Cross Margin in Cryptocurrency Trading

In cryptocurrency markets, Cross Margin is a widely used margin trading system that allows traders to use their entire margin account balance as collateral for maintaining open positions. This method aims to optimize risk management and is often preferred by traders who plan to hold multiple positions or apply hedging strategies.

Features of Cross Margin

All open positions share the same account balance as collateral. If losses occur in one position, profits from other positions can offset those losses.

Lower Risk of Liquidation

When a position approaches liquidation, funds from the entire margin account can be used to prevent forced closures.

Flexibility

Cross Margin provides traders with greater flexibility to manage multiple open positions simultaneously, making it well-suited for hedging strategies.

Benefits of Cross Margin

Risk Control:

Sharing collateral across positions reduces the likelihood of liquidation.

Simple Management:

There is no need to assign margin individually to each position.

Efficient Use of Capital:

The entire account balance can be used as collateral, allowing for larger position sizes.

Drawbacks of Cross Margin

Greater Overall Risk:

If a position suffers extreme losses, the entire account balance may be used to cover it.

Overexposure:

Since all funds are at risk, sudden adverse market movements can lead to significant losses.

Cross Margin vs. Isolated Margin

Cross Margin:

All positions share a common collateral pool, offering higher flexibility but greater overall risk.

Isolated Margin:

Each position has its own allocated margin, limiting losses to a single trade and protecting the rest of the account.

Conclusion

Cross Margin is a margin trading system that offers flexibility and efficient capital utilization, but it comes with higher risk exposure. It is best suited for experienced traders who understand market volatility and apply strong risk management strategies.

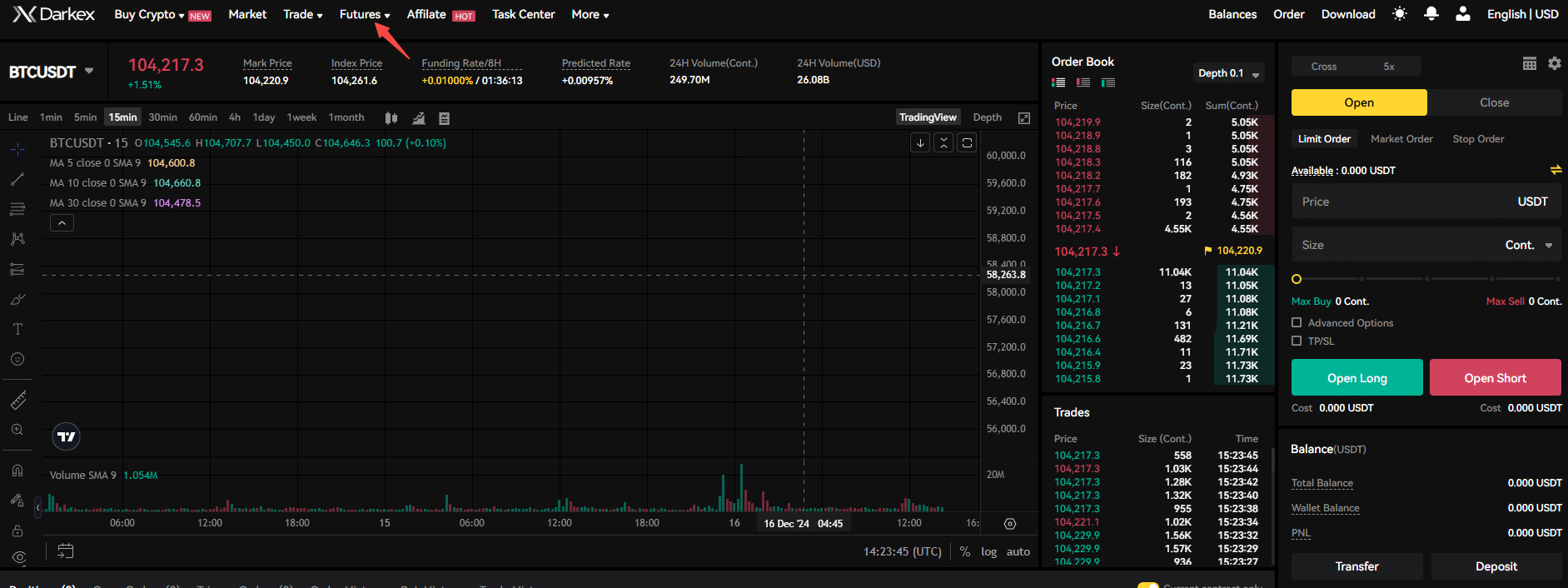

How to trade cross margin on Darkex?

After logging into your Darkex account, click Futures on the page that opens.

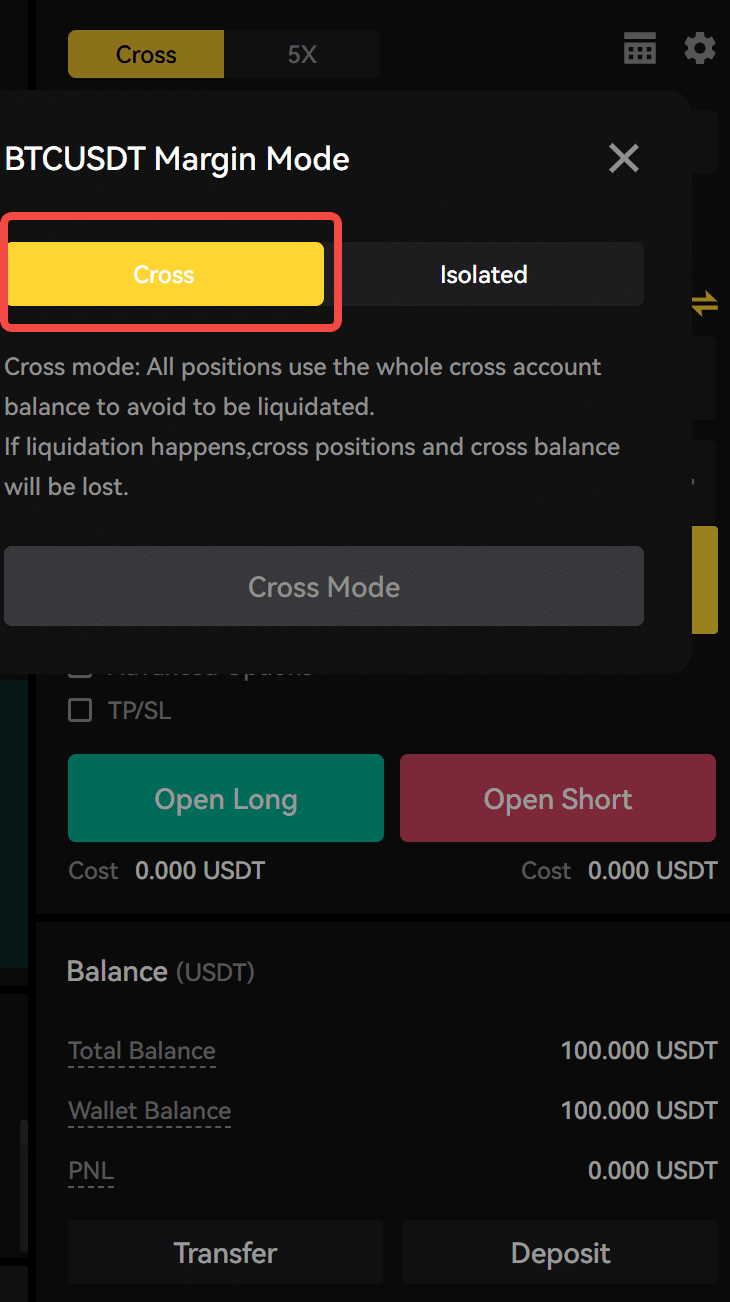

On the page that opens, you can mark your trade mode as cross on the right side

Then you can continue trading by choosing one of the options Limit Order Market Order Stop Order.

Please click to learn more about Limit Order Market Order Stop Order.

Disclaimer

This article is for informational purposes only and should not be considered as financial or investment advice. Cryptocurrency trading involves significant risk, including the potential loss of your entire investment. Always conduct your own research and consult with a qualified financial advisor before engaging in margin or leveraged trading.