Introduction

Fears of a recession in the US are approaching their previous peak, and the American economy is about to enter a recession. A recession is when an economy shrinks for at least six months. It is characterized by two consecutive quarters of negative growth in gross domestic product (GDP). Recessionary periods are characterized by a stagnation in economic activity, a decline in production, an increase in unemployment rates and a decline in consumer spending. It is usually characterized by two consecutive quarters (6 months) of negative in a country’s Gross Domestic Product (GDP).

The main symptoms of a recession are:

- Increase in unemployment rates

- Decline in consumer spending

- Decline in industrial production

- Decline in real estate and financial markets

- Decline in investments

The risk of recession is often triggered by weaknesses in economic indicators (e.g. unemployment rates, consumer confidence index, manufacturing data) and macroeconomic factors (inflation, interest rates, trade wars, energy crises).

US Recession

The last recession in the US occurred in the first half of 2020, at the start of the COVID-19 pandemic. The restrictions imposed due to the pandemic and the halt in economic activity caused the US economy to shrink during this period. Recently, the risk of recession in the US has come back to the agenda. Pricing, especially in bond markets, signals that a period of recession may begin in economies. The fact that the spread between the US 10-year bond yield and the 2-year bond yield has turned positive again adds to these concerns. However, international credit rating agency S&P Global reported that the probability of a recession in the US over the next 12 months has eased since the middle of last year. Economic indicators and market data play an important role in assessing the risk of recession

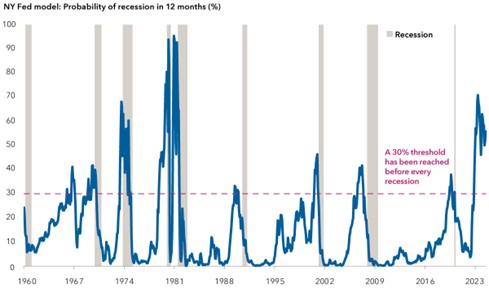

The graph above shows that the period between 1960 and 2023 was the period when the risk of recession was the highest, while past recession periods have been below the 30% threshold, a value that has been exceeded before each recession. When the probability rises above 30%, the risk of a recession increases. This indicates that the risk of an economic contraction is high.

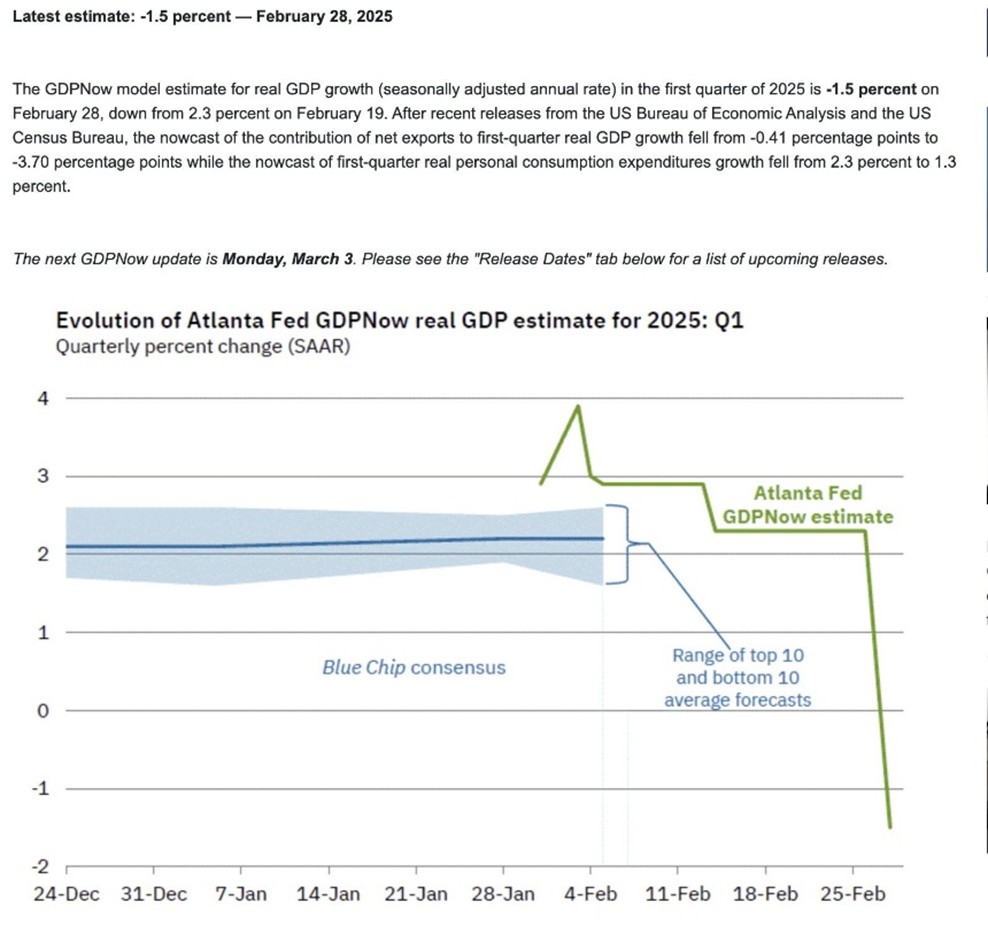

For the first quarter of 2025, the estimated real GDP growth rate (seasonally adjusted annualized rate, SAAR) declined from 3.5% to 1.4% over time, along with GDP forecasts

Since the beginning of the year, all sectors except technology and non-essential consumer spending have been positively affected. MAG 7s (the 7 largest companies on the US stock exchange with the highest market capitalization, especially in the technology sector) profits are being taken and redeployed to other sectors. The reason is fear of recession. Trump may be pro-recession. In an environment where inflation is below 3% and FED interest rates are 4.50%, Trump’s tax measures, simplified regulations and tariffs are among the factors that make it difficult for investment to enter the country. The probability of a recession has risen to 36% from 23% in January. This increase is associated with lower GDP forecasts and interest rate cuts by the US Federal Reserve (FED). Consumer confidence has declined, and this could have a dampening effect on demand. The Fed has sharply reduced its 2025 growth forecast and increased inflation. From April 1, it will slow the flow of balance sheet. It noted increased uncertainty about the economic outlook. Fed extends pause as tariff threats escalate, revises inflation forecast upwards. SMEs (Small and Medium Enterprises) account for 43.5% of the US economy in GDP and half in employment and optimism continues to decline markedly. Fewer people are planning capital expenditures and there is a marked increase in uncertainty.

Change in Corporate Recession Expectations

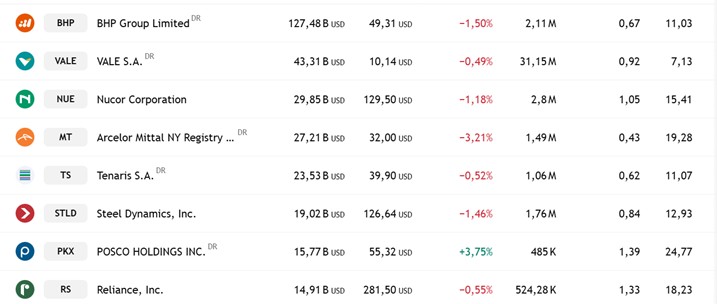

The prospect of macro growth attributed to technology companies (such as Apple, Microsoft, Google, Nvdia) makes downsizing and loss announcements critical. Shares of US-based steel and aluminium companies rallied after President Donald Trump announced an additional 25% tariff on imports from Canada, indicating a belief that in the long run this could lead to higher prices and potentially improved profit margins for steel and aluminium companies, but tariffs and government spending cuts are both actions that will slow the economy. In 2018, the US imposed a 25% tariff on steel imports. This caused a short-term rally in the stocks of local steel producers. However, cost increases in the automotive and construction sectors slowed economic growth. While this may increase the competitiveness of local steel producers, it may lead to cost increases in sectors such as automotive and construction.

Global steel prices The US tariffs may also affect global steel markets. In particular, export-dependent countries (such as China, India and South Korea) may sell less steel to the US market, leading to a decline in global steel prices in the long run. As the steel industry is directly linked to economic activity, expectations of a recession or economic slowdown may adversely affect the performance of companies in this sector. Lower demand for steel during recessionary periods may disrupt the supply-demand balance and lead to a decline in steel prices. This would negatively affect the revenues and profitability of steel producers. The automotive industry is a major consumer of steel. The decline in consumer spending during recessionary periods negatively affects steel demand by reducing automobile sales. The production of durable consumer goods (white goods, machinery equipment, etc.) also affects steel demand. Production in this sector may slow down during recessionary periods.

Conclusion

With the dollar still the global reserve currency and the US at the center of the financial system thanks to systems like SWIFT, huge capital markets and powerful technology companies still attract global capital. Independent in oil and gas production, it plays an important role in energy wars. So there are still factors that reduce the risk of recession. The risk of recession is higher than in the past. The US debt burden is at a historic high and interest rate hikes are suppressing economic growth. The BRICS and the global south’s move to reduce dollar dependence could threaten the reserve currency status in the long run. China and other emerging economies are putting pressure on the US trade balance. The US remains economically strong, but vulnerabilities are growing.

Disclaimer

This text is for informational purposes only and does not constitute investment advice. All financial decisions are the reader’s responsibility.