What is Aster?

The decentralized finance (DeFi) environment is undergoing a transformation thanks to platforms that bridge the gap between user-friendly interfaces and institutional-grade tools. Among these, Aster DEX, a decentralized perpetual futures exchange, has emerged as an innovative leader by leveraging hybrid on-chain architecture and yield-generating mechanisms to attract both retail and institutional capital.

The DEX’s strategic design and rapid adoption metrics position Aster as a transformative force in DeFi, prompting an examination focused on its technological advancements and market impact.

On-Chain Innovation:

Aster DEX’s core innovation lies in its hybrid AMM-CEX model, which combines the liquidity efficiency of automated market makers (AMMs) with the speed and advanced tools of centralized exchanges (CEXs). Supporting multiple blockchains such as BNB Chain, Ethereum, and Solana, the platform solves the cross-chain fragmentation problem, enabling seamless trading across ecosystems. This multi-chain compatibility is critical in an era where interoperability is a key driver of DeFi growth.

One of Aster DEX’s most appealing features is its yield collateral model, which allows users to earn between 5% and 7% on their assets while trading. This dual reward system incentivizes users to provide liquidity without having to lock up their assets in traditional staking mechanisms. As industry analysts point out, this approach not only increases capital efficiency but also aligns with the growing demand for passive income in DeFi.

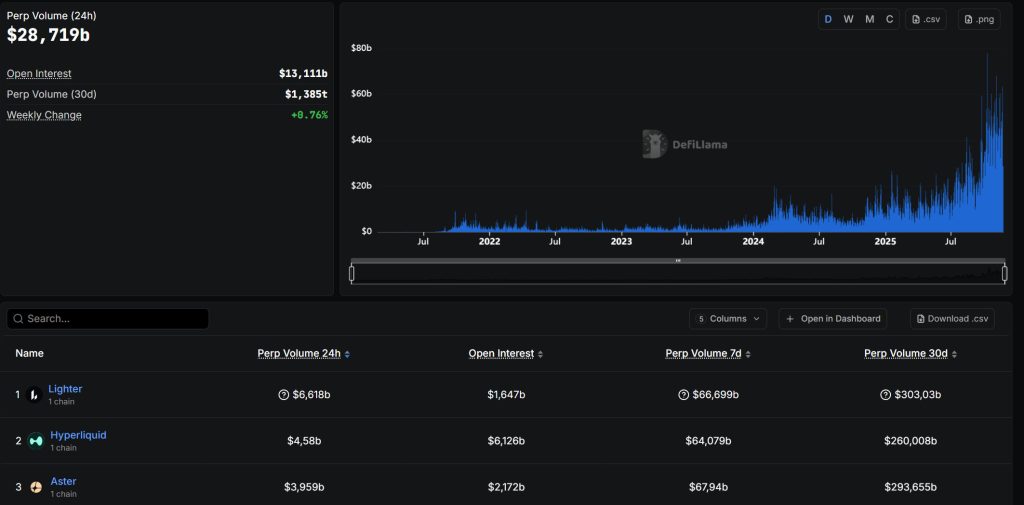

Aster Perp Dex Sets a New Record in Trading Volume

In October 2025, the total trading volume of decentralized perpetual contract exchanges (perp DEX) nearly doubled from the previous month, reaching a record high of $1.2 trillion. This growth was primarily driven by platforms such as Lighter, Aster, EdgeX, Pacifica, and ApeX. Lighter ranked first with approximately 27% market share, while Hyperliquid’s market share fell from 33% last month to 10%. The increase in trading volume appeared to stem from two main factors. First, incentive mechanisms such as “points programs” launched by various platforms; second, the liquidation wave triggered by sharp market fluctuations on October 10, which led to the mass closing of both long and short positions. After the event, many traders increased their trading frequency to recoup their losses.

Adoption of DeFi:

Aster reached a total locked value (TVL) of $17.35 billion one month after its 2025 Token Generation Event (TGE), driven by the impact of DEX adoption in DeFi. This growth accelerated with institutional support from organizations like Binance and YZi Labs, demonstrating confidence in the platform’s infrastructure and governance model. By the third quarter of 2025, TVL had increased further, rising from $172 million to $3.96 billion between September and November, recording a 2,360% increase thanks to strategic governance reforms.

These reforms redefined the ASTER token as a functional trading collateral and fee discount asset, offering liquidity providers (LPs) an 80% margin rate and a 5% trading fee discount. As a result, ASTER’s price increased by 30% within days of the changes, and trading activity surged by 800%.

Competition Continues

Platforms like SushiSwap, PancakeSwap, and Curve leveraged yield farming and governance token incentives to attract liquidity. This approach catalyzed rapid capital formation, drawing billions of dollars into the chain in a short time.

These initial battles were not about speed, leverage, or enterprise-level infrastructure, but rather about who could attract the most total value locked (TVL) and traders through token incentives. Ultimately, Uniswap seized the lead. The game plan it established—including liquidity mining, airdrops, and tokenized participation—laid the foundation for the more sophisticated decentralized exchange (DEX) wars that continue to this day.

DEX Liquidity Wars:

Hyperliquid, a DEX built on its own high-performance blockchain infrastructure, saw significant growth in 2025. The exchange processed over $300 billion in trading volume by mid-2025, with daily activity occasionally nearing $17 billion. Its deep liquidity and fast transactions helped it gain strong appeal among active and professional traders. One of the key drivers behind Hyperliquid’s strong growth was its ability to increase liquidity and user activity through a points-based reward program. This effort ultimately culminated in a major airdrop. In total, 27.5% of the token supply was distributed to 94,000 addresses, rewarding early and active participants. This initiative, launched to encourage more people to participate in trading, has recently become one of the most valuable token distributions in crypto history. The value of the airdrop is currently estimated at approximately $8-9 billion.

Competitors are catching up:

Aster is a rapidly growing DEX built on the BNB Smart Chain and is positioned as one of Hyperliquid’s main competitors. On some days, reported trading volumes have reached tens of billions of dollars, surpassing Hyperliquid’s figures. The project’s connection to Binance co-founder Changpeng “CZ” Zhao has also attracted significant market interest. Additionally, Lighter, a new exchange built on Ethereum rollup, reported that its daily trading volume exceeded $8 billion on October 20.

Aster:

Aster’s momentum stems from its close ties with CZ, who is currently advising the project. His involvement has led many to refer to Aster as “Binance’s DEX.” The exchange has enabled users to buy and sell large assets on-chain with up to 1,000x leverage by launching tokenized stocks. It also plans to launch its own layer-1 blockchain. This combination has made Aster one of the boldest experiments in DEX design to date. Fueling this rise is a massive airdrop program that rewards users for generating trading activity. The second season ended on October 5, 2025, with the distribution of 320 million Aster tokens worth approximately $600 million.

The incentive model has already translated into strong activity. Aster entered the ranks of the highest earners in decentralized finance (DeFi) on November 23 2025, earning over $900,000 in fees. Speculation is also growing that the team may use a portion of these earnings for token buybacks. If true, this move could further increase Aster’s token value and help sustain trader interest beyond the airdrop period.

Some participants have the chance to win significant rewards ranging from thousands of dollars for the most active traders to potentially seven-figure payouts. The scale of these incentives has created strong volume across the platform. However, it remains unclear whether users will continue trading once the rewards diminish.

Lighter:

Lighter has quickly become one of the most technically ambitious platforms in DeFi. Built on a zero-knowledge-based private Ethereum layer 2, the platform supports matching delays under 5 milliseconds. The goal is to approach centralized exchange (CEX) speeds. The platform offers zero transaction fees for retail users, while premium fees apply for API and institutional flows.

Lighter has become one of the most attractive yield opportunities in DeFi. It has experienced rapid growth thanks to its Liquidity Pool (LLP) program. As of November 23 2025, the pool offers an approximate 39% annual percentage yield (APY) on deposits exceeding $490 million. Access to the LLP is based on the user’s point balance, with more active traders receiving higher allocation limits.

Lighter’s zero-fee model and points system have fueled increased speculation among traders. Since its launch, the exchange has recorded significant trading volumes and has occasionally competed with Hyperliquid. Currently, excitement is heightened largely due to expectations surrounding a token launch rumored to take place later this year. Although there is no token yet, there is already an active over-the-counter market for Lighter points, with each point selling for tens of dollars. Prices have risen from $39 to over $60, and one trader reportedly spent $1 million on points priced at $41 each.

One of the easiest ways to gauge the value of a perpetual DEX is to examine its open interest (OI), which represents the total value of all open trades on the platform. The higher the OI, the more real money is tied up in those positions.

Lighter currently has approximately $1.7 billion in OI. Assuming that approximately 15-20% of the tokens were unlocked during the token launch, this translates to a circulating market cap of approximately $1 billion and a fully diluted valuation (FDV) of $5 billion. With approximately 12 million points associated with this initial public offering, each point will be valued at approximately $83 to $100.

If 15% of the supply is allocated to the community, this translates to an airdrop worth between $750 million and $1.1 billion for users. This could be one of the most significant token distributions in DeFi since Hyperliquid’s decline.

Source: Defillama

Institutions Are Entering the Fray

A growing subplot in this battle is the gradual but notable entry of institutional liquidity. Funds that once avoided on-chain derivatives citing slippage, latency, or compliance concerns are now allocating test capital to these platforms.

Hyperliquid’s speed-focused transparent design is increasingly attracting professional traders, while Aster’s Binance-linked narrative is gaining significant traction in Asian trading communities. With transaction speeds under five milliseconds and an on-chain payment model, Lighter is attracting prop-trading firms seeking returns without counterparty risk. The next phase of the DEX wars may hinge less on airdrops and more on platforms that can offer the most reliable rails for serious capital.

Possible Scenarios

Strategic Roadmap:

Looking ahead, the development of Aster Chain, the privacy-focused Layer-1 blockchain of Aster DEX, appears poised to further solidify its position within the DeFi ecosystem. With features like zero-knowledge proofs and anti-MEV (maximum extractable value) protections, Aster Chain aims to address scalability and security concerns that have historically hindered institutional adoption . As privacy-first blockchains gain popularity among institutional liquidity providers, this movement may align with broader industry trends.

The inclusion of ASTER in the roadmap of a US-based centralized exchange by November 2025 is a significant milestone reflecting the token’s growing mainstream recognition for its utility and market potential. For investors, this institutional endorsement, combined with Aster DEX’s hybrid model and yield-focused incentives, demonstrates that it is well-positioned to capture a significant share of the evolving DeFi market.

Aster Token:

The asset, which is experiencing a slight pullback at the time of writing, is being interpreted by some market observers as a potential accumulation opportunity. This perspective is supported by Aster’s expanding presence in major exchange ecosystems and the backing of several established institutions. The general sentiment among investors remains pessimistic, characterized by noticeable caution and hesitation among traders. This emotional climate suggests that if clearer market signals emerge in December, the current weak momentum could give way to greed.

Long-Term Potential and Upside Scenarios:

Although the outlook for November is negative, long-term forecasts for Aster extending to 2026 and beyond cautiously maintain a positive tone. The token’s deepening integration with major trading platforms and institutional support could, over time, lead to increased adoption rates and market confidence. A reversal in general market conditions, combined with the successful achievement of project development goals, could propel Aster into a meaningful recovery and sustainable growth period. Consequently, the current price weakness may represent a strategic entry point for investors with a long-term perspective.

Conclusion

Aster DEX’s success lies in its ability to innovate while aligning with practicality. By integrating AMM and CEX functions, offering yield-generating collateral, and securing institutional backing, the platform has created an attractive value proposition for both traders and liquidity providers. As DeFi continues to mature, projects like Aster DEX that prioritize scalability, security, and user incentives will play a pioneering role in the mainstream adoption process. For investors, the combination of rapid TVL growth, strategic governance reforms, and forward-looking infrastructure makes Aster DEX an intriguing case study of how on-chain innovation can trigger systemic change in the DeFi space. The expansion of Aster DEX’s TVL and user base reflects a broader transformation within DeFi 2.0. By combining yield opportunities with trading functionality, it has eliminated cross-chain barriers and emphasizing top-tier security, has begun to redefine the possibilities of on-chain liquidity. For investors, Aster stands out as the best example of how protocol-level innovation can drive widespread adoption.

The system shows that Aster’s growth is largely narrative-driven, with traders recycling capital to increase volumes, while Hyperliquid maintains the most organic flow from serious participants. Both Aster and Lighter rely on the same point-airdrop strategy to increase liquidity and activity in order to compete with Hyperliquid for market share. The real test will be whether traders stay after the airdrop excitement fades.

Disclaimer

The information provided in this article is for educational and informational purposes only and does not constitute financial or investment advice. Digital asset trading involves significant risk, and you should conduct your own research or consult a licensed financial professional before making investment decisions.