BRÚJULA DE MERCADO

Incertidumbre arancelaria

En los mercados mundiales, las declaraciones de Trump sobre los "aranceles" siguen siendo la principal dinámica que afecta al comportamiento de los precios. En sus últimos comentarios, el presidente insinuó que podrían imponerse aranceles del 25% a la Unión Europea (UE), aunque causando confusión, lo que fue otro factor que afectó negativamente al apetito por el riesgo. El miércoles, Trump declaró que planea imponer aranceles "recíprocos" del 25% a los automóviles y otros bienes europeos, mientras que los aranceles a México y Canadá entrarán en vigor el 2 de abril, en lugar de la fecha fijada anteriormente del 4 de marzo.

Además de este tema principal, la visita de Zelensky a EE.UU. mañana tras la reconciliación entre EE.UU. y Ucrania, los esfuerzos por formar gobierno en Alemania tras las elecciones y las salidas récord de los ETF de Bitcoin al contado se encuentran entre los temas de la agenda de los inversores. Hoy, es posible que la agenda macroeconómica empiece a cobrar un poco más de protagonismo.

El calendario económico está cargado hoy y es posible que la agenda de datos macroeconómicos se vigile un poco más de cerca tras los últimos datos de confianza del consumidor del Banco Central. Entre este conjunto de datos, destacarán los del crecimiento económico estadounidense (PIB), mientras que las declaraciones de los miembros del Comité Federal de Mercado Abierto (FOMC) también estarán bajo escrutinio.

El problema del crecimiento económico en EE.UU.

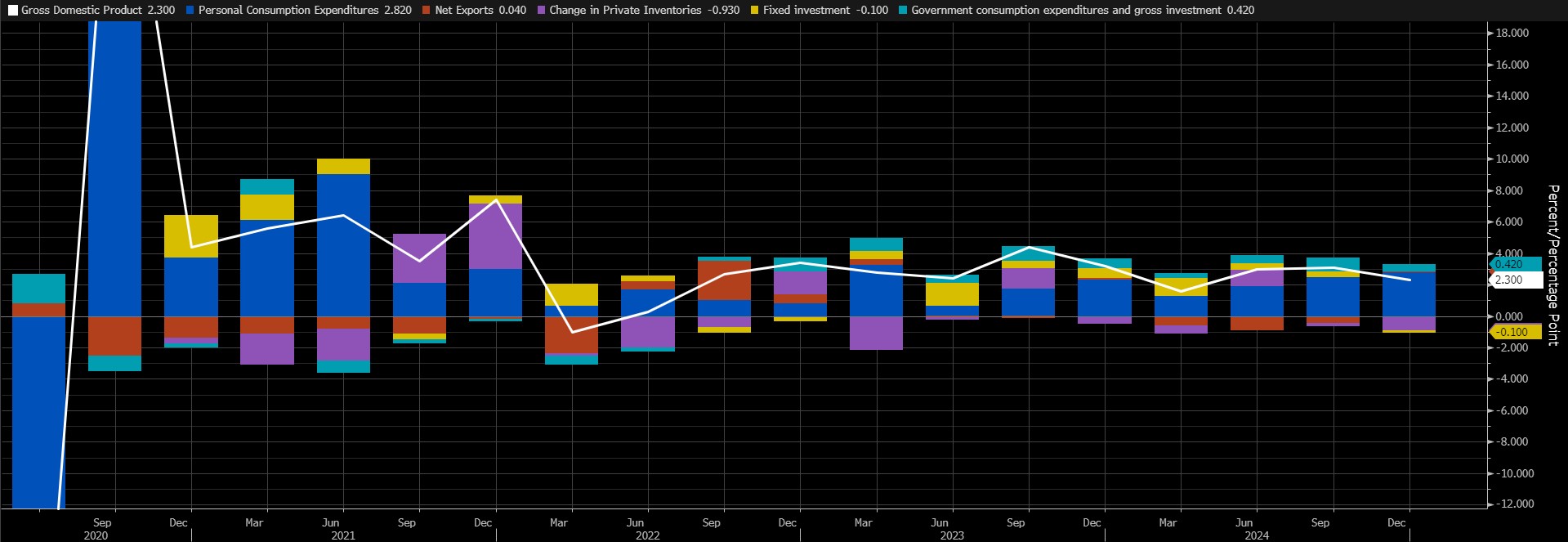

La mayor economía del mundo creció a una tasa anualizada del 2,3% en el cuarto trimestre de 2024, el ritmo más lento en tres trimestres y un ritmo de crecimiento más conservador que el 3,1% del tercer trimestre y el 2,6% previsto. El nuevo dato que se publicará hoy será la segunda estimación de la Oficina de Análisis Económicos para el último trimestre del año pasado. Según datos de Bloomberg, no se esperan cambios respecto a la primera cifra publicada del 2,3%.

Fuente: Bloomberg

En los primeros datos publicados para este trimestre, los gastos de consumo personal, que son el motor de la economía estadounidense, fueron de nuevo los que más contribuyeron al crecimiento económico. No esperamos un cambio significativo en este sentido. Tampoco creemos que veamos una desviación significativa de la previsión mediana del 2,3%. Aunque es justo decir que los datos de crecimiento del primer trimestre serán más importantes en los próximos meses, cabe señalar que una revisión potencialmente importante de los datos del PIB que se publicarán esta semana podría afectar al comportamiento de los precios.

En este momento, existen dos escenarios posibles. Creemos que un dato de crecimiento del PIB que se sitúe ligeramente por encima o por debajo de las previsiones impulsará las expectativas sobre la política monetaria de la Reserva Federal estadounidense (FED). En este contexto, un dato del PIB que se sitúe ligeramente por debajo de las previsiones (como un 2,2%-2,1%) puede aumentar el apetito por el riesgo en los mercados al respaldar las expectativas de que la FED se atreva con un nuevo recorte de los tipos de interés, lo que a su vez puede allanar el camino para la apreciación de los activos digitales. Un dato ligeramente superior al esperado (2,4%-2,5%) podría apoyar la percepción de que la FED esperará más tiempo para recortar los tipos de forma precipitada. En tal caso, podrían observarse pérdidas en las clases de activos consideradas relativamente más arriesgadas. En el segundo escenario, hay que considerar el caso de que el PIB difiera significativamente de las expectativas. Una lectura sorpresa del 2% o inferior podría desencadenar la preocupación de que el crecimiento de la mayor economía del mundo es realmente problemático. Aunque esto probablemente acercaría a la Fed a otro recorte de los tipos, la preocupación por el crecimiento (y quizá por la recesión) podría provocar un cambio significativo en el apetito por el riesgo, lo que podría ejercer presión vendedora sobre los instrumentos financieros, incluidos los activos digitales. Merece la pena subrayar que unos datos significativamente positivos, aunque pensamos que no tendrán tanto impacto como unos malos precios, podrían aumentar el apetito por el riesgo y proporcionar una base para las subidas.

En resumen, los datos de crecimiento de EE.UU. serán un dato importante para todos los mercados. Sin embargo, su importancia para los mercados financieros puede reducirse a lo lejos de las expectativas que veamos una cifra que sorprenda a los mercados. Aunque consideramos poco probable que veamos una serie de datos que afecten al comportamiento de los precios y provoquen una sacudida, no descartamos el escenario de que podamos ver fuertes cambios en los precios si vemos datos sorpresa.

LO MÁS DESTACADO DEL DÍA

Datos importantes del calendario económico

| Tiempo | Noticias | Expectativas | Anterior |

|---|---|---|---|

| - | Sonic SVM (SONIC) - Lanzamiento de Mobius Mainnet | - | - |

| - | Delysium (AGI) - Sesión AMA | - | - |

| - | SKALE (SKL) - Convocatoria de la Comunidad DAO | - | - |

| - | USD Coin (USDC) - Cumbre Circle Dev Denver, Denver, EE.UU. | - | - |

| 13:30 | PIB de EE.UU. (QoQ) (4T) | 2.3% | 2.3% |

| 13:30 | Peticiones iniciales de subsidio de desempleo en EE.UU. | 222K | 219K |

| 13:30 | Pedidos de bienes duraderos básicos en EE.UU. (intermensuales) (enero) | 0.2% | 0.3% |

| 14:15 | Intervención de Schmid, miembro del FOMC | - | - |

INFORMACIÓN

*El calendario se basa en la zona horaria UTC (Tiempo Universal Coordinado).

El contenido del calendario económico de la página correspondiente se obtiene de proveedores de noticias y datos fiables. Las noticias del contenido del calendario económico, la fecha y hora del anuncio de la noticia, los posibles cambios en las cifras anteriores, las expectativas y las cifras anunciadas son realizadas por las instituciones proveedoras de datos. Darkex no se hace responsable de los posibles cambios que puedan producirse en situaciones similares.

AVISO LEGAL

La información sobre inversiones, los comentarios y las recomendaciones contenidas en este documento no constituyen servicios de asesoramiento en materia de inversiones. Los servicios de asesoramiento en materia de inversión son prestados por instituciones autorizadas a título personal, teniendo en cuenta las preferencias de riesgo y rentabilidad de los particulares. Los comentarios y recomendaciones contenidos en este documento son de tipo general. Estas recomendaciones pueden no ser adecuadas para su situación financiera y sus preferencias de riesgo y rentabilidad. Por lo tanto, tomar una decisión de inversión basándose únicamente en la información contenida en este documento puede no dar lugar a resultados acordes con sus expectativas.