Markets Focus on Macro Indicators

Global markets left behind another challenging week. Both the geopolitical agenda and the tariffs issue, along with macro expectations, determined the direction of the markets. Contrary to expectations, the climate in the aftermath of the US bombing of Iran’s nuclear facilities has turned more moderate and progress seems to be being made on trade wars. Apart from these, investors continue to be on the lookout for the timing of the US Federal Reserve’s (FED) next move. We think that the macroeconomic agenda and expectations regarding the FED will play a slightly more decisive role in prices next week.

It is not an unknown fact that US President Donald Trump is unhappy with Fed Chair Powell’s stance. We can state that the opposite is also true. Powell continues to emphasize that they should not be in a hurry to cut interest rates in order to see the effects of Trump’s steps on tariffs more clearly. Trump, on the other hand, is in favor of cutting interest rates as soon as possible and is not happy with Powell’s stance.

On the first working day of next month, we will focus on Fed Chair Powell’s speech and US economic indicators. Among the many data to be released, we can easily say that the most prominent one will undoubtedly be the non-farm payrolls change on Donnerstag (since Freitag will be a public holiday in the US, the relevant data will be released on Donnerstag this time). Although the markets have increased the number of rate cuts they expect from the FED until the end of this year with the news that Trump may announce the name of Powell’s replacement early, we think that the determining factor will continue to be macro realities. In this respect, we think that among the economic indicators to be released, labor market statistics may reshape expectations and we expect that they may give direction to prices before the Federal Open Market Committee (FOMC) meeting on Juli 30th. Therefore, in our newsletter, we will underline that we will closely monitor the tariffs and geopolitical agenda, and we will open a separate section for macro data.

Juli 1 – FED Chair Powell’s Speech

US Federal Reserve Chairman Jerome Powell recently gave speeches both after the Federal Open Market Committee (FOMC) meeting and before the relevant committees of the Senate and the House of Representatives. We cannot state that there was a significant change in the Chairman’s stance. Powell, who wants to see more data in order to monitor the effects of the trade wars that started in the Trump era, continues to take refuge in the confidence of staying in a wait-and-see mode. He will also want to take into account the impact of rising tensions in the Middle East on commodity prices. In addition, the game plan seems to have changed a bit in the last days of Juli with the news that US President Donald Trump may announce the next Fed Chair early, but we do not expect this to have a lasting impact on the markets.

Fed Chair Powell will participate in a panel titled “Policy Panel” at the European Central Bank’s ECB Central Banking Forum in Sintra. We do not think that the Chairman will take a different stance from his recent statements. However, volatility in the markets may increase if he comments on both tariffs and the timing of the next interest rate cut. According to the CME FedWatch Tool, markets expect three rate cuts of 25 bps each (actually 60 bps in total) from the Fed until the end of the year (at the time of writing) amid speculation of a change of chairman. Statements that may reshape this outlook may have a directional impact on asset prices. Statements that may strengthen expectations for further rate cuts may have a positive impact on digital assets, while assessments that may signal fewer rate cuts may put pressure.

Juli 3 – US Employment Data

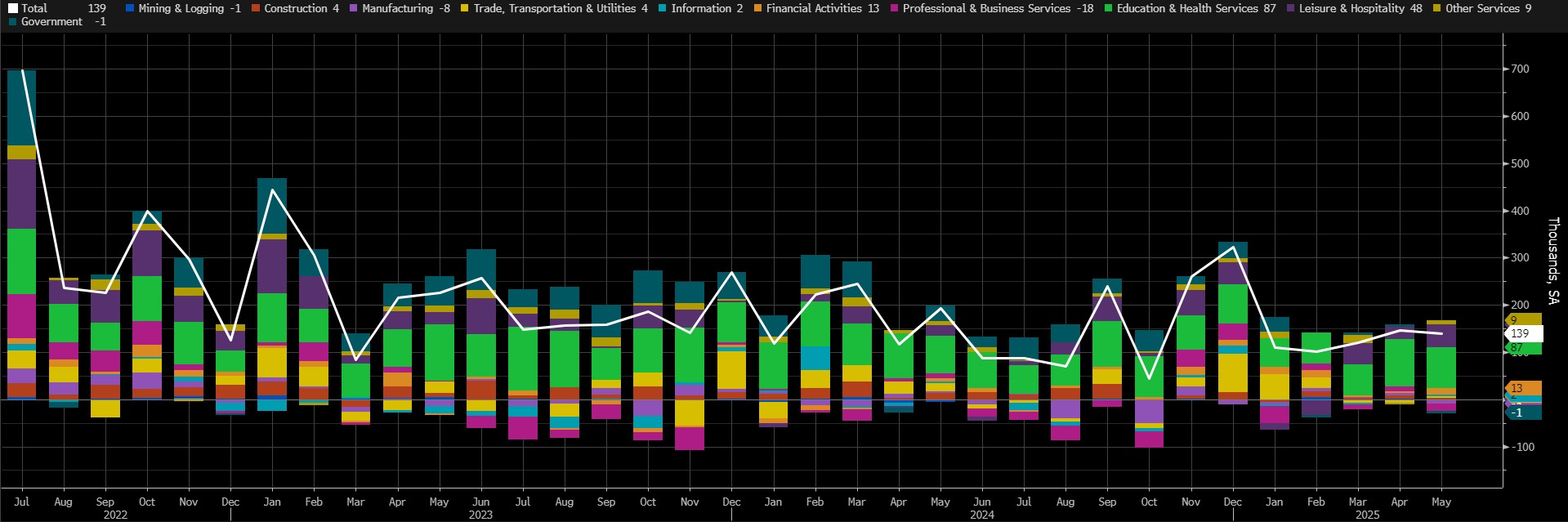

As the markets prepare to leave the first half of the year behind, on Juli 3, they will be receiving the Juni Non-Farm Payrolls (NFP) data, which will provide clues about the tightness of the financial ecosystem in the coming period, as well as the US Federal Reserve’s (FED) interest rate cut path. In addition, März figures such as average hourly earnings and the unemployment rate will also be monitored.

In Mai, the US economy added 139K jobs (Market Expectation: 126K).

Quelle: Bloomberg

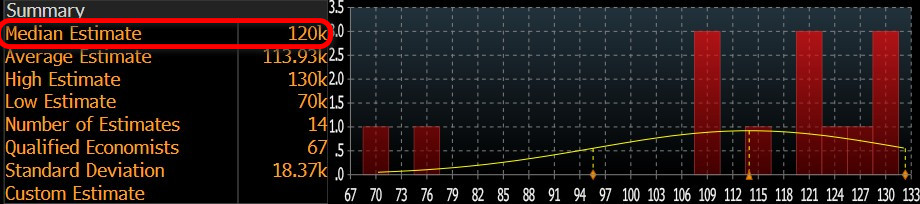

Our forecast for the NFP data, which is highly sensitive to the market, is that we may see a data in the non-farm sectors of the US economy in Juni, well above the general forecasts. At the time of writing, although the number of forecasts entered is small, we see that the consensus on the Bloomberg terminal is more pessimistic, around 120 thousand.

Quelle: Bloomberg

We believe that if the Juni NFP data, which will be published in the shadow of Trump’s tariff-centered foreign policy, domestic disruptions and developments in the Middle East, is slightly below expectations , this will be priced as a potential metric that may create an expectation that the FED may act more boldly to lower the interest rate, thus increasing risk appetite and having a positive impact on financial instruments, including digital assets. We think that a slightly higher-than-expected data may have a similar but opposite effect. However, a much lower than expected NFP data may trigger recession concerns again with a commentary on the health of the US economy, which may put selling pressure on assets considered to be risky. It should be noted here that we expect that a much better-than-expected data release could also have a positive impact. It is worth noting that we anticipate these effects taking into account the current state of market sentiment.

Other Macro Indicators to be released this week

ISM Manufacturing PMI: The Purchasing Managers’ Index (PMI) is a diffusion index based on surveyed purchasing managers in the manufacturing industry. Conducted by The Institute for Supply Management (ISM), this survey of approximately 300 purchasing managers asks respondents to assess the relative level of business conditions, including employment, production, new orders, prices, supplier deliveries and inventories. It is usually published monthly on the first business day after the end of the month, with a score above 50.0 indicating that the sector is expanding and below 50.0 indicating contraction. In general, a lower-than-expected ISM Manufacturing PMI is expected to have a positive impact on digital assets by pricing in expectations regarding the monetary policy course of the US Federal Reserve (FED). However, in some cases, it may also lead to pricing based on the strength of the economy. In this case, figures above expectations have a positive effect on digital assets.

Job Openings and Labor Turnover Survey (JOLTS); Zeigt die Anzahl der offenen Stellen im Berichtsmonat, ohne den Agrarsektor. Diese JOLTS-Daten werden genau beobachtet, da die Schaffung von Arbeitsplätzen ein wichtiger Frühindikator für die Verbraucherausgaben ist, die einen großen Teil der gesamten Wirtschaftstätigkeit ausmachen. Sie werden monatlich und etwa 35 Tage nach Monatsende veröffentlicht. Es wird erwartet, dass eine Veröffentlichung, die niedriger ausfällt als erwartet, positive Auswirkungen auf Kryptowährungen haben wird.

ADP Non-Farm Employment Change; shows the estimated change in the number of people employed in the previous month, excluding the agricultural sector and government, by analysing payroll data from more than 25 million workers to obtain estimates of employment growth by Automatic Data Processing, Inc (ADP). It usually gives a hint of employment growth 2 days before the employment data released by the government. Usually, lower-than-expected ADP data has a positive impact on digital assets.

*Allgemeine Informationen über Prognosen

Zusätzlich zu den allgemeinen Markterwartungen beruhen die Prognosen in diesem Bericht auf ökonometrischen Modellierungsinstrumenten, die von unserer Forschungsabteilung entwickelt wurden. Für jeden Indikator wurden verschiedene Strukturen berücksichtigt und geeignete Regressionsmodelle in Abhängigkeit von der Datenhäufigkeit (monatlich/vierteljährlich), den führenden Wirtschaftsindikatoren und der Datenhistorie erstellt.

The basic approach in all models is to interpret historical relationships based on data and to produce forecasts that have predictive power with current data. The performance of the models used is measured by standard metrics such as mean absolute error (MAE) and is regularly re-evaluated and improved. While the outputs of the models guide our economic analysis, also aims to contribute to strategic decision-making processes for our investors and business partners. Data is sourced directly from the FRED (Federal Reserve Economic Data) platform in an up-to-date and automated manner, so that every forecast is based on the latest economic data. As the research department, we are also working on artificial intelligence-based modeling methods (e.g. Random Forest, Lasso/Ridge regressions, ensemble models) in order to improve forecast accuracy and react more sensitively to market dynamics. The macroeconomic context should be taken into account in the interpretation of model outputs, and it should be kept in mind that there may be deviations in forecast performance due to economic shocks, policy changes and unforeseen external factors. With this set of monthly updates, we aim to provide a more transparent, consistent and data-driven basis for monitoring the macroeconomic outlook and strengthening decision support processes.

Wichtige Wirtschaftskalenderdaten

Klicken Sie hier um den wöchentlichen Darkex Krypto- und Wirtschaftskalender zu sehen.

Informationen

*Der Kalender basiert auf der Zeitzone UTC (Coordinated Universal Time).

Der Kalenderinhalt auf der entsprechenden Seite wird von zuverlässigen Datenanbietern bezogen. Die Nachrichten in den Kalenderinhalten, das Datum und die Uhrzeit der Bekanntgabe der Nachrichten, mögliche Änderungen der bisherigen, erwarteten und angekündigten Zahlen werden von den Datenanbietern Institutionen gemacht.

Darkex kann nicht für mögliche Änderungen, die sich aus ähnlichen Situationen ergeben, verantwortlich gemacht werden. Sie können auch die Darkex-Kalender-Seite oder den Wirtschaftskalender in den Tagesberichten auf mögliche Änderungen von Inhalt und Zeitpunkt der Datenveröffentlichungen überprüfen.

Rechtlicher Hinweis

Die in diesem Dokument enthaltenen Anlageinformationen, Kommentare und Empfehlungen stellen keine Anlageberatungsdienste dar. Die Anlageberatung wird von zugelassenen Instituten auf persönlicher Basis unter Berücksichtigung der Risiko- und Ertragspräferenzen des Einzelnen durchgeführt. Die in diesem Dokument enthaltenen Kommentare und Empfehlungen sind allgemeiner Art. Diese Empfehlungen sind möglicherweise nicht für Ihre finanzielle Situation und Ihre Risiko- und Renditepräferenzen geeignet. Eine Anlageentscheidung, die ausschließlich auf der Grundlage der in diesem Dokument enthaltenen Informationen getroffen wird, kann daher möglicherweise nicht zu Ergebnissen führen, die mit Ihren Erwartungen übereinstimmen.