introduction

It’s a history shaped by economic hardship, government efforts to reform the financial system, and the rise of technology. El Salvador’s acceptance of Bitcoin as a legal tender was an important part of the country’s efforts to transform its economic and financial structure.

The State of El Salvador

Although El Salvador is a small country in Central America, it has struggled with many economic challenges. Much of its economy relied on remittances abroad, mainly to the United States. The income of migrant workers from their work abroad accounted for a significant portion of El Salvador’s GDP. But this posed a serious challenge to economic independence and sustainable development.

Moreover, El Salvador’s financial system was characterized by generally high interest rates, inadequate banking services and low financial inclusion. Most Salvadorans had difficulty accessing the banking system, limiting economic opportunities. The country’s public debt was also large, and loans from international financial institutions such as the IMF strained the country’s economic independence. The emergence of Bitcoin was seen as a revolution in the global financial system. Bitcoin was shaped as a decentralized alternative to state intervention. Created in 2008 by Satoshi Nakamoto, Bitcoin quickly gained popularity as a safe haven against economic crises. Investors began to see Bitcoin as a store of value.

One of the key motivations behind El Salvador’s Bitcoin strategy was the growing power of digital currencies in the global economic system. Bitcoin was a vehicle for El Salvador to diversify its economy and gain international financial independence

Nayib Bukele’s Vision

A major reason for the rapid implementation of the Bitcoin strategy in El Salvador was the leadership of President Nayib Bukele. After being elected President of El Salvador in 2019, Bukele announced his intention to make fundamental changes to the country’s economy and financial structure. As a young leader, he believed in the potential of digital transformation and innovative technologies to transform the economy.

The interest in Bitcoin in El Salvador stemmed from President Bukele’s interest in Bitcoin, as well as his desire for a more accessible and inclusive financial system. In particular, there was a large population without access to banking services, the so-called “unbanked”. This led to economic hardship and limited access to financial services for this segment. By 2021, the Bukele government decided to accept Bitcoin as legal tender. This decision was not only an economic strategy, but also a political move. Bukele aimed to make El Salvador global pioneer in financial freedom and digital currency technologies.

Adoption of Bitcoin Law

The first steps in this area were taken in June 2021. The Parliament of El Salvador approved a bill recognizing Bitcoin as a legal tender. This law made Bitcoin a state-recognized currency and required the state to accept Bitcoin for all payments. It also aimed to promote trade and investment in Bitcoin.

The gains targeted by this move,

Streamlining Money Transfers from Abroad: Migrants in El Salvador often send money back to their families with high fees and long processing times. Bitcoin could make these processes more efficient by reducing these fees and time.

Attracting Investment: The goal was to attract investors to innovative Bitcoin-related projects and make El Salvador a center for the financial technology (FinTech) sector.

Providing Inclusion: For a large population without bank accounts, Bitcoin was seen as a way to gain access to financial services.

Chivo

Following the adoption of Bitcoin as a legal tender, the government of El Salvador has taken several steps to popularize the use of this digital currency. One of these steps was the development of a digital wallet called Chivo. Chivo was a Bitcoin wallet backed by the government of El Salvador, and users could make Bitcoin payments, transfers and other Bitcoin-related transactions through their wallets. In addition, to encourage the use of digital wallets, the government of El Salvador gave away $30 worth of Bitcoin to citizens who wanted to start using Bitcoin. The aim of this step was to accelerate the widespread use of Bitcoin.

Bitcoin’s Volatility and Critics

Bitcoin’s high volatility has been one of the biggest challenges of El Salvador’s Bitcoin strategy. The value of Bitcoin can fluctuate greatly in a day, creating uncertainty in payment systems. This has caused a number of problems in El Salvador’s economy and has drawn some criticism from the country’s population. Indeed, the rapid fall in the value of Bitcoin posed a risk to investors and the government. However, President Bukele believed that Bitcoin would gain value in the long run and bring great economic benefits to the country

El Salvador’s Bitcoin law drew strong criticism from the global financial system and international organizations, with the World Bank and the International Monetary Fund stating that adopting Bitcoin as a legal tender was a risky decision. This backlash was based on concerns about Bitcoin’s difficulty to regulate and its potential to create financial instability, but El Salvador ignored these criticisms and continued to chart its Bitcoin strategy.

El Salvador’s Bticoin Strategy Results

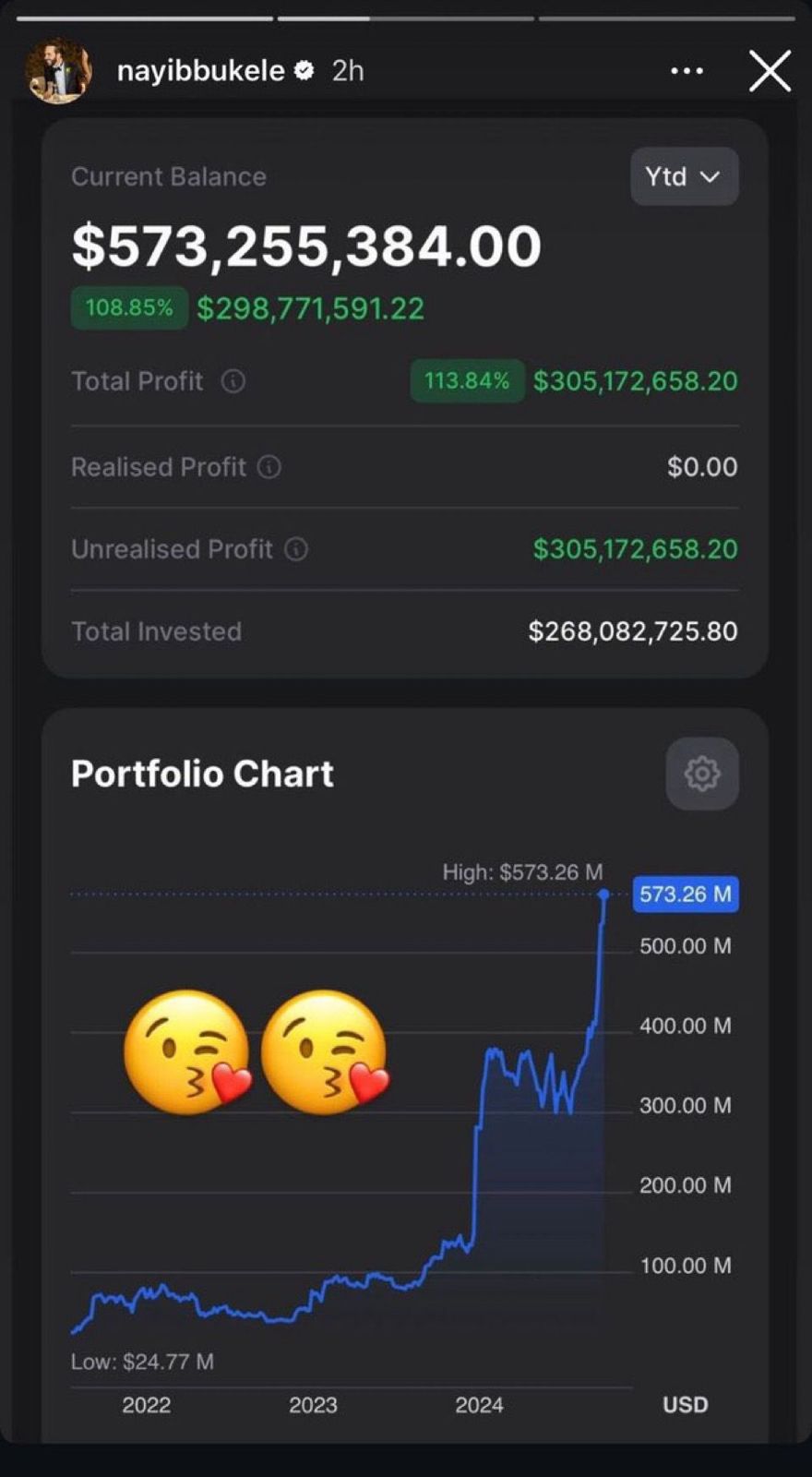

In November 2024, Nayib Bukele, the main actor in this story, introduced chivo on Instagram and shared a snapshot of his portfolio on his social media account. After emphasizing that his Bitcoin portfolio had reached a value of over $573 million, he showed that his initial investment of $268 million had more than doubled.

By December 19, 2024, we can see that the Government of El Salvador has 5,981 Bitcoins and that they have been buying and adding to their portfolio an average of 1 Bitcoin per day for weeks.

El Salvador, loan agreement with IMF

El Salvador has taken a remarkable step towards economic stabilization by signing a $1.4 billion loan agreement with the International Monetary Fund (IMF). However, the agreement requires a rollback of the country’s Bitcoin policies, marking a significant change in El Salvador’s previously bold financial experiment. The 40-month agreement, pending IMF executive board approval, offers El Salvador an opportunity to address its economic challenges, as well as the possibility of securing an additional $3.5 billion in financing from the World Bank and regional development banks.

The terms of the agreement mandate a reduction in the use of Bitcoin. Accordingly, the government of El Salvador will make Bitcoin optional for the private sector and limit its role in everyday transactions. In addition, the public sector will also be restricted from Bitcoin-related activities. The government will no longer accept Bitcoin for tax payments and will phase out its relationship with the state-backed Chivo wallet.

Financial Pragmatism and Economic Challenges

While El Salvador’s adoption of Bitcoin as a legal currency was initially seen as a major innovation, it has been met with some economic and financial challenges in practice. In particular, the high volatility of Bitcoin and the failure of the state-backed Chivo wallet to have the expected impact raised concerns about economic stability. The agreement with the IMF can be seen as a pragmatic step to deal with these economic challenges and to secure international financial support.

Bitcoin Policy Regression

The adoption of Bitcoin as a legal currency has gone down in history as El Salvador’s bold experiment in financial independence and the digital economy. However, the requirement that this policy must be withdrawn suggests that the country’s innovative approach was not entirely successful at an early stage. Bitcoin’s limited use in everyday economic activity and at the public sector level led El Salvador to opt for a more traditional and secure path in its financial strategy.

Impact of the IMF

The IMF’s cautious approach to Bitcoin actually reflects the global financial system’s concerns about digital currencies. The IMF has repeatedly warned El Salvador about the potential risks of Bitcoin. Today, the agreement with the IMF highlights the impact of international financial institutions on El Salvador’s economic model and the need for the state to align with the global financial system.

Global Adaptation

El Salvador’s retreat from its Bitcoin policy can be seen not only as a financial experiment, but also as part of a process of adapting to global economic challenges. It is an example of how countries can adapt to rapidly changing economic conditions, technological innovation and international financial pressures. El Salvador experimented with an innovative technology like Bitcoin, but decided to adopt a strategy more in line with the global economic system.

El Salvador’s limitation of Bitcoin as a legal tender certainly does not mean that it will back down from its decision to keep Bitcoin as a reserve. On the contrary, the country may continue to hold Bitcoin as a store of value and a strategic asset. El Salvador’s decision to increase its Bitcoin reserve is in line with its view of digital assets as a means of long-term investment and economic security. Only the role of Bitcoin in day-to-day economic transactions will be narrowed, but this will not prevent Bitcoin from being included in the country’s reserves.