time of writing, according to the CME FedWatch Tool, markets were pricing in about a 60% chance of a 25 basis point rate cut at the Fed’s December 18 meeting. This equilibrium was quite volatile during the week, with the probability of a rate hold and the probability of a 25 bps rate cut sometimes almost identical.

Source: Bloomberg

Nevertheless, we can say that the markets are more in favor of a rate cut. The Bank’s average funding rate (at the time of writing) is priced to fall to 4.436%, i.e. a 25 bps downward revision of the interest rate range to 4.25%-4.50%. For now, the positioning in the markets seems to be in line with this expectation. However, as we mentioned, the potential for this equation to shift to the side of leaving the interest rate cut unchanged in December, and the necessity to reshape the equation in this parallel, remains an important component. The data in question may affect the likelihood of this risk materializing and close monitoring will be beneficial for investors.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Is MVRV’s Low Peak Signalling Selling Pressure in Bitcoin?

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.