Key Takeaways

Investors can use cryptocurrency derivatives to gain future value from their digital assets through speculative trading.

These financial instruments offer investors a new and flexible way to leverage their portfolios.

Futures trading is a method of hedging a portfolio against sharp market fluctuations that could otherwise result in significant losses.

Spot trading is more suitable for conservative investors who prefer to buy and hold digital assets over a longer period.

Since futures trading focuses on the future value of currencies or asset prices, it attracts traders seeking to profit from volatility and changes in derivatives pricing.

What Is Crypto Futures Trading?

Crypto futures trading is an alternative to spot trading, allowing traders to buy and sell derivative contracts without holding the underlying assets directly. These contracts represent the value of selected cryptocurrencies at a specific future date.

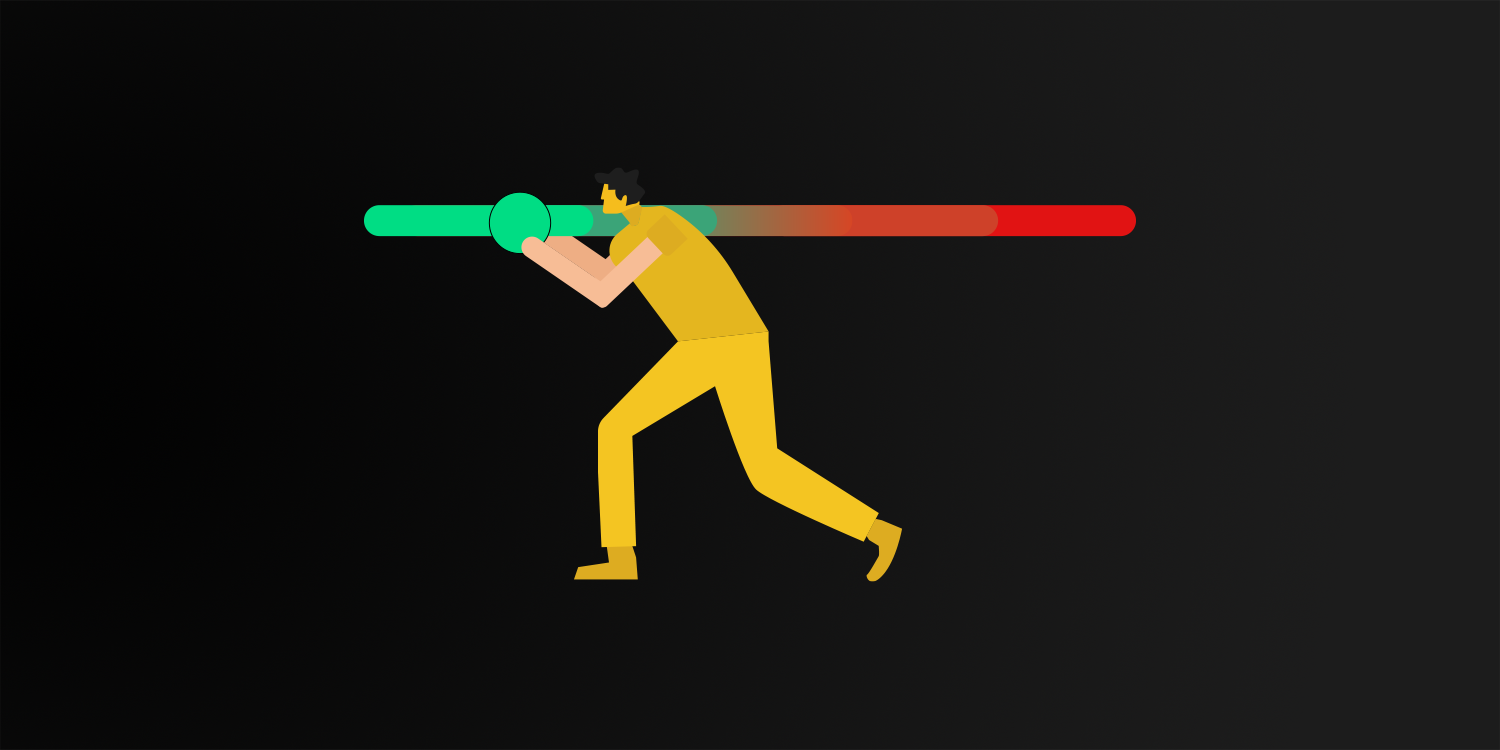

Futures trading enables investors to potentially achieve significant profits or incur substantial losses. If traders expect prices to rise, they can go long, while those anticipating a decline can take a short position.

One of the main advantages of futures trading is the use of leverage. Leverage allows traders to control a larger position with a smaller amount of capital, potentially increasing returns. However, it also amplifies risk, so caution is essential.

For beginners, using low leverage levels such as 2x or 5x is generally recommended, especially when futures contracts are used to hedge portfolios in volatile market conditions. For advanced traders, a well-hedged futures position combined with appropriate leverage can help offset losses if asset prices move against expectations.

Why Invest in Cryptocurrency Futures?

In the case of futures trading, there are many opportunities to increase portfolio value. It is possible to achieve significant gains in a single trade by using leverage, while still attempting to manage risk effectively.

However, if market conditions move against traders who engage in high-yield speculative positions, losses can occur rapidly. In such cases, traders may lose the entirety of their invested capital if risk is not properly controlled.

These downside risks can be mitigated by using futures contracts rather than relying solely on spot market speculation, as futures allow traders to manage exposure more strategically through hedging and position sizing.

In futures markets, unlike spot markets, long positions represent buyers, while short positions represent sellers. Profits in futures trading arise from price movements over time, whether in rising or falling markets.

Because both bullish and bearish traders can participate actively, futures markets offer opportunities regardless of overall market direction, creating a distinct trading environment compared to traditional spot markets.

Steps to Start Trading Futures

- Find a Trading Methodology

- Proper Risk Management

- Create a Trading Plan

- Avoid Emotional Trading

- Continuous Education

Where to Learn More About Crypto?

Disclaimer

The information presented here is for education only. It is not financial, investment or trading advice. Trading in cryptocurrencies with a substantial risk, including day trading and derivatives could lead to the complete or partial loss of funds invested.

There is no assurance of profit or not losing capital. The results of the past are not necessarily indications for how today will pan out. Readers should Do Their Own Research (DYOR), apply conservative risk management techniques, and consult with an appropriate financial consultant before making trades or investments.