BRÚJULA DE MERCADO

The “tariff” issue continues to be a major dynamic in global markets. Finally, President Trump said that Canada and Mexico tariffs are on their way and the one-month delay is over. There are news that the 25% tariffs will be implemented as of Marzo 4th. It is also rumored that the Trump administration is considering tighter restrictions on microchip exports to China. On the political side, yesterday’s Trump-Macron meeting was on the agenda. The summit was important in terms of showing that the two sides have deep differences on Ukraine. The widening gap between the US and Europe on Ukraine does not seem to be a good dynamic.

Risk Avoidance

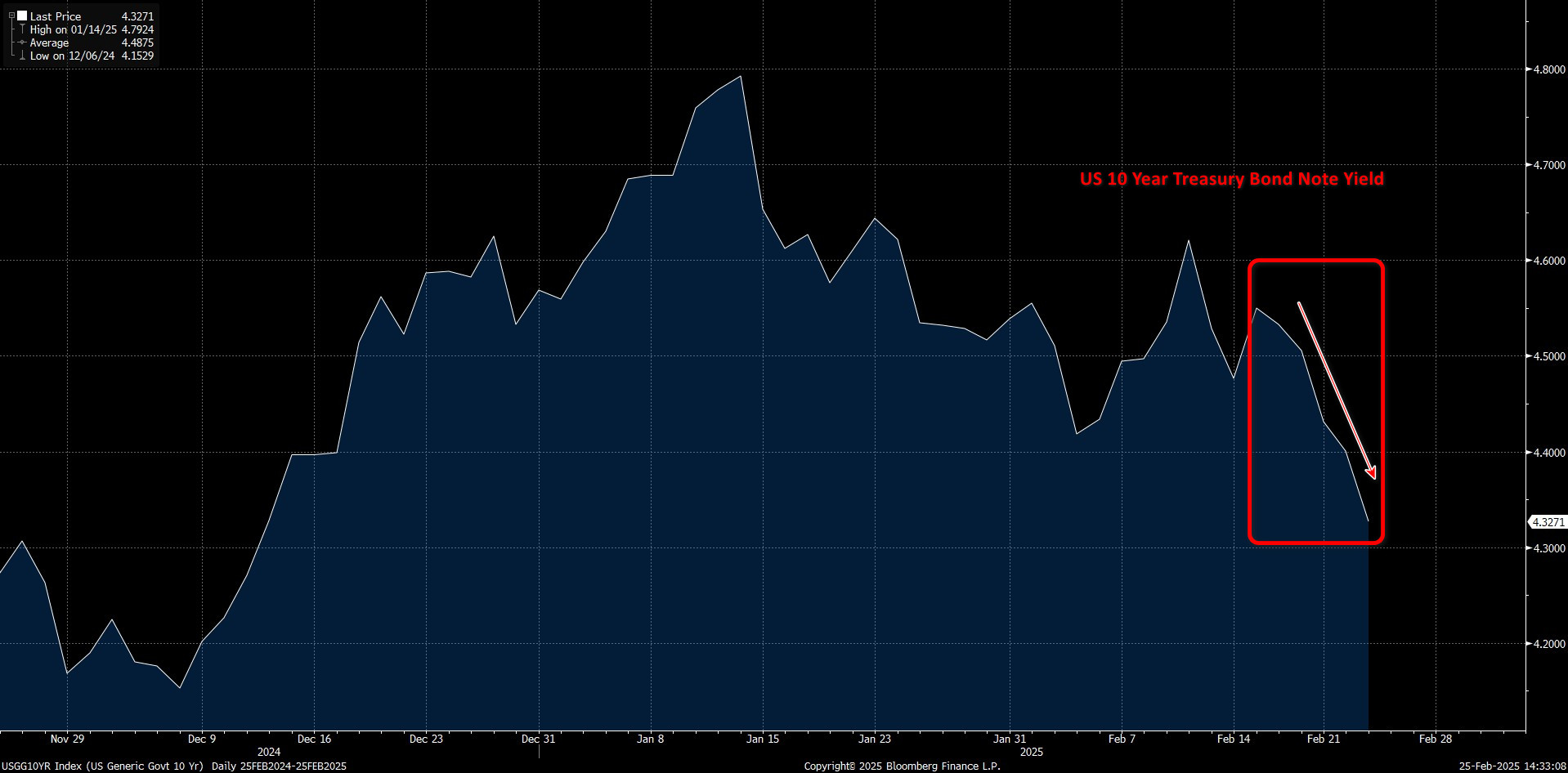

In digital assets, Trump’s recent lack of statements for the crypto world creates a lack of catalysts for a new rise. We should also not ignore the scars left by the recent hacking incident. As a result, we can say that the recent risk-off mood in the traditional markets, combined with this situation and the reasons mentioned above, have created the outlines of the pressurized course. We can highlight the decline in US 10-year bond yields as an indicator reflecting the situation in traditional markets.

Fuente: Bloomberg

Following the demand for US bonds on risk aversion concerns, the yield on the 10-year note has hit below the 4.33% level last seen in mid-Diciembre.

Current situation and CB Consumer Confidence

However, today, we have seen signs of recovery in European stock markets after a weak opening due to the rise in the healthcare sector. Wall Street index futures are also pointing to a flat to positive opening. Major digital assets were very weakly higher during European trading after recent losses. Although macro developments have taken a back seat, data releases for the world’s largest economy later in the day have the potential to impact the market. CB Consumer Confidence should be scrutinized today ahead of GDP and PCE Price Index data later in the week. We maintain our expectation for crypto assets to be volatile in the short term, pressured in the medium term and bullish in the long term.

LO MÁS DESTACADO DEL DÍA

Datos importantes del calendario económico

| Tiempo | Noticias | Expectativa | Anterior |

|---|---|---|---|

| 14:00 | US S&P/CS Composite-20 HPI (YoY) (Dec) | 4.4% | 4.3% |

| 15:00 | US CB Consumer Confidence (Feb) | 102.7 | 104.1 |

| 16:40 | Discurso de Barr, miembro del FOMC | - | - |

| 18:00 | FOMC Member Barkin Speaks | - | - |

INFORMACIÓN

*El calendario se basa en el huso horario UTC (Tiempo Universal Coordinado).

El contenido del calendario económico de la página correspondiente se obtiene de proveedores de noticias y datos fiables. Las noticias del contenido del calendario económico, la fecha y hora del anuncio de la noticia, los posibles cambios en las cifras anteriores, las expectativas y las cifras anunciadas son realizadas por las instituciones proveedoras de datos. Darkex no se hace responsable de los posibles cambios que puedan surgir de situaciones similares.

AVISO LEGAL

La información sobre inversiones, los comentarios y las recomendaciones que figuran en este documento no constituyen asesoramiento en materia de inversiones. Los servicios de asesoramiento en materia de inversión son prestados individualmente por instituciones autorizadas teniendo en cuenta las preferencias de riesgo y rentabilidad de los particulares. Los comentarios y recomendaciones aquí contenidos son de carácter general. Estas recomendaciones pueden no ser adecuadas para su situación financiera y sus preferencias de riesgo y rentabilidad. Por lo tanto, tomar una decisión de inversión basándose únicamente en la información aquí contenida puede no producir resultados acordes con sus expectativas.