Introduction

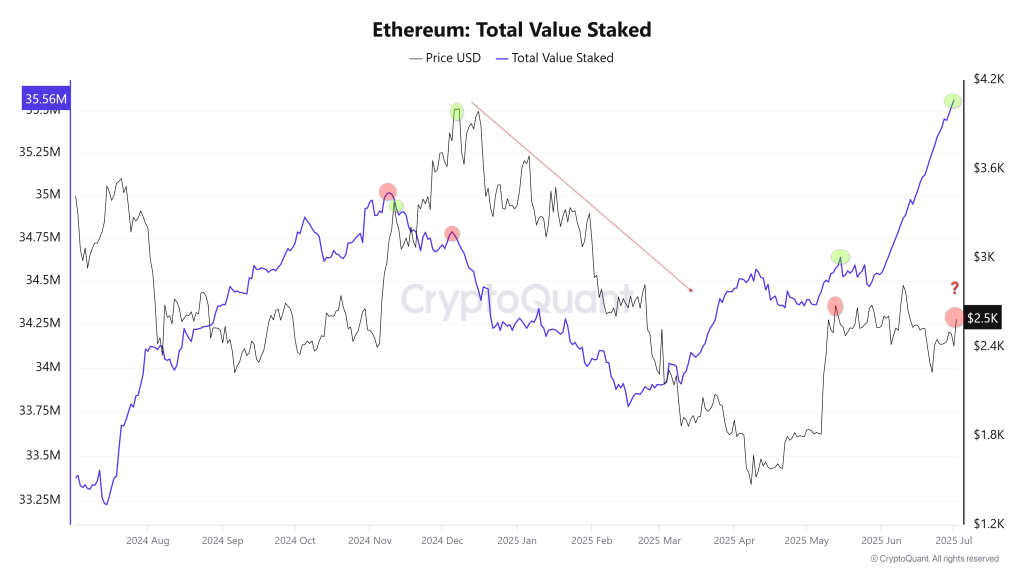

As of June 2025, the total amount of Ether (ETH) staked el the Ethereum network has reached an all-time high. Nearly 35 million ETH, more than 28% of the total supply, was locked en the network’s Proof-of-Stake consensus, demonstrating the long-term confidence of investors and the fundamental robustness of the network. In contrast, during the same period, the ETH price has been el a downward trend and ended June el a downtrend. This mismatch between the strength en key network metrics and weakness en the market price is not unique. A similar metric-price divergence occurred en November-December 2024. During this period, total value staked fell while the ETH price rose, but this mismatch was followed por a significant retracement.

This report examines the key factors behind the increase en Ethereum staking en June 2025 and assesses their impact el the ETH price. It also discusses possible similarities between the current situation and a similar divergence at the end of 2024.

On-Chain Behavioral Metrics and Price Mismatch

- Total Value Staked Mismatch and Historical Similarity

In the November-December 2024 period, a notable divergence was observed, where the amount of ETH staked started to decline, but the price recorded a significant increase. After this period, the price was subject to a rapid correction, demonstrating that staking behavior can have a significant impact el market prices en the medium term. As of June 2025, the opposite pattern is evident. Although the amount of ETH staked has reached historical highs, the price has not responded en parallel and remains under pressure, highlighting the mismatch between the market and network fundamentals. This suggests that the price has the potential to move more en line with the staking data en the coming period.

- Accumulation Addresses Tendency

The total balance of addresses that have not moved el the Ethereum network for a long time and are regular accumulators has been steadily increasing. The Accumulation Addresses metric showed a significant increase en June 2025, both en terms of total balance and inflow volume. This suggests that many investors are continuing to accumulate ETH despite the price pressure and is an important indication that the fundamental demand outlook remains strong.

Key Factors Triggering Ethereum Staking Increase

Beacon Chain Validator Limit Increase

The Pectra protocol update, launched en May 2025, increased the maximum amount of ETH that a validator can stake from 32 ETH to 2,048 ETH. This change provided significant operational relief for large traders who previously had to install hundreds of validators.

Conclusion

- Whales and institutional investors were able to consolidate their ETH holdings el a single validator.

- Large players, who previously had to divide their portfolios into 32 ETH tranches, are now able to stake more amounts “all-en”, reducing the technical infrastructure burden.

- Validator activation queues also grew significantly during this period, showing the increase en staking demand en a tangible way.

This is an important technical reason for the rapid rise en the staking rate en June.

Expectation of Ethereum ETFs’ Staking Approval and Institutional Demand

In the first half of 2025, the market is anticipating the necessary SEC approval for currently traded Ethereum spot ETFs to benefit from staking rewards. This expectation has accelerated the adoption of ETH as a long-term investment vehicle por institutional investors both en the US and offshore.

The prospect that ETFs could also offer staking rewards encouraged institutional players to take early positions. As a result:

- Institutions became direct validators por purchasing ETH,

- Some funds locked a significant portion of their ETH el the network.

This strategy did not cause the price to rise en the short term but contributed to a record high total staked amount.

Solo Investors Switching to LST and LRT Protocols

Users with a balance of less than 32 ETH el the Ethereum network have been forced to opt for liquid staking protocols instead of setting up their own validators.

Thanks to Lido, Rocket Pool and similar protocols, small investors:

– ETH en a pool and earned a return,

– They were able to use their locked assets as collateral through liquid staking tokens (stETH, etc.).

From early 2025, liquid restaking (LRT) solutions (such as EigenLayer) also became widespread. These systems created opportunities for additional returns el staked ETH and generated new demand.

Therefore, liquid staking platforms and restaking practices have been one of the main factors driving the total staking supply.

Conclusion

There are three main reasons behind the historic peak of staking el the Ethereum network en June 2025:

- Beacon Chain validator limit increase, removing operational barriers for big players,

- Pending SEC approval for currently traded Ethereum spot ETFs to benefit from staking returns, accelerating institutional demand,

- Increased participation of small investors en staking with the proliferation of the LST and LRT protocols.

The combination of these factors has reduced liquid supply, reinforcing long-term Ethereum confidence. However, the price decline over the same period reflects cautious market conditions el the demand side and short-term profit realizations. If fundamentals remain strong en the medium term, the price may price en this accumulation over time.

Disclaimer

This report is for informational and educational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency investments carry significant risk and may not be suitable for all investors. The information provided reflects the market conditions as of June 2025 and may change without notice. Always conduct your own research or consult a qualified financial advisor before making any investment decisions. Darkex does not take responsibility for any losses incurred based el the content of this report.