MARKET COMPASS

The most important dynamic affecting investor sentiment in global markets continues to be the ongoing uncertainty regarding the Trump administration’s actions on US trade policy. The President first announced that he would impose 25% tariffs on Mexican and Canadian goods covered by the North American trade agreement, but later exempted automobiles and postponed all tariffs until Aprile 2. After the Asia-Pacific indices closed in the negative territory, European stock markets are also on a downward trend today. After yesterday’s sharp losses, Wall Street is expected to start the day slightly positive.

Recent statements on the US’s highly anticipated “Strategic Crypto Asset Reserve” had put pressure on digital assets. According to the news, the reserve plan in question will only consist of assets to be confiscated by criminal incidents and will not include a new yellow purchase route. Details and first-hand information can be obtained at the summit to be held at the White House today. Therefore, with both the macro agenda and these developments, a volatile weekend in cryptocurrencies may be waiting for us.

Powell Previous Eyes on Non-Farm Payrolls Data

The first critical macro data for the markets in Marzo will be released today. Non-Farm Payrolls (NFP), which will provide clues about the US Federal Reserve’s interest rate cut path and the tightness of the financial ecosystem in the coming period, will be the priority. In addition, Febbraio figures such as average hourly earnings and the unemployment rate will be followed.

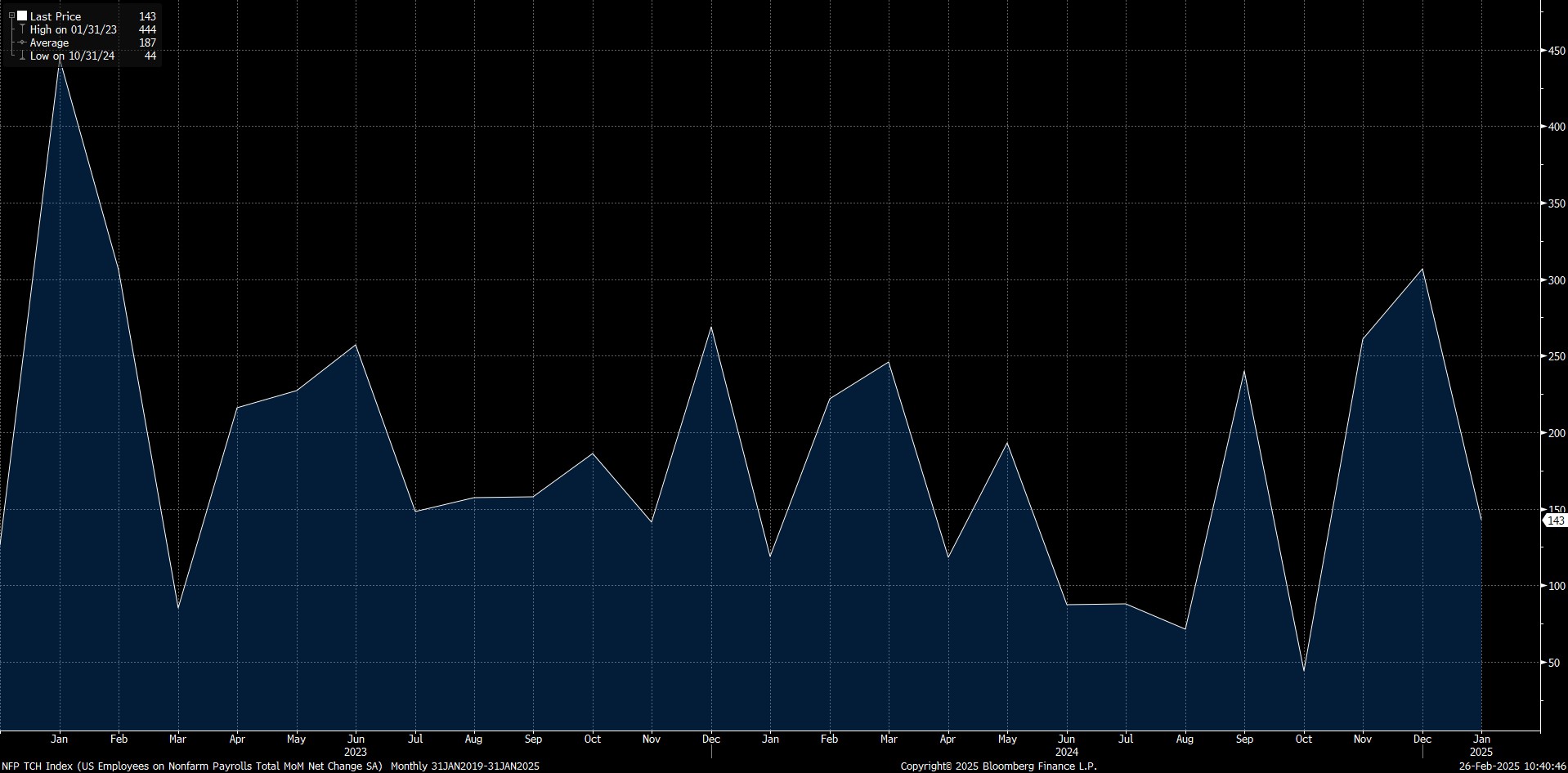

The NFP for the first month of the year was announced as 143 thousand, which was below the general expectation of around 170 thousand. However, when the details of the employment report and other data are analyzed, we believe that this set of statistics does not point to a bad labor market. But to open a separate parenthesis, it is important to note that while the tendency of Americans to stay in their current jobs has increased, their willingness to demand higher wages has decreased. We may see the effects of this negatively in the long run.

Source: Bloomberg

Turning to the Non-Farm Payroll Change data, which is extremely sensitive for the market, our estimate is that the US economy added around 150K new jobs in the non-farm sectors in Febbraio. At the time of writing, the consensus on the Bloomberg terminal is around 160K.

We believe that if the Febbraio NFP data, which will be published in the shadow of the deterioration that Trump’s tariff-centered foreign policy may create domestically, is slightly below expectations, this will be priced as a metric that may create an expectation that the FED may act more boldly to lower the interest rate, thus increasing the risk appetite and having a positive impact on financial instruments, including digital assets. We think that a slightly higher-than-expected data may have a similar but opposite effect. However, a much lower than expected NFP data may trigger recession concerns with a commentary on the health of the US economy, which may put selling pressure on assets considered to be risky. It should be noted here that we expect that a much better than expected data could also have a positive impact. It is worth noting that we anticipate these effects by taking into account the current market sentiment.

Will Powell Give a Clue?

Ahead of the second Federal Open Market Committee (FOMC) meeting of the year, which will conclude on Marzo 19, the remarks of US Federal Reserve Chairman Powell, who will speak about the economic outlook today at the University of Chicago Booth School of Business US Monetary Policy Forum, are likely to have an impact on the markets. He is also expected to accept questions from the audience. Powell’s statements, which may shape expectations about the timing of the Fed’s next interest rate cut and the number of rate cuts by the end of the year, will be closely monitored by investors.

Historic Crypto Summit at the White House and Trump’s Speech

US President Donald Trump will participate in a roundtable discussion on cryptocurrency policy at the White House in Washington DC. Although the high excitement around this event has been tempered by reports that crypto assets will be created as a “Strategic Reserve” with cryptocurrencies derived solely from the proceeds of crime, it will be closely watched for the strength of the list of participants and a possible surprise. Apart from everything else, we see the event as a very important milestone as it is the first summit of this level to be held at the White House. In terms of short-term market effects, it is worth noting that there may be limited impact due to the loss of excitement.

The summit will be led by David Sacks, known as the “Crypto Czar”. The meeting is scheduled to take place between 06:30 – 10:30 pm UTC time zone. US Secretary of Commerce Howard Lutnick stated that Trump considers Bitcoin as a strategic reserve asset, emphasizing that the most important agenda item at the summit will be the roadmap to be followed on this issue. Trump is scheduled to speak at 18:30 UTC time.

The Big Picture

For a long time, in our analysis of digital assets, we have been saying that “we expect volatility in the short term, pressure in the medium term and bullishness in the long term.” The uncertainty created by Trump in the political environment, especially with the tariff tool, and the roadmap he followed on Ukraine were an important dynamic. However, we can state that the lack of catalyst for the undeniable rise of digital assets has largely ended with the President’s latest crypto asset assessment. However, the statement that reserves will only be built with criminally seized assets will cause us to slightly revise the strong weight of this variable in our equation. Therefore, by adjusting the weighting in our equation, we maintain our general view as “bullish with interim corrections” despite the uncertainties that still exist. At this point, it is worth noting that although the first announcement on the reserve issue, which the crypto ecosystem is eagerly awaiting, it is necessary to continue to closely monitor political, geopolitical, the method of holding the assets to be accumulated for the reserve and macro dynamics.

HIGHLIGHTS OF THE DAY

Importanti dati del calendario economico

| Tempo | Notizie | Aspettative | Precedente |

|---|---|---|---|

| 13:30 | US Average Hourly Earnings (MoM) (Feb) | 0.3% | 0.5% |

| 13:30 | US Nonfarm Payrolls (Feb) | 159K | 143K |

| 13:30 | US Unemployment Rate (Feb) | 4.0% | 4.0% |

| 15:15 | FOMC Member Bowman Speaks | ||

| 15:45 | FOMC Member Williams Speaks | ||

| 17:20 | FOMC Member Kugler Speaks | ||

| 17:30 | FED Chair Powell Speaks | ||

| 18:00 | FOMC Member Kugler Speaks | ||

| 18:30 | President Trump Speaks |

INFORMATION:

*Il calendario si basa sul fuso orario UTC (Coordinated Universal Time).

Il contenuto del calendario economico sulla pagina corrispondente è ottenuto da fornitori di notizie e dati affidabili. Le notizie contenute nel calendario economico, la data e l'ora dell'annuncio delle notizie, le possibili variazioni delle cifre precedenti, delle aspettative e delle cifre annunciate sono state realizzate dalle istituzioni fornitrici di dati. Darkex non può essere ritenuta responsabile di eventuali cambiamenti che potrebbero derivare da situazioni simili.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Rapporto mensile sulla strategia di Darkex - Marzo

Analisi settimanale della catena BTC

Analisi settimanale della catena ETH

Stablecoin Issuers Approved Under MiCA Regulation and Market Impacts

Farcaster’s Rise with Brian Quintenz and the Revival of SocialFi

The Combination of Ethereum Staking and ETFs: A New Era for Investors?

Impact of Tether’s Possible Bitcoin Sale on Crypto Markets Under the US Stable and Genius Acts

Why Tether Chose the Arbitrum Infrastructure Network for Stablecoin USDT0?

Click here for all our other Market Pulse reports.

AVVISO LEGALE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorised institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based only on the information contained in this document may not result in results that are in line with your expectations.