PAZAR PUSULASI

The “tariff” issue continues to be a major dynamic in global markets. Finally, President Trump said that Canada and Mexico tariffs are on their way and the one-month delay is over. There are news that the 25% tariffs will be implemented as of Mart 4th. It is also rumored that the Trump administration is considering tighter restrictions on microchip exports to China. On the political side, yesterday’s Trump-Macron meeting was on the agenda. The summit was important in terms of showing that the two sides have deep differences on Ukraine. The widening gap between the US and Europe on Ukraine does not seem to be a good dynamic.

Risk Avoidance

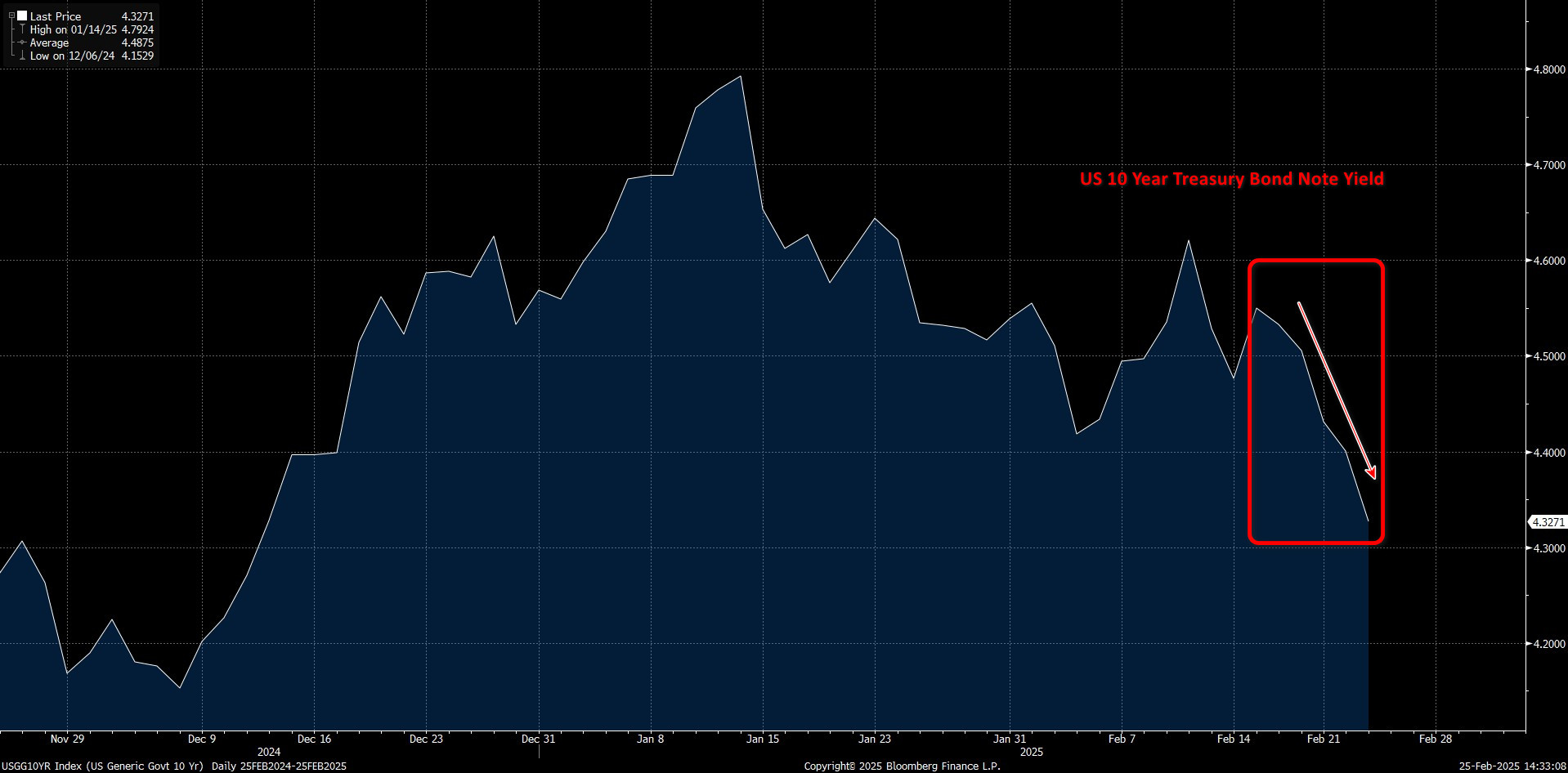

In digital assets, Trump’s recent lack of statements for the crypto world creates a lack of catalysts for a new rise. We should also not ignore the scars left by the recent hacking incident. As a result, we can say that the recent risk-off mood in the traditional markets, combined with this situation and the reasons mentioned above, have created the outlines of the pressurized course. We can highlight the decline in US 10-year bond yields as an indicator reflecting the situation in traditional markets.

Kaynak: Bloomberg

Following the demand for US bonds on risk aversion concerns, the yield on the 10-year note has hit below the 4.33% level last seen in mid-Aralık.

Current situation and CB Consumer Confidence

However, today, we have seen signs of recovery in European stock markets after a weak opening due to the rise in the healthcare sector. Wall Street index futures are also pointing to a flat to positive opening. Major digital assets were very weakly higher during European trading after recent losses. Although macro developments have taken a back seat, data releases for the world’s largest economy later in the day have the potential to impact the market. CB Consumer Confidence should be scrutinized today ahead of GDP and PCE Price Index data later in the week. We maintain our expectation for crypto assets to be volatile in the short term, pressured in the medium term and bullish in the long term.

HIGHLIGHTS OF THE DAY

Önemli Ekonomik Takvim Verileri

| Zaman | Haberler | Beklenti | Önceki |

|---|---|---|---|

| 14:00 | US S&P/CS Composite-20 HPI (YoY) (Dec) | 4.4% | 4.3% |

| 15:00 | US CB Consumer Confidence (Feb) | 102.7 | 104.1 |

| 16:40 | FOMC Member Barr Speaks | - | - |

| 18:00 | FOMC Member Barkin Speaks | - | - |

BİLGİ

*Takvim UTC (Koordineli Evrensel Zaman) zaman dilimini temel alır.

İlgili sayfada yer alan ekonomik takvim içeriği güvenilir haber ve veri sağlayıcılardan elde edilmektedir. Ekonomik takvim içeriğinde yer alan haberler, haberlerin açıklanma tarihi ve saati, önceki, beklenti ve açıklanan rakamlardaki olası değişiklikler veri sağlayıcı kurumlar tarafından yapılmaktadır. Benzer durumlardan kaynaklanabilecek olası değişikliklerden Darkex sorumlu tutulamaz.

YASAL BİLDİRİM

Burada yer alan yatırım bilgi, yorum ve tavsiyeleri yatırım danışmanlığı kapsamında değildir. Yatırım danışmanlığı hizmeti, kişilerin risk ve getiri tercihleri dikkate alınarak yetkili kuruluşlar tarafından bireysel olarak verilmektedir. Burada yer alan yorum ve tavsiyeler genel niteliktedir. Bu tavsiyeler mali durumunuz ile risk ve getiri tercihlerinize uygun olmayabilir. Bu nedenle, sadece burada yer alan bilgilere dayanarak yatırım kararı vermeniz beklentileriniz doğrultusunda sonuç vermeyebilir.