Markets Focus on Macro Indicators

Global markets left behind another challenging week. Both the geopolitical agenda and the tariffs issue, along with macro expectations, determined the direction of the markets. Contrary to expectations, the climate in the aftermath of the US bombing of Iran’s nuclear facilities has turned more moderate and progress seems to be being made on trade wars. Apart from these, investors continue to be on the lookout for the timing of the US Federal Reserve’s (FED) next move. We think that the macroeconomic agenda and expectations regarding the FED will play a slightly more decisive role in prices next week.

It is not an unknown fact that US President Donald Trump is unhappy with Fed Chair Powell’s stance. We can state that the opposite is also true. Powell continues to emphasize that they should not be in a hurry to cut interest rates in order to see the effects of Trump’s steps on tariffs more clearly. Trump, on the other hand, is in favor of cutting interest rates as soon as possible and is not happy with Powell’s stance.

On the first working day of next month, we will focus on Fed Chair Powell’s speech and US economic indicators. Among the many data to be released, we can easily say that the most prominent one will undoubtedly be the non-farm payrolls change on Jueves (since Viernes will be a public holiday in the US, the relevant data will be released on Jueves this time). Although the markets have increased the number of rate cuts they expect from the FED until the end of this year with the news that Trump may announce the name of Powell’s replacement early, we think that the determining factor will continue to be macro realities. In this respect, we think that among the economic indicators to be released, labor market statistics may reshape expectations and we expect that they may give direction to prices before the Federal Open Market Committee (FOMC) meeting on Julio 30th. Therefore, in our newsletter, we will underline that we will closely monitor the tariffs and geopolitical agenda, and we will open a separate section for macro data.

Julio 1 – FED Chair Powell’s Speech

US Federal Reserve Chairman Jerome Powell recently gave speeches both after the Federal Open Market Committee (FOMC) meeting and before the relevant committees of the Senate and the House of Representatives. We cannot state that there was a significant change in the Chairman’s stance. Powell, who wants to see more data in order to monitor the effects of the trade wars that started in the Trump era, continues to take refuge in the confidence of staying in a wait-and-see mode. He will also want to take into account the impact of rising tensions in the Middle East on commodity prices. In addition, the game plan seems to have changed a bit in the last days of Julio with the news that US President Donald Trump may announce the next Fed Chair early, but we do not expect this to have a lasting impact on the markets.

Fed Chair Powell will participate in a panel titled “Policy Panel” at the European Central Bank’s ECB Central Banking Forum in Sintra. We do not think that the Chairman will take a different stance from his recent statements. However, volatility in the markets may increase if he comments on both tariffs and the timing of the next interest rate cut. According to the CME FedWatch Tool, markets expect three rate cuts of 25 bps each (actually 60 bps in total) from the Fed until the end of the year (at the time of writing) amid speculation of a change of chairman. Statements that may reshape this outlook may have a directional impact on asset prices. Statements that may strengthen expectations for further rate cuts may have a positive impact on digital assets, while assessments that may signal fewer rate cuts may put pressure.

Julio 3 – US Employment Data

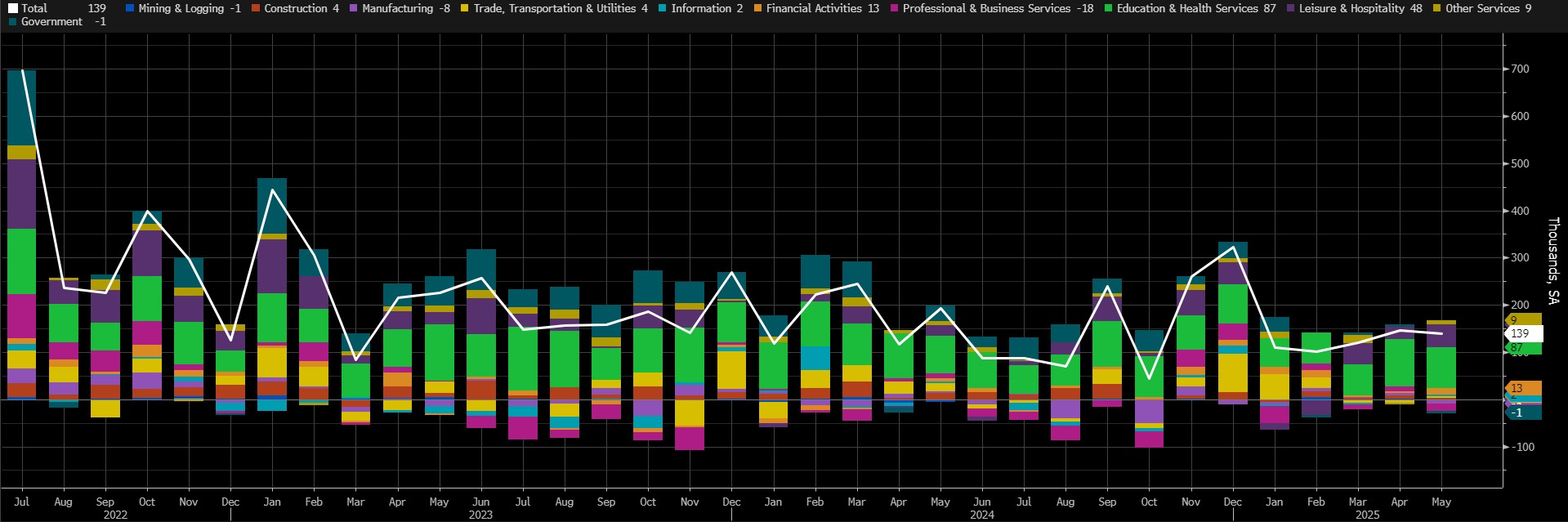

As the markets prepare to leave the first half of the year behind, on Julio 3, they will be receiving the Junio Non-Farm Payrolls (NFP) data, which will provide clues about the tightness of the financial ecosystem in the coming period, as well as the US Federal Reserve’s (FED) interest rate cut path. In addition, Marzo figures such as average hourly earnings and the unemployment rate will also be monitored.

In Mayo, the US economy added 139K jobs (Market Expectation: 126K).

Source: Bloomberg

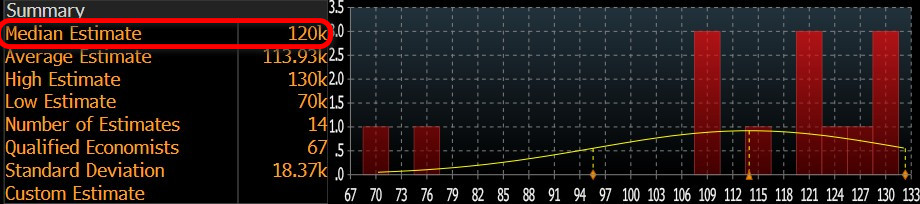

Our forecast for the NFP data, which is highly sensitive to the market, is that we may see a data in the non-farm sectors of the US economy in Junio, well above the general forecasts. At the time of writing, although the number of forecasts entered is small, we see that the consensus on the Bloomberg terminal is more pessimistic, around 120 thousand.

Source: Bloomberg

We believe that if the Junio NFP data, which will be published in the shadow of Trump’s tariff-centered foreign policy, domestic disruptions and developments in the Middle East, is slightly below expectations , this will be priced as a potential metric that may create an expectation that the FED may act more boldly to lower the interest rate, thus increasing risk appetite and having a positive impact on financial instruments, including digital assets. We think that a slightly higher-than-expected data may have a similar but opposite effect. However, a much lower than expected NFP data may trigger recession concerns again with a commentary on the health of the US economy, which may put selling pressure on assets considered to be risky. It should be noted here that we expect that a much better-than-expected data release could also have a positive impact. It is worth noting that we anticipate these effects taking into account the current state of market sentiment.

Other Macro Indicators to be released this week

ISM Manufacturing PMI: The Purchasing Managers’ Index (PMI) is a diffusion index based on surveyed purchasing managers in the manufacturing industry. Conducted by The Institute for Supply Management (ISM), this survey of approximately 300 purchasing managers asks respondents to assess the relative level of business conditions, including employment, production, new orders, prices, supplier deliveries and inventories. It is usually published monthly on the first business day after the end of the month, with a score above 50.0 indicating that the sector is expanding and below 50.0 indicating contraction. In general, a lower-than-expected ISM Manufacturing PMI is expected to have a positive impact on digital assets by pricing in expectations regarding the monetary policy course of the US Federal Reserve (FED). However, in some cases, it may also lead to pricing based on the strength of the economy. In this case, figures above expectations have a positive effect on digital assets.

Encuesta sobre ofertas de empleo y rotación de la mano de obra (JOLTS); muestra el número de ofertas de empleo durante el mes del que se informa, excluido el sector agrícola. Este dato de la JOLTS se sigue muy de cerca, ya que la creación de empleo es un importante indicador adelantado del gasto de los consumidores, que representa una gran parte de la actividad económica global. Se publica mensualmente y aproximadamente 35 días después del final del mes. Se espera que una publicación por debajo de lo esperado tenga un impacto positivo en las criptodivisas.

ADP Non-Farm Employment Change; shows the estimated change in the number of people employed in the previous month, excluding the agricultural sector and government, by analysing payroll data from more than 25 million workers to obtain estimates of employment growth by Automatic Data Processing, Inc (ADP). It usually gives a hint of employment growth 2 days before the employment data released by the government. Usually, lower-than-expected ADP data has a positive impact on digital assets.

*Información general sobre las previsiones

Además de las expectativas generales del mercado, las previsiones compartidas en este informe se basan en herramientas de modelización econométrica desarrolladas por nuestro departamento de investigación. Se consideraron diferentes estructuras para cada indicador y se construyeron modelos de regresión adecuados en función de la frecuencia de los datos (mensual/trimestral), los principales indicadores económicos y el historial de datos.

The basic approach in all models is to interpret historical relationships based on data and to produce forecasts that have predictive power with current data. The performance of the models used is measured by standard metrics such as mean absolute error (MAE) and is regularly re-evaluated and improved. While the outputs of the models guide our economic analysis, also aims to contribute to strategic decision-making processes for our investors and business partners. Data is sourced directly from the FRED (Federal Reserve Economic Data) platform in an up-to-date and automated manner, so that every forecast is based on the latest economic data. As the research department, we are also working on artificial intelligence-based modeling methods (e.g. Random Forest, Lasso/Ridge regressions, ensemble models) in order to improve forecast accuracy and react more sensitively to market dynamics. The macroeconomic context should be taken into account in the interpretation of model outputs, and it should be kept in mind that there may be deviations in forecast performance due to economic shocks, policy changes and unforeseen external factors. With this set of monthly updates, we aim to provide a more transparent, consistent and data-driven basis for monitoring the macroeconomic outlook and strengthening decision support processes.

Datos importantes del calendario económico

Haga clic aquí para ver el calendario semanal de criptomonedas y economía de Darkex.

Información

*El calendario se basa en el huso horario UTC (Tiempo Universal Coordinado).

El contenido del calendario en la página correspondiente se obtiene de proveedores de datos fiables. Las noticias en el contenido del calendario, la fecha y hora del anuncio de la noticia, los posibles cambios en las cifras anteriores, las expectativas y las cifras anunciadas son realizadas por las instituciones proveedoras de datos.

Darkex no se hace responsable de posibles cambios derivados de situaciones similares. También puede consultar la página del calendario Darkex o la sección del calendario económico en los informes diarios para conocer los posibles cambios en el contenido y el calendario de publicación de datos.

Aviso legal

La información sobre inversiones, los comentarios y las recomendaciones que figuran en este documento no constituyen servicios de asesoramiento en materia de inversiones. Los servicios de asesoramiento en materia de inversión son prestados por instituciones autorizadas con carácter personal, teniendo en cuenta las preferencias de riesgo y rentabilidad de los particulares. Los comentarios y recomendaciones contenidos en este documento son de tipo general. Estas recomendaciones pueden no ser adecuadas para su situación financiera y sus preferencias de riesgo y rentabilidad. Por lo tanto, tomar una decisión de inversión basándose únicamente en la información contenida en este documento puede no dar lugar a resultados acordes con sus expectativas.