MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | Weekly | Monthly | Market Cap. |

|---|---|---|---|---|

| BTC | 96,111.64$ | -3.23% | 32.36% | 1,90 T |

| ETH | 3,574.68$ | 5.35% | 33.80% | 430,53 B |

| SOLANA | 240.22$ | -7.37% | 34.85% | 114,11 B |

| XRP | 1.624$ | 16.84% | 211.00% | 92,66 B |

| DOGE | 0.4067$ | 3.51% | 138.00% | 59,78 B |

| CARDANO | 1.0603$ | 22.95% | 198.00% | 37,09 B |

| AVAX | 43.44$ | 19.65% | 64.99% | 17,80 B |

| TRX | 0.2017$ | 1.35% | 20.11% | 17,40 B |

| SHIB | 0.00002589$ | 4.85% | 38.94% | 15,28 B |

| DOT | 8.746$ | 44.16% | 109.00% | 13,32 B |

| LINK | 17.77$ | 16.76% | 49.17% | 11,14 B |

*Table was prepared on 11.29.2024 at 11:30 (UTC). Weekly values are calculated for 7 days based on Friday.

Fear & Greed Index

Source: Alternative

Change in Fear and Greed Value: -16

Last Week’s Level: 94

This Week’s Level: 78

The decline in the Fear&Greed Index from 94 last week to 78 this week indicates a decline in investor confidence and a weakening risk appetite. This decline was mainly driven by increased uncertainty in the markets. Trump’s nomination of Scott Bessent as Treasury Secretary has raised concerns among investors about policies such as high tariffs and tax cuts. This led to lower inflation expectations and reduced demand for risky assets, causing investors to turn to safer assets. This shift played a decisive role in the index’s shift to the fear level.

In addition, with the approach of the Thanksgiving holiday, the decline in trading volume in the Bitcoin market and the increase in year-end profit realization trends strengthened the selling pressure. Psychologically, the price fluctuations experienced during holiday periods in previous years seem to have shaped investor expectations downwards. These factors combined to cause a cautious stance in the crypto market, leading market participants to move away from risky positions.

Overall, rising uncertainties, lower trading volume and expectations of year-end profit realizations weighed on the market, weakening investor confidence and contributing to the index’s decline this week.

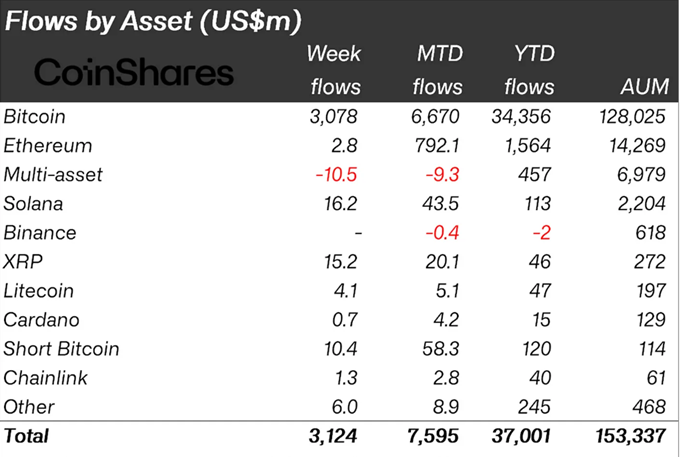

Fund Flow

Source: Coin Shares

This report contains the weekly performance of inflows and outflows into and out of digital asset funds. High inflows may indicate that investor confidence in digital assets is growing, while low inflows may indicate that this confidence is declining.

In 2024, total inflows have reached $15.2 billion since mid-September, when interest rates were cut for the first time in the US.

One of the biggest reasons why Bitcoin went from $47,000 at the beginning of 2024 to $99,000 by the end of 2024 was the record $37 billion in year-to-date inflows. US Gold ETFs accounted for the largest share of the inflows with $309,000,000,000.

Bitcoin ETFs saw the largest inflows on record last week, totaling USD 3.12 billion. Solana outperformed Ethereum last week with inflows of US$16 million against US$2.8 million.

Altcoins;

XRP, Litecoin and Chainlink also saw inflows of US$15 million, US$4.1 million and US$1.3 million respectively.

Outflows from multi-asset investment products totaled USD 10.5 million for the second consecutive week. These inflows had a significant positive impact on asset price levels.

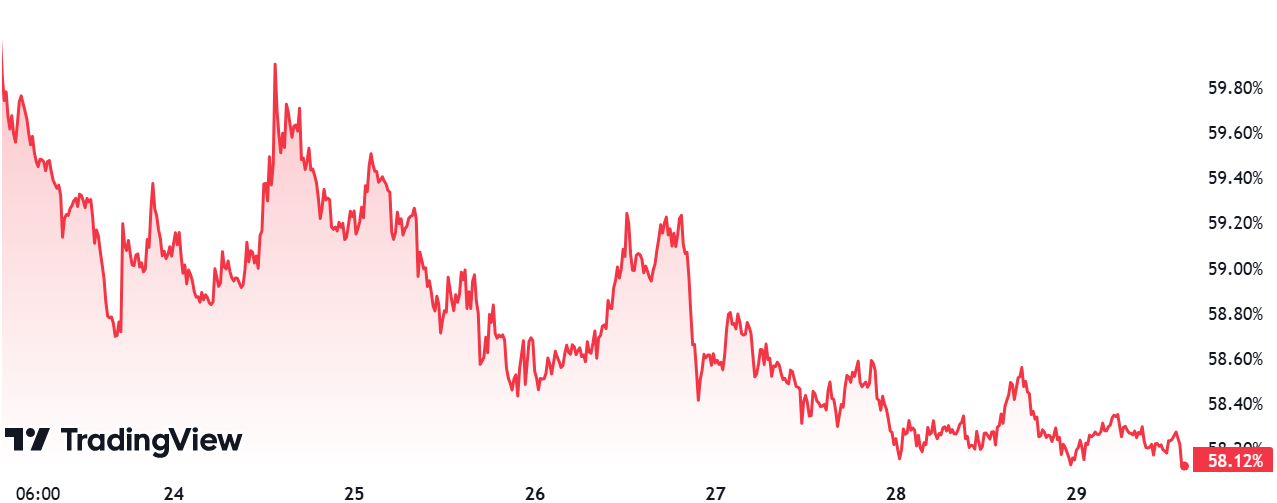

Bitcoin Dominance

Source: Tradingview

Bitcoin Dominance

Bitcoin dominance, which generally moved between 58.50%- 61.50% levels in November, retreated after testing the 61.53% peak. When we take a look at the important developments affecting Bitcoin dominance, We saw that US Unemployment Benefit applications were realized as 213K below expectations. However, US Leading Gross Domestic Product data and US Core PCE data were realized as 2.8% and 0.3% respectively in line with expectations. Bitcoin Dominance, which is currently moving at 58.12%, may retreat in the light of incoming data.

The Shift in Bitcoin Dominance:

- Last Week’s Level: 59.21%

- This Week’s Level: 58.12%

Improvement in US Jobless Claims

Applications for US Unemployment Benefits were realized as 213K in October 2024, below expectations.

US Leading Gross Domestic Product and US Core PCE Data in Line with Expectations

US Leading Gross Domestic Product and US Core PCE data were realized as 2.8% and 0.3%, respectively, in line with expectations.

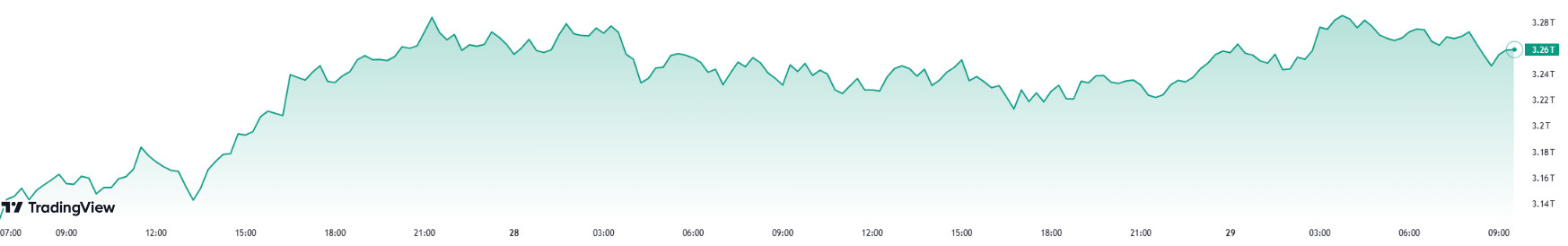

Total MarketCap

Source: Tradingview

Change in Market Value:

- Last Week’s Market Capitalization: 3.27 Trillion Dollars

- This Week’s Market Capitalization: 3.26 Trillion Dollars

The bull run on the cryptocurrency market continues, the marketcap, which has closed positive for 3 weeks, has experienced a very slight pullback this week. The total market, which was worth 3.27 trillion dollars at the beginning of the week, oscillated between 3.35 trillion dollars and 3.03 trillion dollars during the week. While the total market, which is currently at 3.26 trillion, has lost 0.41% this week, it does not seem to have created a very negative atmosphere in the cryptocurrency markets.

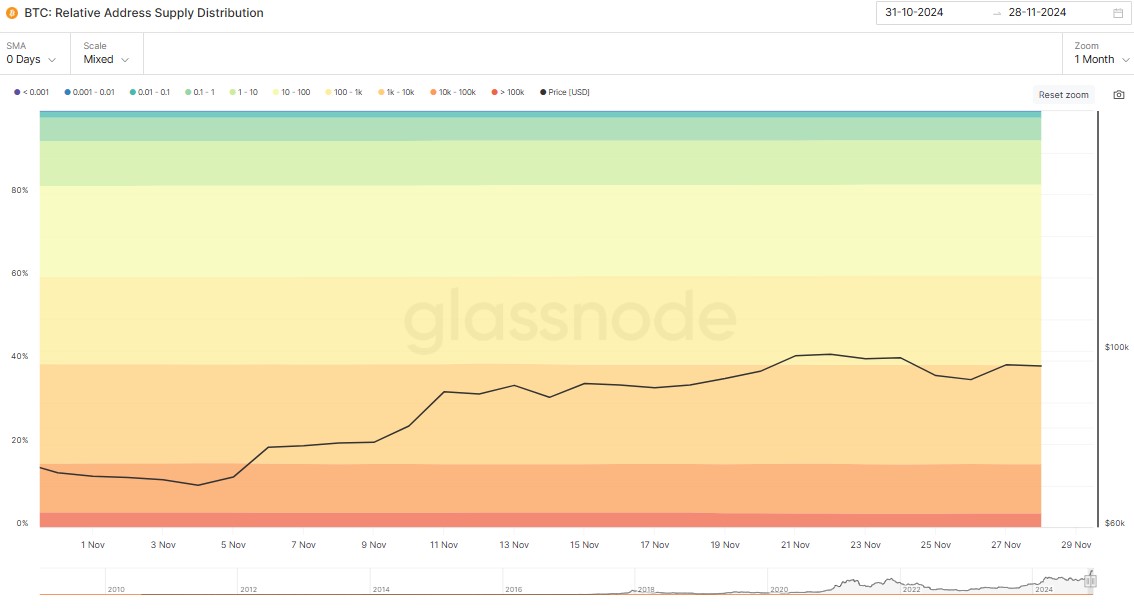

Bitcoin Supply Breakdown

Source: Glassnode

| Address Range | 21.11.2024 | 28.11.2024 | Change | Analysis |

|---|---|---|---|---|

| 0.01 – 0.1 BTC | 1,385% | 1,377% | Decline | A small decline is observed. There may have been a certain wave of selling among small-scale investors. |

| 0.1 – 1 BTC | 5,493% | 5,463% | Decline | This group makes up a significant portion of individual investors. The decline in this category may reflect profit realizations in connection with the fall in the market price. |

| 1 – 10 BTC | 10,654% | 10,615% | Decline | There is a similar decline among larger individual investors. However, this rate is less remarkable compared to other groups. |

| 10 – 100 BTC | 21,791% | 21,746% | Decline | Although there has been a decline in this category, the rate is still quite high. This shows that large investors have not completely lost confidence in the market. |

| 100 – 1k BTC | 21,425% | 21,640% | Increase | There is an increase in this range. We can say that big players see the price drop as a buying opportunity. This may indicate a long-term perspective. |

| 1k – 10k BTC | 23,769% | 23,770% | Fixed | The almost complete lack of change suggests that addresses in this category are more stable and think long-term. |

| 10k – 100k BTC | 11,943% | 11,872% | Decline | The slight decline in this category can be attributed to sales or address movements in the market. |

| > 100k BTC | 3,299% | 3,275% | Decline | There is a small reduction among the largest whales. Changes in the amounts held by such addresses have the potential to cause large market fluctuations. But the rate of change is quite small. |

General Evaluation

In general, there has been a wave of selling among small and mid-level investors as the market price declined, while large investors (especially in the 100 – 1,000 BTC range) seem to have increased their holdings. This suggests that whales and big players are taking long-term positions in the market by buying on dips.

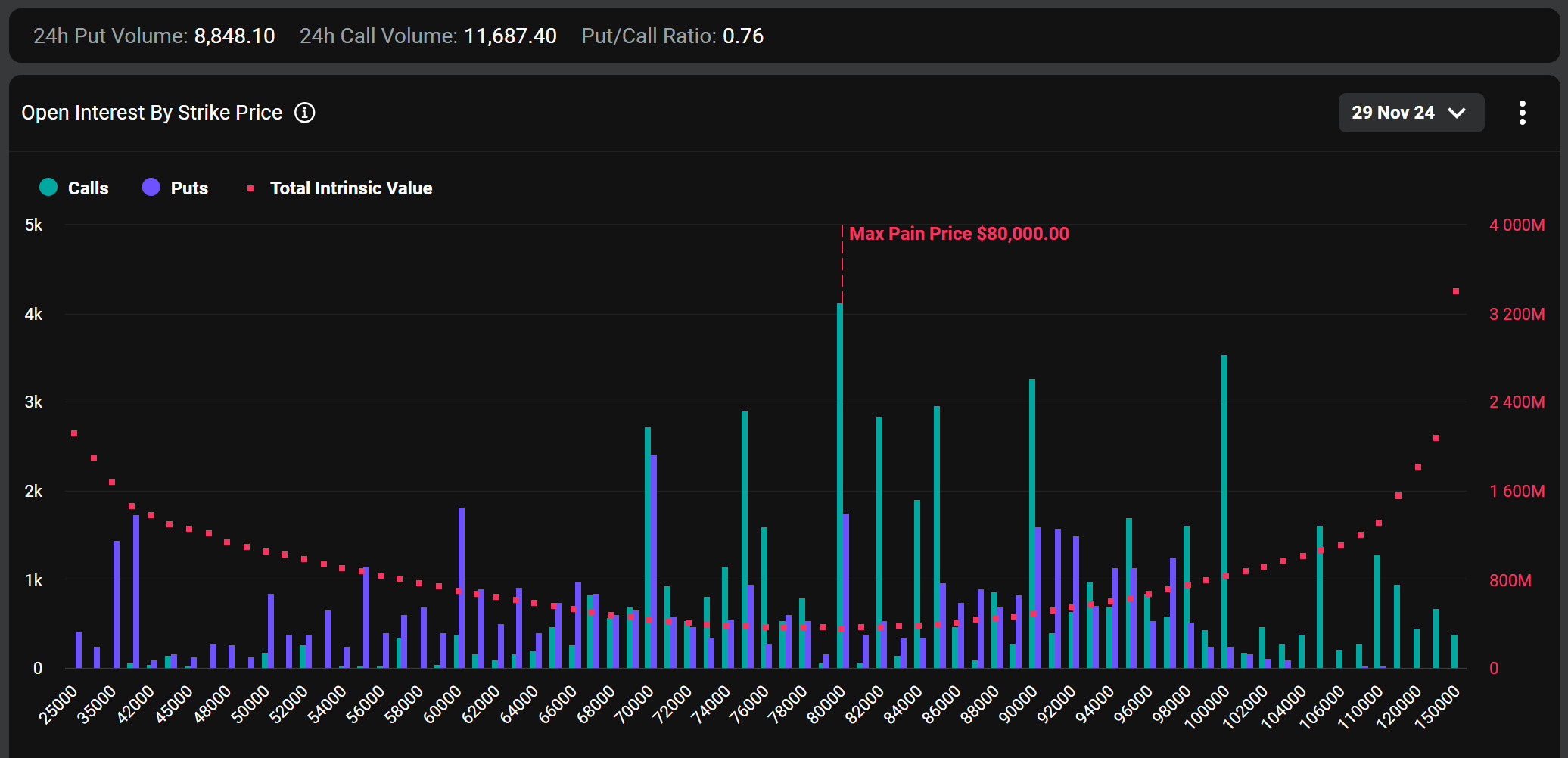

Bitcoin Options Breakdown

Source: Deribit

According to Greeks. Live, a total of 6,000 BTC transactions took place on Wednesday. During the day, a total of 120 million dollars worth of block call option transactions were reported. In addition, about 5,000 BTC of these transactions consisted of active purchases of call options with a price range of $ 92,000 to $ 100,000 with a maturity of December 27. According to analysts, this heavy buying is still ongoing and market participants expect strong price action at these levels. At the same time, another notable feature of this wave of buying is that the premiums paid are well above the usual levels. Greeks.live reported that these premiums were more than double the normal levels and that big whales were entering the market.

Deribit Data: Options contracts with a notional value of $9.4 billion BTC expire today.

Maximum Pain Point: Bitcoin’s maximum pain point is set at $80,000.

Option Expiration:

Call/Sell Ratio: The call/put ratio for these options is set at 0.76. A call/put ratio of 0.76 indicates that there is a strong preference for call options over put options among investors and a possible uptrend in the markets.

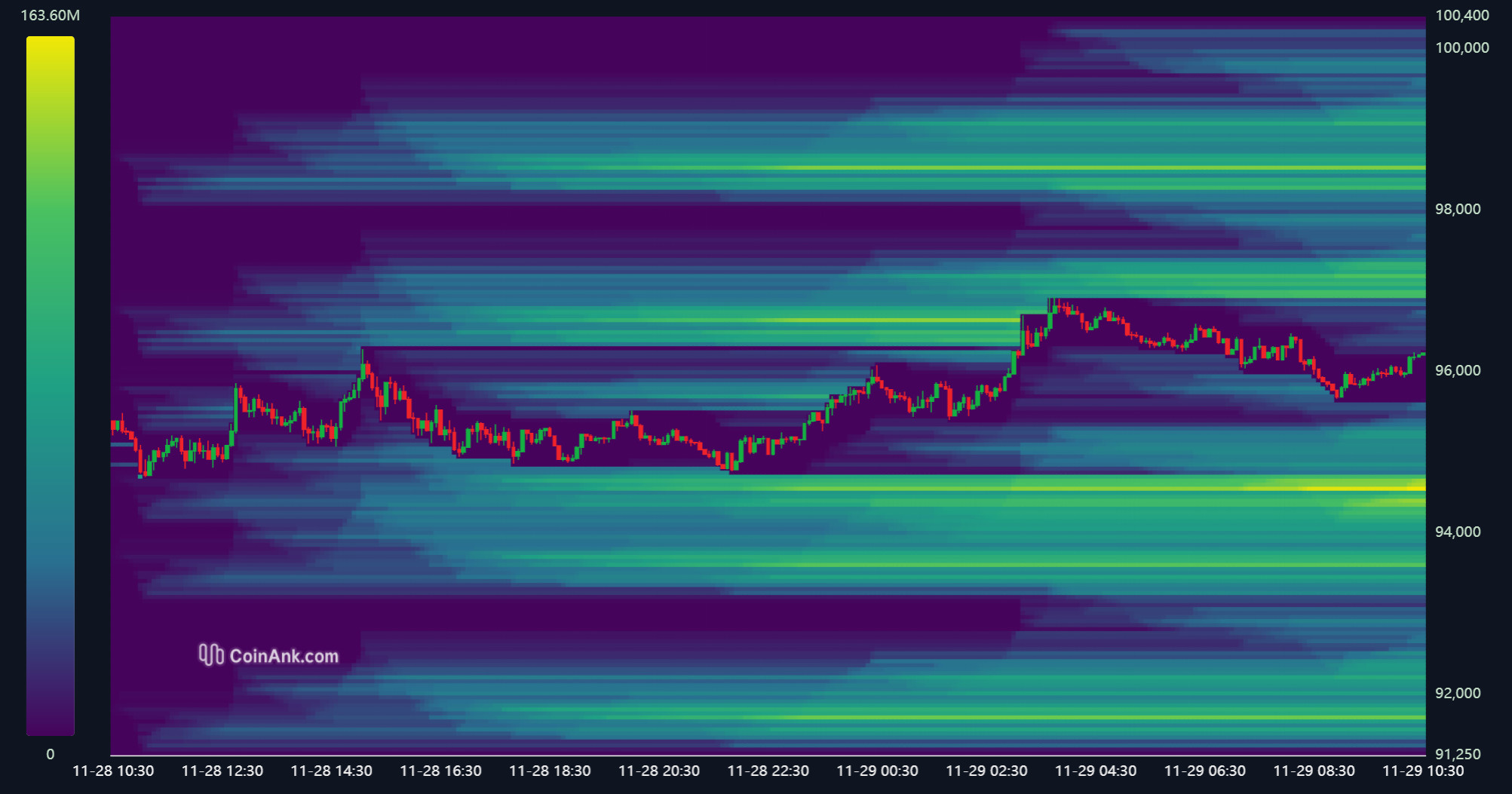

Bitcoin Liquidation Chart

Source: CoinAnk

When the liquidation heat map for BTC is examined, it is seen that long positions were liquidated by clearing the area between 90,800 and 91,400 during the week, and as a result of the subsequent rise, short transactions between 94,800 and 95,800 reached the liquidation value.

Currently, there is a significant liquidation area between 97,000 and 97,500 for short transactions and may want to clear the area in this price range in the coming period. For long transactions, liquidations seem to have accumulated between 94,300 and 94,700. These levels can be seen with the downward movement of the price and long transactions may be liquidated.

When the weekly liquidation amounts of Bitcoin are analyzed, a total of 231.36 million dollars of long transactions were liquidated between November 22 and 28, while the amount of short transactions liquidated between the same dates was 142.31 million dollars.

Weekly Bitcoin Liquidation Amounts

| History | Long Amount (Million $) | Short Amount (Million $) |

|---|---|---|

| November 25th | 117.88 | 27.83 |

| November 26th | 75.95 | 37.3 |

| November 27th | 14.73 | 62.65 |

| November 28 | 22.8 | 14.53 |

| Total | 231.36 | 142.31 |

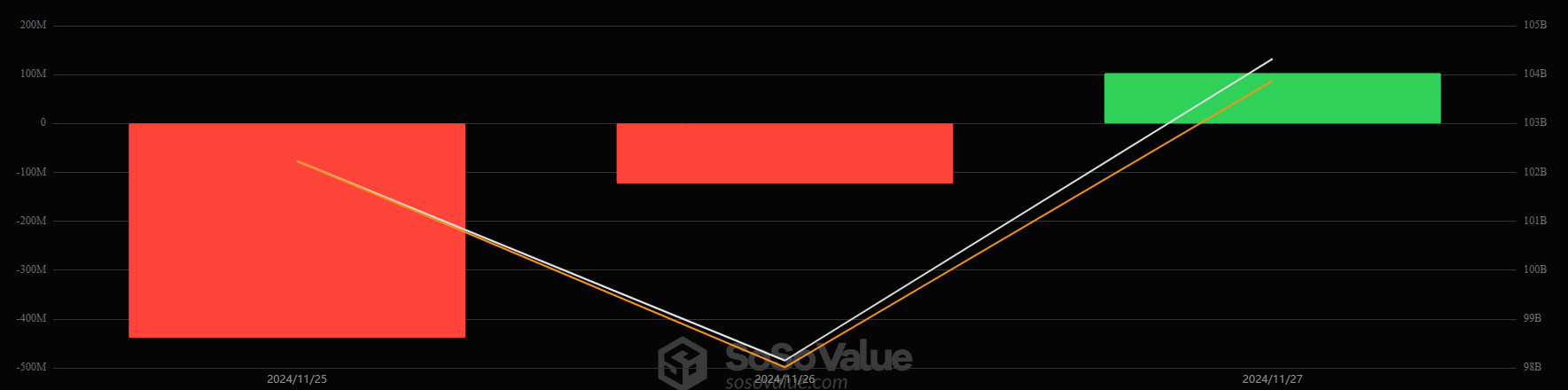

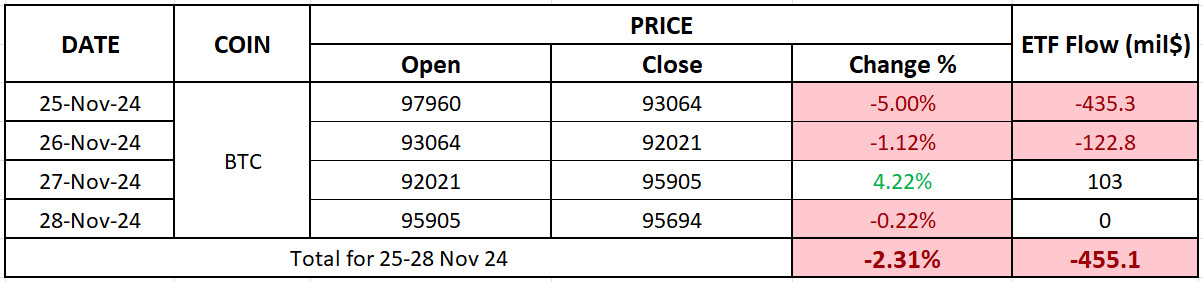

Source: SosoValue

Bitcoin Spot ETF

General Status:

- Bitcoin’s Depreciation: Last week, the value of Bitcoin fell to a low of $92,000 on November 26, after rising to over $99,000. This decline was attributed to profit realization and market correction.

- Massive Fund Outflows: The depreciation in BTC also had an impact on Spot Bitcoin ETFs. Spot Bitcoin ETFs in the US saw net outflows totaling $558.1 million, including $435.2 million on November 25 and $122.8 million on November 26. On November 27, BTC value rose to $95,000, while Spot Bitcoin ETFs ended the day with a net inflow of $103 million. Between November 25-28, the Spot Bitcoin ETF picture was a net outflow of $455.1 million.

- Stagnation in BlackRock IBIT ETF: The BlackRock IBIT ETF, which saw net inflows of over $2 billion last week, saw net flows of $0 on November 26-27 ahead of Thanksgiving on November 28, when the US stock market was closed, after net inflows of $267.8 million on November 25 this week.

- Total BTC Reserves of ETFs: The total BTC reserve value of spot Bitcoin ETFs decreased to $102.2 billion. US Spot Bitcoin ETFs represent 5.4% of the BTC market.

Featured Situation:

- Market Impact: Spot BTC ETFs also saw net outflows in the week that saw a decline in the value of Bitcoin. In particular, on November 25 and November 26, Spot BTC ETFs saw net outflows totaling over $500 million, while BTC fell to $92,000.

- BTC Price Change: There was a 2.31% depreciation in the Bitcoin price between November 25-28.

Conclusion and Analysis:

- Total Net Inflows and Outflows: In the week of the decline in BTC value, a total net outflow of $ 455 million was realized in Spot Bitcoin ETFs between November 25-28.

Price Impact: Last week, Spot Bitcoin ETFs saw total net inflows totaling approximately $3.3 billion, while the value of Bitcoin rose to over $99,000. Between November 25-28, Spot Bitcoin ETFs saw total net outflows of $455 million, and Bitcoin lost a total of 2.31% in value during this period. While the interest of both institutional and individual investors in Spot Bitcoin ETFs has increased in recent weeks, market fluctuations and high inflows and outflows have increased the volatility of these products.

WHAT’S LEFT BEHIND

Fed Cautious on Rate Cut: The Fed Minutes emphasize that rate cuts may be gradual and that a shift to a more neutral stance is likely if the economy remains strong with inflation falling to 2%.

New Mission for Elon Musk: As part of the presidential transition, Trump will create a unit responsible for artificial intelligence and emerging technologies in the White House, and Elon Musk will play an active role in this process.

Trump’s Pro-Crypto SEC Nominee: In Trump’s new cabinet, pro-crypto former SEC executive Paul Atkins is a strong candidate for SEC chairmanship.

Bitcoin Statement from Tim Cook: He stated that he has owned Bitcoin for three years but that Apple has no plans to incorporate cryptocurrencies into its payment systems.

Eyes on MicroStrategy Again: MicroStrategy, which bought 80,000 BTC in the last two weeks, is rumored to make new purchases with a $2 billion Tether mint.

Bitwise ETF Application: Bitwise has filed with the SEC for an ETF with 10 cryptocurrencies (BTC, ETH, SOL, ADA, AVAX, LINK, BCH, DOT, UNI).

Metaplanet Increases Bitcoin Investments: Metaplanet is raising $62 million to increase Bitcoin investments.

MARA Holdings Acquires Another 703 Bitcoins: MARA bought 703 Bitcoin, bringing its total holdings to 34,794 BTC, with an average cost of $95,395.

Bitcoin Move from SOS Limited: The China-based company announced that it will purchase $50 million to hold Bitcoin as a long-term reserve asset.

$29 Million Bitcoin Purchase from Semler Scientific: Semler Scientific bought 297 BTC, bringing its total Bitcoin holdings to 1,570 BTC and bringing its total investment to $117.8 million.

Rumble to Invest in Bitcoin: Rumble plans to purchase $20 million worth of Bitcoin as part of its corporate financial diversification strategy.

The United Kingdom Sets a Target for Crypto: By 2026, it will implement a comprehensive crypto regime aimed at increasing investor protection and closing regulatory loopholes.

Morocco lifts crypto ban: Morocco will reallow Bitcoin and other cryptocurrencies and start working on CBDCs, lifting the crypto ban it imposed in 2017.

Japan Reorganizes Web3 and Crypto Policy: Japan has restructured its Web3 and crypto department to boost digital innovation.

Russia Approves Crypto Tax Law: Russia has approved a new draft law imposing a 13-15% income tax on cryptocurrencies.

China’s Joint Action Plan for Digital Finance: China has released an Action Plan to promote digital finance growth, prioritizing areas such as digital RMB and green finance.

South Korea Rejects Bitcoin Reserve: Kim Byung-hwan rejected the national Bitcoin reserve plan, saying they will follow the crypto steps of other countries.

Crypto Move by Hong Kong’s ZA Bank: The bank became the first bank in Asia to offer crypto services by launching Bitcoin and Ethereum trading service.

Tether Halts EUR₮ Issuance: Tether has halted its EUR₮ stablecoin due to regulatory challenges and announced that it will prioritize new projects.

Pump.fun Leads Solana DEX Volume: Pump.fun accounted for 62.3% of Solana DEX volume in November. Solana DEX volume increased 100% in November to $109.8 billion.

SUI and Franklin Templeton Partnership: Partnering with Franklin Templeton, Sui will provide support to developers through its digital assets subsidiary.

Starknet Launches First Layer-2 Staking Feature: Ethereum offers staking support between Layer-2 networks, allowing users to generate revenue by staking tokens.

Partnership between Aave and Instadapp: Aave strengthens DeFi collaboration with Instadapp by investing $4 million.

Record and New Bug Bounty Program from Uniswap: Uniswap launched a $15.5 million bug bounty program for v4 as it broke a record with $38 billion in trading volume in November.

Big SOL Transfer to Kraken: Pump.fun sold 65,000 SOLs, generating $207 million in revenue, and transferred 99,999 SOLs worth $22.74 million to Kraken.

HIGHLIGHTS OF THE WEEK

Having turned a very important corner in November, global markets are preparing for the last month of the year. In addition to the news of a ceasefire in the Middle East, rising Russia-Ukraine tensions keep geopolitical risks on the agenda, while President-elect Trump’s appointments to Congress and the looming “crypto regulation” continue to play a decisive role in asset prices. Institutional digital asset investments, ETF and option transactions are also on investors’ radar for crypto assets. Of course, the steps to be taken by the US Federal Reserve (FED) on the dose of global financial tightness are very critical, and next week, in addition to all these dynamics, we can say that it will continue to be the determining criterion for the markets.

Throughout the week, the macro indicators for the US and the statements of the Federal Open Market Committee (FOMC) members will be under scrutiny as they will shape expectations for the FOMC decisions on December 18. Among these, Fed Chair Powell’s speech on Wednesday and Friday’s labor market statistics will be of utmost importance.

Powell ahead of December 18th…

Fed Chair Powell will participate in a discussion at the New York Times DealBook Summit. During this week, we will hear the assessments of many FOMC officials at various events, but of course, the Chairman’s remarks may be quite important.

On Saturday, December 7, the communication ban for the FOMC meeting will start and will continue until December 19. Powell’s messages ahead of the FOMC decisions, where we will see whether interest rates will be cut or not, may have an impact on asset prices by shaping expectations. Therefore, it would not be wrong to say that global markets will be at the center of attention.

The President may not address monetary policy at all. Nevertheless, in this moderated event, he will be expected to provide information on the topics that everyone is curious about. In his last speech, Powell showed a relatively more cautious attitude towards further rate cuts. If he speaks with a similar attitude or a more hawkish stance, this may reduce the risk appetite of the markets by fueling expectations that the FED will not be in a hurry to cut interest rates. Therefore, we may see negative effects on digital assets. If the FED Chairman emphasizes the necessity of interest rate cuts or gives a clear hint that interest rate cuts will be made at the December 17-18 FOMC meeting, risky assets may find a basis for rises.

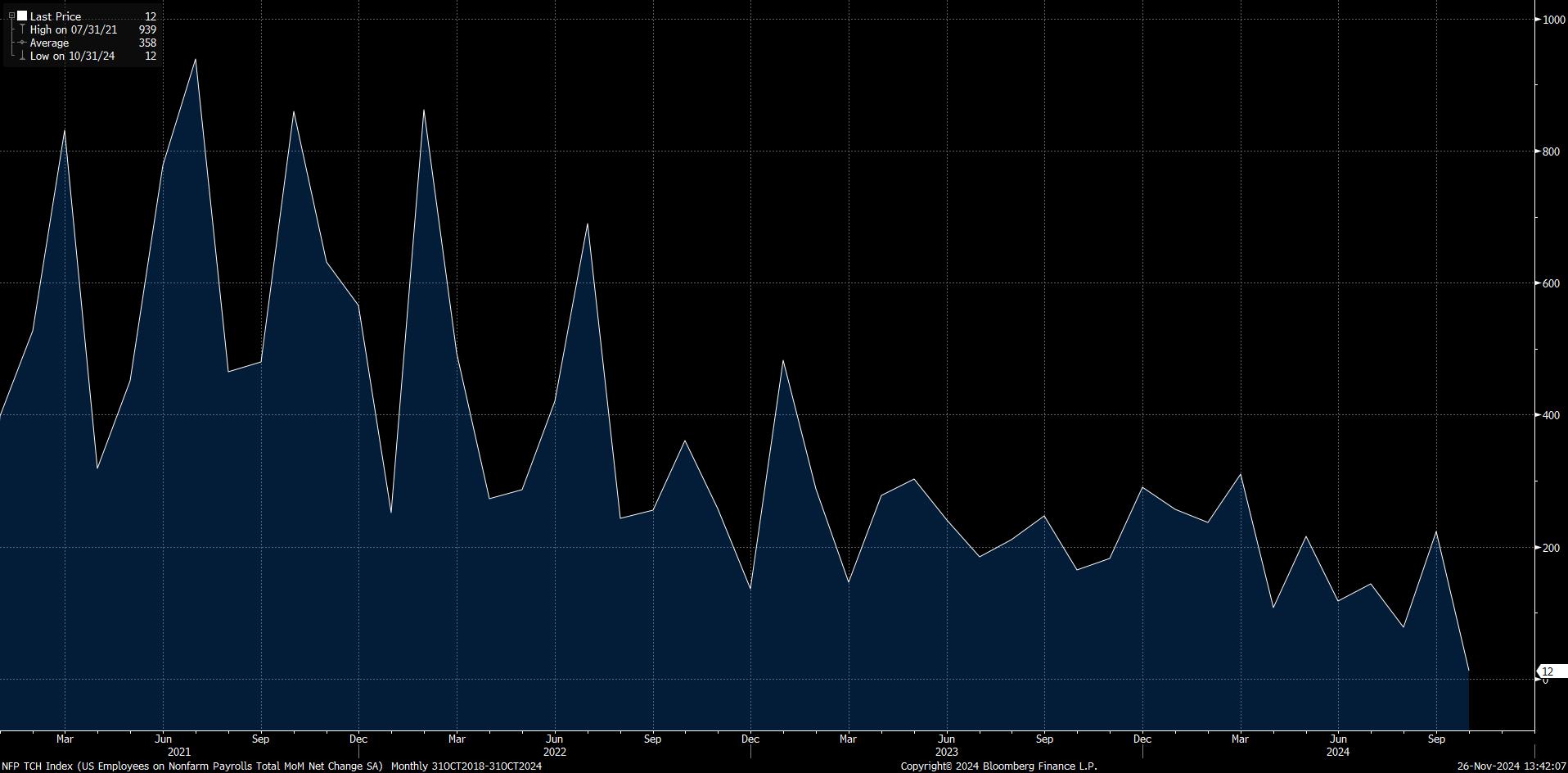

Non-Farm Payrolls Change Before Interest Rate Decision!

In October, the US economy was only able to increase non-farm payrolls by 12,000 jobs, well below expectations (106,000) due to the storms and strikes in the country. Almost everyone had already predicted that natural disasters and strikes would have an impact on the data. However, such a deep mark was not in anyone’s projections. Nevertheless, this NFP, which was much lower than expected, did not disturb the market perception too much and there was a broad-based acceptance of the idea that this was due to a temporary factor. However, it would not be wrong to say that this may not be the case for the November data.

Source: Bloomberg

We expect NFP, which is known to include seasonal effects, to point to a better performance in November after last month’s quiet one-off increase. However, it is important to keep in mind that market expectations will also be in this direction and this will have already entered prices. According to Bloomberg, the US economy is expected to have added 200,000 jobs in November. After October’s 12,000, this expectation includes payrolls coming back from strikes affecting 38,000 workers at Boeing and 3,400 hotel workers in Hawaii. The effects of Hurricane Helene and Hurricane Milton in October are really hard to gauge and we think we will see revisions more clearly in the November report.

If the NFP data is below expectations, we think that this will be read as a factor that will ease the Fed’s hand to cut the policy rate and risk appetite in global markets will increase. On the other hand, we expect a higher-than-expected data to have the opposite effect. In other words, the equation of “good data bad market, bad data good market” may work. It should be added that a data that is too high or too low than the consensus figure that will emerge as a result of the surveys may cause us to see a different reaction from this equation.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Is MVRV’s Low Peak Signalling Selling Pressure in Bitcoin?

Net Unrealized Profit/Loss (NUPL) Analysis

Bitcoin: Puell Multiple Analysis

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expec