Technical Analysis

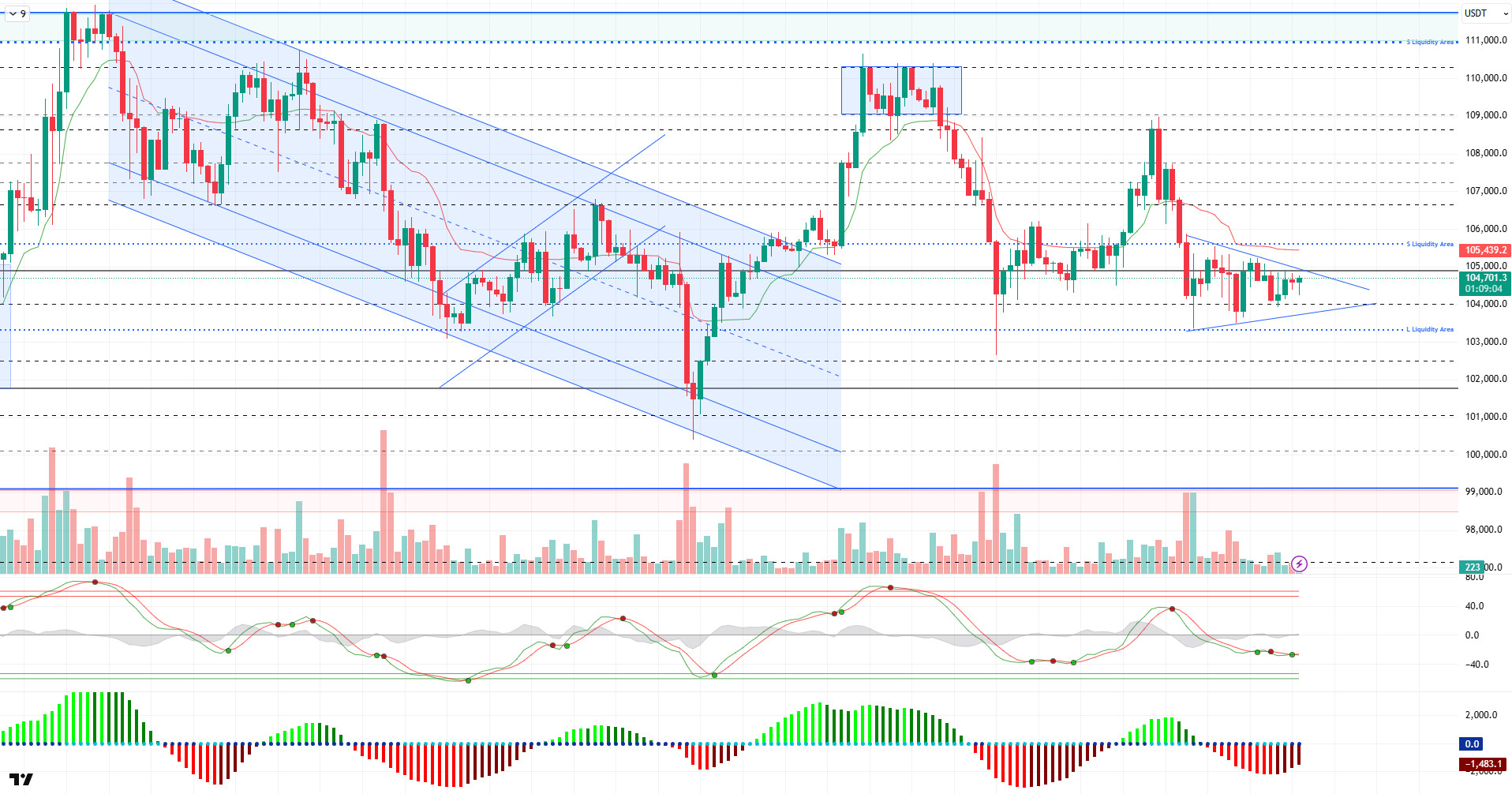

BTC/USDT

Rising tensions between the United States and Iran are entering a new phase of diplomatic and military assessment with President Trump’s National Security Meeting today. Israel’s plan for a unilateral attack on the Fordow nuclear facility raises the possibility of action within the next 72 hours, with or without US support. Trump’s announcement that he would make the decision to intervene within two weeks signaled a critical process in terms of regional security balances. On the other hand, on the institutional crypto investments side, US company Semler Scientific’s target of 105,000 BTC by the end of 2027 sets a new threshold in the institutional adoption of Bitcoin as a reserve asset.

Looking at the technical outlook, we can say that the BTC price continues to move in low volatility and weak volume conditions in line with the previous analysis and is trading at 104,800 levels, just below the 105,000 resistance.

On the technical indicators front, the Wave Trend (WT) oscillator maintains its buy signal, albeit weak. This indicates that the upside potential of the price remains, while the Squeeze Momentum (SM) indicator is trying to regain momentum after reaching its maximum levels. The Kaufman moving average is just below the price at 105,400 and does not give a signal to fully support the upside. As long as the price does not break above this average with persistence, it would be premature to talk about a strong uptrend.

The picture has not changed on the liquidity data side either. While it is seen that buying positions have been re-activated to some extent, it is seen that selling positions are maintained in the 105,700-107,000 band. This indicates that if the price rises to these levels, it may encounter resistance.

As a result, although BTC’s technical structure and liquidity data provide a bullish backdrop, the short-term direction is still undecided. If the 105,000 level is crossed on volume, the 106,600 level is likely to be targeted. On the other hand, in a scenario where fundamental developments are insufficient or negative surprises occur, the 104,000 and 103,300 levels will regain importance as support points.

Supports 104,000 -103,300 -102,400

Resistances 105,000 – 105,500 -106,600

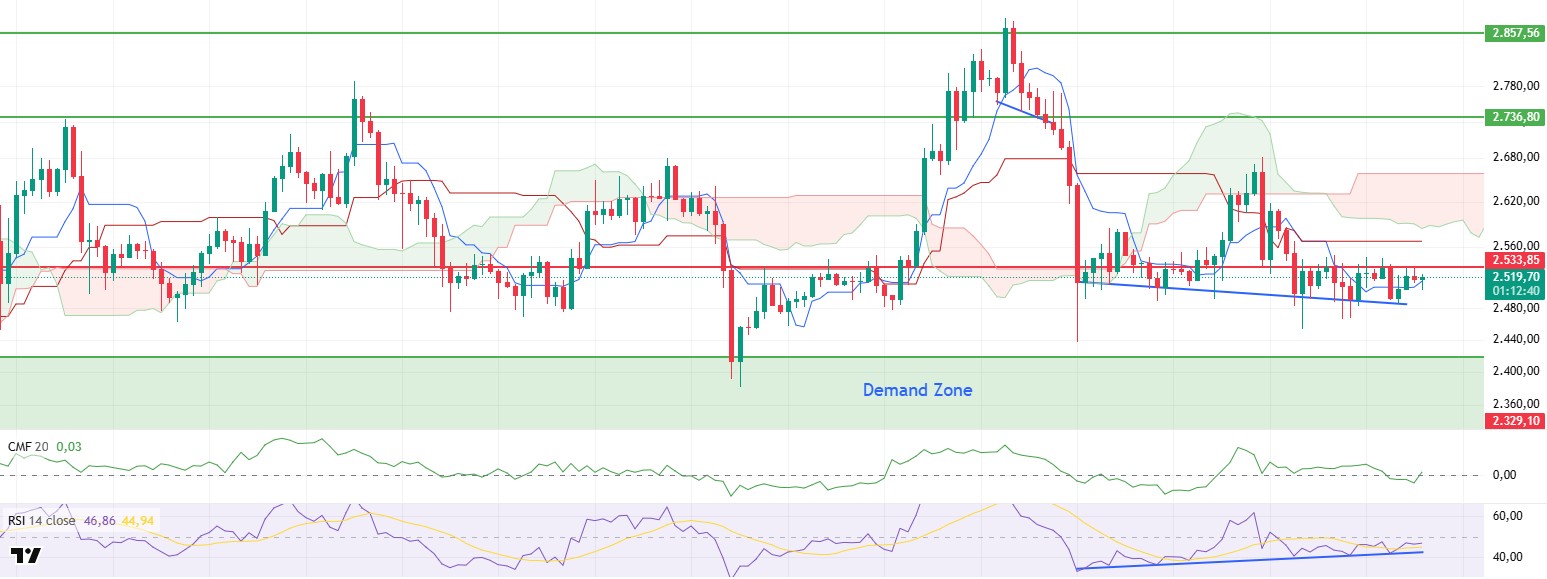

ETH/USDT

ETH continued its horizontal course in the range of $2,500 – $2,533 yesterday evening. Although it retested the $ 2,533 level during the night hours, it was observed that it had difficulty in exceeding this region. The main reason for this is that there is not enough volume in buying transactions. This region has become a strong resistance point in recent days.

Technical indicators started to signal a recovery in the short-term outlook. The Chaikin Money Flow (CMF) indicator had moved into negative territory yesterday, but as of today, it has returned to positive territory, indicating that buying appetite has increased and liquidity inflows to the market have resumed. This turn signals that investor confidence has started to recover.

The Relative Strength Index (RSI) indicator supports momentum. The RSI value maintains its upward trend along the moving average (based MA) line it moves on, indicating that buyers are more dominant in the market. This outlook can be considered as an element that increases the upside potential of the price.

Looking at the Ichimoku indicator, the overall structure is still negative. The fact that the price is below both the kijun level and the lower boundary of the kumo cloud suggests that the main trend remains downward. However, the rise in the tenkan level indicates that a recovery trend has started, albeit limited in the short term. This could signal a trend reversal if the price breaks out of the current pressure.

When the overall outlook is evaluated, these signs of recovery in technical indicators keep the possibility of the price exceeding the $2,533 resistance on the agenda. If this level is exceeded with a voluminous breakout, the price is likely to head towards the kijun resistance at $2,568 in the first place. However, if it sags below the $ 2,500 level and persists in this region, the possibility that the selling pressure will increase and the decline will become more severe should not be ignored. Therefore, in the short term, the 2,500 – 2,533 dollar band continues to be critical for both support and resistance.

Top of Form

Below the Form

Supports 2,329 – 2,130 – 2,029

Resistances 2,533 – 2,736 – 2,857

XRP/USDT

XRP retested the kumo cloud lower band, which corresponded to the $2.17 level yesterday evening, but with the sales coming from this level, it turned down and fell below the tenkan level again. In particular, the fact that the kumo cloud lower band could not be exceeded shows that this level is perceived as a strong resistance by market participants and the selling pressure intensified here. The fact that the price remains below the tenkan level weakens the short-term recovery prospects.

Technical indicators support the weak course. The Chaikin Money Flow (CMF) indicator has been in negative territory for a while and with this decline, the negative trend continues. Although a short-term and limited recovery effort is seen, the fact that CMF remains in the negative zone reveals that the market is still facing liquidity outflows and that sales transactions continue to dominate.

The Relative Strength Index (RSI) indicator also confirms the current technical weakness. The RSI continues to move down below its moving average (based MA), indicating a continued weakening in momentum. It is clear that the buyers’ influence in the market has diminished and selling pressure is becoming more prominent.

The overall structure on the Ichimoku indicator also remains negative. The fact that the price continues to remain below both the tenkan and kijun levels, as well as pricing below the kumo cloud, indicates that the negative technical structure has not yet been broken and the downtrend remains active. This structure increases the likelihood that possible short-term rises will be met with sales.

As a result, the price’s failure to exceed the lower band of the kumo cloud at the $2.17 level may cause the weak course to continue in the short term. Under these conditions, the potential for the price to retreat towards the $2.08 support level stands out. On the other hand, exceeding the $2.17 level and sustaining above this zone may increase the possibility of a short-term technical recovery. However, even in this scenario, a volume-supported breakout and continued buying interest will be necessary for the upward movement to gain strength.

Supports 2.0841 – 1.9664 – 1.6309

Resistances 2.1960 – 2.3928- 2.4765

SOL/USDT

SOL price continued its sideways trend in a narrow band. The asset tested the base level of the descending triangle pattern, which is a strong support and showed a slight acceleration from there. If the upside movement continues, it may test the $150.67 level and the 50 EMA (Blue Line) moving average as resistance. The retracement may deepen on closes below the base level of the descending triangle pattern.

On the 4-hour chart, the 50 EMA continued to be below the 200 EMA. This suggests that the bearish trend may continue in the medium term. At the same time, the fact that the price is below both moving averages suggests that the market may continue to retrace in the short term at the moment. Chaikin Money Flow (CMF-20) has crossed into negative territory; in addition, a decrease in daily inflows may move CMF into negative territory. Relative Strength Index (RSI-14) continued to be in negative territory. On the other hand, it tested the uptrend that started on June 13 as resistance and failed to break it, maintaining the selling pressure. If it breaks it, an uptrend may start. The $150.67 level stands out as a strong resistance point in case of an uptrend on the back of macroeconomic data or positive news on the Solana ecosystem. If this level is broken upwards, the rise can be expected to continue. If there are pullbacks due to contrary developments or profit realizations, the $138.73 level can be tested. In case of a decline to these support levels, the increase in buying momentum may offer a potential bullish opportunity.

Supports 144.35 – 138.73 – 133.74

Resistances 150.67 – 163.80 – 171.82

DOGE/USDT

DOGE price followed a horizontal trend. The asset, which tested the strong support level of $0.16686 as support, accelerated from here and rose slightly. If the candle closure below the level of 0.16686 occurs, the retreat may deepen. Otherwise, the $0.17766 level and the 50 EMA (Blue Line) moving average should be followed.

On the 4-hour chart, the 50 EMA (Blue Line) continues to be below the 200 EMA (Black Line). This suggests that the asset is bearish in the medium term. The fact that the price is below the two moving averages signals that the asset remains bearish in the short term. Chaikin Money Flow (CMF-20) continued to be at the neutral level. In addition, negative money inflows may move CMF into negative territory. Relative Strength Index (RSI-14) continued to be in negative territory. However, it started to be below the uptrend formed since June 13 and although it tested it as resistance, it failed to break it, indicating that selling pressure continued. However, positive divergence should be monitored. This could be bullish. The $0.17766 level stands out as a strong resistance zone in the event of a rally in line with political developments, macroeconomic data or positive news flow in the DOGE ecosystem. In the opposite case or possible negative news flow, the $0.15680 level may be triggered. In case of a decline to these levels, the increase in momentum may start a new bullish wave.

Supports 0.16686 – 0.15680 – 0.14952

Resistances 0.17766 – 0.18566 – 0.19909

Legal Notice

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually by authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not produce results in line with your expectations.