Marktkompass

Resurgent Geopolitical Concerns

In the past week, global markets mostly followed the progress on trade wars. We saw progress in the talks between the US and Chinese delegations in London and we can say that there were positive results. Of course, the fact that President Trump is the final arbiter on this issue continues to keep the risks alive due to his unpredictable attitude.

The health of the US economy has been a hot topic in recent days. In particular, the additional burden on the US economy due to Trump’s tax bill and the uncertainty caused by tariffs further complicates the US Federal Reserve’s (FED) job. Ahead of next week’s Federal Open Market Committee (FOMC) meeting, Mai inflation data was not as high as feared and even came in slightly below expectations. Still, this was not enough to reinforce expectations that the Fed will cut interest rates before September. On Mittwoch, we will get clearer information on the timing of the Fed’s next rate cut.

In addition to the above-mentioned dynamics that drive asset prices, we should not ignore the reignited Middle East risk. Israel’s attack on Iran led to increased uncertainty in the region and reduced risk appetite. In line with this, we saw that digital assets also lost value towards the end of the week. The issue does not seem to be a knot that can be untied in a short period of time and we think that investors may not be too eager to take new risks for a while. Accordingly, in our equation, we increase the weight of the coefficient representing the impact of the variable related to geopolitical risks on prices.

All these topics will be the determining factors for the direction of global markets next week. However, we will open a separate section on the critical FOMC meeting and evaluate this development that will determine the dose of financial tightness in the coming period.

Juni 18 – FOMC Meeting

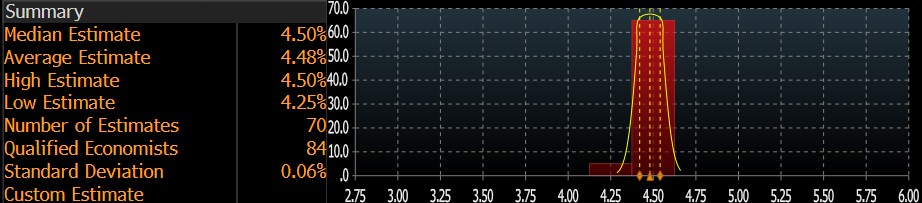

The US Federal Reserve’s (FED) fourth Federal Open Market Committee (FOMC) meeting of the year will be held on Juni 17-18 and the decisions will be announced on Juni 18. The FED is not expected to change its policy interest rate. In fact, according to the CME FedWatch Tool, the Bank is not expected to decide on a rate cut before September. However, what makes the Juni meeting important is that we may get clues about the timing of the rate cut.

Quelle: Bloomberg

On Juni 18th, markets will be looking for clues that could lead to a major change in expectations. The first thing to look for is whether the interest rate is left unchanged as expected. At the same time, the FOMC members’ interest rate forecasts, i.e. the “dot plot” chart and the projection chart, which shows their predictions for economic indicators, will be closely scrutinized. Half an hour after the release of these decisions and documents, FED Chairman Powell will step behind the lectern and hold a press conference.

1-Will interest rates change?

As we mentioned, we do not expect a rate cut from the Committee after the recent developments and the statements of the FOMC members. There may be a surprise decision to cut interest rates, which we see as a very low probability. We define a rate hike as unlikely.

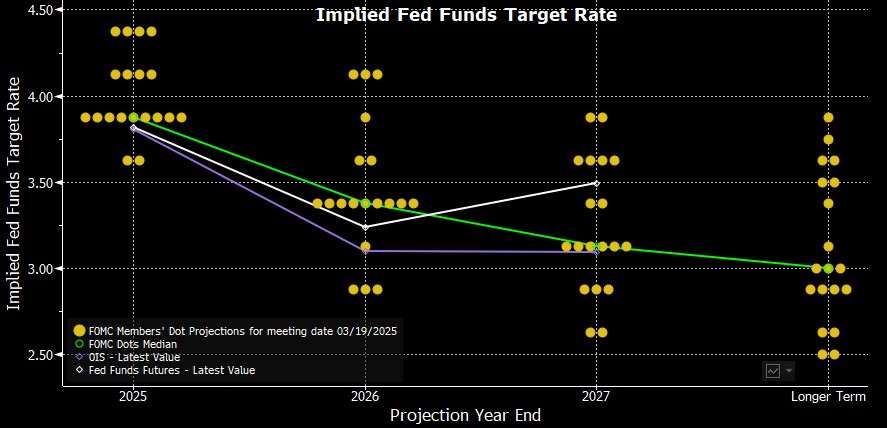

2-What will the “Dot Plot” Table tell us?

The FOMC meets eight times a year, every six weeks, and at four of these meetings it publishes the so-called “dot plot” table and the members’ projections of their forecasts for the economy. In this respect, the Juni meeting will be one of the most important meetings where these documents are published.

Quelle: Bloomberg

The table above, which was last released at the März meeting, shows each FOMC member’s forecasts for the policy rate. The FED’s current policy rate is set at a range of 4.25-4.50. We see that the majority of members think that this rate will be reduced to the 3.75-4.00 band by the end of 2025. This implies a total of 50 basis points of rate cuts during the year, whereas the FED usually changes interest rates in steps of 25 basis points each. This means that we could see rate cuts at two of the four meetings in the rest of the year (assuming no rate cut at the Juni meeting). The potential changes we will see in the upcoming dot plot may cause market expectations to be reshaped and we may see significant price changes.

According to the CME FedWatch Tool, the pricing in the markets is not very different from the expectations of the FOMC members. In other words, we can say that a 50 basis point cut until the end of the year is reflected in prices. Therefore, if we do not see a change in the picture, we will not consider this as an important dynamic that will create price changes. However, if the rate cut forecasts indicate only a 25 basis point cut, this could be interpreted as a sign that global financial tightness will remain at these levels for longer than previously anticipated, which could lead to dollar appreciation, lower risk appetite and depreciation of stock markets and digital currencies.

3-Economic Projections

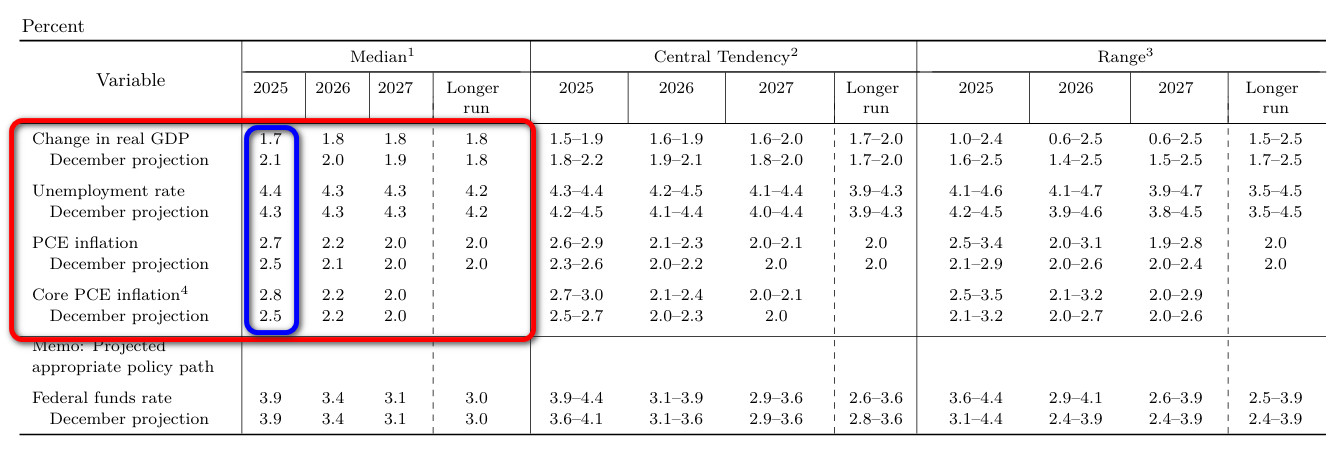

Along with the “dot plot”, another important and potentially influential piece of information that will be published in the same document will be the FOMC’s projections reflecting its expectations for the economy. Of course, every detail is important, but for short-term pricing, we will carefully examine the changes in the data for 2025 in the last table published on März 19.

This table includes data on Change in real GDP (which can be defined as economic growth), unemployment rate, PCE inflation and core PCE.

Source: Federal Reserve

Finally, among these macro indicators, we prefer to analyze the possible projection changes for GDP and core PCE data, which were announced at the März meeting. A moderate upward revision of growth may have a positive impact on the markets (we see this as unlikely). A downward revision could have a negative impact on risk sentiment. On the other hand, an upward revision in core PCE may strengthen the perception that the FED will not be too eager to cut interest rates, which may negatively affect risk appetite. A potential downward revision in this data may have a positive impact on instruments considered to be relatively risky, including digital assets.

4-Powell’s Press Conference

As is the case after every FOMC meeting, FED Chairman Jerome H. Powell will speak at a press conference on Juni 18, half an hour after the decisions are published. Powell will first read the text of the decision and explain the reasons for the decisions taken. Then there will be a question and answer session where press members’ questions will be answered. Volatility in the markets may increase a little more in this part.

Of course, the interest rate decision, the dot plot and the projections may change the significance of the Chairman’s Q&A. We do not expect a major change in the stance Powell has taken in his recent speeches. Last time, he argued that the break in the rate cut cycle was justified and that their decisions would not be affected by the consequences of the fiscal policies implemented by the new US administration. In short, he set a relatively moderate, hawkish tone. He also maintained his stance that they needed more data to get a clearer picture of the impact of the tariffs. Lastly, we can add to this his possible comments on the impact of the Israeli-Iranian friction and rising oil prices on inflation.

In the face of questions from the press, Powell’s more hawkish stance than before may reinforce expectations and pricing that the Fed will not rush to restart interest rate cuts. This may have a negative impact on digital assets. However, his assessments on economic growth and the labor market, his mention of the necessity of a new rate cut, and his messages that more than 50 basis points could be cut by the end of the year may increase the risk appetite and this may have positive effects on cryptocurrencies.

Forschungsabteilung Darkex Aktuelle Studien

Monatlicher Bericht zur Kryptomarktanalyse

Wöchentliche BTC Onchain-Analyse

Wöchentliche ETH Onchain-Analyse

Robinhood’s RWA Move: A New Financial Era?

Stars of Social Media: 5 Altcoins Shining in the Recent Bitcoin Rally

Effects of FED’s Interest Rate Decisions on Cryptocurrency Markets

Bitcoin and BlackRock: Decentralization at Risk?

Klicken Sie hier für alle unsere anderen Market Pulse Berichte.

Wichtige Daten des Wirtschaftskalenders

Klicken Sie hier um den wöchentlichen Darkex Krypto- und Wirtschaftskalender zu sehen.

Informationen

*Der Kalender basiert auf der Zeitzone UTC (Coordinated Universal Time).

Der Kalenderinhalt auf der entsprechenden Seite wird von zuverlässigen Datenanbietern bezogen. Die Nachrichten in den Kalenderinhalten, das Datum und die Uhrzeit der Bekanntgabe der Nachrichten, mögliche Änderungen der bisherigen, erwarteten und angekündigten Zahlen werden von den Datenanbietern Institutionen gemacht.

Darkex kann nicht für mögliche Änderungen, die sich aus ähnlichen Situationen ergeben, verantwortlich gemacht werden. Sie können auch die Darkex-Kalender-Seite oder den Wirtschaftskalender in den Tagesberichten auf mögliche Änderungen von Inhalt und Zeitpunkt der Datenveröffentlichungen überprüfen.

Rechtlicher Hinweis

Die in diesem Dokument enthaltenen Anlageinformationen, Kommentare und Empfehlungen stellen keine Anlageberatungsdienste dar. Die Anlageberatung wird von zugelassenen Instituten auf persönlicher Basis unter Berücksichtigung der Risiko- und Ertragspräferenzen des Einzelnen durchgeführt. Die in diesem Dokument enthaltenen Kommentare und Empfehlungen sind allgemeiner Art. Diese Empfehlungen sind möglicherweise nicht für Ihre finanzielle Situation und Ihre Risiko- und Renditepräferenzen geeignet. Eine Anlageentscheidung, die ausschließlich auf der Grundlage der in diesem Dokument enthaltenen Informationen getroffen wird, kann daher möglicherweise nicht zu Ergebnissen führen, die mit Ihren Erwartungen übereinstimmen.