Weekly Ethereum Onchain Report

Total Value Staked

On December 3, while the ETH price was trading at $3,189, the Total Value Staked was at 35,998,568. As of December 9, while the ETH price rose to $3,318, the Total Value Staked fell to 35,968,661, recording a 0.08% decline.

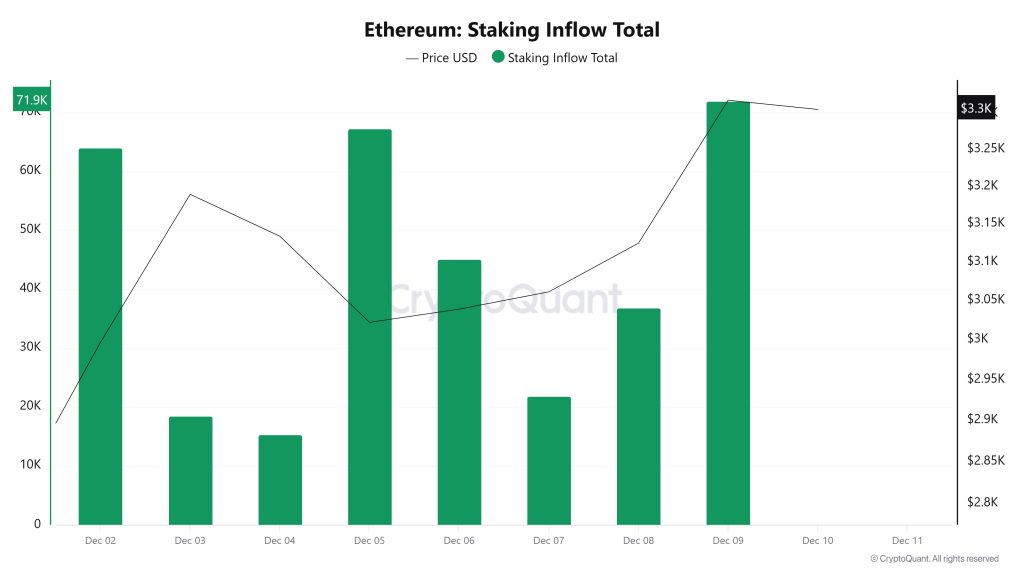

Staking Inflows

On December 3, while the ETH price was trading at $3,189, the Staking Inflow was at 18,456. As of December 9, while the ETH price rose to $3,318, the Staking Inflow increased to 71,915, recording a 289.66% increase.

Derivatives

Open Interest

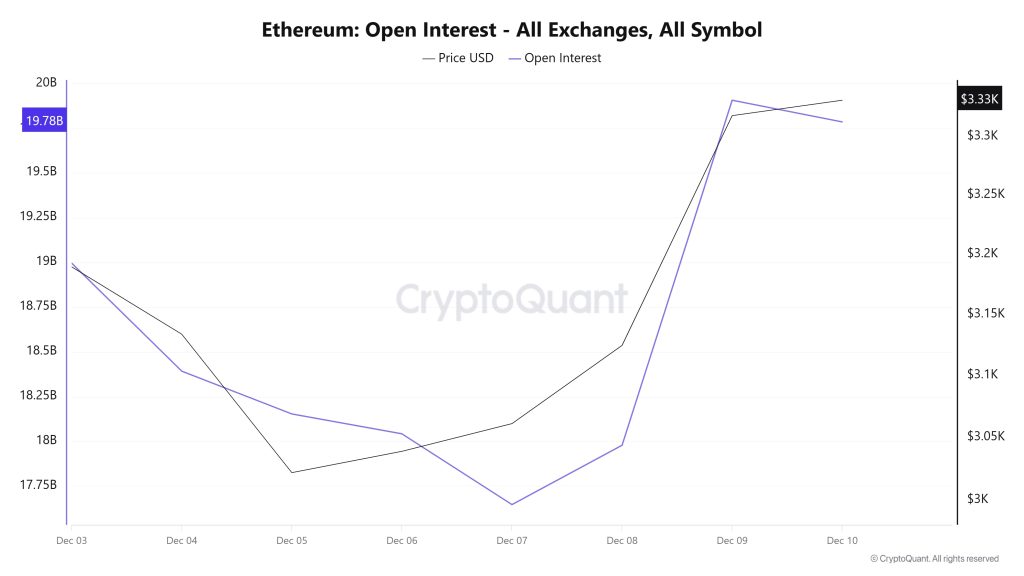

Ethereum open interest data shows that the futures market experienced sharp volatility in recent days. Initially, the decline in both price and open positions signaled a period of weakened risk appetite and reduced leveraged positions. Following this decline, the rapid recovery in price was accompanied by a strong rebound in open interest. The sharp rise on December 8–9, in particular, reveals that new positions are gaining momentum and that expectations for an increase are regaining strength. At this point, the sharp rise in both price and open interest in the same direction supports a positive scenario that confidence is returning to the market.

The fact that open positions remained high after consolidation indicates that existing long positions continue to be maintained. The overall picture shows that strong buying interest has returned to the Ethereum futures market and that the upward trend is technically supported.

Funding Rate

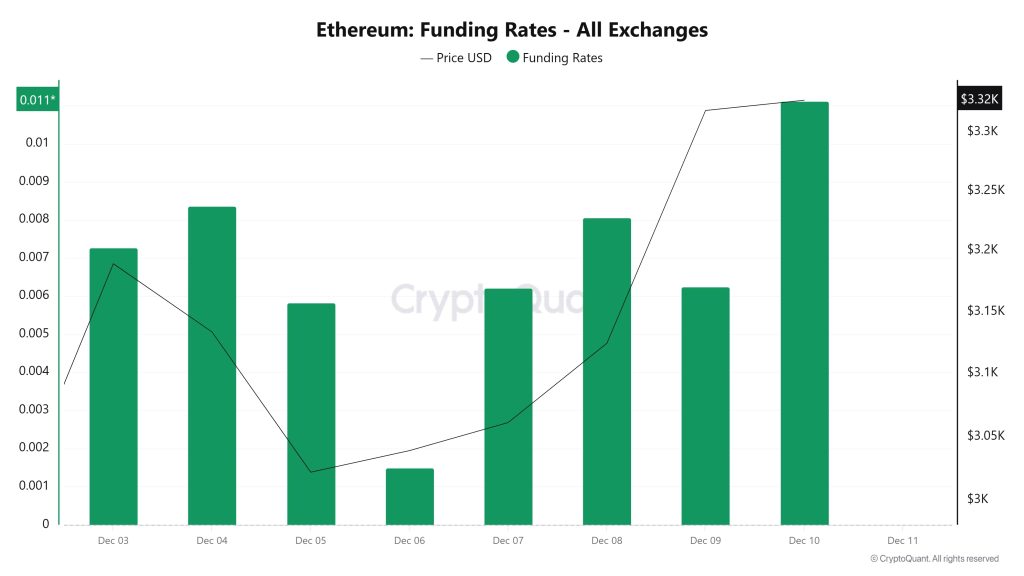

Ethereum funding rate data shows that confidence in an upward trend in the futures market has strengthened in recent days. The chart clearly shows that despite price pullbacks, rates have remained in positive territory and long positions have maintained their dominance. The simultaneous rise in both price and funding rate between December 7 and 10 is particularly noteworthy. This alignment indicates that price movements are supported by real demand and expectations in the market, rather than speculation. The sharp jump observed on December 10 shows that leveraged investors have been aggressively increasing their bullish positions.

As a result, the continuation of the positive funding structure supports the short-term upward scenario for Ethereum. The current view of market participants is clear. Long positions will continue to be maintained as long as the upward trend remains intact.

Long & Short Liquidations

With the ETH price rising from $2,720 to $3,390, a total of approximately $322.4 million in long positions were liquidated. During the same time frame, nearly $444 million in short positions were also liquidated.

| Date | Long Amount (Million $) | Short Volume (Million $) |

|---|---|---|

| December 3 | 23.56 | 87.17 |

| December 4 | 51.35 | 98.91 |

| December 5 | 122.24 | 31.76 |

| December 6 | 11.14 | 17.26 |

| December 7 | 55.67 | 58.03 |

| December 8 | 22.90 | 42.92 |

| December 9 | 35.53 | 108.90 |

| Total | 322.39 | 444.95 |

Supply Distribution

Total Supply: Reached 121,423,446 units, an increase of approximately 0.04% compared to last week.

New Supply: The amount of ETH produced this week was 45,087.

Velocity: The velocity, which was 10.05 last week, reached 10.00 as of December 9.

| Wallet Category | 12/03/2025 | 12/09/2025 | Change (%) |

|---|---|---|---|

| 100 – 1k ETH | 8.5032M | 8.4042M | -1.16 |

| 1k – 10k ETH | 12.1055M | 12.1359M | 0.25% |

| 10k – 100k ETH | 21.2335M | 21.4287M | 0.92% |

| 100k+ ETH | 4.421M | 4.4651M | 1.00% |

Recent weekly data indicates a shift toward the upper segments in the Ethereum wallet distribution. While the total balance in the 100–1k ETH range decreased, a limited increase was observed in the 1k–10k ETH group. In contrast, a more pronounced rise in the 10k–100k ETH range suggests that medium-to-large-scale investors remain on the buying side. The increase seen in the largest wallets holding 100k+ ETH indicates that major players are adding liquidity back into the market. The overall picture suggests that while the retail side remains weak, large-scale addresses are supporting the positive trend in Ethereum.

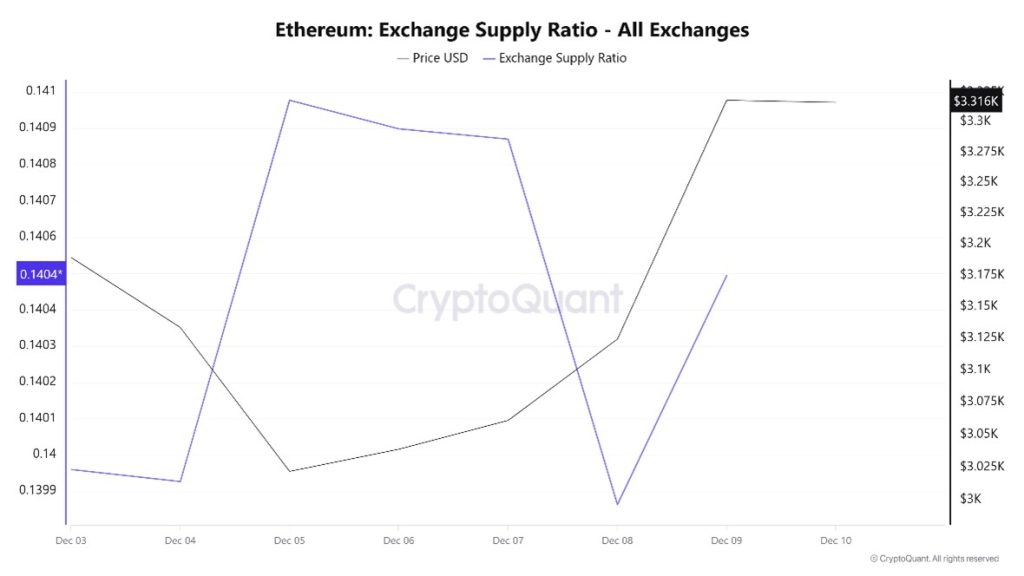

Exchange Supply Ratio

Between December 3 and December 10, the Ethereum Exchange Supply Ratio rose from 0.13996006 to 0.14049458. During this period, the price of Ethereum rose from $3.189 to $3.318. Specifically, on December 4 ( ), when the price and Exchange Supply Ratio intersected, the correlation between the price and Exchange Supply Ratio turned negative. On December 8, the correlation turned positive and increased. This indicates that, along with the rise in price, the amount of Ethereum supplied to exchanges has increased and that long-term investors have likely shifted their assets toward purchasing Ethereum ( ). Overall uncertainty may prevail in the Ethereum price.

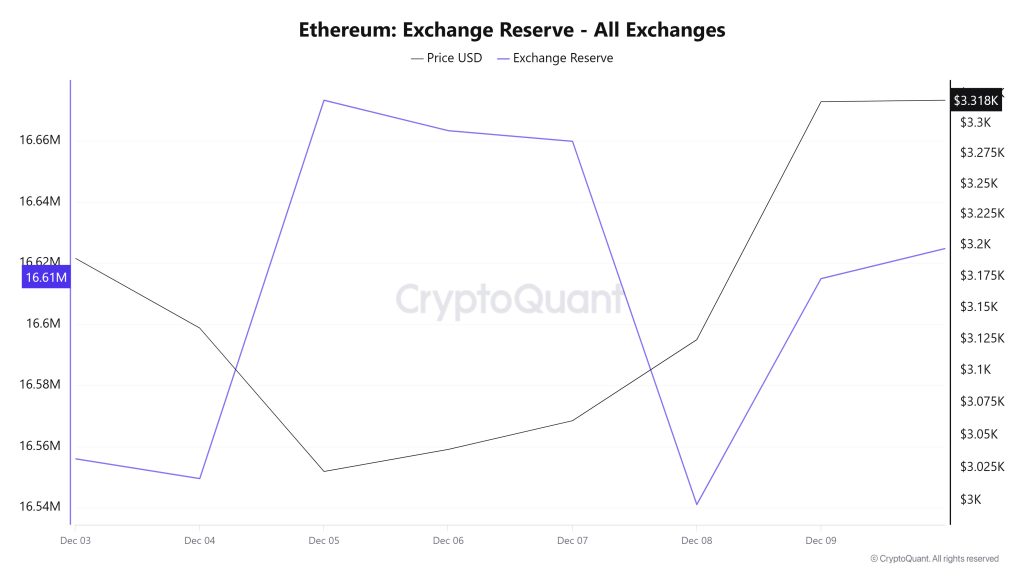

Exchange Reserve

Between December 3 and 9, 2025, Ethereum reserves on exchanges rose from 16,586,586 ETH to 16,614,906 ETH, recording a net inflow of 28,320 ETH. During this period, reserves saw a limited increase of approximately 0.17%, while the ETH price rose from $2,998 to $3,318, experiencing a strong increase of approximately 10.70%. Despite the price increase, the slight rise in reserves indicated that some investors turned the uptrend into a selling opportunity, but selling pressure remained limited. The steady upward movement of the price despite the fluctuations in inflows and outflows observed during this period revealed that demand was strong. Although the slight increase in reserves indicates that liquidity entered the market on the sell side, it may not be large enough to completely halt the current upward momentum.

| Date | December 3 | Dec 4 | 05-Dec | 06-Dec | 07-Dec | December 8 | 09-Dec |

|---|---|---|---|---|---|---|---|

| Exchange Inflow | 970,718 | 907,149 | 880,870 | 251,714 | 339,966 | 611,977 | 924,736 |

| Exchange Outflow | 1,001,347 | 913,612 | 757,083 | 261,677 | 343,446 | 730,828 | 850,817 |

| Exchange Netflow | -30,628 | -6,463 | 123,787 | -9,963 | -3,480 | -118,851 | 73,919 |

| Exchange Reserve | 16,555,958 | 16,549,495 | 16,673,282 | 16,663,319 | 16,659,838 | 16,540,988 | 16,614,906 |

| ETH Price | 2,998 | 3,134 | 3,022 | 3,039 | 3,061 | 3,124 | 3,318 |

Fees and Revenues

When examining the Ethereum Fees per Transaction (Mean) data for the period between December 3 and 9, it is observed that the indicator reached 0.000071787442296788 on December 3, the first day of the week.

A fluctuating trend was observed until December 6, and on this date, the indicator recorded the week’s lowest value at 0.000057257587928002.

In this context, as of December 6, the indicator regained momentum as a result of increased price volatility in Ethereum, following a positive trend due to the impact of price volatility.

On December 9, the last day of the weekly period, the indicator closed the week at 0.000126169543381167.

Ethereum: Fees (Total)

Similarly, when examining the Ethereum Fees (Total) data between December 3 and 9, it is observed that on December 3, the first day of the week, the indicator reached a level of 132.9787709608012.

A fluctuating trend was observed until December 6, and on this date, the indicator recorded the week’s lowest value at 82.71144864139592.

In this context, as of December 6, the indicator regained momentum as a result of increased price volatility in Ethereum, following a positive trend due to the impact of price volatility.

On December 9, the last day of the weekly period, the indicator closed the week at 184.6900056703935.

Blocks Mined

When examining Ethereum block production data between December 3 and 9, an increase was observed throughout the week. While 7,093 blocks were produced on December 3, this number rose to 7,122 by December 9.

During the period in question, a time-dependent correlation structure was observed between the Ethereum price and the number of blocks produced. However, the general trend shows that a positive correlation between these two variables is dominant.

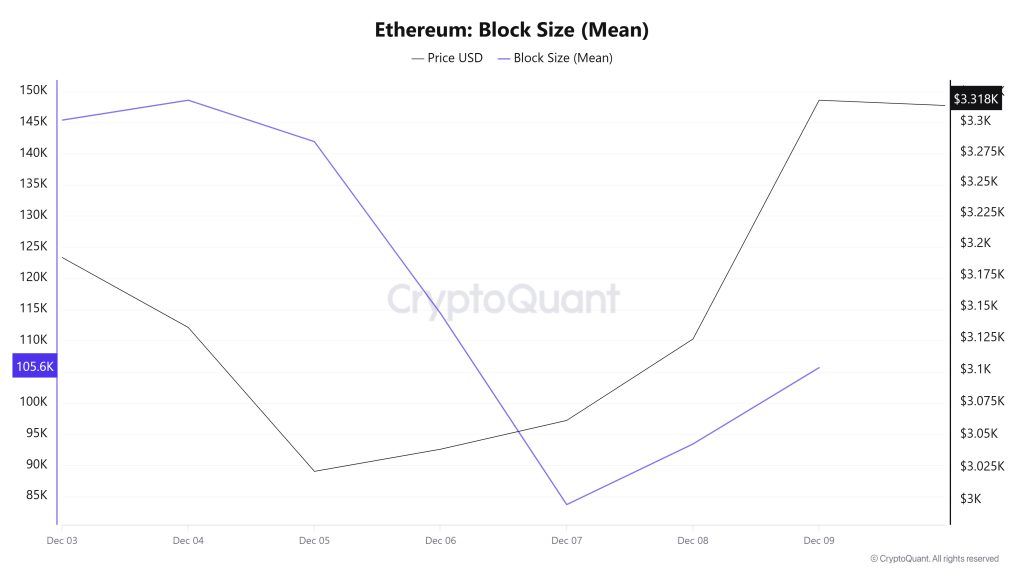

Block Size

When examining Ethereum block size data between December 3 and 9, a decrease was observed throughout the week. While the average block size was measured at 145,381 bytes on December 3, this value had declined to 105,672 bytes by December 9.

During the relevant period, a time-dependent correlation structure was observed between block size and the Ethereum price. However, the general trend indicates that a positive correlation between these two variables is dominant.

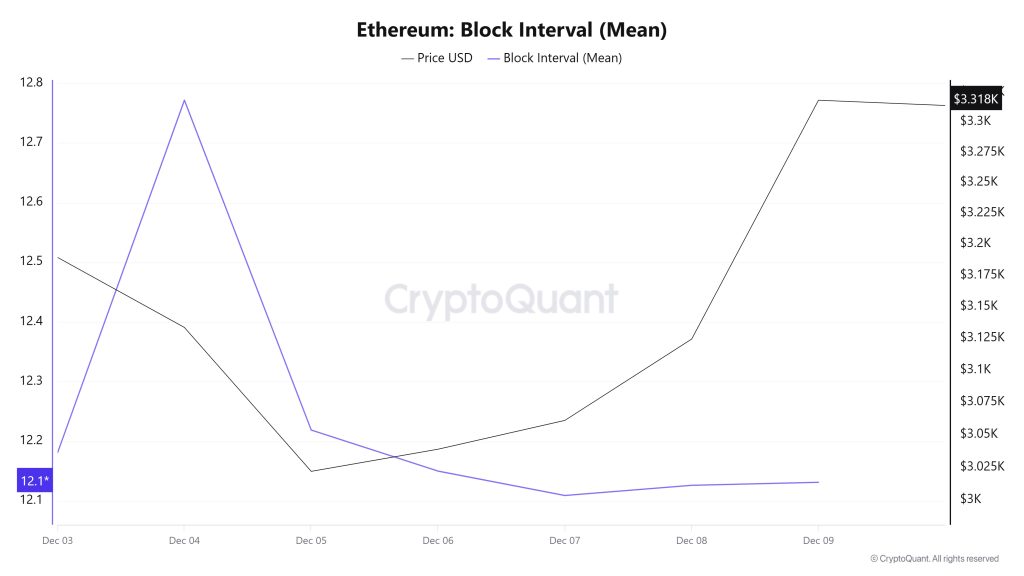

Block Interval

When examining the Ethereum block time between December 3 and 9, a decline was observed throughout the week. While the average block time was recorded as 12.18 seconds on December 3, this time decreased to 12.13 seconds as of December 9.

During the period in question, a time-dependent correlation structure was observed between Ethereum block time and price movement. However, the general trend indicates that a negative correlation between these two variables is dominant.

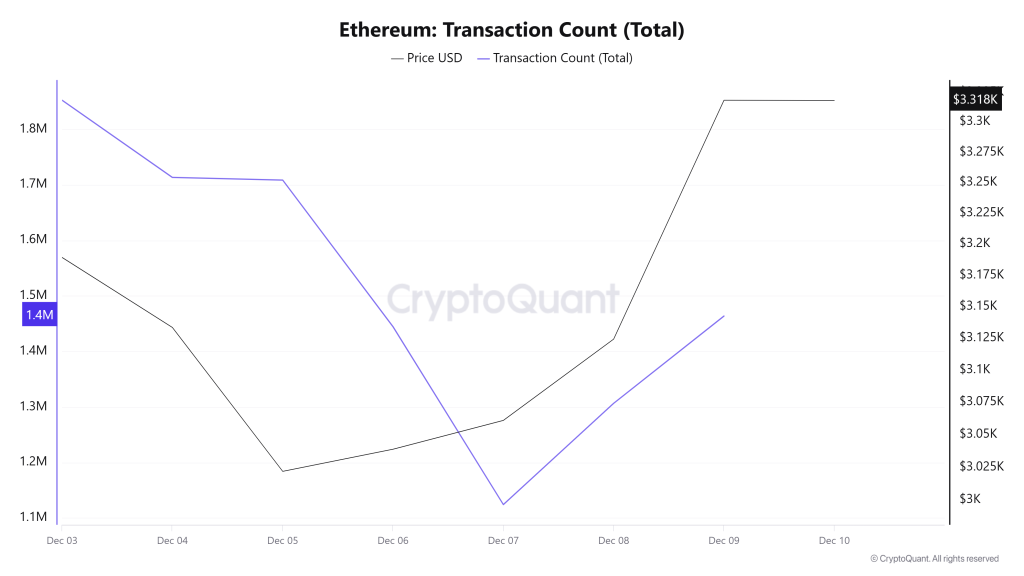

Transaction

Last week, 11,638,824 transactions were executed on the Ethereum network, while this week the number of transactions fell by approximately 8.8% to 10,613,654. The highest transaction volume of the week was recorded on December 3 at 1,852,396, while the lowest volume was recorded on December 7 at 1,124,281. Although the correlation between transaction volume and price showed mixed results throughout the week, the prevalence of positive correlations allows us to assess the period as a whole as positively correlated. However, the decline in network activity compared to the previous period indicates a noticeable slowdown in Ethereum’s transaction momentum.

Tokens Transferred

The total amount of ETH transferred last week was 10,465,681 ETH, while this week the value fell to 9,887,336 ETH, recording a decline of approximately 5.5%. The highest transfer volume during the period occurred on December 3 at 1,980,603 ETH, while the lowest value was recorded on December 6 at 585,869 ETH.

The fluctuations of up to 300% seen in daily transfers, when considered alongside the decrease in the number of transactions, indicate that the average amount of ETH transferred per transaction remained more balanced between days compared to the previous period, while the amount of ETH per transaction remained largely stable between periods. This pattern is a natural consequence of the simultaneous decline in total transfer volume and transaction count. Overall, network activity appears to have shifted this week toward a profile dominated by smaller investors rather than major players.

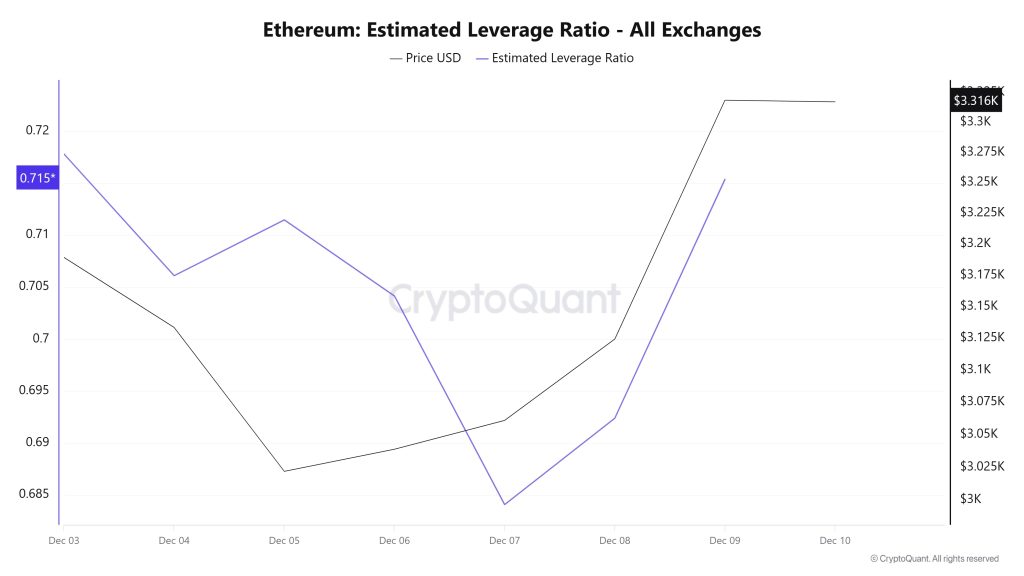

Estimated Leverage Ratio

Over the 7-day period, the metric experienced a decline until the middle of the process. The ELR (Estimated Leverage Ratio), which fell to 0.684 on December 7, the middle of the process, and formed the lowest point of the process, began to rise after this date, indicating an increase in risk appetite. The peak occurred on December 3, the first day of the process, reaching a value of 0.717. At the time of writing, the metric stands at 0.715, indicating increased investor appetite compared to the middle of the process. A higher ELR means participants are more willing to take on risk and generally indicates bullish conditions or expectations. The increases may also stem from a decrease in reserves. Looking at Ethereum reserves, there were 16.56 million reserves at the beginning of the process, but this figure fluctuated throughout the rest of the process and currently stands at 16.62 million. At the same time, Ethereum’s Open Interest was $35.87 billion at the beginning of the process. As of now, volume has shown a slight increase during the process, and the open interest value has accelerated to $40.40 billion. With all this data, the ELR metric fluctuated throughout the process. The asset’s price fluctuated between $3,000 and $3,360 with all this data. As of now, investors’ and traders’ risk appetite appears to have increased. Consequently, the slight increase in open interest data observed throughout the process, coupled with the fluctuating movement of reserves, indicates that risk appetite has genuinely increased.

ETH Onchain Overall

| Metric | Positive 📈 | Negative📉 | Neutral➖ |

|---|---|---|---|

| Total Value Staked | ✓ | ||

| Derivatives | ✓ | ||

| Supply Distribution | ✓ | ||

| Exchange Supply Ratio | ✓ | ||

| Exchange Reserve | ✓ | ||

| Fees and Revenues | ✓ | ||

| Blocks Mined | ✓ | ||

| Transaction | ✓ | ||

| Estimated Leverage Ratio | ✓ |

*The metrics and guidance provided in the table do not alone explain or imply any expectation regarding future price changes in any asset. Digital asset prices can fluctuate based on numerous variables. The on-chain analysis and related guidance are intended to assist investors in their decision-making process, and basing financial investments solely on the results of this analysis may lead to unfavourable outcomes. Even if all metrics produce positive, negative, or neutral results simultaneously, the expected outcomes may not materialize depending on market conditions. It would be beneficial for investors reviewing the report to take these warnings into consideration.

Legal Notice

The investment information, comments, and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in outcomes that align with your expectations.

NOTE: All data used in Ethereum on-chain analysis is based on CryptoQuant.