MARKET COMPASS

- On Giovedì, Trump confirmed that his proposed 25% tariffs on Mexico and Canada will go into effect on Marzo 4 and that an additional 10% tariff will be imposed on goods imported from China

- With Trump’s statements, sales in risky assets, including digital assets, deepened

- The dollar maintained its global gains amid tariff concerns, while the yield on the US 10-year bond continued to decline, indicating investors’ risk aversion

- Asian stock markets are down this morning. Futures contracts of European stock markets with large economies are negative. Wall Street futures point to a flat to negative opening.

In global markets, Trump’s new statements on tariffs supported the risk-off sentiment. The news flow on the issue will continue to be influential on asset prices. In addition, macro indicators that will provide information about the health of the US economy will be closely monitored both in terms of economic stagnation and in terms of predicting the next policy step of the US Federal Reserve (FED). Today, the PCE Price Index, which is used as a measure of inflation by the FED, will be under scrutiny.

We expect to see a weak recovery in digital asset prices after the recent losses. However, it should be underlined that the markets are highly sensitive to news flows and pricing behavior is more sensitive to new statements that may come from the Trump front at any time. We maintain our expectation of volatility in the short term, pressure in the medium term and bullishness in the long term.

FED’s Inflation Indicator: PCE

US Federal Reserve Chairman Powell’s speech at the Jackson Hole Symposium last year led to a significant shift in the equation. Powell shifted the focus from inflation to the strength of the labor market and gave messages that the FED would now give more importance to the strength of the labor market in its decisions. Or at least that is how the markets interpreted the statements. Recent months have shown that this may not be the right approach.

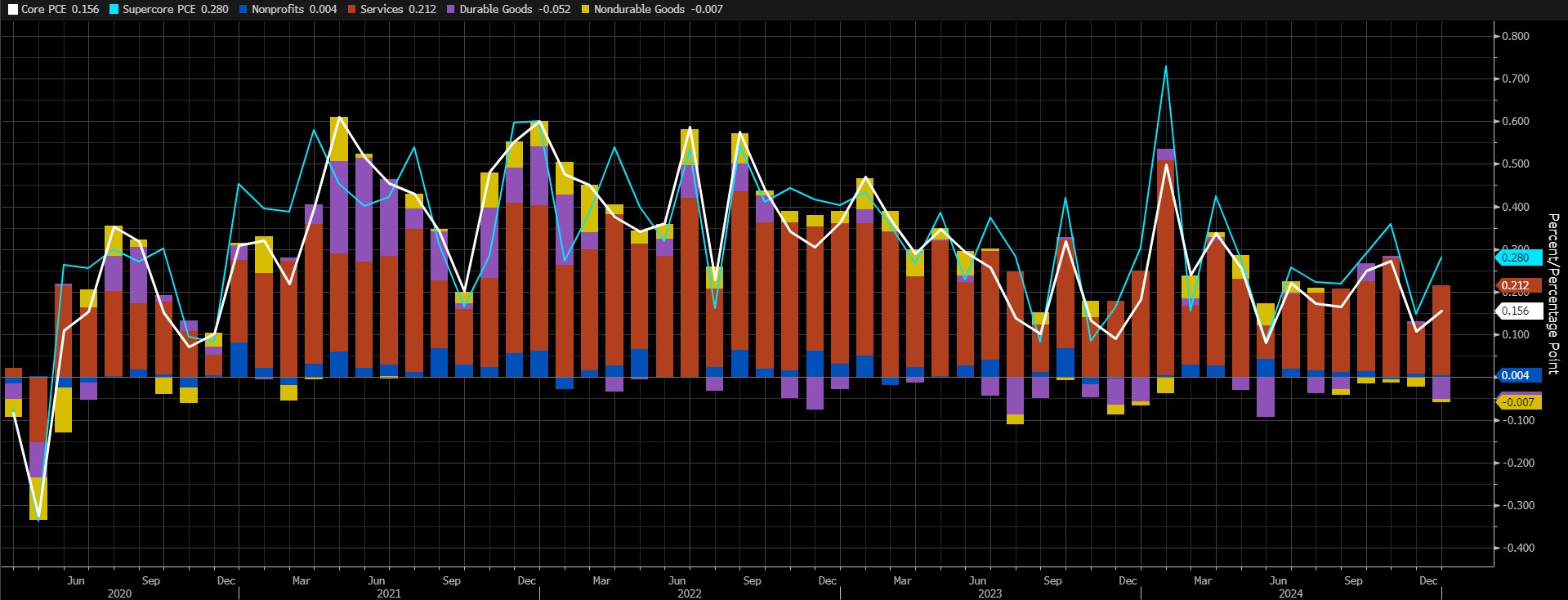

In Gennaio, the Consumer Price Index (CPI) came in at 3% on an annualized basis. In Settembre, with a reading of 2.4%, it pointed to the lowest inflation increase since Febbraio 2021. So this CPI from Settembre points to faster increases. In this regard, we can say that the FED has followed a path that can be criticized. On the other hand, the core PCE Price index (annualized), which the FED considers to monitor changes in inflation, has been unchanged (2.8%) for the last three months (Ottobre-Novembre-Dicembre). The monthly data for this indicator had pointed to an increase of 0.2% in Dicembre. We think that this is the data that will be important for the markets today.

Fonte: Bloomberg: Bloomberg

Some items of the Producer Price Index (PPI), which constitute some components of the PCE data, drew attention as the PPI data released on Febbraio 13th came in above the forecasts. However, the change in retail sales for the same month (Gennaio data), which is also calculated by monthly change, indicated that spending in the country declined faster than expected. In other words, we can say that we watched two macro data in the previous week that made PCE forecasting difficult.

According to Bloomberg, Core PCE Price Index (m/m) data is expected to point to a 0.3% rise in Gennaio. A higher-than-median forecast may support expectations that the Fed will maintain its cautious stance on interest rate cuts , reducing risk appetite and weighing on digital assets. A lower-than-expected data, on the other hand, may have the opposite effect and pave the way for value gains.

HIGHLIGHTS OF THE DAY

Importanti dati del calendario economico

| Tempo | Notizie | Aspettative | Precedente |

|---|---|---|---|

| - | XRP (XRP) – 40 Million Token Unlock | - | - |

| - | Optimism (OP) – 31.34 Million Token Unlock | - | - |

| - | Movement (MOVE) – Movement Mainnet launch | - | - |

| - | SingularityNET (AGIX) – Future Day 2025 conference | - | - |

| 13:30 | US Core PCE Price Index (MoM) (Jan) | 0.3% | 0.2% |

| 13:30 | US Core PCE Price Index (YoY) (Jan) | 2.6% | 2.8% |

| 13:30 | US PCE Price Index (MoM) (Jan) | 0.3% | 0.3% |

| 13:30 | US PCE Price Index (YoY) (Jan) | 2.5% | 2.6% |

| 14:45 | US Chicago PMI (Feb) | 40.5 | 39.5 |

INFORMATION:

*Il calendario si basa sul fuso orario UTC (Coordinated Universal Time).

Il contenuto del calendario economico sulla pagina corrispondente è ottenuto da fornitori di notizie e dati affidabili. Le notizie contenute nel calendario economico, la data e l'ora dell'annuncio delle notizie, le possibili variazioni delle cifre precedenti, delle aspettative e delle cifre annunciate sono state realizzate dalle istituzioni fornitrici di dati. Darkex non può essere ritenuta responsabile di eventuali cambiamenti che potrebbero derivare da situazioni simili.

AVVISO LEGALE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorised institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based only on the information contained in this document may not result in results that are in line with your expectations