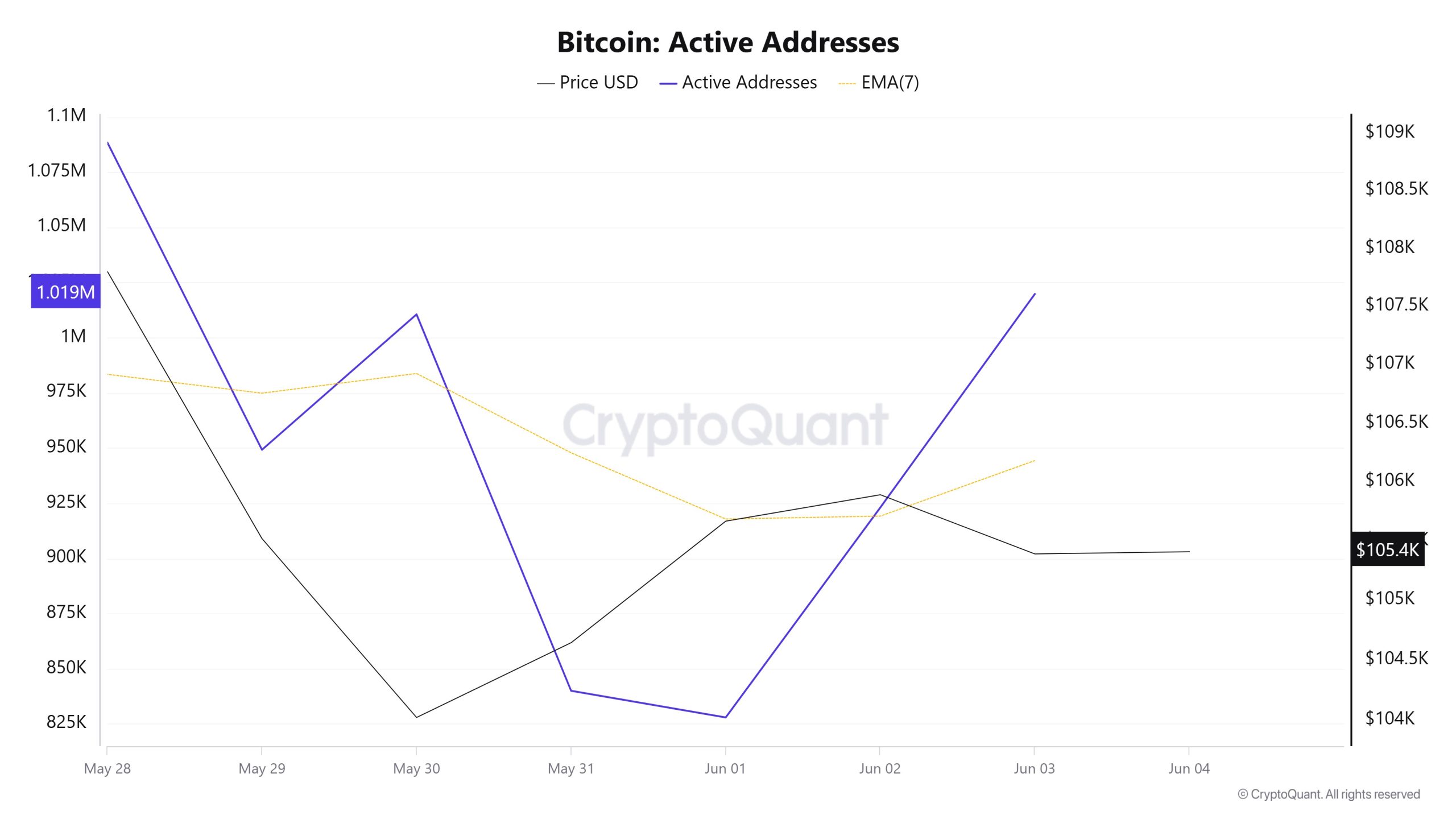

Active Addresses

In terms of active addresses, there were 1,022,033 active entries el the BTC network between June 18 and June 25 this week. During this date range, Bitcoin rose to the $106,000 level. On June 22, at the intersection of price and the number of active addresses, there was an uptrend. When we follow the 7-day simple moving average, it is observed that the price followed an upward trend el the dates when this average also crossed the price. This situation indicates that purchases have been experienced since the $101,000 levels.

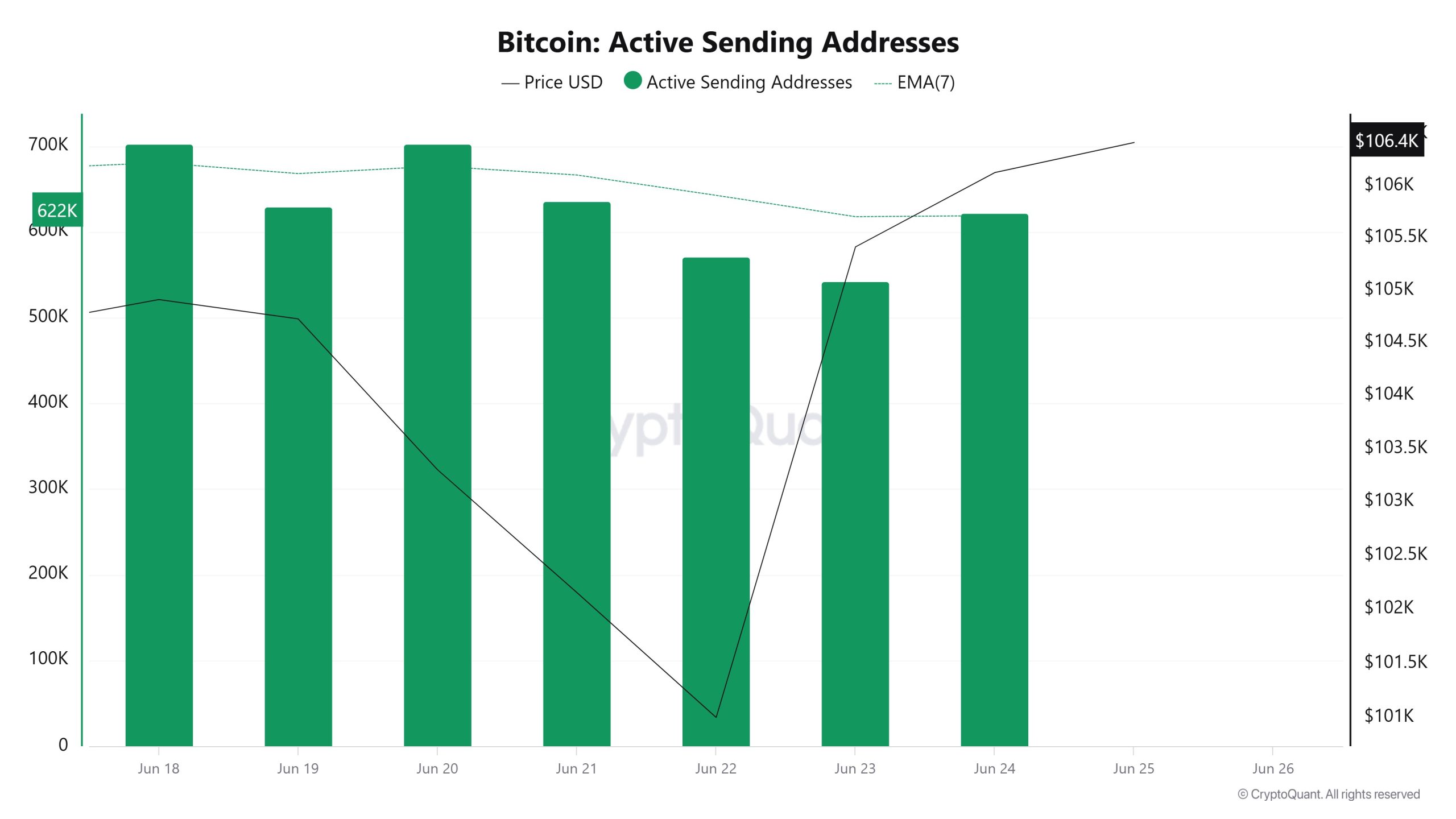

Active Sending Addresses

There was an increase en active shipping addresses el June 18-25. On the day when the price reached its highest level, active sending addresses rose to 622,422 levels; Bitcoin active address entries show that active address entries take into account the $106,000 levels. As a result, there is an increase en Active Sending Addresses levels.

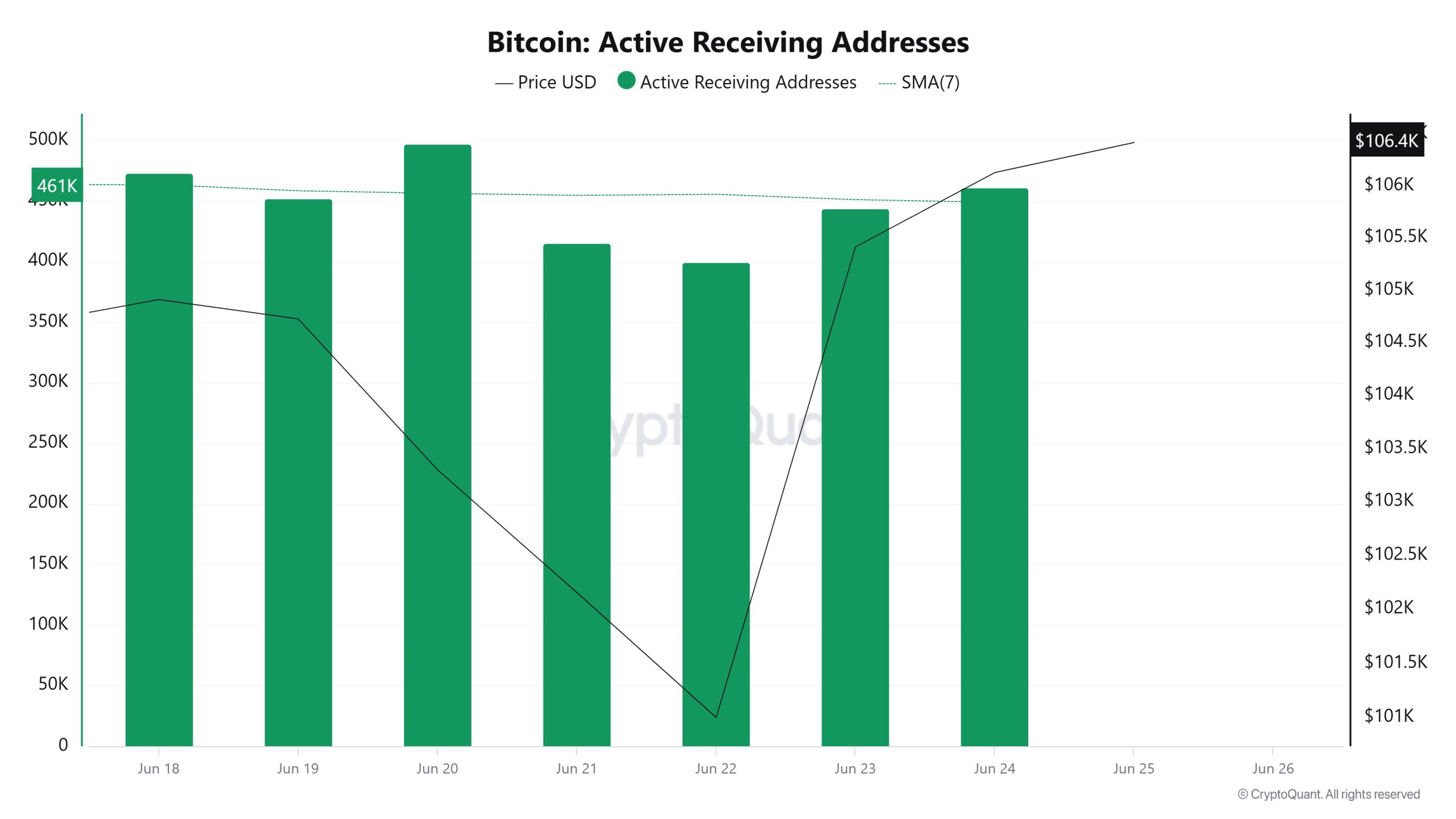

Active Receiving Addresses

Active buying addresses, along with the Black Line (price line), saw a significant rise el June 18-25. On the day when the price reached a high level, the active receiving addresses rose to 461,021 levels; It shows that buyers bought Bitcoin at the level of 106,000 dollars.

Breakdowns

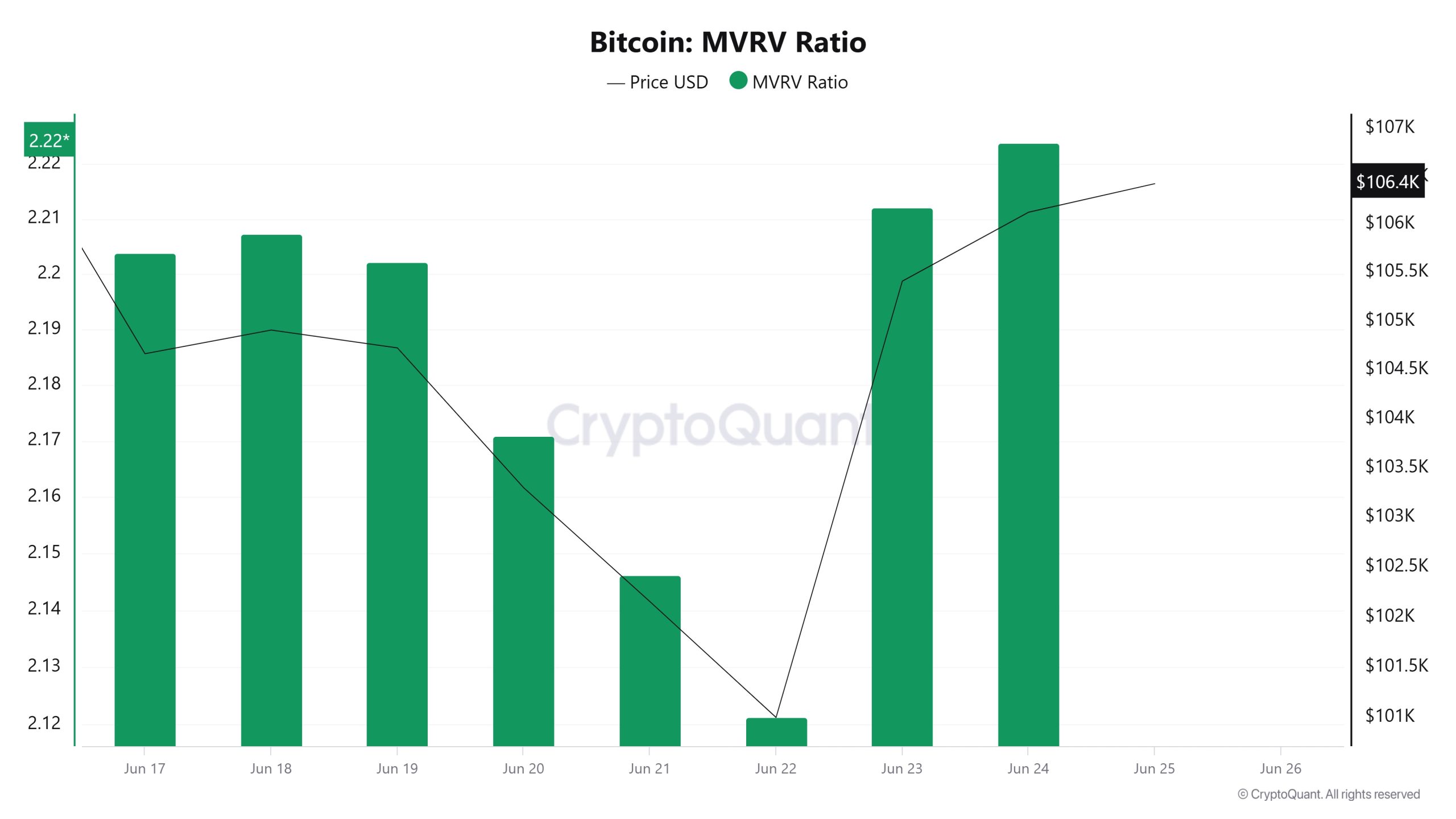

MRVR

On June 18th, the Bitcoin price was 104,911 while the MVRV Ratio was 2.207. As of June 24, the Bitcoin price rose to 106,129, an increase of 1.16%, while the MVRV Ratio rose to 2,223, an increase of 0.73%.

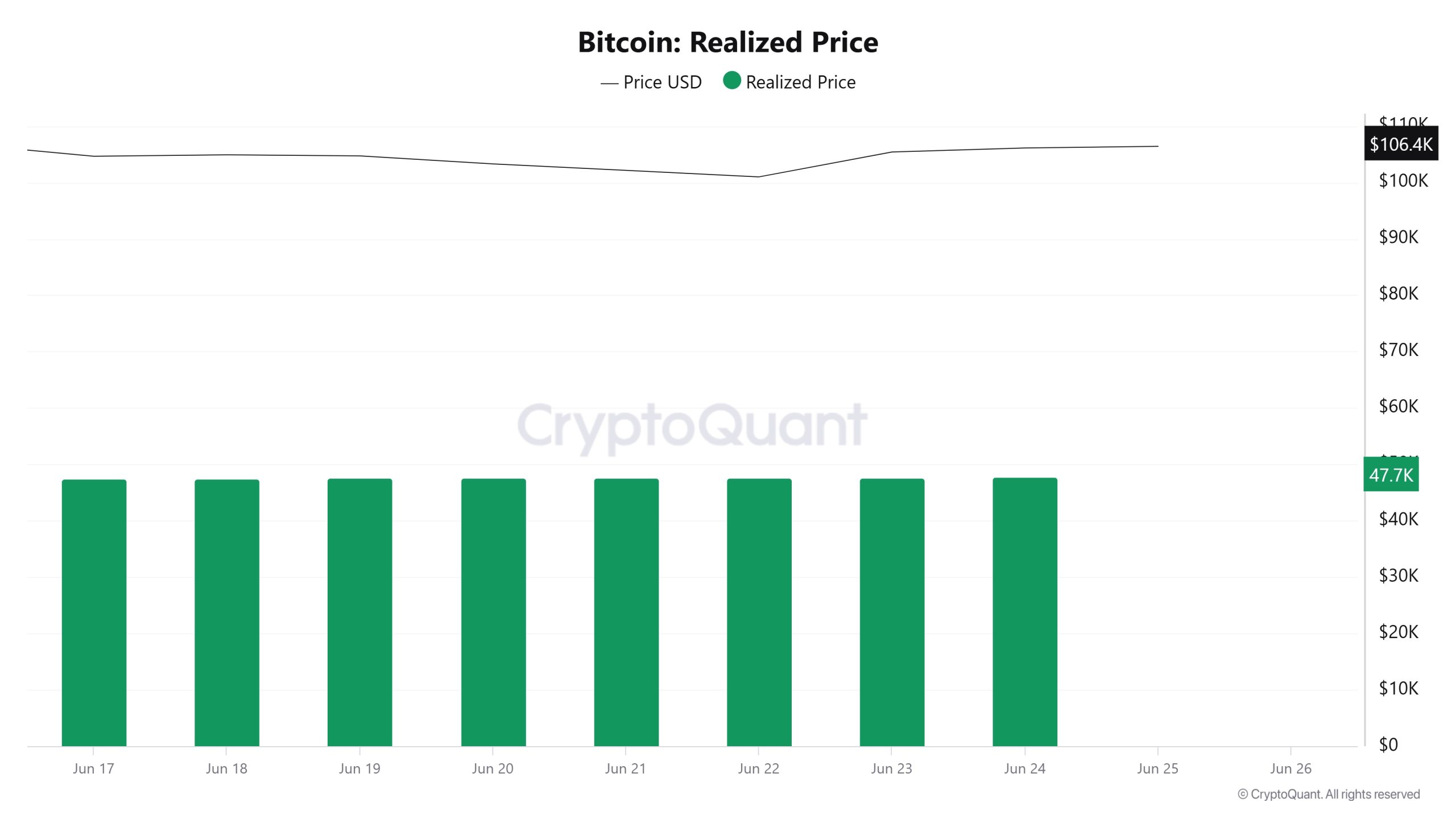

Realized Price

On June 18th, Bitcoin price was 104,911 while Realized Price was 47,528. As of June 24, the Bitcoin price was up 1.16% to 106,129, while the Realized Price was up 0.40% to 47,720.

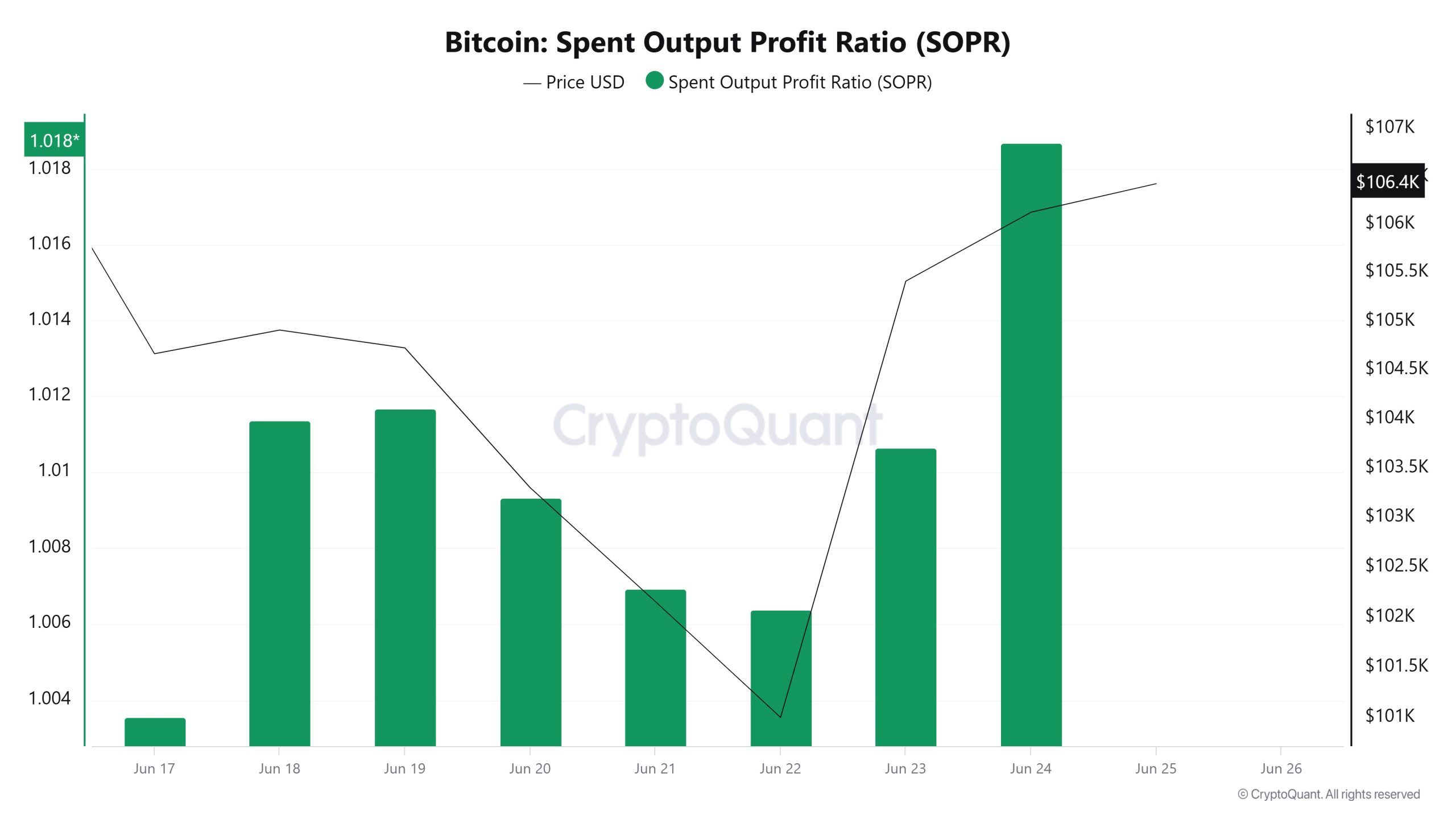

Spent Output Profit Ratio (SOPR)

On June 18, the Bitcoin price was at 104,911 while the SOPR metric was at 1,011. As of June 24, the Bitcoin price rose 1.16% to 106,129, while the SOPR metric rose 0.69% to 1,018.

Derivatives

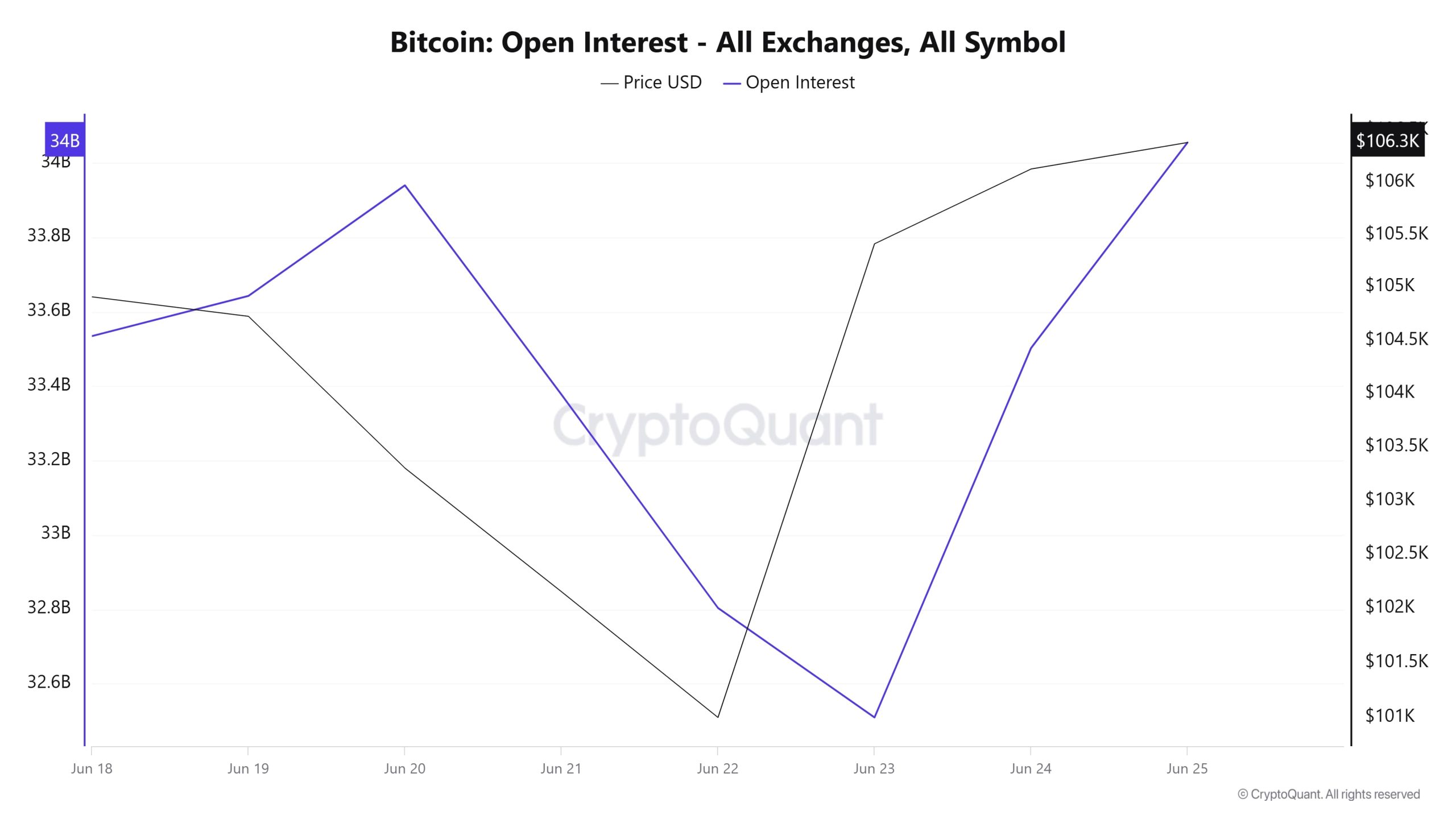

Open Interest

When the Bitcoin price and open interest data are considered together en the chart covering June 18-25, a rather characteristic transformation en the market can be observed. Initially, the slight increase en open interest as the price fell suggests that the positions opened despite the decline were probably short-weighted. However, after June 20, with the escalation of tensions between Israel and Iran, both the price and open interest declined rapidly. The real breakthrough comes after June 22. As the price reverses sharply from the bottom, open interest climbs up at almost the same pace. This simultaneous rise indicates that the market is repositioning and the rise is strongly supported por buying en the futures market. Especially el June 24-25, this synchronization becomes clear. Not only price but also risk appetite has returned to the field. The upside structure en Bitcoin has strengthened. But the rapid inflation of open interest also suggests that caution should be exercised en case of a possible liquidation scenario.

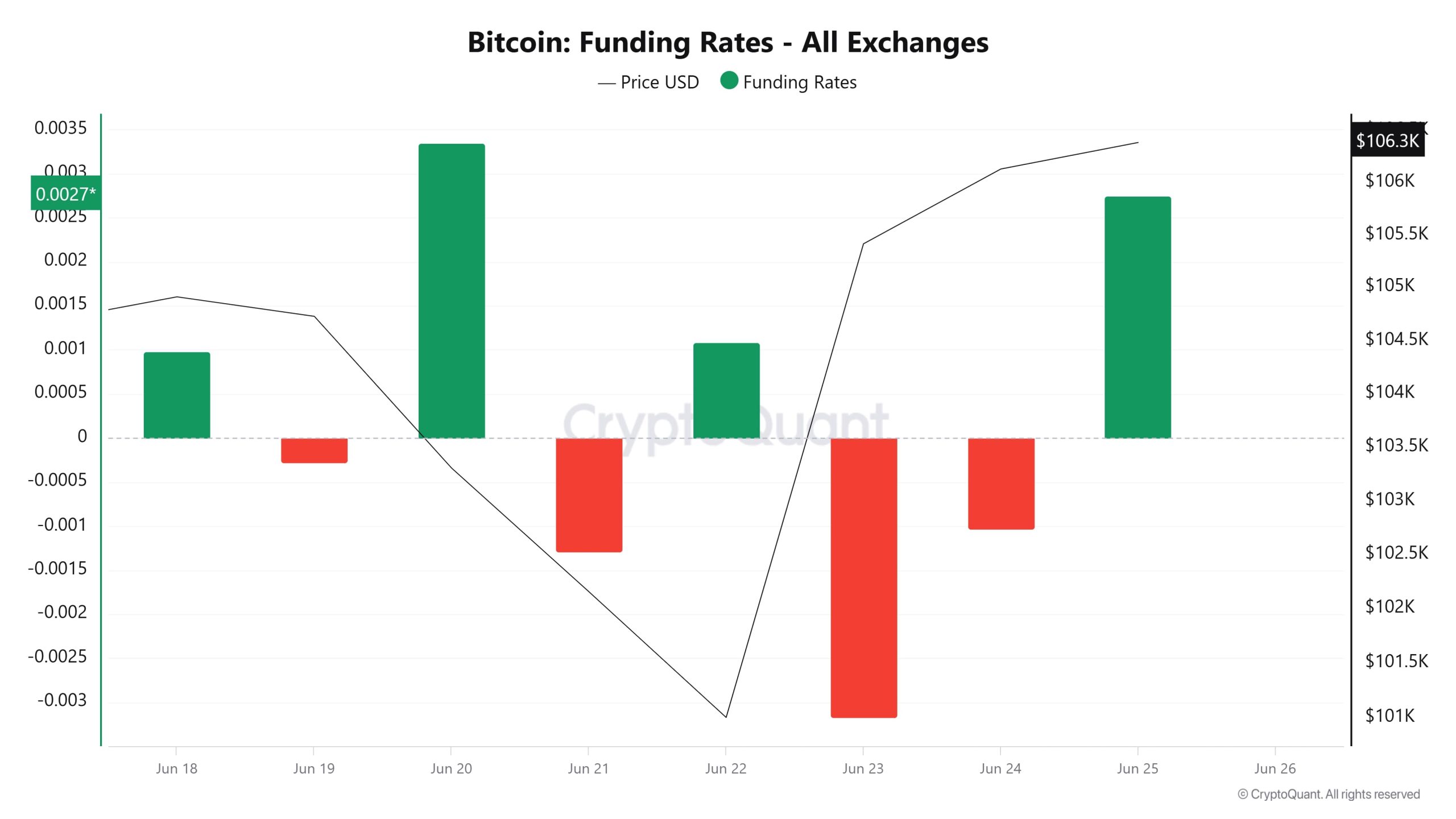

Funding Rate

The funding rate, which started positive el June 18, peaks el June 20. This indicates that long positions were concentrated and the market was expecting upside. However, when the price did not follow suit and started to decline, the funding rate turned negative between June 21 and 23. Especially el June 23, the rates turned sharply negative, suggesting that short positions gained weight and investors started to avoid risk.

Immediately after this downward pressure, the price started to recover el June 24 and the funding ratio turned positive again el June 25. This transition suggests that the buying incentive has returned and the market has started to push higher again. In short, the sharp reversals en both funding rates and prices over a period of a few days suggest that the direction of the market is not clear, but that short-term players are aggressively shifting positions. This clearly demonstrates the impact of highly leveraged transactions en the market and how quickly trader psychology can change.

Long & Short Liquidations

| Date | Long Amount (Million $) | Short Amount (Million $) |

|---|---|---|

| June 18 | 44.59 | 18.21 |

| June 19 | 8.14 | 4.11 |

| June 20 | 227.81 | 22.66 |

| June 21 | 196.69 | 15.00 |

| June 22 | 264.19 | 121.51 |

| June 23 | 30.56 | 146.85 |

| June 24 | 10.42 | 18.03 |

| Total | 782.40 | 346.37 |

After the start of the war between Israel and Iran and the sharp decline en BTC price after the US struck Iran’s nuclear facilities, the ceasefire agreement started a new uptrend. With this activity, 782 million dollars worth of long and 346 million dollars worth of short transactions were liquidated.

| Date | Long Amount (Million $) | Short Amount (Million $) |

|---|---|---|

| June 18 | 44.59 | 18.21 |

| June 19 | 8.14 | 4.11 |

| June 20 | 227.81 | 22.66 |

| June 21 | 196.69 | 15.00 |

| June 22 | 264.19 | 121.51 |

| June 23 | 30.56 | 146.85 |

| June 24 | 10.42 | 18.03 |

| Total | 782.40 | 346.37 |

Supply Distribution

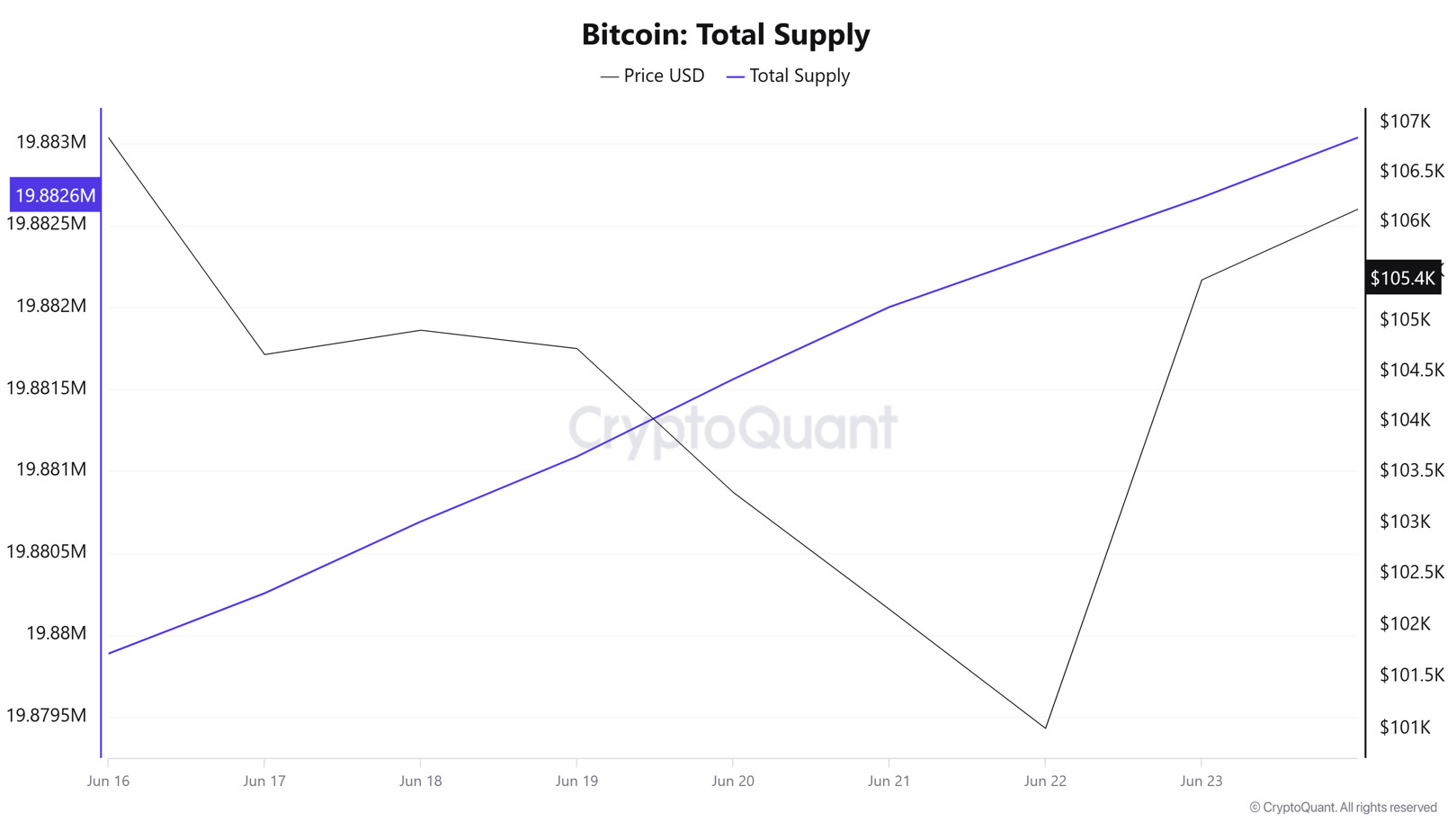

Total Supply: 19,882,671 units, up about 0.014% from last week.

New Supply: The amount of BTC produced this week was 2,785.

Velocity: Velocity, which was 12.87 last week, was 12.85 as of June 23.

| Wallet Categoría | 16.06.2025 | 23.06.2025 | Change (%) |

|---|---|---|---|

| < 1 BTC | 8.4847% | 8.4795% | -0.06% |

| 1 – 10 BTC | 11.4706% | 11.4552% | -0.13% |

| 10 – 100 BTC | 24.5713% | 24.6075% | 0.14% |

| 100 – 1k BTC | 28.8714% | 28.9068% | 0.12% |

| 1k – 10k BTC | 18.3746% | 18.3613% | -0.07% |

| 10k+ BTC | 8.2271% | 8.1891% | -0.46% |

According to the latest weekly data, there was a limited decrease of -0.06% en <1 BTC wallets, while a decrease of -0.13% was observed en the 1-10 BTC range. There were slight increases of +0.14% en the 10-100 BTC segment and +0.12% en 100-1k BTC. The 1k-10k BTC range saw a limited decline of -0.07%, while the 10k+ BTC category saw a more significant decline of -0.46%.

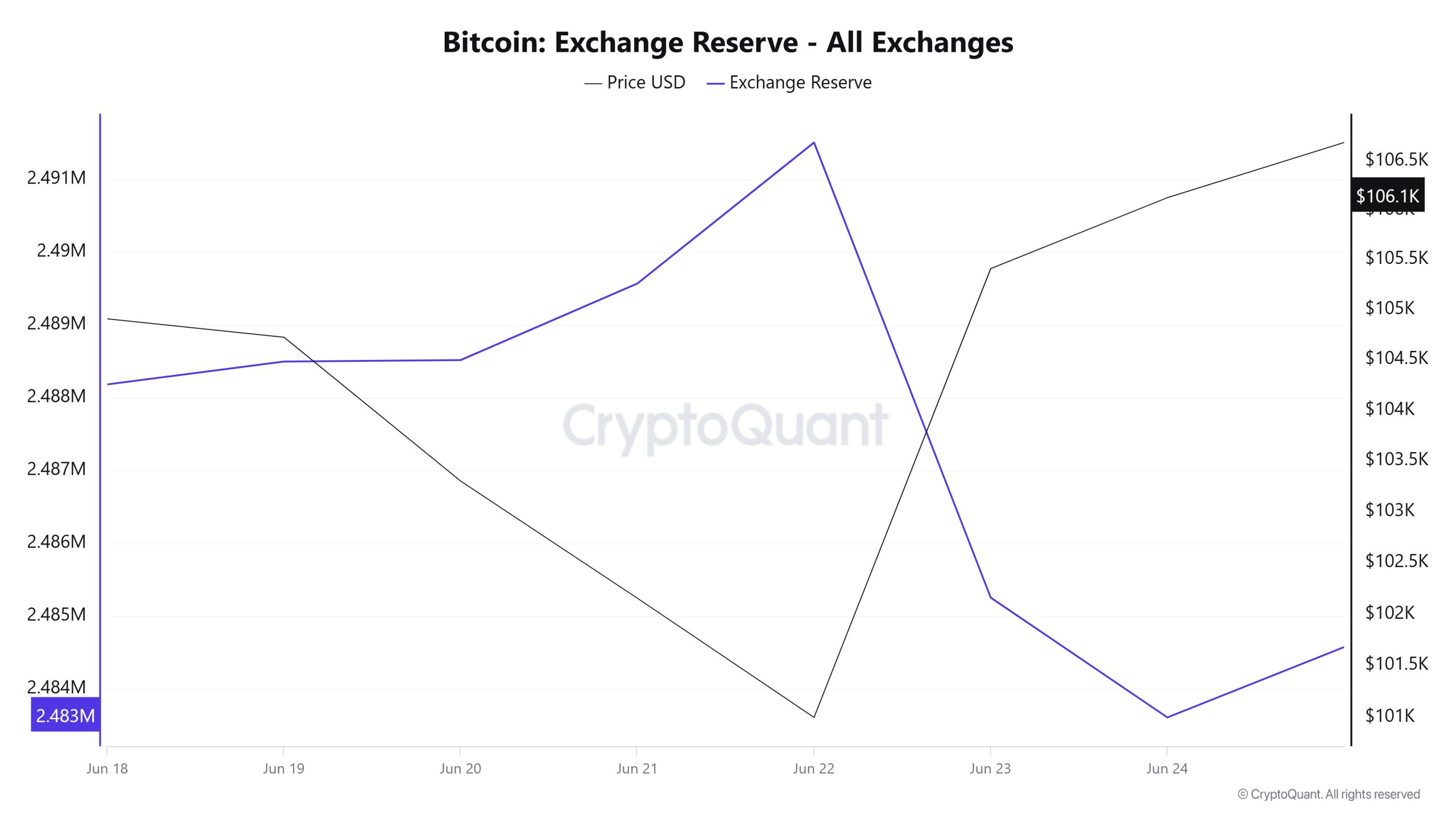

Exchange Reserve

Between June 18-24, 2025, Bitcoin reserves el exchanges decreased from 2,488,184 BTC to 2,483,608 BTC. In total, there was a net outflow of 4,576 BTC during this period and the Bitcoin reserves of exchanges decreased por approximately 0.18%. The Bitcoin price, el the other hand, rose por 1.16% during the same period, from $104,911 to $106,129. The decline en exchange reserves suggests that investors remain inclined to hold their assets off-exchange, while the rise en prices indicates that market interest remains. A horizontal outlook may prevail en the short term, while the positive trend may continue en the long term.

| Date | Exchange Inflow | Exchange Outflow | Exchange Netflow | Exchange Reserve | BTC Price |

|---|---|---|---|---|---|

| 18-Jun | 27,459 | 28,489 | -1,030 | 2,488,184 | 104,911 |

| 19-Jun | 10,888 | 10,574 | 314 | 2,488,499 | 104,727 |

| 20-Jun | 21,537 | 21,517 | 20 | 2,488,519 | 103,302 |

| 21-Jun | 8,008 | 6,956 | 1,052 | 2,489,571 | 102,156 |

| 22-Jun | 19,370 | 17,433 | 1,937 | 2,491,508 | 101,003 |

| 23-Jun | 22,233 | 28,487 | -6,253 | 2,485,255 | 105,415 |

| 24-Jun | 26,755 | 28,401 | -1,646 | 2,483,608 | 106,129 |

Fees and Revenues

When Bitcoin Fees per Transaction (Mean) data between June 18 and June 24 are analyzed, it is seen that this indicator was realized at 0.00001576 el June 18, the first day of the week.

As of June 19, a downward trend was observed due to the volatile movements en the Bitcoin price; as of June 22, it fell to 0.00001048, reaching the lowest level of the week.

In the following days, Bitcoin Fees per Transaction (Mean) started to rise again and closed at 0.00002208 el June 24, the last day of the week.

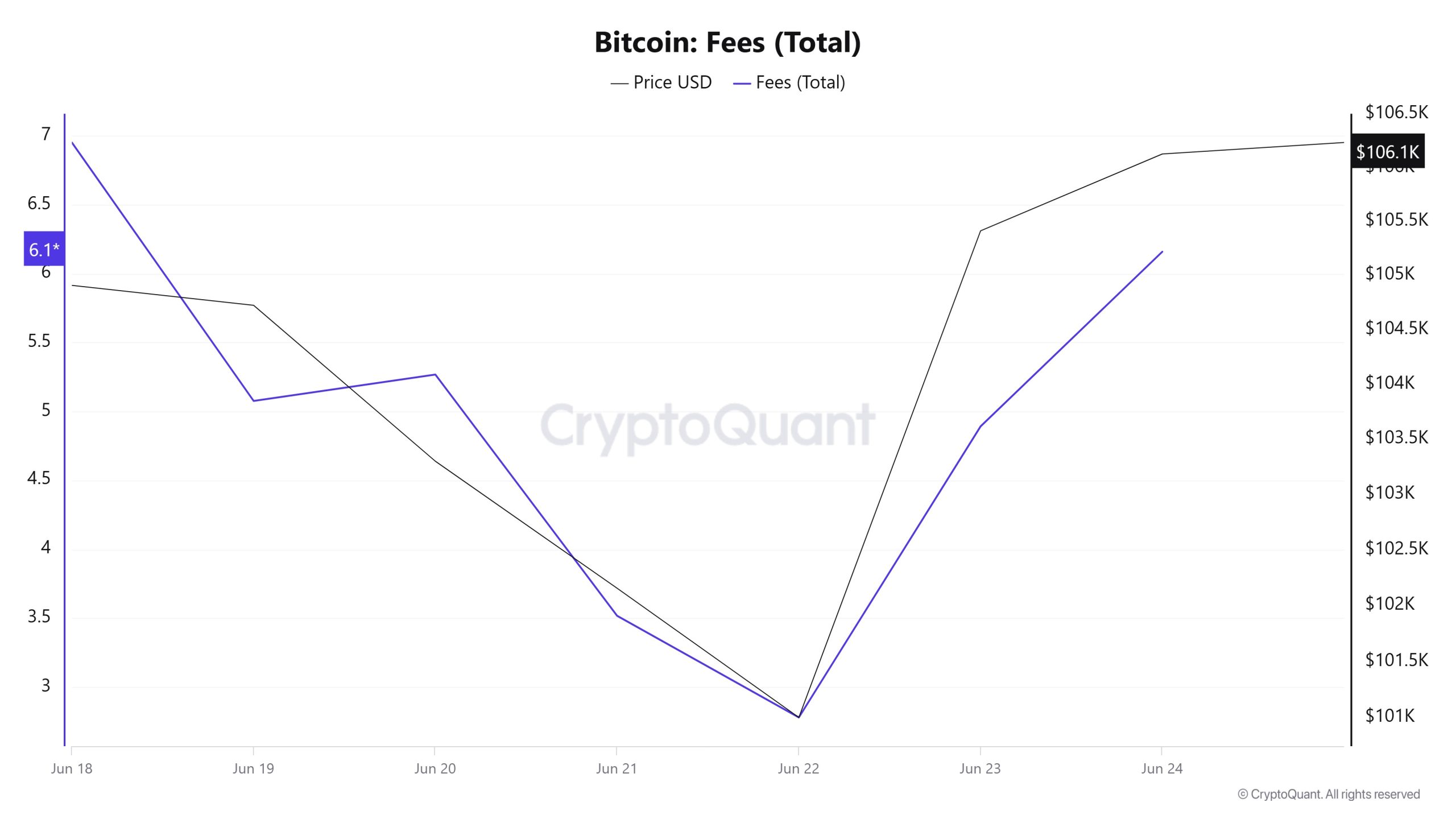

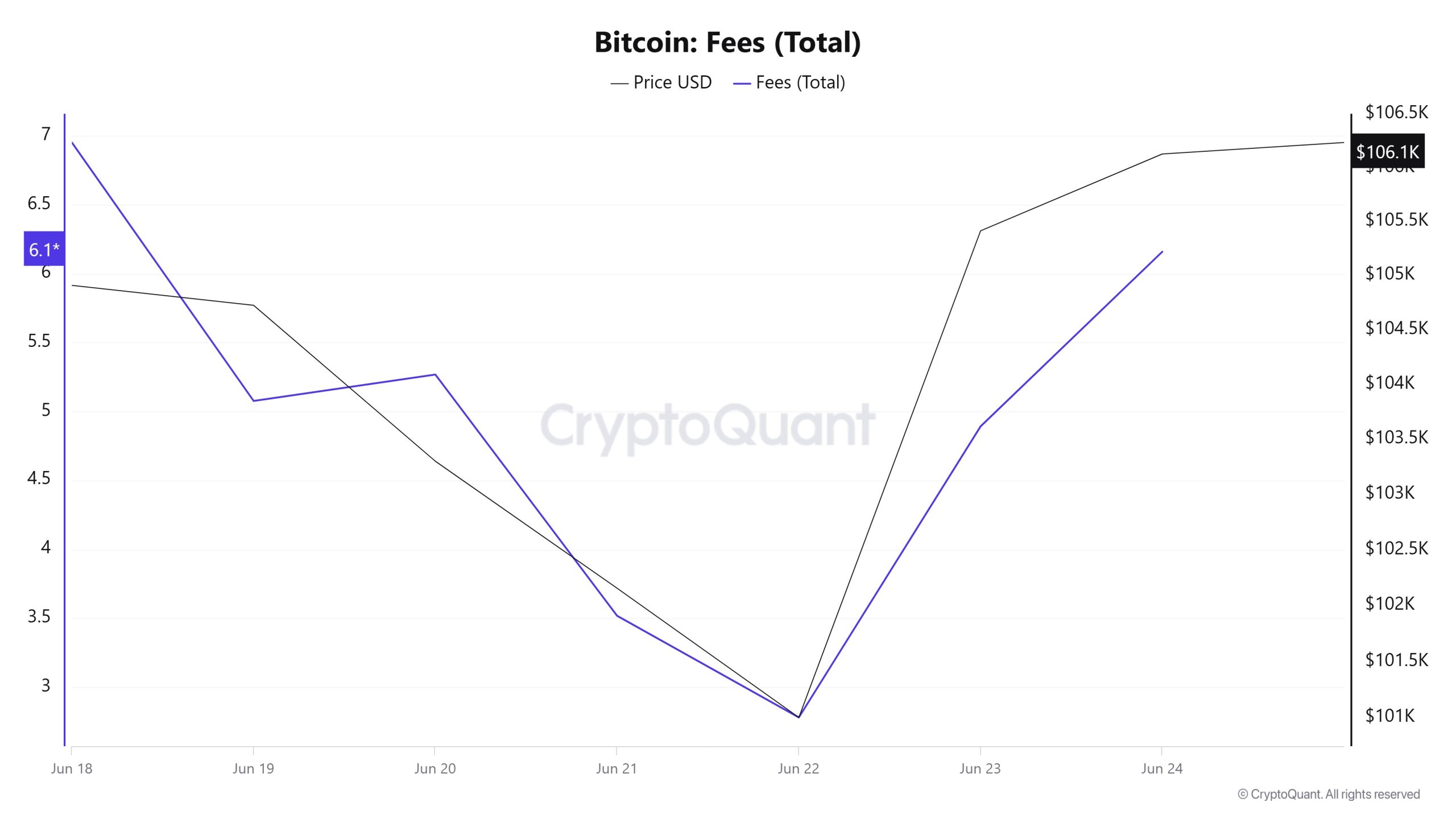

Bitcoin: Fees (Total)

Similarly, when Bitcoin Fees (Total) data between June 18 and June 24 are analyzed, it is seen that this indicator was realized at 6.95175944 el June 18, the first day of the week.

As of June 18, a downward trend was observed due to the volatile movements en the Bitcoin price; as of June 22, it fell to 2.78059806, reaching the lowest level of the week.

In the following days, Bitcoin Fees (Total) started to rise again and closed at 6.15937865 el June 24, the last day of the week.

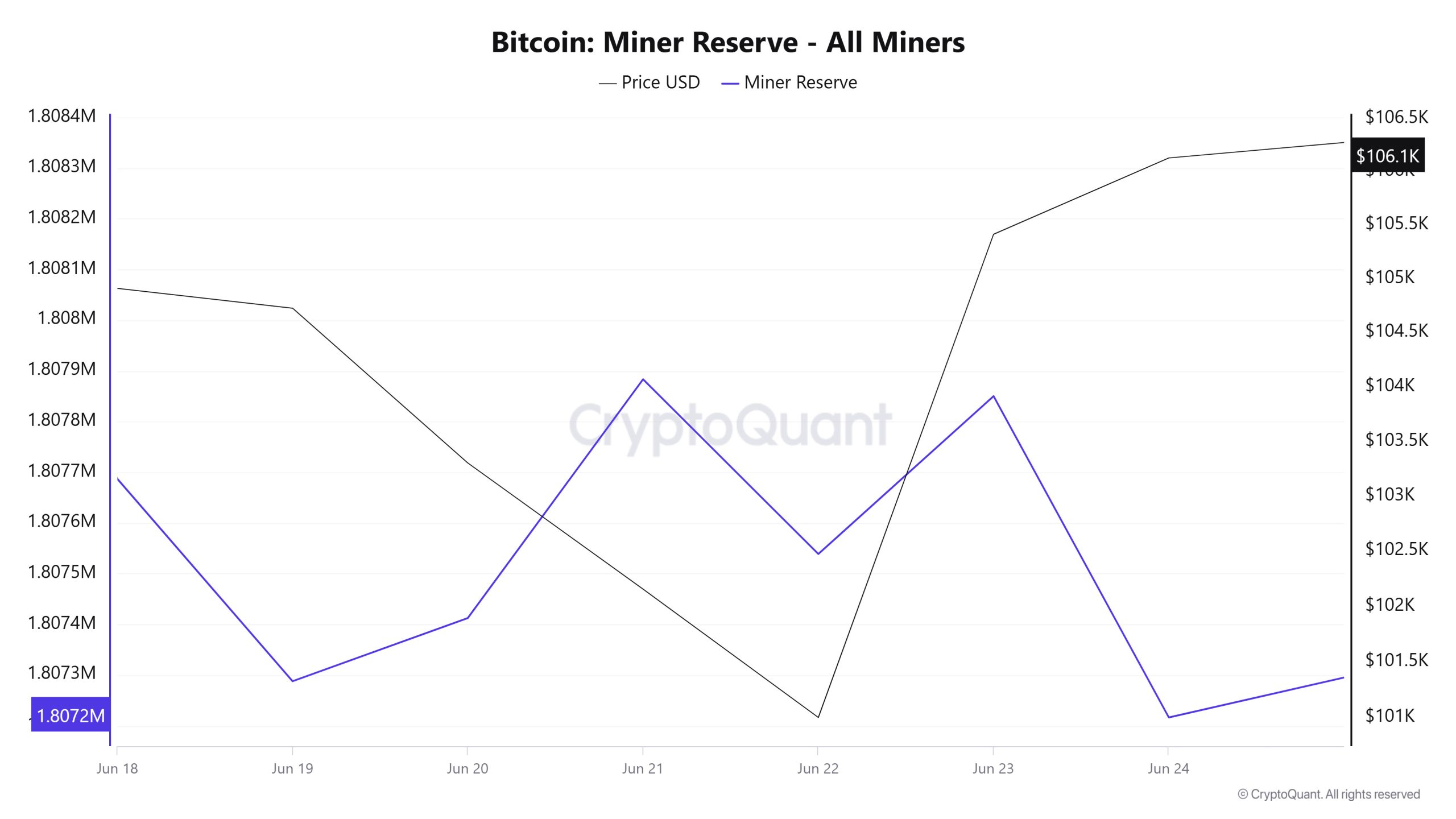

Miner Flows

According to the data obtained from the Miner Reserve table, there was a decrease en Bitcoin reserves held en miners’ wallets this week. During the week, the correlation between Bitcoin price and Miner Reserve followed a dynamic course. The relationship, which was positive en the first days of the week, evolved into a negative correlation towards the middle of the week, then returned to a positive structure for a short period of time and shifted back to the negative correlation zone por the end of the week.

Miner Inflow, Outflow and NetFlow

Between June 18th and June 24th, 33,187 Bitcoins exited miners’ wallets, and 32,053 Bitcoins entered miners’ wallets between the same dates. This week’s Miner Netflow was -1,134 Bitcoin. Meanwhile, the Bitcoin price was $104,911 el June 18 and $106,129 el June 24.

For the week, the net flow (Miner NetFlow) was negative as Bitcoin inflow into miner wallets (Miner Inflow) was less than Bitcoin outflow from miner wallets (Miner Outflow).

| Metric | June 18 | June 19 | June 20 | June 21 | June 22 | June 23 | June 24 |

|---|---|---|---|---|---|---|---|

| Miner Inflow | 3,516.52 | 2,547.57 | 5,111.38 | 3,653.65 | 5,960.88 | 5,635.45 | 5,627.64 |

| Miner Outflow | 4,180.09 | 2,946.60 | 4,986.65 | 3,182.81 | 6,305.46 | 5,324.11 | 6,261.39 |

| Miner Netflow | -663.57 | -399.04 | 124.73 | 470.84 | -344.59 | 311.34 | -633.75 |

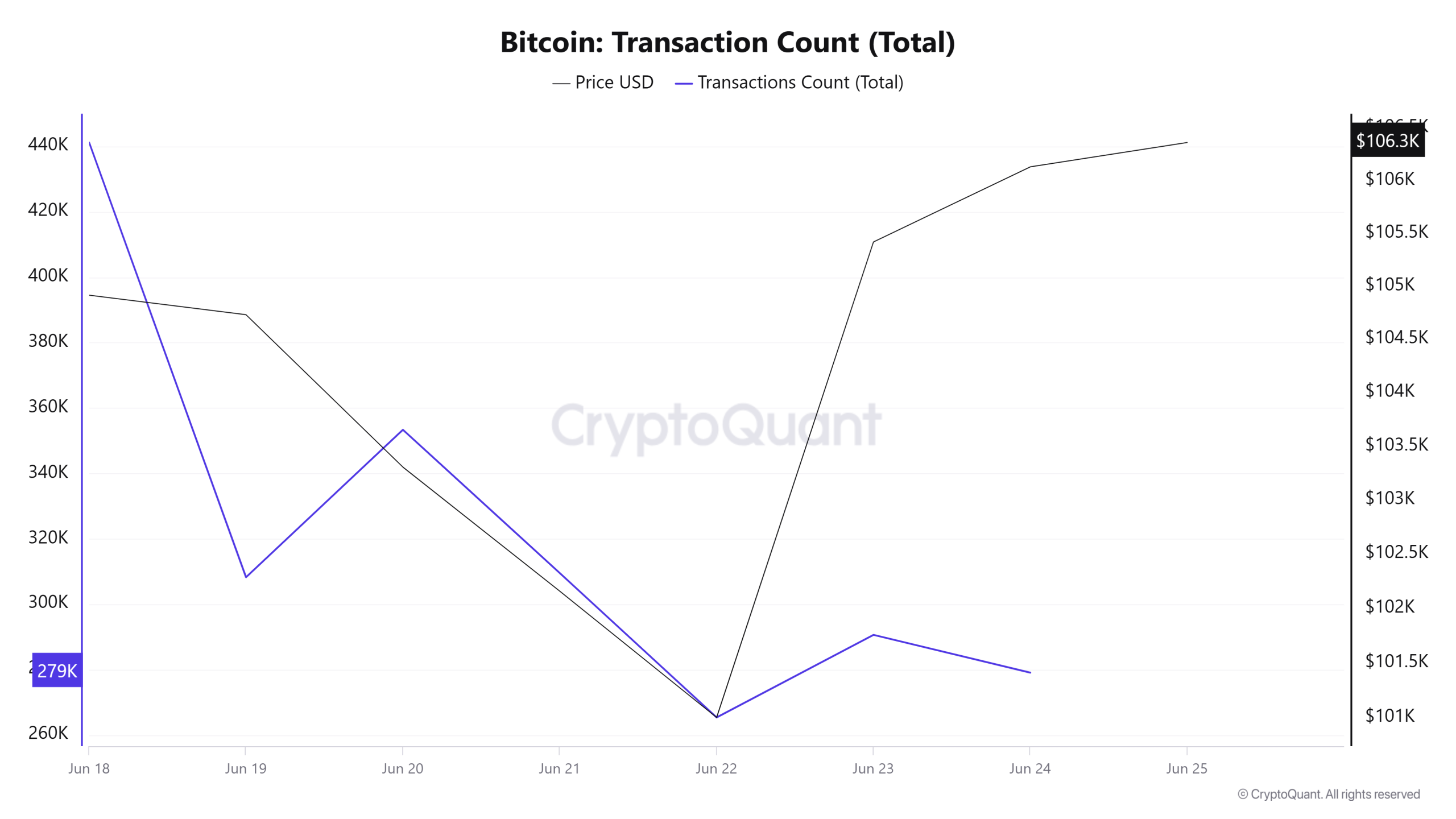

Transaction

Last week, there were 2,394,602 transactions el the Bitcoin network, while this week it decreased por about 6.16% to 2,247,054. The 265,314 transactions recorded el June 22 were the lowest for the week, while the highest number of transactions was 441,177 el June 18.

Correlations between price and number of trades were mixed during the week, with positive correlations predominating throughout the week, but the decrease en network activity compared to the previous week suggests that a strong indicator is not yet en place.

Tokens Transferred

While 3,715,566 BTC was transferred last week, this week it increased por approximately 1.53% to 3,772,565 BTC . On June 24, the highest token transfer volume of the week was 695,393 BTC, while the lowest token transfer volume was recorded el June 21 with 323,165 BTC. The positive correlation between the amount of BTC transferred el the network and the price this week is lower than last week, but a complete decoupling has not yet been realized.

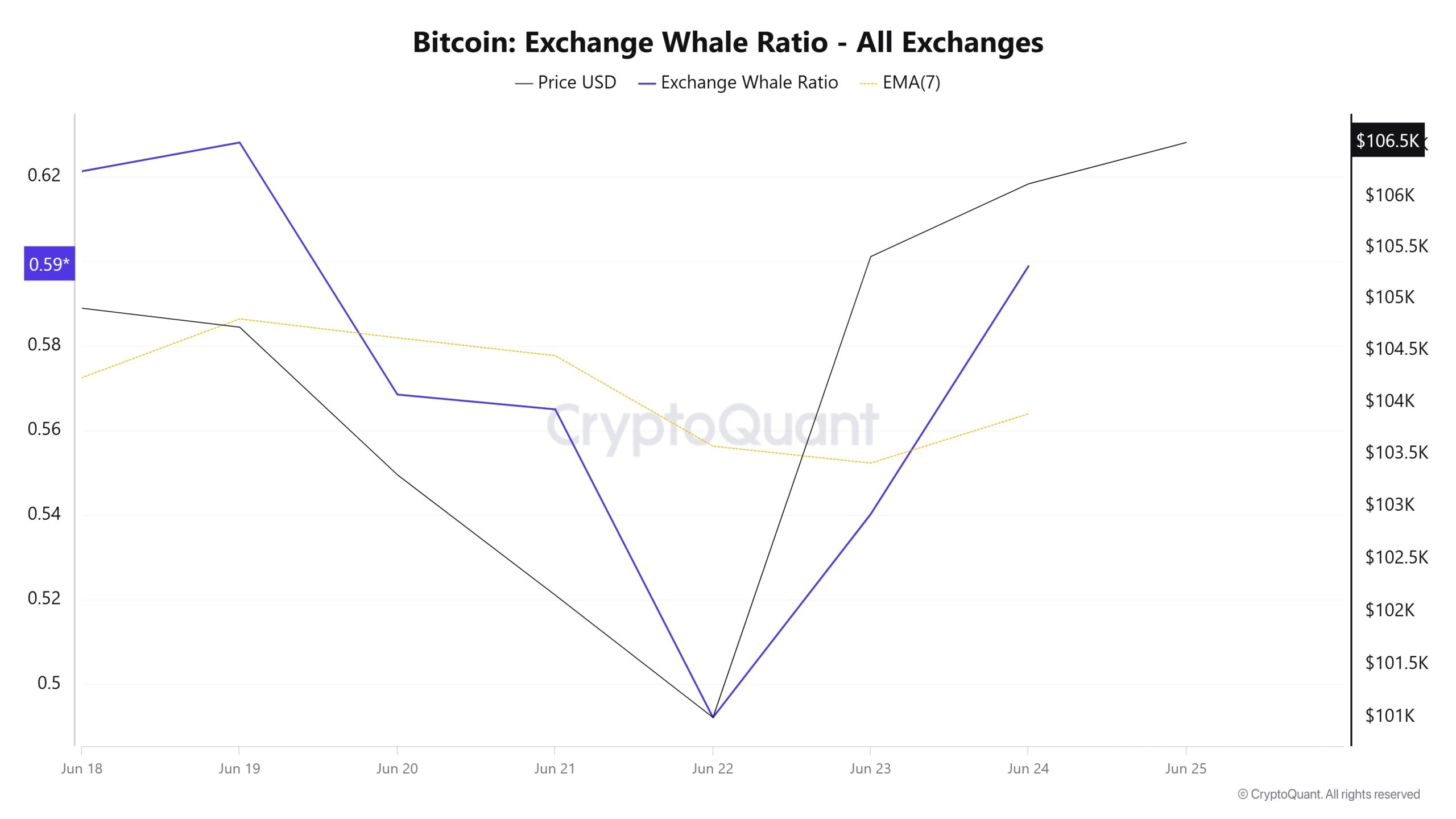

Whale Activities

Whales Data:

Over the last 7 days, data from the cryptocurrency market showed that whale activity el centralized exchanges was high at the beginning of the process. Towards the middle of the process, these activities declined. When we look at the Exchange Whale Ratio metric, June 18, the first day of the 7-day period, measured the rate of whales using central exchanges as 0.621. The peak of the process took place el June 19 and the value was 0.628. When this ratio is above 0.35, it usually means that whales use centralized exchanges frequently. This measurement decreased towards the middle of the process, dropping to 0.492 el June 22, marking the low point of the process. It currently stands at 0.598 and centralized exchanges continue to be used frequently. BTC’s value was $104,000 at the beginning of this process and fell to $98,000 en the middle of the process. It is currently priced at $106,500. This suggests that whales used centralized exchanges to buy at the beginning of the process. In the middle of the process, they used them to sell. At the moment, the accumulating whales are en the circuit. At the same time, 3,772,565 BTC moved en total BTC transfers, en line with last week. The data shows that four separate transactions totaling more than 5,690 BTC, each worth between $107 million and $207 million, were sent from unknown wallets to newly created addresses. These transfers attracted attention as they coincided with a period of increased market volatility and risk aversion. As a result, when we focus el the movements, the fact that whales often use centralized exchanges for buying may continue to have a positive impact el the price.

BTC Onchain Overall

| Metric | Rise 📈 | Decline 📉 | Neutral ➖ |

|---|---|---|---|

| Active Addresses | ✓ | ||

| Breakdowns | ✓ | ||

| Derivatives | ✓ | ||

| Supply Distribution | ✓ | ||

| Exchange Reserve | ✓ | ||

| Fees and Revenues | ✓ | ||

| Miner Flows | ✓ | ||

| Transaction | ✓ | ||

| Whale Activities | ✓ |

*The metrics and guidance en the table do not, por themselves, describe or imply an expectation of future price changes for any asset. The prices of digital assets may vary depending el many different variables. The onchain analysis and related guidance is intended to assist investors en their decision-making process, and making financial investments based solely el the results of this analysis may result en harmful transactions. Even if all metrics produce a bullish, bearish or neutral result at the same time, the expected results may not be seen depending el market conditions. Investors reviewing the report would be well advised to heed these caveats.

Legal Notice

The investment information, comments and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en results that are en line with your expectations.

NOTE: All data used en Bitcoin onchain analysis is based el Cryptoqaunt.