Technical Analysis

BTC/USDT

ADP private sector employment in the US fell by 33K in June, signaling an unexpected weakening in the employment market. Genius Group increased its BTC reserve by 20% to 120 BTC and announced a target of 1,000 BTC by the end of the year. Companies such as K33, Mogo and Vaultz Capital also continued their buying moves, while Canada-based Mogo received a $50 million Bitcoin reserve authorization. In the rest of the day, US stock markets, which are partially negative on the futures side, will be followed.

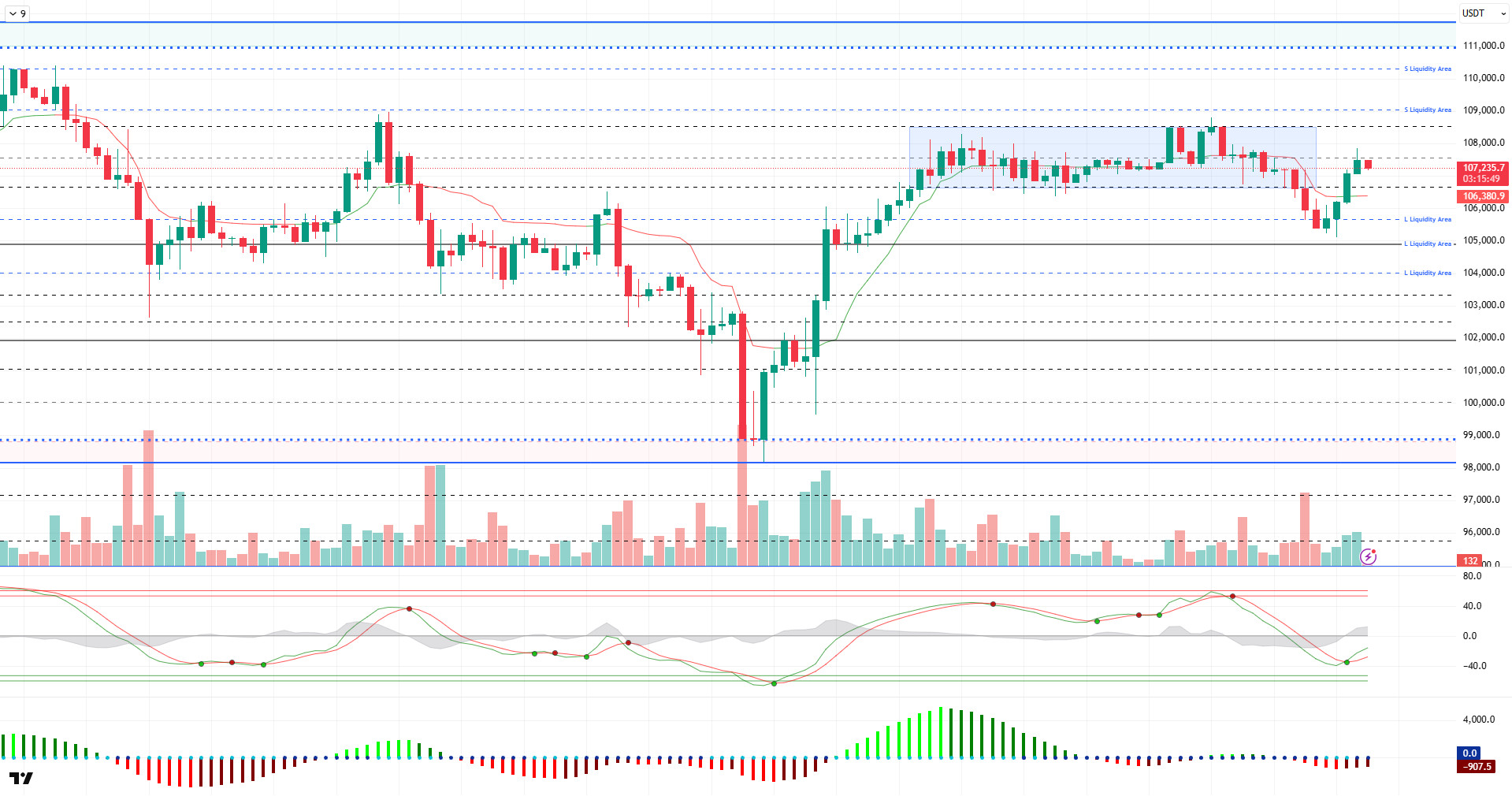

Looking at the technical outlook, BTC has yet to break through the 107,500 resistance point as it continues to maintain yesterday’s gains. At the time of writing, BTC is trading at 107,300 and continues to push higher.

Technical indicators are pointing to a trend reversal near the Wave Trend (WT) oversold area, while the histogram on the Squeeze Momentum (SM) indicator may move into positive territory once again, although the histogram is negative again. The Kaufman moving average is moving just below the price at 106,400, confirming the short-term bullishness.

Liquidity data shows that the buy trades with the recent decline were liquidated above the 105,000 level. Then, BTC, which is heading towards the liquidity area again, may target selling positions within the 108,000 – 110,000 band this time.

As a result, while fundamental developments continue to be the catalyst for pricing, liquidity data and technical indicators have started to accompany it. In the continuation of upward movements, 109,000 – 110,000 levels can be followed as resistance bands. On the other hand, we will follow the 106,600 support zone again in a possible selling pressure.

Supports 106,600 – 106,000 – 105,500

Resistances 108,500 – 109,000 – 110,000

ETH/USDT

The ADP Nonfarm Employment Change data announced during the day came in at -33K, reducing the risk appetite in global markets. Following this development, there were withdrawals in crypto assets along with global markets. Under this pressure, ETH broke down the kijun level, which is technically an important support, and the price fell directly to the upper band of the kumo cloud.

The IchimokU indicator shows that the price is currently trying to hold on to the upper band of the kumo cloud. This level stands out as a structurally strong support zone. However, with the tenkan level cutting the kijun level downwards, a technical sell signal has been formed. This intersection is a warning that if the price loses its current support, the decline may deepen.

On the other hand, the Relative Strength Index (RSI) indicator fell below the moving average-based support line with the recent decline, indicating that the weak price action continues. This trend of the RSI can be considered as a clear indication that the purchasing power in the market is weakening. Chaikin Money Flow (CMF) data is similarly trending towards negative territory. This is an important signal that capital outflows from the market are accelerating and buyer interest is waning.

Nevertheless, the price still has some resistance on the momentum side. This suggests that the kumo cloud level is still likely to act as a support that could work in the short term. However, a sustained close below the $2,436 level in the evening hours would confirm the negative technical outlook. In this case, the possibility of accelerating the downward movement will be on the table. On the other hand, since the $2,436 level is a strong support level, potential purchases from this region could rebound the price. From this perspective, how investor reactions take shape at this level will play a critical role in determining the short-term direction.

Supports 2,329 – 2,130 – 2,029

Resistances 2,533 – 2,736 – 2,857

XRP/USDT

Although XRP rose above the $2.20 level during the day, indicating that buyers came into play in the short term, it fell below the $2.18 level again with increasing selling pressure towards the evening hours. This movement reveals that the price is struggling to gain upward momentum and the market is in an unstable structure.

Technical indicators support this. The Relative Strength Index (RSI) continues to trend lower, indicating that the weakness in market momentum continues. This structure of the RSI suggests that short-term risks are still dominant and the price may struggle to realize an upside breakout.

On the other hand, the Chaikin Money Flow (CMF) indicator remains in positive territory despite the price decline. This indicates that the liquidity leaving the market remains limited and buyer interest has not completely disappeared. The positive CMF data means that the price may find support at current levels and the possibility of heading back to the $2.21 band remains alive.

On the Ichimoku indicator, it can be said that short-term risks have become more evident. With the Tenkan level crossing the kijun level to the downside, a classic sell signal has been formed. This intersection, especially when combined with the weak RSI and the price approaching the support zone, is a signal that downward pressure may continue.

In line with this technical outlook, if the price fails to persist above the $2.21 level in the evening hours, it is among the possible scenarios that the retreat will continue and extend to the upper band of the kumo cloud at the $2.14 level. However, since the $2.21 level is a resistance point where strong reactions have come in the past, the possibility of triggering an upward movement if this level is exceeded should not be ignored. If the price crosses this zone, it may be possible to regain a positive momentum in the short term.

Supports 2.0841 – 1.9115 – 1.7226

Resistances 2.2111 – 2.3928 – 2.5900

SOL/USDT

The first US-listed Solana stake ETF will start trading today.

The SOL price was flat during the day. The asset accelerated by testing the $144.35 level, which is a strong support, and rallied from there. Breaking the 50 EMA (Blue Line) moving average to the upside, the price continued its momentum and tested the 200 EMA (Black Line) moving average as resistance before losing strength and declining. It is currently testing the 50 EMA as support. If the price breaks the 50 EMA moving average downwards, the $ 144.35 level appears as an important support level.

On the 4-hour chart, the 50 EMA continued to be below the 200 EMA. This suggests that the bearish trend may continue in the medium term. At the same time, the fact that the price is between both moving averages suggests that the market is currently in a short-term decision phase. Chaikin Money Flow (CMF-20) is now at the neutral level; in addition, a decline in inflows could push CMF back into negative territory. At the same time, it continues to be below the uptrend that started on June 27. This could deepen the decline. Relative Strength Index (RSI-14) moved from neutral to negative territory. The $150.67 level stands out as a strong resistance point in case of an uptrend on the back of macroeconomic data or positive news on the Solana ecosystem. If this level is broken upwards, the rise can be expected to continue. If there are pullbacks due to contrary developments or profit realizations, the $144.35 level can be tested. In case of a decline to these support levels, the increase in buying momentum may offer a potential bullish opportunity.

Supports 144.35 – 138.73 – 133.74

Resistances 150.67 – 163.80 – 171.82

DOGE/USDT

DOGE price continued to remain inside the ascending triangle pattern during the day. Facing resistance from the 50 EMA (Blue Line) moving average, the asset continues its decline and remains close to the base level of the ascending triangle pattern. If price declines continue, the $0.15680 level can be followed as support again. On candle closes above the 50 EMA, the ceiling level of the ascending triangle pattern can be followed.

On the 4-hour chart, the 50 EMA (Blue Line) continues to be below the 200 EMA (Black Line). This suggests that the asset is bearish in the medium term. The fact that the price is below both moving averages suggests that the asset is bearish in the short term. Chaikin Money Flow (CMF-20) maintains its neutral position. In addition, negative inflows may push CMF into negative territory. Relative Strength Index (RSI-14) continued to be in negative territory. On the other hand, selling pressure seems to have reappeared. The $0.16686 level stands out as a strong resistance zone in case of a possible rise in line with political developments, macroeconomic data or positive news flow in the DOGE ecosystem. In the opposite case or possible negative news flow, the $0.15680 level may be triggered. In case of a decline to these levels, the momentum may increase, and a new bullish wave may start.

Supports 0.15680 – 0.14952 – 0.14237

Resistances 0.16686 – 0.17766 – 0.18566

Legal Notice

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.